Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Following the 1H25 results and the trading update, Metcash seems to be on track to beat analyst forecasts of $17.4 billion in sales and $268 million NPAT. Statutory NPAT was $141.8 million and underlying NPAT was $134.6 million.

The first 4 weeks of 2H25 suggests the second half could be stronger with total group sales up 8%. All divisions except hardware are performing strongly. Hardware has increased only 3.6%, despite receiving addition revenue from the recent acquisitions Alpine Truss and Bianco. If these were excluded hardware actually went backwards by 2.1%.

According to a report in the AFR this morning “Citi has upgraded Metcash from “neutral” to “buy” on expectations that its cyclically depressed hardware unit will bounce back.

“Earnings have likely bottomed in hardware,” said Adrian Lemme, an analyst at Citi. “Combined with a more resilient earnings outlook for food and reasonable valuation, we upgrade to buy.”

The analyst predicted a “significant earnings recovery” in FY26 for the retailer and wholesaler behind brands such as IGA and The Bottle-O, given detached housing approvals have bounced.

The broker lifted earnings before tax estimates by 3 percentage points in FY25 and 4 percentage points in FY26. The target share price was lifted from $3.40 to $3.70.”

I added more shares recently at four year lows of $3.03. The proposition for me was; hardware is going through a rough patch and I think this will turn around as the need for new housing in Australia boosts sales for Metcash. Meanwhile, with a gross dividend yield close to 8% I can remain patient waiting for a turnaround.

Held IRl (3.2%)

ASX Announcement summary

1H25 Financials

• Group revenue increased 6.3% to $9.6bn and 8.1% to $8.5bn excluding charge-through1

• Group underlying EBIT decreased 0.2% to $246.1m

• Underlying profit after tax decreased 5.5% to $134.6m

• Statutory profit after tax increased 0.6% to $141.8m

• Underlying EPS 12.3 cps, Statutory EPS 13.0 cps

• Operating cashflow $164m (3yr average CRR3 ~86%)

• Interim dividend 8.5 cps (payout ratio ~70% UPAT)

Outlook and trading update

Total Group sales have been strong with growth in the Food, Liquor and Hardware pillars, partly buoyed by acquisitions.

Total Food revenue has increased significantly buoyed by the acquisition of Superior Foods. Supermarkets sales ex-tobacco continued to grow, reinforcing the business’ resilience in a highly value conscious environment.

Superior Foods is continuing to win new customers and perform in line with expectations.

In Liquor, the independents are continuing to win market share, led by the IBA network. This is being underpinned by the network’s tailored, localised offer and convenience.

In Hardware, soft Trade activity continues to place pressure on volumes and retail store margins. In IHG, a strong focus on costs and accelerating growth initiatives is expected to provide earnings benefits in the second half of FY25. In Total Tools, competition remains strong, albeit at more normal levels. The business expects trading in the second half to be stronger than the second half of FY24.

Metcash remains well positioned with the plans, platform, capabilities and diverse business portfolio for future growth and strong returns through the cycle.

Sales – first 4 weeks of 2H25

Total Group sales for the first four weeks increased 8.0%.

Total Food sales (excluding tobacco) increased 22.6% (+12.4% including tobacco). Total Supermarkets and Campbells & Convenience sales were up 2.9% (-2.6% incl. tobacco), with Supermarkets wholesale sales up 2.3% (-3.7% incl. tobacco). Wholesale price inflation (ex tobacco and produce) moderated further to 0.2%. Sales in Superior Foods increased 6.1%

Total Liquor sales increased 4.4%, with wholesale sales to IBA retail and contract customers up 5.0%. Wholesale sales to on-premise customers were flat.

In Hardware, IHG sales increased 3.6%, (-2.1% excluding the impact of Alpine Truss and Bianco) and Total Tools sales in the first three weeks of 2H25 increased 2.6% with network sales up 6.5% and network LfL sales flat.

I started writing this over a week ago, but having just spent a week with our granddaughters in Geelong the time got away from me. Here are my week old thoughts anyway. The proposition has changed a little since I started writing. The share price has kicked nearly 5% in a week, but it’s worth keeping a watch on the share price over the next week before it goes ex-dividend.

Once In a while an opportunity arises where the upside of an investment seems to outweigh the downside risks. Sometimes this opportunity is hidden amongst the most boring businesses on the ASX…businesses like Metcash!

Metcash reported a lack lustre result this financial year ending 30 April 2024. The market was underwhelmed by the results:

- Group underlying EBIT decreased 0.9% to $496.3m

- Underlying profit after tax decreased 8.2% to $282.3m

- Statutory profit after tax decreased 0.7% to $257.2m

- Underlying EPS 28.3 cps, Statutory EPS 25.8 cps (down from 26.8 cps last year)

- Total dividends 19.5 cps (payout ratio ~70% UPAT), down from 22.5 cps in FY23

The market was expecting single digit earnings growth, so a slightly negative result came as a bit of a surprise.

On the positive side:

- Group revenue increased 0.7% to $15.9bn and 0.7% to $18.2bn including charge-through, and

- Operating cashflow was up 29.5% to $482.6m

Management noted:

- Strong results in challenging macro environment

- Results underpinned by diversification, resilience and disciplined execution

- Pleasing pillar performance in line with strategic positioning and current market conditions

- Food and Liquor delivered strong returns and positioned for structural growth

- Hardware continued to outperform the softer addressable market and remains ideally positioned for cyclical growth

- Retail networks healthy and strong – investments are delivering

- Independent offer continues to resonate with shoppers – increasingly relevant, differentiated and competitive

- Excellent cash, cost and operational performance underpinned by disciplined execution

- Plans, platform and capabilities in place to continue growing current, as well as future businesses

- Strong earnings since FY20 with EBIT up 56% (12% CAGR)

So what’s the opportunity?

Dividends

I think it’s possible, without too much of a stretch, for Metcash to return somewhere between 10% and 25% on a share price of $3.54 within the next 14 months. Why 14 months? Metcash will go ex-dividend in a week (on the 16 July) and pay out an 8.5 cps fully franked on 27 August 2024. Over the next 14 months we could expect 3 dividend payments totalling 28 cps fully franked. That’s a return of 11.3% over 14 months including the franking credits, providing the share price doesn’t deteriorate. That’s not a bad return without any share price appreciation. However, it’s likely there could be a kick in the share price also.

Valuation

Using McNivens formula assuming equity of $1.40 per share, forward ROE of 19.3%, 24% of earnings reinvested into growth, a 5.4% fully franked dividend, and a required annual return of 10%, I get a value of $4.20.

Analysts see some upside also. Evans & Partners have a neutral rating on Metcash with a $3.93 price target. The consensus 12 month price target from 13 analysts covering Metcash on Simply Wall Street is $4.19. Analysts are expecting modest earnings growth of c. 6% over the next few years.

Combining the dividends and a little share price appreciation it might be possible to return up to 25% on Metcash over the next 14 months.

I ended up adding a parcel of Metcash $3.51 on the 28 June. I don’t expect it to shoot the lights out, but I think it will do better than the ASX 200, or a term deposit, over the next 14 months without a lot of risk.

Held IRL (1.6%)

Today (06/03/24) Metcash (MTS) announced the completion of the SPP. Due to strong support $153 million was received from shareholders. This was no doubt driven by the strong upward movement in the share price, and now trading at a 10% premium to the SPP offer of $3.35.

Metcash was aiming to raise $25 million, however they have decided to increase this to $60 million. There were no details about how much the larger applications would be scaled back, other than the scale back would be on a pro rata basis relative to the shareholding on the record date.

Having applied for the maximum of $30,000, we still don’t know how many shares we will be allocated at this stage…but I’m guessing it will be about half? All eligible shareholders applying for over $1000 will receive a minimum allocation of $1000 in new shares.

Shareholders will find out the full details of their allocations under the SPP this Friday, 8 March 2024 and these shares are expected to commence trading on ASX on Monday, 11 March 2024.

Metcash Limited (ASX:MTS) is pleased to confirm the completion of its share purchase plan (“SPP”) as announced to the market on Monday, 5 February 2024. The SPP offer closed on Friday, 1 March 2024 and followed Metcash’s $300 million placement to institutional investors, which was successfully completed on Tuesday, 6 February 2024 ("Placement”).

Valid applications totalling approximately $153 million were received from 9,350 eligible shareholders. The average SPP application amount was approximately $16,380.

As a result of this strong support from eligible shareholders, Metcash has increased the SPP size from $25 million to $60 million.

Applications were scaled back on a pro rata basis having regard to the relative shareholdings of eligible shareholders as at the Record Date. Where this scale back would have resulted in an eligible shareholder receiving less than the minimum parcel of $1,000 of new fully paid ordinary shares in Metcash (“New Shares”), those applications were scaled up to the minimum parcel such that each eligible shareholder who participated in the SPP will receive at least the minimum parcel of $1,000 of New Shares.

New Shares will be issued under the SPP at $3.35 per New Share, being the price at which shares were issued under the Placement.

Approximately 17,910,449 New Shares will be issued under the SPP on Friday, 8 March 2024 and those shares are expected to commence trading on ASX on Monday, 11 March 2024. New Shares issued under the SPP will rank equally with existing Metcash shares on issue.

Holding statements are expected to be dispatched on Monday, 11 March 2024.

Shareholders with questions in relation to the SPP may contact Metcash’s share registry from 8.15am to 5.30pm (AEDT) Monday to Friday on 1800 655 325 (callers within Australia) or +61 9290 9696 (callers outside Australia).

Held IRL (1.2% prior to the SPP allocation)

Following the successful completion of the $300m institutional placement of 89.6 million shares at $3.35 per share, Metcash has released details of the share purchase plan (SPP) for retail investors (see below, or the ASX Announcement).

In short, investors holding Metcash shares on the 2nd Feb 2024 can apply for up to $30,000 of new shares at $3.35 per share, subject to a scale back (offer closes 1st March). Funds will be used as additional capacity to support growth opportunities. Metcash has entered into binding agreements for three strategic acquisitions:

‒ Superior Food, a leading Australian foodservice distribution business for an enterprise value (EV) of $390m to $412.3m.

‒ Bianco, a construction & industrial supplies business servicing the SA and NT trade markets for an EV of $82.2m; and

‒ Alpine Truss, one of the largest Frame & Truss businesses in Australia for an EV of $64.0m.

The Acquisitions are expected to be mid-single digit EPS accretive on a pro forma Oct-23 LTM basis including ~$19m of expected annualised synergies, and EPS accretive excluding synergies. The Acquisitions are also expected to be accretive to Metcash’s margins.

The market has reacted positively to the news with the share price up 4% to $3.71 since the announcements. The SPP offer is now at a 14% discount to the current share price.

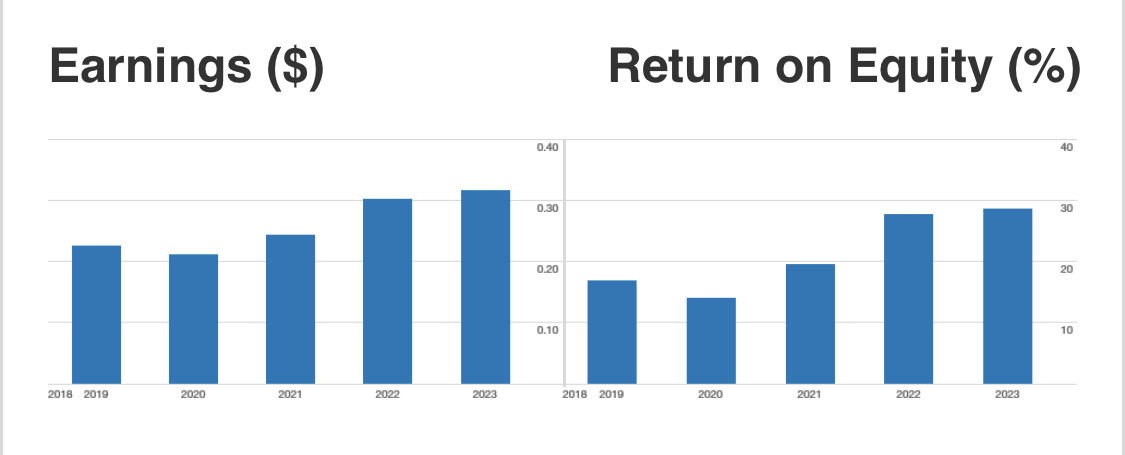

While Metcash is not a hugely exciting business, the quality of its earnings has improved significantly in recent years, thanks to the contribution of Total Tools. ROE has lifted from 15% to 28%, but the market hasn’t recognised this in the PE multiple (13 x) which hasn’t changed much over several years.

The new acquisitions are expected to be accretive to Metcash’s margins, and I am hoping this will also flow through to maintain ROE. Based on analyst earnings consensus for FY24, ROE should be c.22%. Projecting ROE of 22% forward I get a valuation of $3.88 at a required return of 10% using McNiven’s Formula.

The SPP offer at $3.35 per share looks very attractive to me with a 6% fully franked dividend yield while it reinvests 20% of its earnings back into growth. Net debt on equity before the acquisitions was 29%. I am hoping for a total 11.5% annual return on the SPP offer, including franked dividends and growth.

I intend applying for the maximum $30,000 in shares, but I expect the offer will be over-subscribed and scaled back significantly. At least we’ll know the outcome within a week so we can get our cash back earning some interest!

Share Purchase Plan

Eligible Metcash shareholders with a registered address in Australia or New Zealand as at the record date of 7:00pm (AEDT) on Friday, 2 February 2024 will have the opportunity to apply for up to $30,000 worth of Metcash shares free of any brokerage, commission and transaction costs, and subject to scale back in accordance with the policy set out in the Share Purchase Plan offer booklet. Shares will be offered at the lower of:

• $3.35 per share, being the Placement Price; and

• The volume weighted average price of Metcash shares traded on the 5 trading days up to, and including, the Share Purchase Plan closing date.

Proceeds raised under the Share Purchase Plan will provide Metcash with additional capacity to support growth opportunities. New shares issued under the Share Purchase Plan will rank equally with existing ordinary shares on issue.

Full details of the Share Purchase Plan will be contained in the Share Purchase Plan offer booklet which will be made available to eligible shareholders on or around Monday, 12 February 2024.

All dates and times in the timetable are indicative and Metcash reserves the right to amend any or all of these events, dates and times subject to the Corporations Act 2001 (Cth), ASX Listing Rules and other applicable laws. All times and dates are in reference to Australian Eastern Daylight Time (AEDT).

This morning (01/02/2024) Metcash entered into a trading halt while negotiations were underway for the acquisition of Superior Food Group. The AFR reported this about Superior Food Group:

”Superior Food supplies ingredients, packaging and cleaning items to restaurants, cafés and the like. It has been shopped with expectations of $55 million EBITDA for the 2025 financial year. It is expected to be worth about $500 million, and has been a long-standing target for Metcash

The big question is if Metcash would need to tap the equity capital markets to fund the acquisition. On Wednesday evening, fund managers were preparing to be asked for extra cash by the company, should Metcash’s M&A bet pan out.

Metcash is being advised by Barrenjoey Capital Partners and Herbert Smith Freehills. Quadrant has Stanton Road Partners in its corner.”

ends.

…and from the Superor Food Services Website:

“Superior Food Services is an industry leader, that for the last 30 years, prides itself on delivering great outcomes for a broad range of customers across a varied landscape of foodservice clients. Not too large to care, or too small to compete, we are Australian owned and operated and we are determined to continue to evolve, improve and to be at the forefront of innovation in the ever changing competitive foodservice market. With a wide range of dry, chilled, frozen, meat, smallgoods and seafood lines, Superior Food Services proudly services all facets of the food service industry.

For nearly 30 years, Superior has partnered with restaurants, cafes and canteens, big and small, as well as organisations such as caterers, schools and universities, healthcare and aged care facilities and a variety of other food service operations. From remaining compliant with industry regulations and making on-time food service deliveries, to helping you plan your menu – we give you our best so you can serve your best to the customers who expect nothing less.

The Company’s operations are well represented with over 20 branches and business premises nationally and a diverse range of product categories. These also include our Global Meats and Mooloolah River Fisheries protein businesses'.

Superior Food Services is pleased to include a collection of our exclusive brands. These represent products that are specifically selected for Superior customers and are not available elsewhere. These products provide the quality, consistency and exact specifications required by foodservice professionals - sourced for our customers to meet gaps in the market or specific needs. These brands include Iluka, Forbidden Fruit, Global Meats and MRF.”

Held

Request for trading halt

Metcash Limited (ASX:MTS) (Metcash) requests that its securities be placed in a trading halt with immediate effect pursuant to ASX Listing Rule 17.1.

Metcash refers to the article in the Street Talk section of today’s Australian Financial Review speculating that Metcash may be in advanced discussions in relation to the acquisition of Superior Food Group.

For the purposes of ASX Listing Rule 17.1, Metcash provides the following information:

(1) Metcash confirms that it is in discussions with the vendors concerning the potential acquisition of Superior Food Group, however, at this stage the discussions are incomplete and there is no certainty that they will lead to a transaction. The trading halt is requested pending an announcement relating to the potential acquisition and is required to ensure that Metcash securities are not trading on a misinformed basis.

(2) Metcash requests that the trading halt remain in place until the earlier of:

(a) the commencement of trading on Monday, 5 February 2024; or

(b) an announcement being made about the potential acquisition.

(3) Metcash is not aware of any reason why the trading halt should not be granted or any other information necessary to inform the market about this trading halt.

Held

Yesterday Metcash announced that it is increasing its ownership in Total Tools Holdings Pty Ltd (TTH) from 85% to 100% in late November 2023.

if it weren’t for @Jimmy’s Roundup Straw I would have totally missed this, because the announcement was not marked as “Market Sensitive”. It seems strange given Total Tools has been a star performer for Metcash since it took a majority stake in 2020.

“This follows the exercise of a put option by current owners of the remaining 15% of TTH, as flagged in the Company’s FY23 results materials. The consideration for the remaining 15% is $101.5m.

TTH is franchisor to the largest professional tools retail network in Australia. Since Metcash acquired a majority ownership in 2020, the business has delivered remarkable growth with annual sales in the retail network almost doubling from $585m in FY20 to $1,085m in FY23. In addition to strong demand, the growth has been supported by an expansion of the retail store network from 81 to 112 stores, with plans to add around 10 stores a year for the foreseeable future.

Consistent with the successful approach in Metcash’s Independent Hardware Group, Metcash’s growth strategy for TTH has included having a mix of independently owned and Metcash majority- owned joint venture retail stores. There are currently 44 joint venture stores which have put and call option arrangements in place for the remaining ownership of these stores.

The combined acquisition multiple is approximately five times EBITDA for 100% of TTH and the acquired joint venture or company-owned Total Tools stores.

Reset of joint venture store put options

Metcash is currently in advanced discussions with the majority of its Total Tools store joint venture partners on resetting the current put option arrangements. This is to provide joint venture partners with a balance between receiving some capital and remaining both vested and engaged in the ongoing success of their stores. Most of these joint venture partners have indicated interest in further reinvesting in their stores and/or opening new stores as the network continues to expand. Retaining the experience and enthusiasm of these retailers in the network helps to further underpin the ongoing growth and success of Total Tools.

Resetting the current put option arrangements involves Metcash acquiring a further equity interest in the joint venture stores and deferring the put option in relation to the residual ownership interest a further three to five years.

Metcash disclosed in its FY23 results materials that these put options had a maturity profile ranging between FY24 and FY31, with a valuation of $172.8m at the end of FY23.

The Company anticipates being able to provide further information in the second half of FY24, including detail on the expected step acquisitions and the new maturity profile.

Management change

Paul Dumbrell has advised that he intends to step down as CEO of TTH after more than five years in the role.

Paul was appointed CEO of TTH in 2018 and agreed to stay on in the role after Metcash’s acquisition of a majority stake in 2020. Under Paul’s leadership, Total Tools has seen enormous growth, including establishing and maintaining a clear leading position in the Australian professional tools market.

Paul has indicated he intends to remain in the role to the end of April 2024 to continue driving the business’ growth strategy and to remain integrally involved in the design and implementation of the reset of arrangements with our joint venture stores. He then intends to take an extended break with his family.

Metcash Group CEO, Doug Jones said: “Paul has played a key role in the growth of Total Tools and in the smooth and seamless transition to Metcash ownership. Paul is leaving the Total Tools business in great shape with a successful winning strategy and a strong leadership team. I sincerely thank him for his considerable efforts and support, and we wish him all the best for the future, including his well-deserved extended break.”

Paul Dumbrell said: “It’s been a pleasure to lead such a strong and exciting growth business and I wish to thank Metcash, all our franchisees and supplier partners for their significant support. I would also like to personally thank Doug for his support over the last 18 months, he has been instrumental in progressing the Total Tools growth strategy.

“We have a network of very experienced and passionate franchisees, and I am particularly pleased that our joint venture partners want to remain in the business and help drive our continued success. This is clearly a great outcome for the business, and I am looking forward to supporting and executing this reset before taking my extended break.”

An executive search has commenced for a successor that includes both internal and external candidates.

This announcement is authorised for release by the Board of Directors of Metcash Limited.”

Ends

Disc: Held IRL (1.3%)

Yes, I thought so too! I’ve owned Metcash (MTS) in the past and back then it was boring with a capital B, but things have changed!

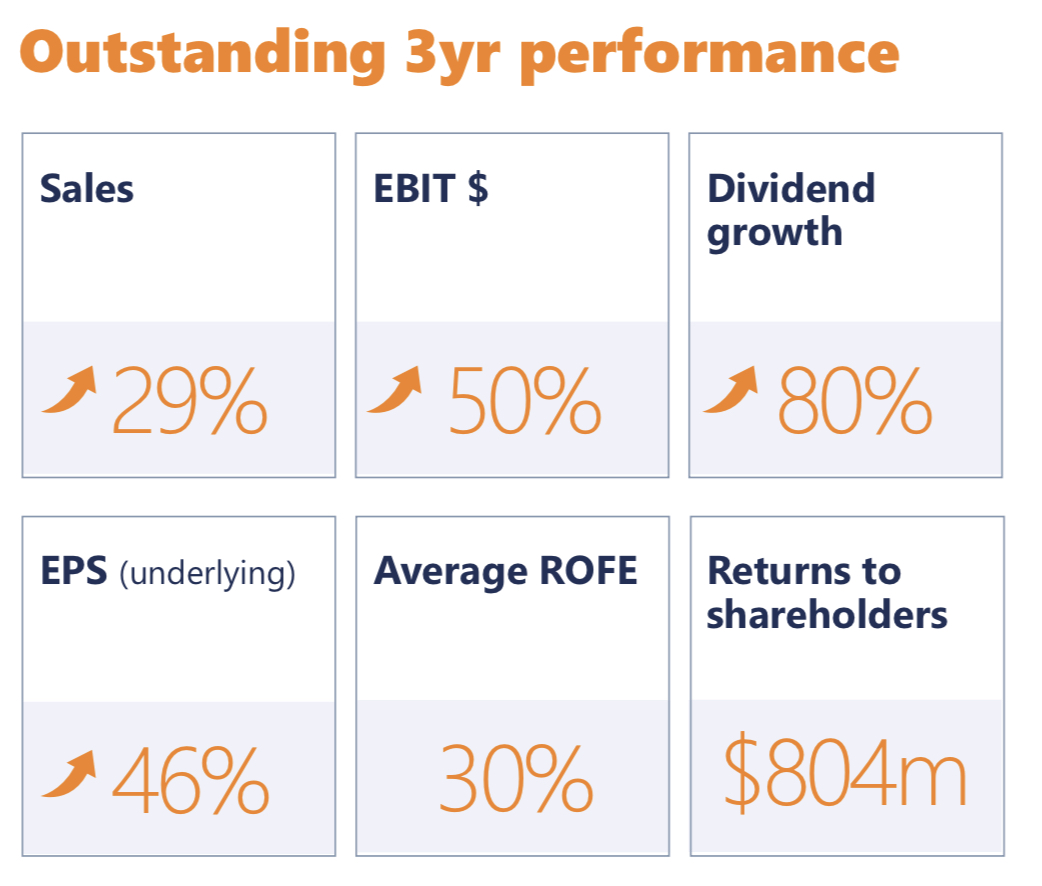

The Metrics

To be honest I was a bit surprised when I lifted the bonnet on Metcash last week. A lot more grunt than I expected. Metcash has been quietly supercharging their ROE over recent years. Underlying FY23 ROE was 28%, up from 14.1% in 2020. Underlying EPS has climbed from 21 cps in 2020 to 32 cps over the last 3 years (up 46% in 3 years).

Source: Commsec

I didn’t realise that Metcash was a dividend stock either. This year Metcash paid investors fully franked dividends of 22.5 cps (up 80% in 3 years). On the current share price ($3.60 on 26/07/23) that’s a yield of 6.3% fully franked, or 8.9% if you can take full advantage of the franking credits.

What about future growth? With a payout ratio of 84% this year that leaves only 16% to reinvest into growth. Over the last three years more earnings have been invested into growth: 38% in 2020, 25% in 2021 and 27% in 2022. We can expect earnings growth to steady a bit from here. Analyst consensus (9 analysts, Simply Wall Street data) have earnings growing of 5.4% per year over the next 3 years.

Margins are thin with gross margins at 11.5% and net profit margins a razor thin 1.64%.

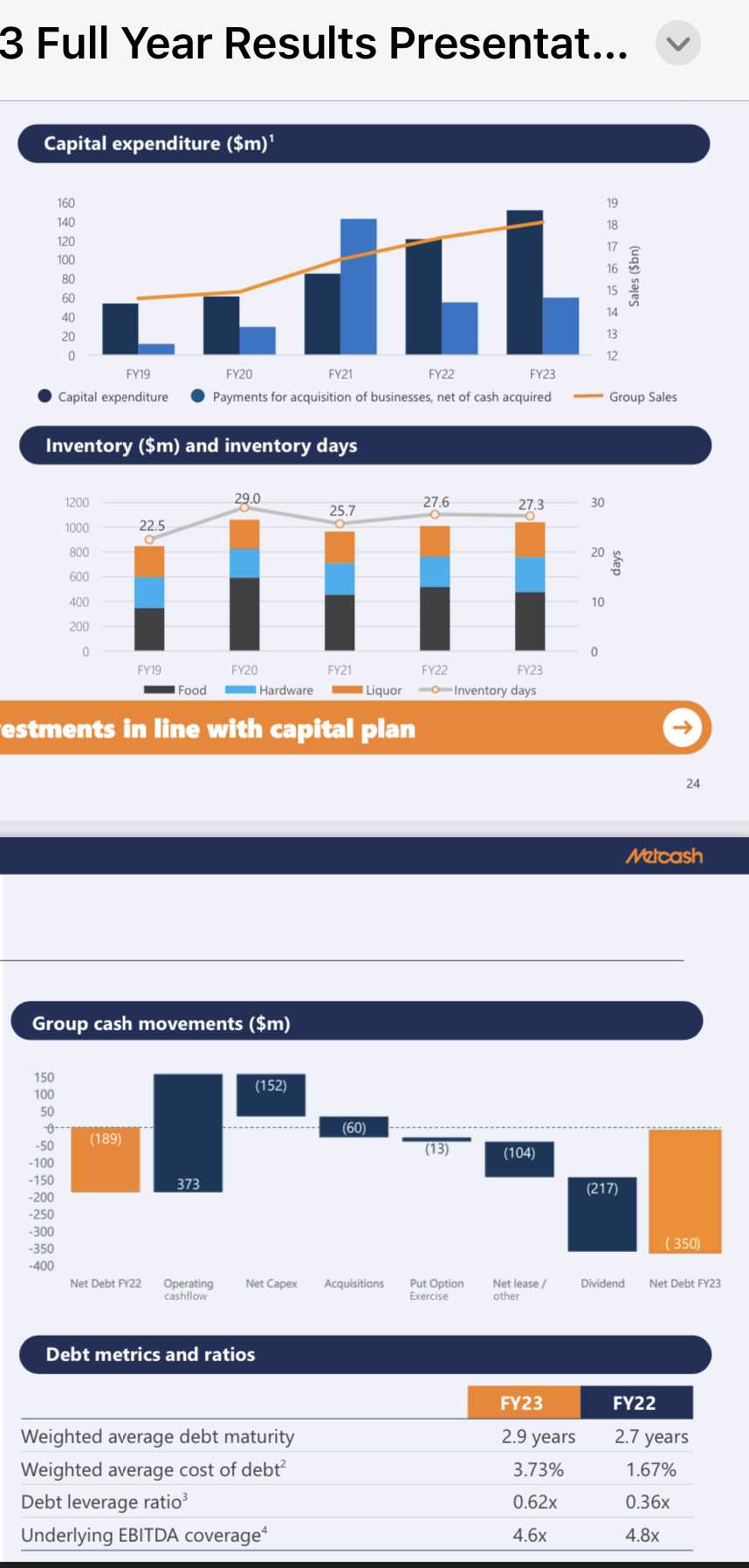

Cash Flows and Debt

Net debt to equity is OK at 32.2% but this has increased significantly over 3 years. In January 2020 Metcash had more cash than debt.

This year net debt increased from $189 million to $350 million. Of the $161 million increase in net debt, $60 million went toward acquisitions. There was also $152 million on Capex this year.

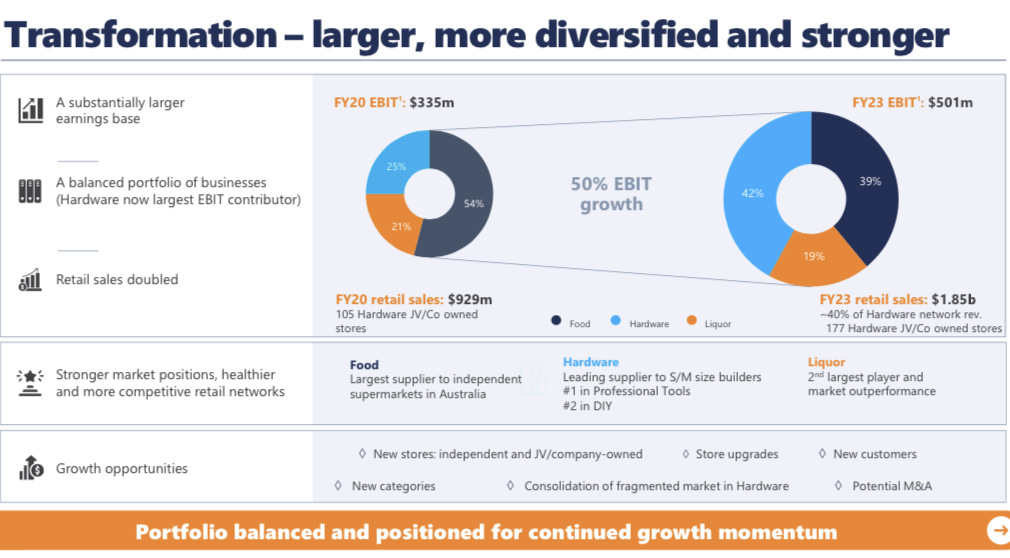

The Business

I was surprised to see how the business has changed since I looked at it last. The business still consists of 3 main categories, food, hardware and liquor. The biggest change has been the shift from food to hardware. Hardware is now king, increasing from 25% to 42% over the last 3 years.

Most investors, including myself, probably see Metcash playing second fiddle in hardware (Bunnings v. Mitre10 and Homeware), second fiddle in liquor (Endeavour v. other brands) second fiddle in food (Woolworths, Coles, Aldi v IGA) however, it seems to have carved out a niche here as the second fiddle. Mitre 10 even refer to themselves when advertising as ‘the other hardware store’.

What most people are probably not aware of is Metcash is now #1 in professional tools. I wasn’t even aware they had a joint venture in Total Tools until a week ago, and this year Total Tools sales increased by 61.9%.

In the hardware division, total sales (including charge-through) increased by 10.6% normalised to $3.4bn.

Outlook

In the first 7 weeks of FY24 total group sales have grown 2.3%. It’s not outstanding, but given many retailers have been reporting negative growth, it’s a reasonable start to FY24.

My Take

I like what I see at Metcash. I think the business has a good balance of growth and defensiveness. I like the Strong ROE of 28% and the current gross yield of 8.9% which is very attractive in the superfund.

Using McNivens StockVal formula, projecting underlying ROE of 28%, equity of $1.12 per share and 16% reinvested earnings into growth, I get a total return of c.13% per year including franking credits over the next few years.

Metcash has just earned a small position in our portfolio with the possibility of adding more if our conviction builds.

Disc: Added IRL yesterday (1%)

Post a valuation or endorse another member's valuation.