Two businesses: EzyStrut (cable and pipes) and Korvest Galviniser (galvinising)

90% of revenue, with slightly lower margins, is generated through EzyStrut

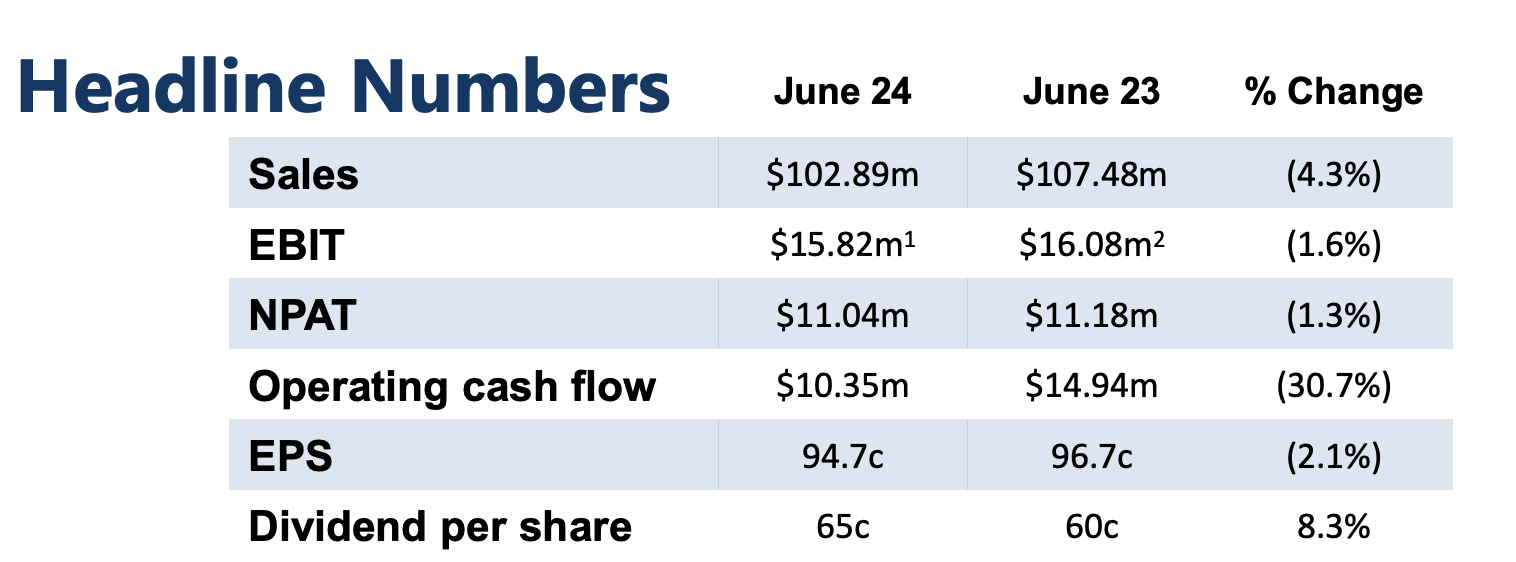

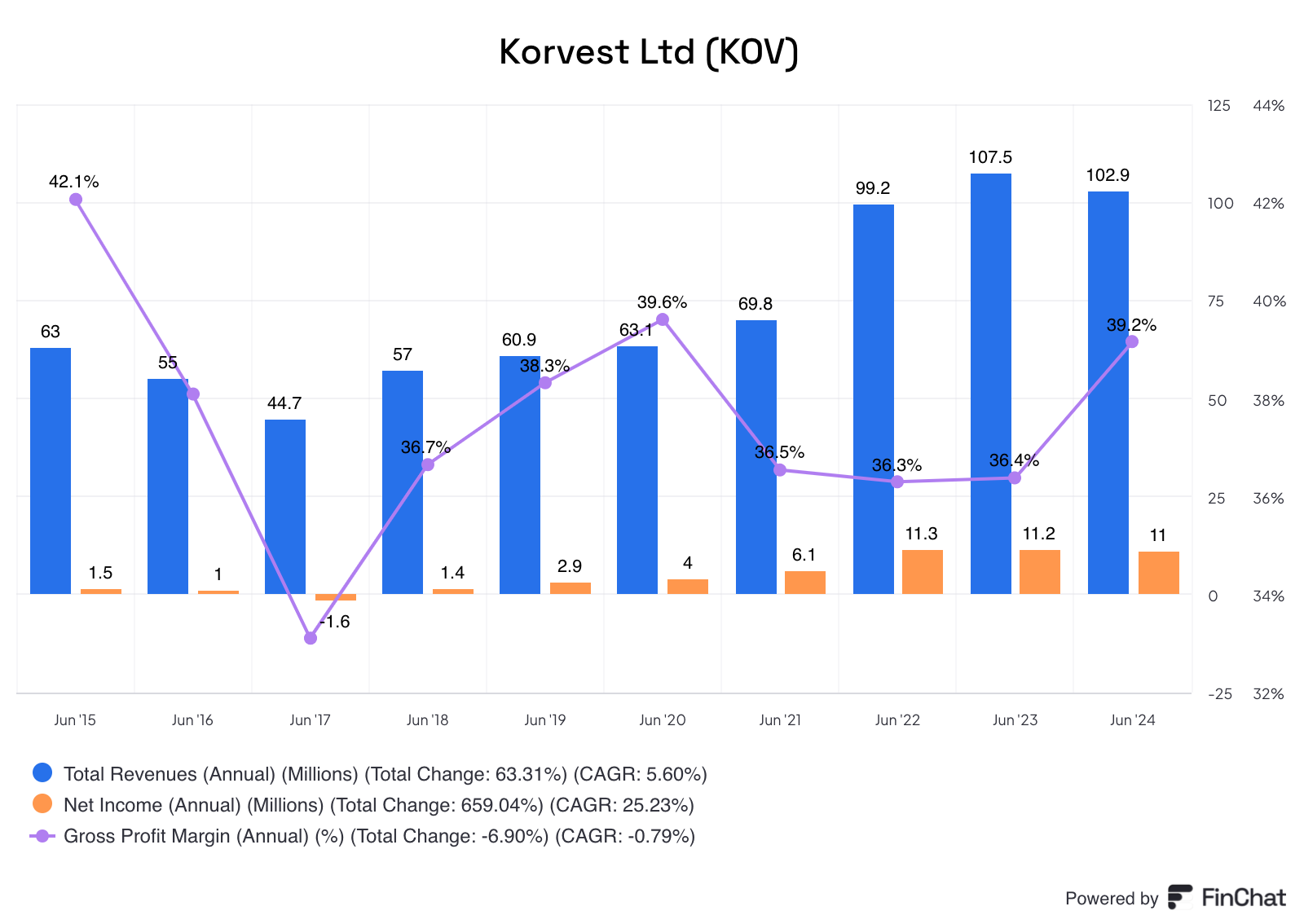

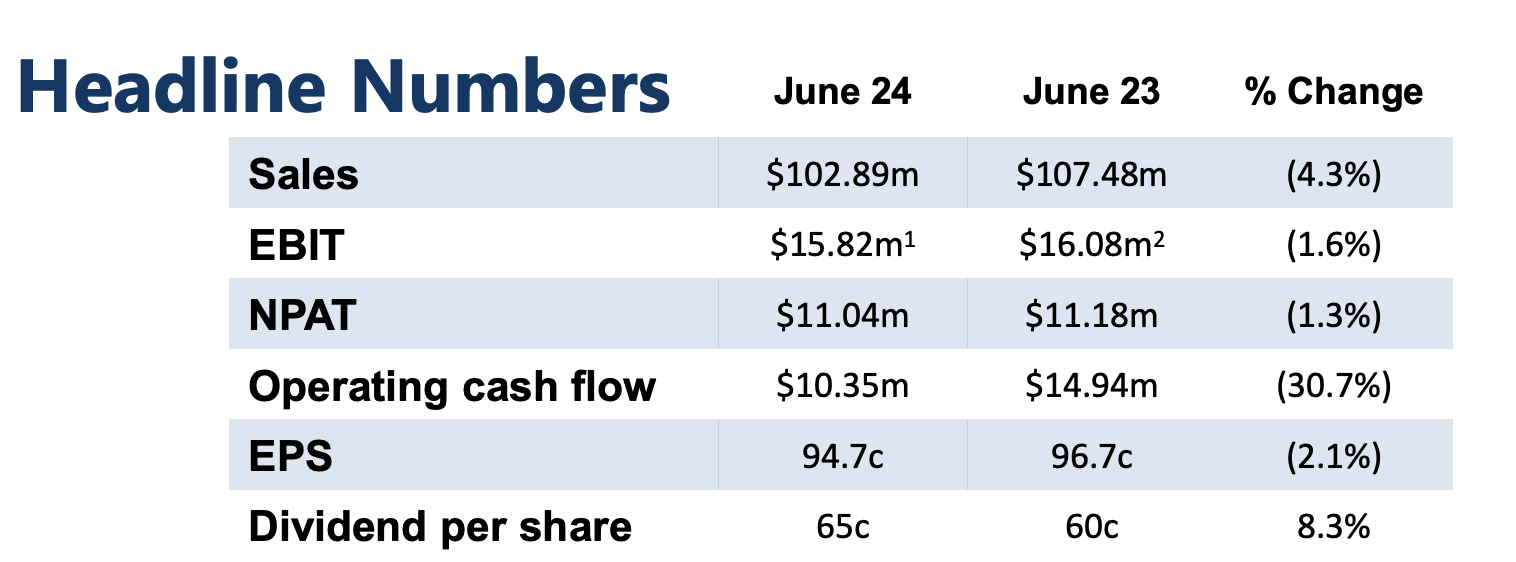

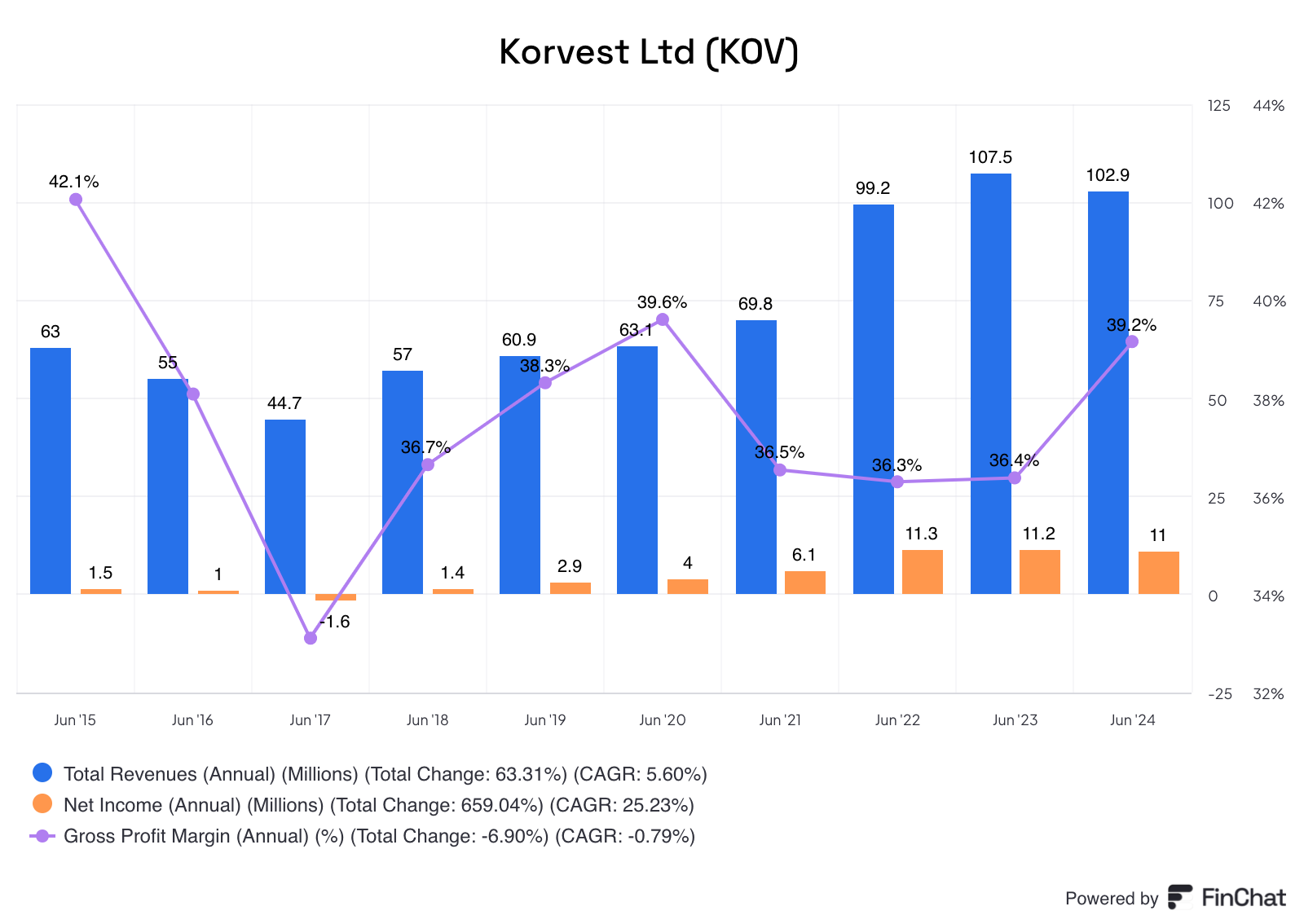

Flat-to-negative growth past three years, however impressive growth between FY21 and FY22

With a PE of about 10 and a dividend yield of 6.5%, the market views this company as more of an income play than growth.

Seems like the company's exists on a few major projects at a time. For instance in the trading update part of the presso they quoted

1 major project to commence in FY25 with supply into FY26 and FY27

1 major project in tender phase, at least 1 more expected in FY25

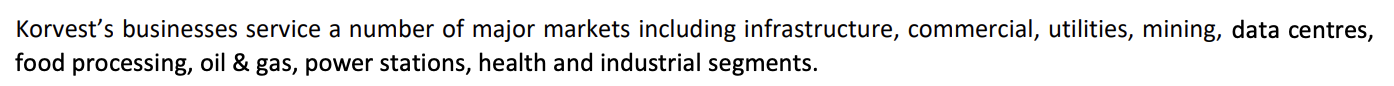

Twice in the company's FY24 presso, Korvest mentioned 'data centres'. Is this legit or they just trying to ride the AI/data centre trend. They did not mention Data Centres once in last years presentation.

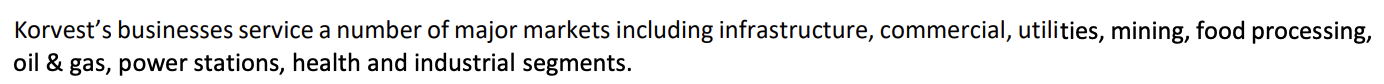

Also in last years 'Full Years Statutory Accounts' in the 'Principal Activities' section there is no mention of data centres in the sectors/markets they service

This year however 'data centres' has been added:

There is a possibility the company's management realised during the year that data centres and this trend is something they can successfully tap into.

More than doubled CAPEX for FY24, half of which is growth CAPEX