An LIC which has all the issues of vested interested and closed capital. This one being a case in point of how bad they can be. I think the issues are magnified when they're small and this one is around ~$300M so quite small.

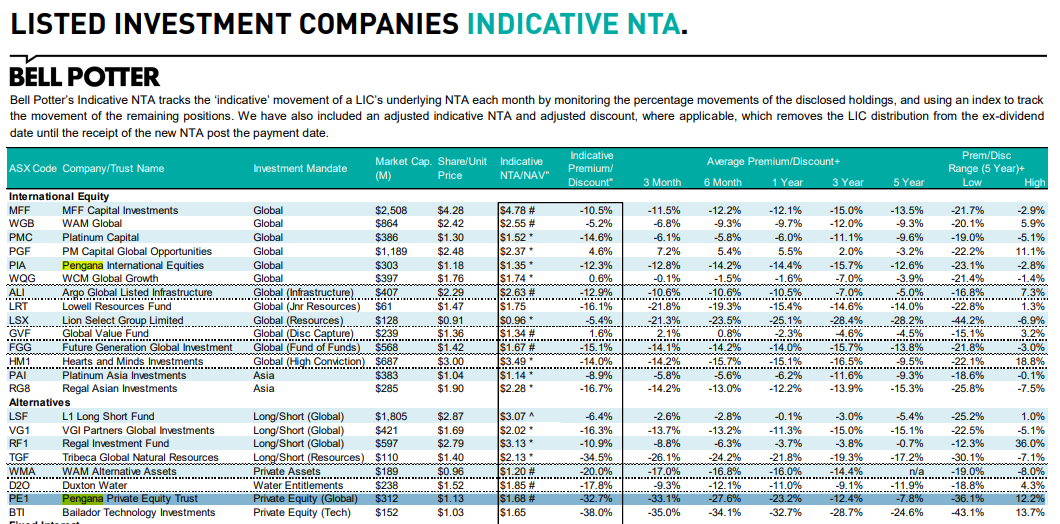

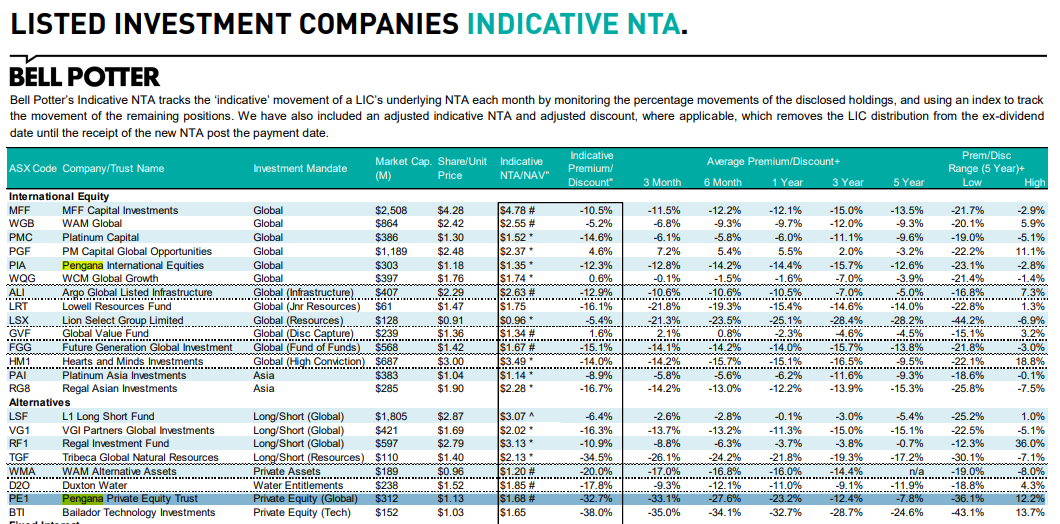

However it is trading at a 32% discount:

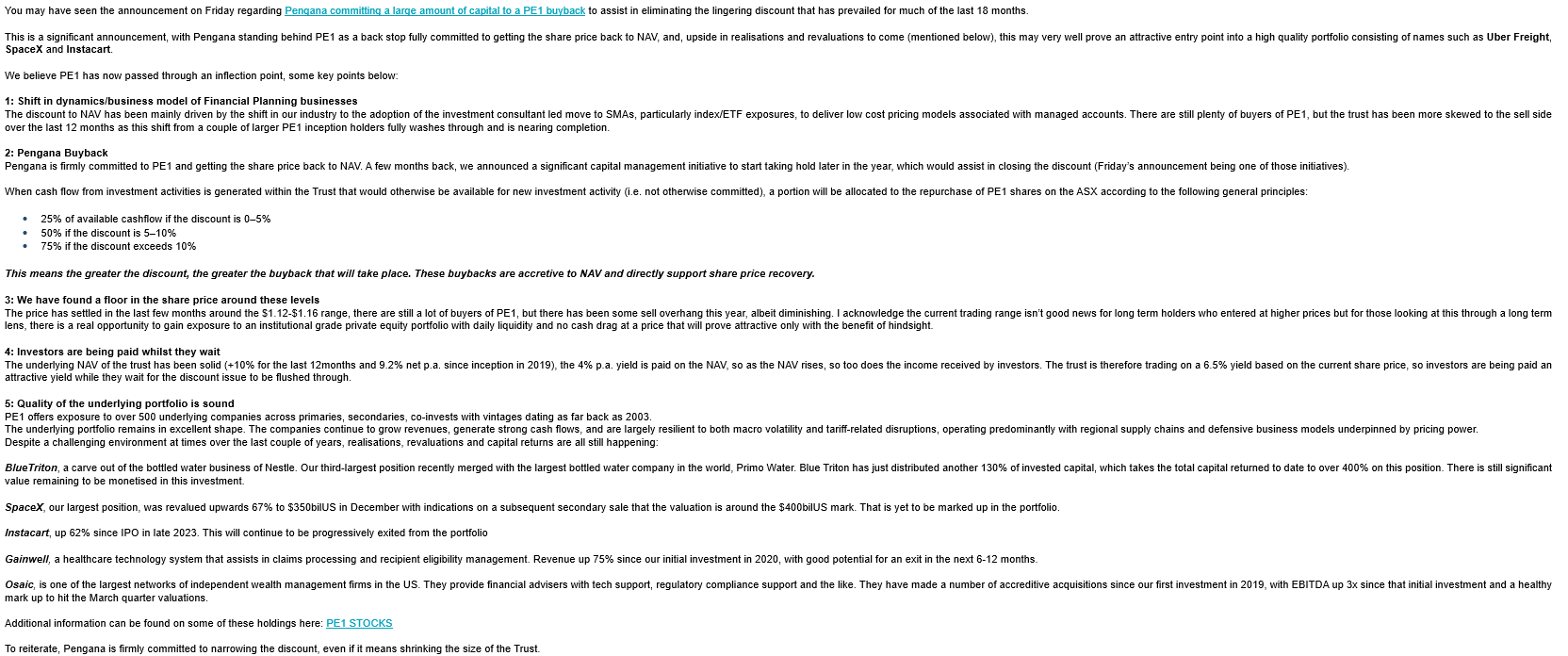

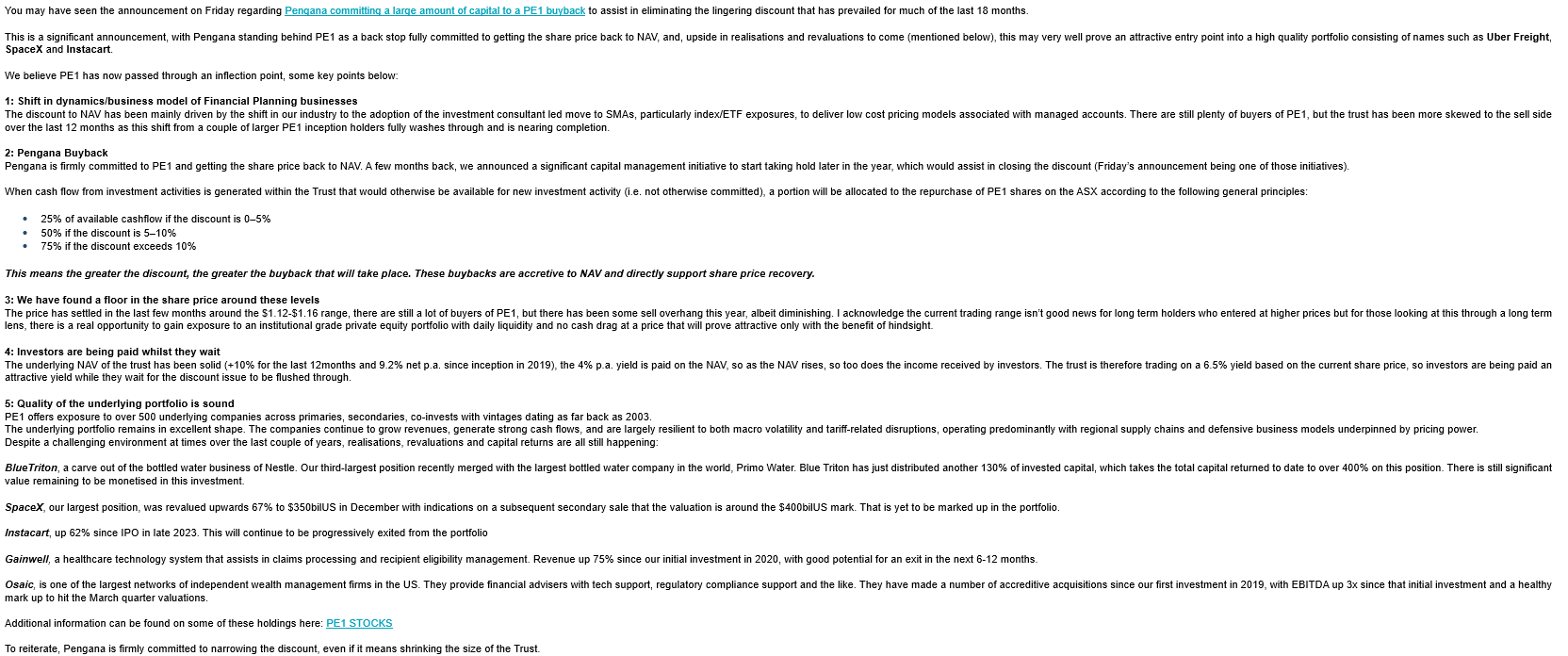

Furthermore action is now being taken to close the discount:

Email below:

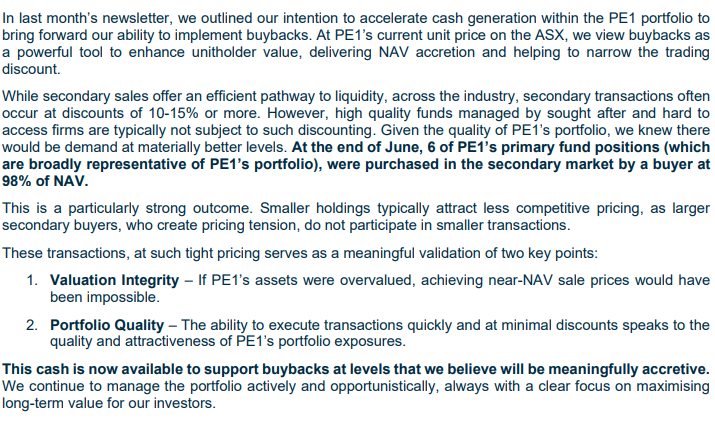

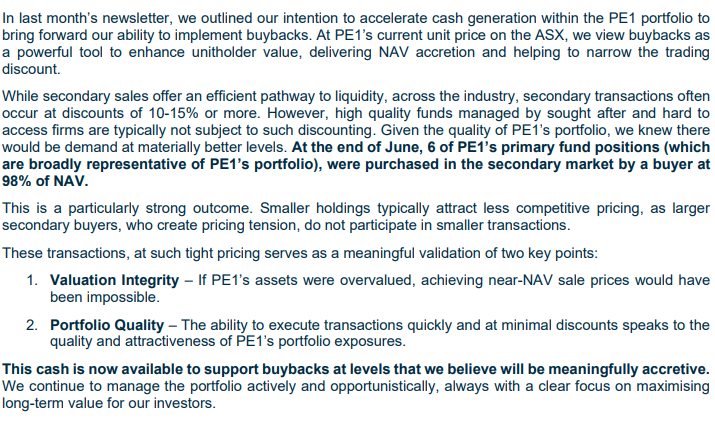

Now do we believe the NTA. From the monthly report they've been selling some assets as per below that are supportive.

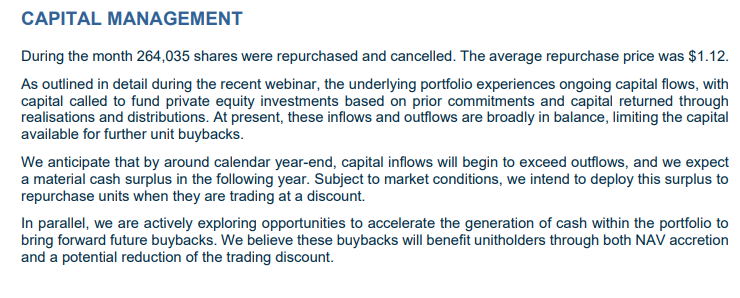

and the buyback has started:

In the past with small LICs, buybacks, have done little to close discounts but they can temporarily.

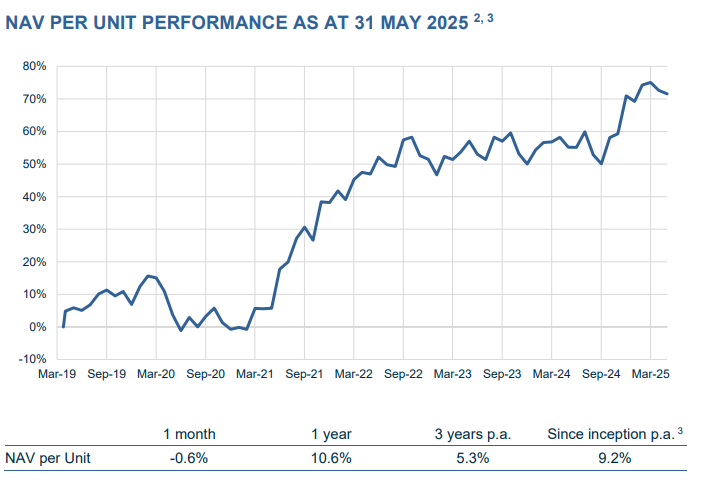

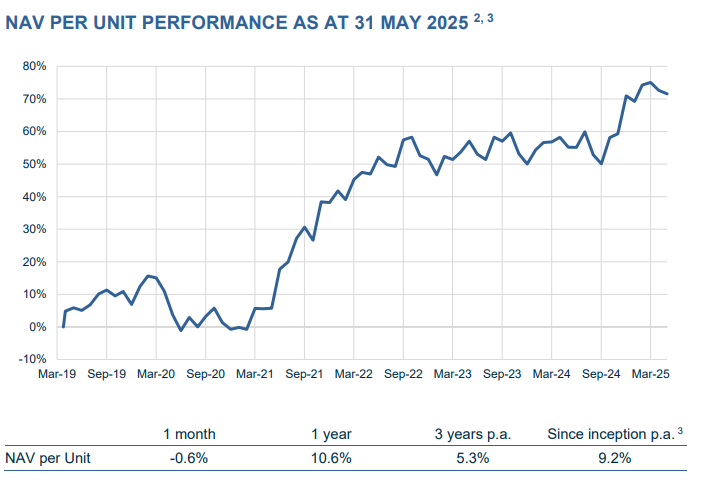

Furthermore there have been issues with PE but performance has been lack luster. Lack luster performance results in discounts.

As the LIC shrinks corporate listing fees also become an issue.

It does provide a dividend but not franked so might not get the baby boomer crowd.

Not sure who would be the natural buyer and long term owner. Seems to me this will delay time until an activist and wind up.

In any case a possible interesting scenario if people wanted to share their thoughts?