Part of the run in MetalsX could be explained by upcoming plans from Indonesia to restrict Tin exports

https://internationalbanker.com/brokerage/why-have-tin-prices-struggled-in-2022/

Some bulls might be buoyed by news published in October that Indonesia, the world’s biggest exporter of refined tin, was reportedly planning to ban exports of the metal to promote its domestic tin-processing capacity. Indonesia consumes only 5 percent of the refined tin it produces while exporting 95 percent. The ban is part of a broader Indonesian plan to reserve mineral resources such as nickel, tin, copper and bauxite for domestic processing and export higher-value-added products instead of just shipping cheap raw materials, Reuters reported on October 20

In response, Chinese buyers appear to be frontrunning the demand. However nothing firm yet.

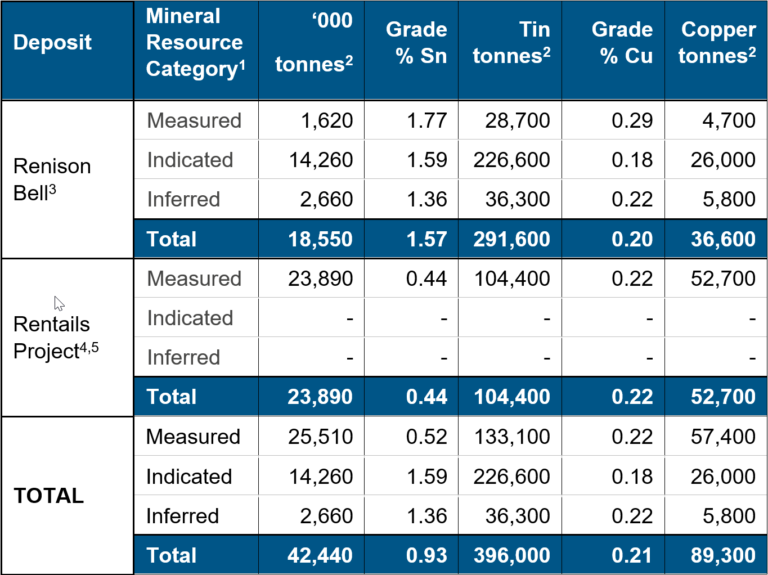

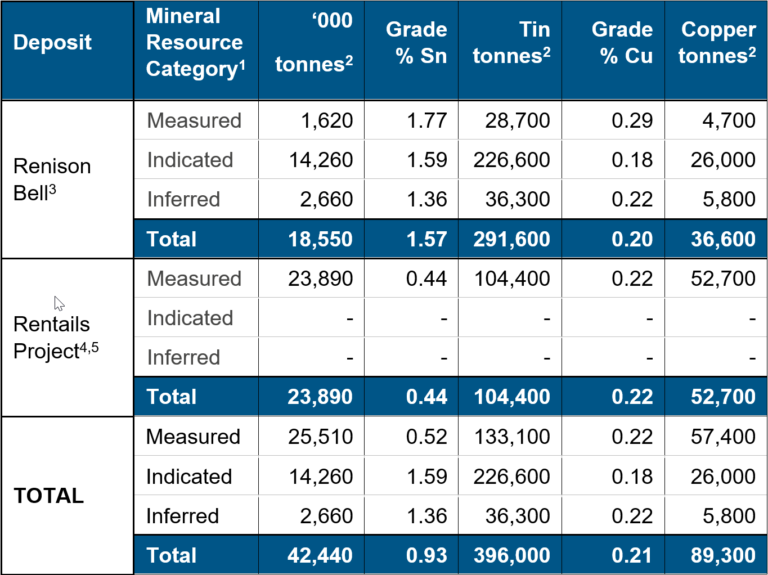

This is just a short to medium term hold which I didn't have time to put into my strawman holding the other day so the buy order is just hanging there at 34c. Also below is evidence that MetalsX also has copper although it is not much.

Given the run on the share price these last few days, might be tempting to reduce.

https://www.metalsx.com.au/tin-mineral-resource-estimates/

[held]