If you’re an investor who likes to look at companies when they’re out of favor, Judo might be the company for you.

I reckon Andrew has me covered in terms of lack of interest in banks – but not by much. It is broadly a pretty boring, overvalued and underperforming sector. But Judo is actually kind of interesting. Listening to the story of the bank and from founders and management there’s a lot to like.

What is Judo Bank?

Judo lends and takes deposits exclusively for Small and Medium Enterprises (SMEs). It is the only bank in Australia with this singular purpose.

What began as a Powerpoint in 2015 has grown into a full- fledged licensed bank, expected to have a loan book of $9 billion by June this year. They are already profitable and generating cash.

Why are they called Judo Bank?

The name Judo is derived from the martial art that seeks to use the size and momentum of one’s opponent against them. Judo Bank believe the ingrained culture of the incumbents prevent them from adapting their practices to undermine Judo’s competitive advantages. To do so they would have to disrupt themselves to an extent their shareholders wouldn’t accept.

What is their secret sauce?

Judo isn’t trying to be all things to all people. They’re not considering moving into retail banking or becoming a big institutional bank. They’re also not trying to compete on price or on products. They just seek to offer the meat and three veg to their customers, but to offer the best meat and three veg in the business.

This slide, which I think they pilfered, sums up how they think about the benefits of their narrowed focus.

They believe the specialist focus gives them the opportunity to deliver the sorts of service, speed and availability that the competition can’t match.

That sounds like a slogan and no doubt a version of the same is plastered on the wall of all the big banks. I think the difference is in action though. Judo doesn’t seek to have the lowest cost base. In fact, at maturity they expect to have roughly twice the number of Relationship Bankers (RBs) per customers/loan values as their competition. RBs do not have individual sales targets and metrics measured include % time RBs spend on customer activities. RBs are given significant decision-making authority, including credit decisioning. Where decisions exceed their delegated authority the size of Judo is an inherent advantage in minimising delays, and this is likely to be the case well into the medium term.

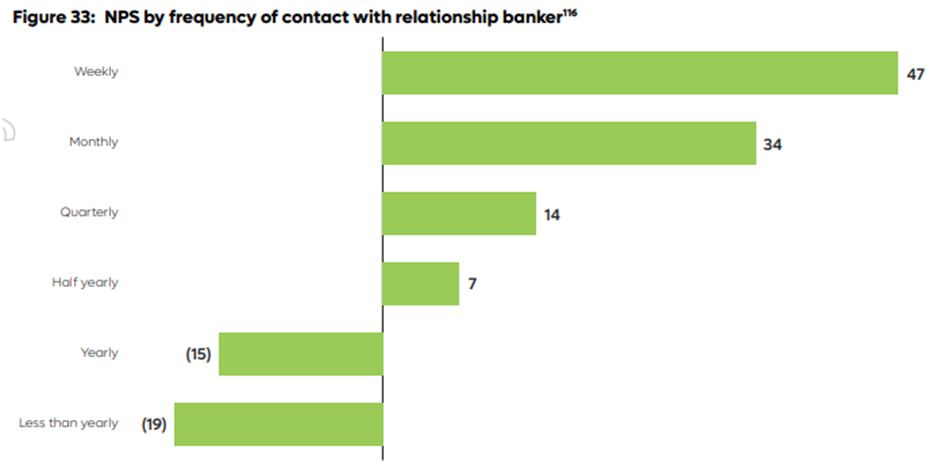

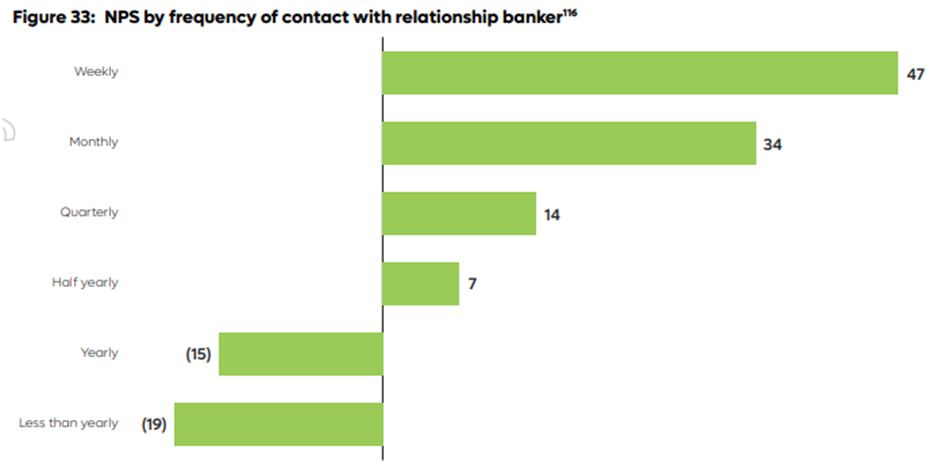

That’s all very well but if their customers number one driver is cost, competing on service isn’t going to be winning strategy. Judo’s management believe pricing – while a factor – is not the prime consideration. This was an interesting slide from their prospectus which speaks to that (NPS=Net Promoter Score).

I think it makes sense from an economics perspective too. Individuals are likely to be much more price sensitive as they have limited ability to offset price in income. They might be able negotiate a salary increase, but usually only annually. More dramatic intervention might require changing jobs (which adds risk) or adding side hussles (which is a tradeoff). Whereas, businesses – even low margin ones – have the ability to offset at least some of their cost impacts by increasing prices.

Speaking of economics, it’s probably not a bad time to talk about the business economics.

Business Economics

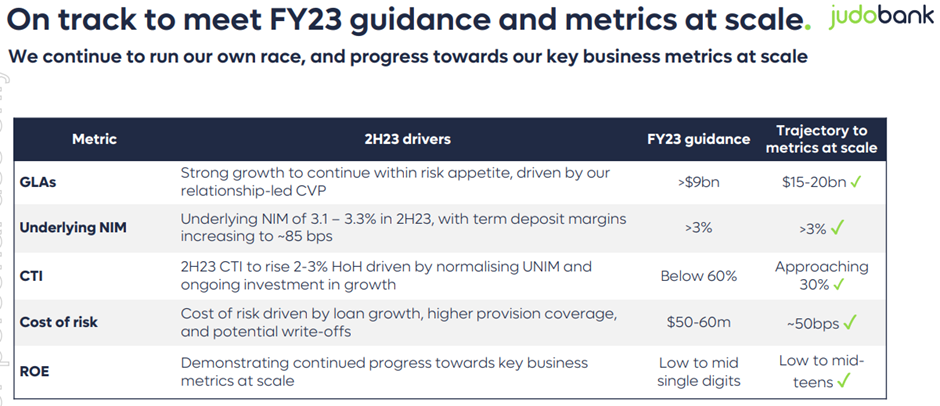

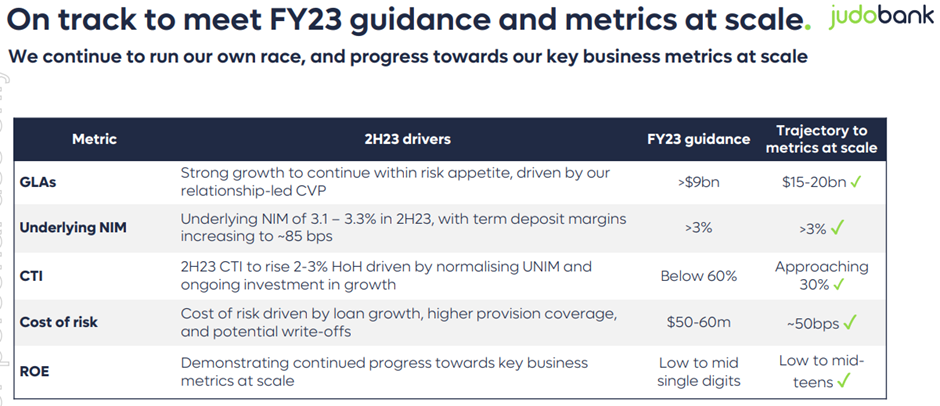

Since coming to market the business has consistently reiterated the same metrics, which they believe they can achieve and are targeting at scale. These are:

- Loan book of $15-20 billion (currently $7.5b and forecasting $9b by June)

- Net Interest Margin exceeding 3% (currently exceeding this)

- Cost to Income ratio (CTI) approaching 30% (currently about 55% - given investment in FY23 it probably won’t drop much below that until next FY)

- Permanent loan book impairment of 0.5% per annum (so far they’ve only had two write-offs in their history for a total of $5.3 million. None in 1H FY23)

- Return on Equity of low to mid-teens, which for a bank is world leading ROE (they did 2.5% in 1H – unannualized - and have guided to low to mid-single digits for the full year)

Arguably the most challenging of these metrics is a Cost to Income ratio of around 30%. That is significantly lower than their peers even though Judo doesn’t aspire to be a low-cost bank. However, they make the point that if you were to adjust the denominator instead of the numerator to allow for a 3% NIM, then their peers would have a CTI approaching 30%.

The NIM and ROE targets are really interesting. We’re consistently told Australia’s banks are the best there is and statistically there seems to be some truth in that. But the Big 4 struggle to get their NIM above 2% and ROE into double digits (CBA is best of these at 12%). The fact Judo already has a NIM over 3% and ROE heading in the right direction is encouraging.

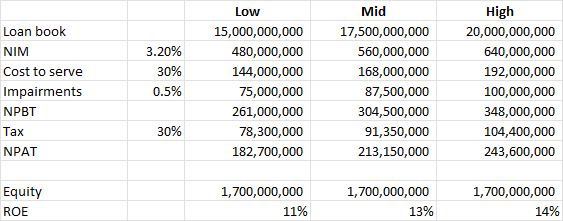

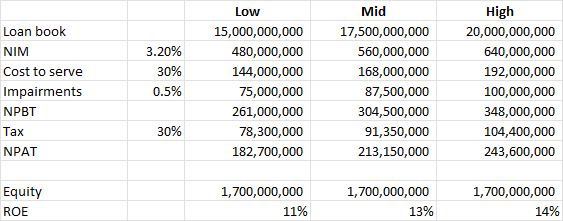

What’s a little less encouraging is plugging those assumptions into a model suggests they need to hit the upper end of all those assumptions to achieve the ROE and the model is fairly sensitive to changes in any of the assumptions. The denominator value is a bit of an unknown – I’ve gone with an equity balance of $1.7 billion versus $1.4 billion currently.

The other big unknown is the impact of the unwind of the RBA’s Term Funding Facility (TFF), which is one of the reasons why they’ve been able to so quickly achieve their NIM target. I’ll address this now.

What is the TFF?

The TFF gets 218 mentions in Judo’s prospectus reflecting its magnitude of importance (in contrast ‘shareholder(s)’ gets 139 mentions so go figure). The TFF was rolled out in March 2020, as a response to COVID, to encourage lending to Australian businesses. It was available for all business lending but had some incentives specifically for SME lending. Clearly this was right in Judo’s wheelhouse. In simple terms it allowed banks who loan to businesses to borrow from the RBA at a fixed rate of 0.10% until 30 June 2024. Pretty good deal and as a result Judo filled their boots.

The problem is what happens when it’s gone? Not only are the banks facing their own funding cliffs but some are arguing that the bigger banks will try to use their superior balance sheets to initiate a price war and squeeze out some of the smaller players. Even if they don’t I struggle to believe SMEs will be able to absorb a 300bps+ increase to rates overnight. The good news is that’s the worst case scenario and it won’t be anything like that bad. The TFF is only one of Judo’s funding sources, albeit a significant one, plus the unwind will be gradual, plus Judo has room to lower their NIM, plus they’ll look to increase margins from other funding sources like deposits. Still, it’s a risk worth noting.

Other risks

Speaking of deposits, Judo’s goal is to fund 70-75% of lending from deposits. I imagine in the past few weeks there’s been many a Board/CEO asking their CFOs to assess the concentration risk of their deposits and reduce accordingly. On the other hand, the Fed’s response to SVB and SB has exposed the policy of capping deposit guarantees for the fig leaf it is. On balance I suspect it’s not going to be an existential risk in the long term, but in the short term it may have an impact and I suspect that’s a major reason the share price has suffered in recent weeks.

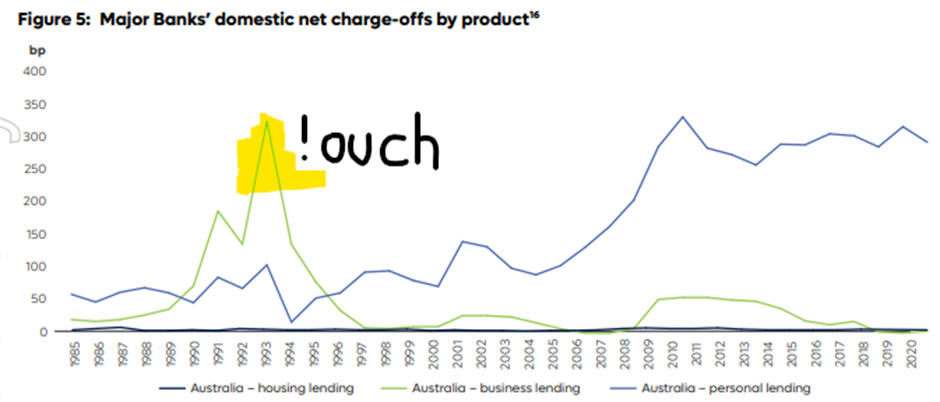

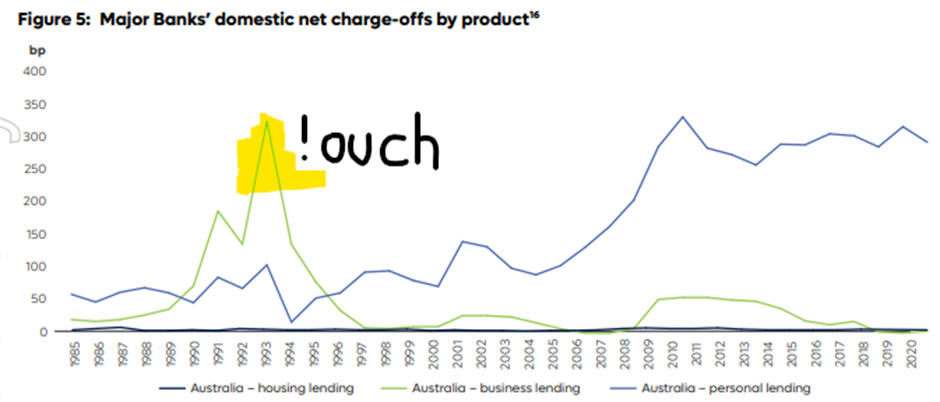

The other major risk is we’ve yet to see a complete credit cycle for Judo. You probably have to go back to the early 1990s see a significant impairment event across the Australian business lending segment but when it happens it’s significant.

Management

They seem to be pretty decent with lots of ex-NAB and ANZ execs. CEO Joseph Healy with 35+ years in banking was former CEO of NAB’s Business Banking division. Joseph is a co-founder of the business. Deputy CEO and now Chief Relationship Officer Chris Bayliss also with 35+ years in banking held exec positions with NAB and several other banks in multiple geographies. Chris was the CFO but was moved to fill a perceived weakness in the leadership of the business. The new CFO is Andrew Leslie with 15+ years experience in banking, most recently at Morgan Stanley. Being a bank the Chief Risk Officer Frank Versace also needs a mention with 20+ years experience and prior roles at ANZ and Macquarie. The Board is Chaired by Peter Hodgson with prior roles at Bank of America and ANZ.

Insider ownership is well under 10%, which is not high for a founder-led business but is high relative to its peers. Incentives do have equity elements and include hurdles such as continued employment and performance versus budgets.

For what it’s worth their briefings do seem to be pretty open and transparent. There’s not a lot of question dodging or tangential speak. At their last Investor Day (next one is due in a couple of months) there was the opportunity to hear from and ask questions of all senior management rather than just the usual suspects.

More info

If interested I’d recommend the following:

Half Year result presentation

Investor Day presentation

Celeste Funds Management research note

The Call #1

The Call #2 (I just realised @Strawman was on this one and adjusting for the bank discount he was practically giddy!)

[Holding about 2% here and IRL]