Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Based on the below screenshot from LinkedIn, it appears that the largest company in the Powerhouse Portfolio, Cirrus Materials Science, may be undertaking a new raise, which could lead to another portfolio NTA uplift, if the value of the company increases again.

In 2017, Powerhouse first invested in Cirrus in their Pre-Seed Round, contributing $150K @ $1/share. This was a US$1.5m raise in total for Cirrus.

In 2019, Cirrus then conducted a Seed Round at $4/share. PVL did not participate in this round, but their initial investment had increased 4x and was now worth $600k NZD. This seed round put the company at an NZ$8.3 million pre-money valuation and an NZ$12m post-money valuation (US$2.5m was raised in total during this round).

In 2022, Cirrus conducted its Series A at a valuation of NZ$10/share, Powerhouse invested another $400K NZD in this round, highlighting confidence in the progress of the company. The company raised US$6m in total and the new valuation of Cirrus had climbed again (by 150%) to circa $26 million AUD.

Up 10x so far: Powerhouse's initial $150k NZD cheque in Cirrus has thus increased 10x to NZ$1.5m ($1/share to $10/share) and the total carrying value of PVL's investment in the company is NZ$1.9m when considering the additional NZ$400k invested in the 2022 Series A round.

Next Steps: Let's see how the next fundraise plays out for Cirrus and if the company can secure a higher valuation once again. If so, this may finally be the catalyst that highlights to the market that despite the huge Powerhouse share price discount to NTA (circa 9c/share NTA versus a 4c share price), the underlying portfolio companies continue to kick goals and there are more than a handful of 'winners' in this portfolio.

Because Cirrus is the largest position in the Powerhouse Portfolio, at a carrying value of NZ$1.9m, it is currently contributing about 1.5c/share towards the NTA of circa 9c/share. I.e. if the valuation was to double again in the Series B, the NTA uplift would be in the order of +1.5c/share, taking the total NTA to around 10.5c/share.

Interesting podcast here with the founder of Inhibit Coatings: https://www.morgo.co/podcasts/eldon-tate

- "There are 5 of us working at the company at the moment mostly from a technical perspective, but we are looking at growing this out, particularly now that we are breaking into the US market..."

- "We derive revenue from project R&D with our customers and also direct sales of materials with our customers"

- "We've minimised technical risk and now we are focused on meeting customers and growing sales"

- "We are raising at the moment, and the main focus of this raise is all around business development and minimising our commercial risk going forward"

- "We're currently based at Victoria University in NZ, but we will be looking to scale up into new facilities"

My take is that this is important news because PVL owns ~17.5% of the company, which is worth around A$800K currently based on an Inhibit valuation of ~$5m (last round was a seed round in July 2021). This puts Inhibit in the top 5 biggest positions in the PVL portfolio.

Following the pending Series A round mentioned in the podcast, we could see the Inhibit valuation double (potentially triple), and PVL's carrying value in Inhibit Coatings may increase again from A$800K currently to north of ~A$1.5M. I would hope that Inhibit's valuation could rise from ~$5M to ~$10M+.

Deep tech valuations can potentially be much higher than that at the Series A stage: https://www.bdc.ca/en/articles-tools/blog/deep-tech-valuations-how-they-compare-software-start-ups

That would lead to another NTA uplift. Given there are circa 120 million PVL shares on issue, a carrying uplift in Inhibit of circa $700K, would equate to a PVL NTA/share uplift of ~0.6c/share. This combined with the recent Skykraft raise (A$120 million), suggests to me that PVL's NTA/share is in the process of rising again from 8.9c/share to potentially north of 10c/share.

Let's see.

Massive news was announced earlier today - Skykraft has raised $120m - the second largest raise in Australia this year. In my opinion, Skykraft is on track to become a $1bn+ business and the anchor of the Powerhouse (PVL) portfolio in the same vein as SiteMinder has done for Bailador. This is likely to have multi-bagged Skykraft's valuation... Will be interesting to see where the PVL NTA lands, I suspect it may have risen from 8.9c/share to closer to 10c/share... Compared to a current share price of sub 5c.

Exclusive

Big money is back as space tech start-up raises $120m

Technology editor

Oct 16, 2023 – 11.00am

Big money is back as space tech start-up raises $120m

Paul SmithTechnology editor

Oct 16, 2023 – 11.00am

In a sign that big money investment is returning to the Australian start-up scene, Canberra-based space technology specialist Skykraft is set to lift off for the stars, after banking $120 million to fuel its ambitious aviation satellite vision.Skykraft has designed and built satellites to improve communications between air traffic control and aircraft flying over remote areas, and has spent two years raising the funds needed to get a constellation of hundreds of its satellites into low-earth orbit.

Skykraft CEO Dr Michael Frater stands in a workshop with one of SkyKraft’s satellites.Skykraft CEO Dr Michael Frater has now raised enough capital to get a full constellation of satellites up into orbit.

The company’s chief executive, Michael Frater, told The Australian Financial Review the lengthy capital raising process was needed to find the right profile of investor, who could understand and value the firm like a transport infrastructure company, rather than viewing it through the lens of technology and space.“While there is lots of tech in what we do … we have had to explain to investors that what we are doing has all the important characteristics of other infrastructure investments,” he said.“We are dealing with customers that have high credit ratings, it’s a market with long-term contracts – it’s just that we are building infrastructure in space, rather than what investors associate with infrastructure, like concrete and steel on the ground.”

Alongside CSIRO-backed Australian deep technology venture capital fund Main Sequence Ventures, other major investors in the funding round were Foresight Australia, the local subsidiary of the UK-listed fund manager, and OPTrust, one of Canada’s largest pension funds.Dr Frater declined to reveal the valuation the funding round had been struck at.

In an era of relatively conservative funding rounds, compared with the 2021 peak, Skykraft’s represents the second-largest round in Australia so far this year. Cut Through Venture data shows medical device company Saluda Medical secured a $150 million equity round in April, with the other largest deals being Loam Bio’s $105 million in February, and Secure Code Warrior’s $US50 million ($73 million) in July.

The start-up had previously raised a $3.5 million round from investors including former Macquarie Group boss Allan Moss, Lennoxgrove Capital and Adcock Private Equity.The company’s satellites are designed and manufactured in Australia, before being sent into orbit on SpaceX rockets. Its first batch was successfully launched in January, and a second load went up in June.

It plans to build a global air traffic management service, where it will provide constant real-time communications to aircraft between air traffic controllers and pilots, and enable more energy efficient and safer flight path planning.In circumstances such as the disappeared MH370 flight in 2014, which was never found after it went off radar, Dr Frater said a satellite system would have been able to answer some of the questions.“This will provide global coverage, so it means that where there is an incident like that, we will be able to track the plane, and at least we would know where it came back down to ground,” he said.

Skykraft’s latest funding will be sufficient to sustain the company until it has deployed its full constellation of satellites, and revenue starts rolling in from clients to sustain it. But Dr Frater said he was open to taking on a further $10 million in external investment.

Main Sequence partner Martin Duursma said he believed Skykraft’s expertise in designing, building and operating satellite constellations would enable it to provide services that replace legacy systems in the aviation industry globally.“Skykraft is doing truly groundbreaking work that has the potential to transform aviation communications infrastructure,” Mr Duursma said. “By reinventing transport infrastructure from the ground up using space-based platforms, they can increase air safety and address the gaps in surveillance and communications over oceans and remote regions.”

I don't believe the Board has any plans to use this power in the short-medium term (given where the share price is), but I will be voting no to RESOLUTION 3 – APPROVAL OF 7.1A MANDATE regardless, at the AGM. The company needs to keep costs down and allow the performance of the portfolio to shine through over time, leading to further steady NTA/share uplifts. That is what will ultimately lead to a rising share price.

Hopefully, this is a helpful resource, below, to highlight the market cap (mc), enterprise value (EV) and NTA discount at a corresponding share price (anything ranging from 3c to 10c) for PVL. The current share price stands at circa 4.4c and NTA currently stands at 8.9c/share, up from 7c/share approximately 18 months ago. A "fair" EV/portfolio value discount might be 30%, which would equate to a fair value share price of ~7c/share. If the NTA per share continues to rise across FY24, then the intrinsic value of the stock should rise in tandem.

Future/Outlook:

- It would be reasonable to assume Inhibit would be looking to do a Series A this year following their (Seed) Venture Round in July 2021 where shareholders might see a valuation uplift

- I'm feeling fairly confident about the prospects of this company.

- I'd like to see a Series A take them to a $10m+ valuation (from ~$4m currently) based on an estimate that their TAM/rev opportunity is around 30% the size of Cirrus

- It is interesting to note that they have just added two new board members, "to drive the next phase of growth for the company".

- One of these has a strong angel investing network, which again, to me, hints at a possible new round.

- Let's see...

News update:

The announcement notes that one of the board members, Joshua Baker, has ceased to have the power to dispose of the PVL securities held by the Capital H entity.

I'm not sure exactly what this entails — but suspect it is due to the merger of Capital H with Whiley Close Investment Group to form HD Capital Partners.

@BkrDzn, would it be possible for you to confirm this and/or add any extra detail, please?

At 4.5c, PVL has a market cap of A$5.43M.

The company has cash of A$3.2M, and minimal operating cash burn.

If one values the cash fully, then the portfolio (ex-cash) is being recognized at just A$2.23M, by Mr Market (i.e. A$5.43M market cap minus A$3.2M cash).

Yet, the company has a reported portfolio value (ex-cash) of ~A$7.59M, based on major independent pricing events (i.e. raises involving other VC funds or 3rd parties).

In other words, the market is treating the PVL portfolio (ex-cash) at a discount of ~70% (e.g. [A$7.59M - A$2.23M] / A$7.59M).

And yet, 4 of the top 5 positions (Cirrus, Skykraft, Ferronova, Inhibit) have been through major pricing events (i.e. increased in value) across the past 24 months and the other has held its value (Urbix).

In contrast to the share price, the portfolio companies are performing - NTA has increased from 7c to 8.9c across the past 18 months.

Time will tell whether Mr Market is being erratic or not.

The top 5 positions in the PVL portfolio are now:

- Cirrus Materials Science = A$1,749,043

- Ferronova = A$1,034,145

- SkyKraft = A$930,000

- Urbix = A$771,070

- Inhibit Coatings = A$797,827

These (top 5) are collectively valued at A$5.28m, comprising 66% of the total PVL portfolio value of A$7.8m versus a market cap of just $5.55m and $3.2m in cash.

And 4 of these 5 have increased in value across the past 2 years.

Ideally, just a couple of big winners from this set (maybe Cirrus or Skykraft) could lift the PVL portfolio dramatically.

Let's see how FY24 plays out.

The fair value of the PVL investment portfolio continues to increase.

The portfolio recorded a +$855,497 increase in FY23 following the +$108,583 increase in FY22. The big winner for the portfolio in FY23 was Skykraft and the big winner for the portfolio in FY22 was Cirrus Materials Science - both are still in the early stages of their journey.

The initial investment in Skykraft of $250,000 AUD has now multibagged, up +$680,600 (+272%) to $930,600 AUD following the successful Sept 2022 raise. Skykraft is now well on its way to establishing a constellation of satellites for global air traffic surveillance, with a cornerstone customer (ASA).

Additionally, across FY23, PVL's Ferronova holding rerated from $753,794 AUD to $1,032,024 AUD, up +$278,230 or +37%, following a new $8m round of funding, with a non-dilutive research grant from the Government.

Management continues to have skin in the game and is showing judicious cost control.

I like the long-term story playing out here. The 45% SP/NTA discount (4.8c sp vs 8.9c NTA) is at odds with the caliber of management, the quality of the portfolio, and the track record emerging since James Kruger took the reins in late 2021...

Following the sale of Firmus, 50% of the current PVL market cap is now accounted for by cash at hand. Good position to be in with the risk-free rate (10 Year Treasury rate) currently at 4.21%. (PVL can earn ~$135k p.a. in interest income).

Firmus's recent partnership with ST Telemedia Global Data Centres looked promising, but as a shareholder, I am supportive of this strategy to return more of the NAV to cash (particularly for the lower conviction port co's and/or legacy investments). The greater the percentage of NAV held in cash, the lower the SP/NTA discount (in theory).

I'm most bullish on the prospects of Skykraft, Quantum Brilliance, Urbix and Liquid Instruments - and I suspect the board is too. If any of these were contemplated on the secondary market, PVL would most likely only take a premium to the current disclosed NAV.

Skykraft was recently featured in this 'Meet the Fund Manager' series by Reach Markets.

It appears that Powerhouse Ventures' (ASX:PVL) initial check (in Dec 2021) of $250,000 AUD into Skykraft at a 1.7% stake (est. ~$15m valuation of Skykraft) has now turned into a circa ~$1.1 million dollar position at a ~$75m Skykraft valuation.

See the following Reach Markets link for further details on Skykraft and the recent fundraising rounds:

https://reachmarkets.com.au/the-insider-meet-the-fund-manager-anthony-murphy-4/?

I've had a quick look at other comparables (LICs focused on small/nano/VC) listed on the ASX. Understandably, there does seem to be a correlation between scale (market capitalisation) and the share-price/NTA discount. This is likely because a larger scale is correlated with success (growth over time), longevity, and also a lower expense ratio (MER). However, even when accounting for that, PVL appears to be very cheap with a discount much higher (~45% discount) than what should be expected (~22% discount) based on the trend line (see the scatter plot below). A 22% discount to 9c NTA for PVL would be a share price of ~7c vs ~5c today. I expect the discount to close to that level in time.

Interesting news was released publicly yesterday.... Firmus Grid has just achieved a major milestone in partnering with a global player, ST Telemedia Global Data Centres (STT GDC), to set up a joint venture using Firmus IP.

As far as I take it, they will offer infrastructure-as-a-service (IaaS) for high-performance AI clusters, running on Nvidia A100 & H100 GPUs in systems, which STT GDC describes as "sustainable AI factories".

All of the funding required is being put forward by STT.

Given the global nature of this JV and the credibility of this partner (STT), this hopefully will lead to a significant valuation uplift for Firmus over the coming quarters.

"The SMC is made up of immersion tanks from Firmus, installed in 1MW shipping containers known as "Hypercubes" within STT GDC facilities in Singapore, India, and Australia. The Singapore availability zone (SIN01) will be launched first, before the end of 2023.The Firmus Hypercube containers will hold servers from OEM partners including Supermicro, and offer services with "industry-standard" uptime SLAs, warranted directly to each customer. Firmus - formerly known as Firmus Grid - was founded in 2019, and has been offering immersion-cooled AI systems running OpenStack and Kubernetes-based software from Canonical. STT GDC described the partnership as a "significant investment" into a global venture with the company."

Source: https://www.arnnet.com.au/article/707783/firmus-technologies-st-telemedia-partner-create-ai-factories/

Interesting to see a sizeable cross-trade go through today at 4.95c for ~2m units ($100,000 AUD). I suspect it is the #1 shareholder buying (Capital H), and probably the #2 shareholder (HUB) selling, given they are a legacy shareholder from the pre-2020 era who are underwater (pre James Kruger as Chair). We'll find out soon enough with an ASX substantial shareholder notice. Hopefully, this marks the bottom. The share price chart does seem to be forming a base/bottom here around 5c, but it is possibly too early to tell. A pause in rates (and eventually a pivot) will breathe some life into higher-risk asset classes, such as VC, and there could be a solid bounce back to say 7c or so (that would be a 22% discount to 9c NTA versus 45% currently at 5c). BTI made a great announcement today, and its NTA discount has started to close from -33% to around -22%) following the low on the 29th of May 2023 (historically BTI has traded at an NTA premium). PVL also traded at a premium to NTA across most of 2021.

Positive announcement. I appreciate the board's proactive, considered approach here. They have a portfolio of well-performing deep tech investments (Skykraft, Quantum Brilliance, Urbix, Cirrus Materials Science, etc) and the discount to NTA (~45%, 5c v 9c) seems to be largely a function of macro market sentiment as opposed to the teams' performance (steadily increasing NTA and low levels of cash-burn). This announcement highlights that they are taking active steps to close that discount (5c share price v 9c NTA) before continuing with future plans (a managed deep tech fund etc, which they consider as "expanding horizons"). There's (9-5)/5= 80% upside from current share price levels if they manage to close the NTA gap.

The quantum computing industry is still (extremely) nascent, but it is exciting to witness Australia taking a leading position in quantum computing via startups like Quantum Brilliance, Q-CTRL and others.

Quantum Brilliance (a Powerhouse Ventures Portfolio company) raised AUD$25.8 million back in February of this year in its Pre-Series A, and more recently released a quantum software dev kit and announced office expansion. I've collected a few key links below and am keen to keep tracking the progress of this company in particular.

- Overview: https://www.gizmodo.com.au/2023/04/quantum-brilliance-quantum-computing/

- Quantum Brilliance releases quantum software dev kit (March, 2023): https://www.innovationaus.com/quantum-brilliance-releases-quantum-software-dev-kit/

- Pre-Series A (Feb, 2023): https://www.businessnewsaustralia.com/articles/canberra-s-quantum-brilliance-closes--26m-raise-backed-by-main-sequence--investible-and-more.html

- Seed Round (2021): https://www.businesswire.com/news/home/20210825005293/en/Quantum-Brilliance-Raises-9.7-Million-Seed-Funding-to-Advance-Diamond-Quantum-Accelerator-Development-and-Deployment

“We’ve had experience with companies developing technology quietly until their breakout and then reaching significant valuations on the global stage,” said Shaun Wilson, founder of QxBranch, Australia’s first quantum computing applications company, founded in 2014 and acquired by Rigetti in 2019. “We are quietly confident Quantum Brilliance has all the foundations in place to be a globally significant company and to reshape the quantum computing industry.”

Fortunately for Powerhouse Ventures shareholders (ASX PVL), we are in the box seat to watch this one unfold as our Exec Chair, James Kruger, is the Chairman of Quantum Brilliance. Powerhouse invested $500,000 AUD in May 2022 and this investment has since undergone a valuation uplift associated with the Pre-Series A raise, leading to PVL NTA rising (see here).

The next step for Quantum Brilliance will be to raise a much larger (Series A) round. "Dr Doherty, the company’s chief scientific officer, declined to reveal the company’s valuation and said the founders had chosen to raise a pre-Series A round and delay a larger investment because of uncertainty in the foreign capital market.“We made a strategic choice to delay our major Series A raise until there was greater market certainty,” Dr Doherty told The Australian Financial Review." (Source)

It is unclear what the current valuation is of Quantum Brilliance. But, for shareholders, the key question is how big could this company become and how likely is it to succeed. Personally, I think it has the foundations to be a unicorn.

Nice little preso here. PVL currently trades (6.5c) at a ~30% discount to NTA (9.1c). It is pleasing to see solid and steady ongoing increases in NTA despite difficult venture market conditions across the past 12 months. I suspect we will see NTA continue to increase this year as market conditions improve and more of the portfolio undergoes new financing rounds. Let's see. A possible strategy here is simply to buy when there is a discount to NTA and sell when there is a premium to NTA in order to benefit from the underlying portfolio return (NTA increases) plus take advantage of mood swings by the market (for an enhanced return). If they can keep cash-burn near neutral and continue a solid track record the gap between share price and NTA should in theory close. A 30% discount to NTA feels cheap to me given that this is a solid late-stage VC portfolio (i.e. averaging Series B, not Seed stage).

Excellent quarter.

NTA now at 8.5c, up 0.4c from 8.1c.

Neutral net operating cash — seems like they are now generating (consulting?) revenue... Awesome to see such strong cash (cost) control.

A bonus is that Skykraft has been revealed to have just closed a financing round (details confidential), this should lead to a further uplift in NTA (fingers crossed).

Well done to the team.

Looking forward to the quarterly this week and the pending announcement confirming the size of the PVL NTA uplift as indicated in the last release (I believe NTA is now around ~8-9c/share). Bailador Technology Investments Ltd is a good example of a strong investor comms strategy for a listed VC vehicle. Powerhouse is unlikely to need monthly NTA updates (due to no listed portfolio companies, unlike BTI), but a quarterly NTA update in a newsletter format would be beneficial for investors. Let's see if the Directors can secure their reward this year (options) if the share price hits > 20c! Seems a long way to go, but anything is possible. The first milestone would be to get back over 10c, I think that is achievable in the next 3 months with further positive portfolio company developments. Consulting style revenue could be the game changer -- Kruger & Co have the skills, it is just a matter of finding a win-win structure / incentive package for i) PVL to take consulting earnings and ii) allow Kruger (and shareholders, including Capital H) to win via the PVL share price.

Keen observers will notice that key PVL staff (James Kruger & Gregory Ross) have established a consulting/advisory business that is supporting/working with some of the PVL portfolio companies (hint: take a look at LinkedIn). This aligns with PVL's 3rd pillar of "expand horizons"... If this is linked to PVL in a way that is a win-win for all involved (i.e. some further options at 20c might need to be granted), PVL would move from a cash burner (which requires portfolio returns to exceed the cash-burn rate to continue increasing NTA) to a cash earner with multiple levers to increase NTA... Moreover, if PVL becomes a cash earner, not a cash burner, you'd expect the stock to swing from trading at a discount to NTA to a premium... Let's see what happens here across 2023.

Significant news out yesterday from Urbix (see below).

I suspect this helps explain why the Powerhouse share price has been so strong over the past month... in addition to the excellent progress of Skykraft in launching Australia's largest satellite constellation... and the ASX PVL release indicating impending NTA uplift...

Impressive progress here — a joint development agreement with SK positions Urbix as a potential major player in the EV (graphite) supply chain.

https://eng.sk.com/news/sk-on-to-work-with-u-s-graphite-processor-to-develop-anode-materials.

The Powerhouse (PVL) team are supporting both with capital and also via advisory roles.

Australia’s largest ever satellite constellation now active

Updated: 5 days ago

12 January 2023, Canberra – Skykraft's Block II satellites successfully reached low Earth orbit after their 3 January launch by SpaceX from Cape Canaveral.

The satellites were launched as a single payload, with four mission satellites carried by an orbital transfer vehicle. Following successful initial testing of the single payload by Skykraft, the four mission satellites were separated from the orbital transfer vehicle to become five single satellites.

Over the past 7 days, Skykraft has performed critical operations including testing communication through its UHF command channel to communicate regularly with all satellites, ensuring a functioning power system with batteries being recharged by the solar panels, and operations of the mission computer.

"All onboard systems tested on the five satellites are performing in line with expectations, including the mission computer which is operating flawlessly," said Dr Michael Frater, CEO of Skykraft.

"Skykraft is now actively operating the five satellites, which form the largest ever constellation of Australian built spacecraft, and will be carrying out proof of concept activities for our Air Traffic Management services”

Skykraft's global Air Traffic Management (ATM) service is set to be commercialised over the next 2 years, and will address gaps in surveillance and communications for aircraft travelling over remote and oceanic areas.

"This first launch is just the start. Over the next 2 years, Skykraft is building and launching a satellite constellation that will accurately track and monitor aircraft movements globally, allowing aircraft to follow more efficient flight routes."

This proof of concept activities will see Skykraft testing the capability of our Air Traffic Management services and analysing data over the next 3 months, with further launches scheduled for mid-2023 and early-2024.

Skykraft's design, manufacture and operation of satellites have now been proven in space.

FIFA to use Australian technology to monitor concussions at World Cup

Concussed players at the World Cup in Qatar will be assessed using a new piece of Australian-owned technology as part of the most extensive set of protocols FIFA has ever deployed at a major tournament.

NeuroFlex, a virtual reality headset which tracks eye and head movements to help facilitate a safe return to play, has inked a partnership deal with Aspetar, Qatar’s world-leading sports medicine hospital which provides care to all sporting events held in the country.

Former Socceroo Gerry Gomez with NeuroFlex executive director Grenville Thynne.CREDIT:

JAMES BRICKWOOD

That includes the forthcoming World Cup, which kicks off in Doha on November 20 and is the first in which teams will be permitted to use a concussion substitute, in line with IFAB’s ongoing global trial, regardless of how many of the usual five subs have been made.

After being successfully tested in Super Rugby, the SANFL and last year’s FIFA Arab Cup, the NeuroFlex system will be available at Aspetar during the tournament to help team doctors determine how quickly a player is able to return to the field following head trauma.

Unlike many sporting governing bodies which have mandated arbitrary timeframes that concussed players must observe before returning to play, FIFA has only put forward a recommendation of six days – but this technology will ensure any such call made at the World Cup will be based on pure science and real-time data, NeuroFlex executive director Grenville Thynne said.

“What NeuroFlex does is it provides the objective data to the medical team to make an informed decision,” Thynne said.

“Right now, the data that the medical teams rely on is very subjective – waving of a finger, a couple of balance tests, maybe a couple of cognitive tests. And a lot of players these days can sometimes memorise those cognitive questions and the answers those questions.

“This takes out subjectivity ... there’s a lot of data that is given to the team doc in order to make his decision.”

In addition to NeuroFlex, FIFA has put in place a range of additional measures including the concussion sub, a replay screen for team doctors to review concussion or injury incidents, and concussion ‘spotters’ who will be seated in the media tribune to analyse any medical incidents.While most of the public discussion regarding concussion in recent years has revolved around collision sports like the rugby codes, Aussie rules and American football, the beautiful game is also facing its own reckoning in parts of Europe.

RELATED ARTICLE

Concussion crisis

How a charity match injury triggered an answer to football's heading conundrum

CTE, or chronic traumatic encephalopathy, is believed to be caused by repetitive sub-concussive knocks, such as those football players regularly sustain while heading the ball.

Five members of England’s 1966 World Cup-winning team have been diagnosed with dementia, leading to the death of four of them. England’s Football Association has responded by banning under-12s from heading the ball at training and in games.

Football Australia has not enacted such a ban, but recently engaged an expert working group to provide ongoing guidance on concussion in football, while FIFA says it has made brain injuries in football a “key objective” of its medical subdivision and is constantly monitoring research on the matter.

“In addition, FIFA is conducting research on the mechanical properties of footballs and is exploring how these factors can influence ball impacts, as well as how they can best be measured and quantified,” a FIFA spokesperson said.

Sports news, results and expert commentary. Sign up for our Sport newsletter.

* PVL invested $225,000 CAD in Neuroflex in April 2022 for a 1% stake, which gives Neuroflex a current valuation of ~A$24 million (Seed). With trials complete and partnerships secured, it is likely that Neuroflex will want to scale up into its Series A soon.

PVL Investment Details:

- Powerhouse Ventures invested $435,000 AUD into Courseloop in Dec 2021

- Thus, PVL has a circa 1.4% ownership stake (~A$31m last recorded valuation)

- This investment was a strategic potential upcoming IPO play, co-ordinated/encouraged by Capital H, reflecting the new Kruger et. al. strategy of PVL in investing in late-stage VC companies to secure quick wins (NTA uplifts) and quick liquidity events

Current Progress:

- CourseLoop is an end-to-end curriculum management system with superior ease of integration and user experience.

- The software is built by higher education experts with hands-on university experience to create better solutions for today’s students, administrators, and academics.

- 500,000+ students are studying curriculum managed on the CourseLoop Platform including at Monash Uni, La Trobe, Macquarie Uni, QUT, UCLA and Nottingham Trent.

- Courseloop's revenue continues to grow and management will want to ensure their growth rate remains high, such that they can secure a strong valuation (>$100m AUD) at a potential upcoming IPO

Next Steps/Future

- Courseloop is one of the most mature VC companies owned in the PVL portfolio and is approaching an IPO, which was initially scheduled for 2022, prior to the market conditions dictating otherwise

- Although the IPO has been postponed, it is possible it may happen this year instead (2023)

- Alternatively, another form of liquidity event could be an acquisition, with a few acquisitions recently occurring in the EdTech space

PVL Investment Details:

- Powerhouse invested $500,000 AUD in May 2022 for an undisclosed stake in the company

- I haven't yet been able to unearth what the current valuation of Quantum Brilliance is

- From my understanding, Quantum Brilliance has raised about $10m to-date and they are probably at the Seed Stage, and will next look to do a Series A.

Company Details:

- This is a very exciting IP-moat technology, but it is early days here so far

- Spun out of the Australian National University, Quantum Brilliance was accepted into Germany’s future “Diamond Valley” of greener, miniaturised quantum computing (offices in Germany & Australia).

- It recently announced a three-year €20 million joint research project with the Fraunhofer Institute for Applied Solid State Physics IAF and the University of Ulm in Germany to develop new techniques for the fabrication and control of diamond-based quantum microprocessors.

- As part of the collaboration, Quantum will work with Fraunhofer IAF to jointly develop precision manufacturing techniques for the fabrication of scalable arrays of diamond qubits.

Next Steps/Future Potential:

- It is too early to tell when Quantum will next raise or how their technology will progress

- We do know, however, that valuations in the quantum computing space can move fast.

- In 2021, an Aussie-led quantum computing startup in Silicon Valley (PsiQuantum) closed a US$450 million ($611 million) Series D raise, reportedly giving it a valuation of US$3.15 billion ($4.3 billion)

- This is the potential for Quantum Brilliance, but we will need to wait to see how this story evolves.

Momentous news out from Skykraft today (see below, thanks @reddogaustin). I estimate Skykraft's current valuation at around A$15m following the $3.5m seed round in Dec 2021. Powerhouse put in A$250,000 at that round for an ownership stake of ~1.7%.

As the company scales up from 5 satellites (proof of concept) to 250(!), another capital injection will be required and the next one will likely need to be a major one. Thus, I'm expecting a significant Series A for Skykraft this year or in the first half of 2024 at the latest.

The valuation of that will be anyones' guess, but if you read the post from James Kruger below ("toll roads of the sky") it is quite clear that Skykraft could/should become a significant recurring-revenue earner and the valuation of Skykraft will soon start to reflect that.

I have my own estimate for what I think that valuation could be, but it is probably too early to start speculating. Towards the end of this year, we might have some very significant news on our hands.

https://www.youtube.com/watch?v=qrg7LKtXyd4

PVL Investment Details:

- PVL invested $400K USD in July 2022 in the Liquid Instruments Series B round (US$28.5m raise)

- This gives PVL 0.4% ownership of Liquid Instruments

- The sizeable investment makes this PVL's 5th largest portfolio company (by carrying value), which also reflects the later stage (further progressed) nature of Liquid Instruments

Progress:

- Liquid Instruments is an innovator and market leader in Test & Measurement instrumentation - a $20B market across legacy and rapidly growing industries like Aerospace & Defence, Automotive, Connectivity and Semiconductor.

- This is a very solid, post-revenue company progressing well (already at a ~US$100m valuation)

- Liquid Instruments is the first to develop and commercialize proprietary “Instrument-on-Chip” technology with their Moku product range. This software-defined, hardware-accelerated, cloud-connected instrumentation disrupts the old paradigm of heavy, expensive hardware boxes designed for single tasks.

- PVL were provided with the opportunity to invest because of their technology networks with the ANU

Future Outlook/Next Steps:

- Liquid Instruments have a cash runway now for about 3 years

- Yet, they are essentially very close to breakeven and could make themselves breakeven at any point

- So this is all about execution now for them and it is a massive TAM.

- All of the major incumbents in this space are billion-dollar+ revenue companies, so Liquid Instruments should do well.

- The duration to a liquidity event on Liquid Instruments should be faster than most other companies in the PVL portfolio.

- This investment is thus a strong juxtaposition with the "old book" of PVL investments (pre-Kruger), one has a clear line of sight to a liquidity event here versus some of the old book (pre 2020) which was hard to have a line of sight on, even in the medium term (5+ years)

PVL Investment Details:

- PVL initially invested many years ago and owns ~17.5% of the company, worth around A$670K

- This is another materials company, but with a more specialised application than Cirrus (thus Cirrus has a much larger TAM opportunity)

Progress to Date:

- They are starting to get "paid to play" style engagements but are less progressed than Cirrus

- They are dealing with substantial players in the industry

- I think they are largely through the valley of death stage and suspect they have recently extended their runway

Future/Outlook:

- It would be reasonable to assume they would be looking to do a Series A mid-next year following their Venture Round in July 2021 where shareholders would/could see a value uplift

- I'm feeling confident about the prospects of this company. I'd like to see a Series A take them to a $10m+ valuation (from ~$4m currently) next year based on an estimate that their TAM/rev opportunity is around 30% the size of Cirrus

PVL Investment:

- PVL invested $500,000 USD in the $50m USD Series B Urbix raise

- This significant amount (for PVL) makes it PVL's 3rd largest holding, which reflects the higher level of confidence of the PVL team (Kruger et. al.) in the company and the more advanced state of progress of this company (closer to a liquidity event)

- This gives PVL an ownership stake of ~0.3%

- PVL also has introductory (Gregory Ross, President of the Australian Chamber of Commerce in Korea) and advisory (Ben Hodge through an affiliated advisory company) roles in the EV supply chain (primarily Korean companies) which has entitled them to this investment access

Progress so far:

- This is already a behemoth of a company that could become very large (multi-billion dollar valuation)

- Urbix technology can process graphite with only 5% of the energy that would be consumed otherwise with traditional methods, the process also avoids the use of acids that are used in traditional methods

- Urbix have already worked with 50+ mines across the world to get samples, and work with these raw material inputs

- The company seems to be executing very well

Potential/Future:

- From a timeline perspective, the EV industry needs to move quickly, so this is potentially a multi-bagger in the 12-36 month timeframe

- It would be reasonable to expect that Urbix could move into their first commercial plant with production over that timeframe

- Once this is happening, with commercial contracts, this becomes a traditional valuation exercise (discounted future cashflows) to determine the fair value of the company

- This could therefore be a very large, very significant company. In terms of where the liquidity eventually happens and whether it is an IPO, it is too early to know

- I'd be looking towards a potential Series C raise at a valuation north of ~A$500m

Ferronova (~A$6m valuation)

PVL Investment Details:

- PVL initially invested in May 2016 and owns ~12.6% of the company, which is currently worth around $760K AUD

- Ferronova subsequently raised a Series A in May 2020 raising ~$3.5m

- Uniseed is a substantial investor and also has a board seat

Current Progress:

- This is essentially a biotech company going through the drug development pathway (clinical trials)

- Based on the recent announcement(s) and their clinical trial timelines I believe Ferronova are underway with a current financing round...

- Biotech companies often have a binary style outcome associated with them, but Ferronova appears significantly de-risked since the first PVL investment back in 2016 and now have multiple drugs going through clinical trials

- Their TRL is probably around the mid-point (4/5/6) and inching now towards the 7/8/9 levels where it can be commercialised

Next Steps:

- Following the current financing round (which will give them a runway), there would be a circa 2-year period of progressing through the next phase of regulatory/clinical trials (Phase II)

- At that point, if Ferronova can succeed with the Phase II trials (over the next 2 years), we could see a big re-rate scenario moving into Phase III trials (2025).

Future/Potential:

- The uplift for Ferronova is likely to be small for the impending/current financing round but could be very significant if all continues well in ~2 years' time (i.e. I have seen anything from $40m to $400m+ valuations for phase III biotech companies on the ASX and Ferronova operates in a massive TAM)

Cirrus Materials Science (~A$26m valuation)

PVL Investment Details:

- PVL initially invested $150K NZD in 2017 ($1/share) (pre-seed round)

- PVL owns ~6.7% of the company worth ~$1.75m AUD

- Cirrus completed a Seed round in 2019 ($4/share)

- This was followed by a Series A in 2022 raising $6m ($10/share) (PVL did a follow-on investment here of $400K NZD)

- PVL's initial investment has thus 10-bagged so far

Current Progress:

- Current clients include: US DoD, US DoE, aerospace majors, leading EV makers, superconductor makers

- Cirrus has made really good progress in levelling up their TRL

- They are very efficient capital allocators

- Cirrus offers exclusivity in the customer’s field-of-use, making the technology highly attractive and disruptive.

Next Steps:

- Cirrus is likely to be currently looking for a strategic investor (also serving as a key customer)

- In addition, they will look to move from trial-style revenue to proper commercial licenses (in the next 12-month timeframe)

- If we look to 2023 (next 12 months), it would be reasonable to assume that if they hit the milestones they are looking for, we could see a re-rate (Series B).

- Cirrus has the potential to generate revenue in a multitude of industries: semiconductors, car manufacturing, wind turbines, space tech etc., so they can keep carving out commercial licenses for companies where they are commercial benefits (often in the order of millions or tens of millions of dollars of savings for their customers)

Future/Potential:

- Could this become a unicorn? That's anyone's guess, but the TAM for high-performance coatings is estimated to reach US$200 billion by 2025 (Source: Research & Markets, 2017)

- I'd like them to hit a $50m+ valuation at Series B and $100m+ valuation at Series C

Anything that remains in the PVL VC portfolio from pre-2021 (pre-James Kruger's era) has been through a long Winter (3-6 years) and therefore the chances of these companies surviving and thriving (increases to NTA) are now quite reasonable — that's venture capital investing 101. From the initial PVL portfolio (2016 to 2021), these are the winners that remain alive, well and growing:

- 1) Cirrus Materials Science (~A$26m valuation),

- 2) Ferronova (~A$6m valuation),

- 3) Inhibit Coatings (~A$4m valuation) and

- 4) Certusbio (~A$3m valuation)

Great to see the new team starting to build a track record of NTA uplifts.

- At the end of the Q3CY22 (Q1-FY23), cash resources were $3,243,000 AUD

- Prior to today's update, the total PVL carrying value in portfolio companies stood at $6,976,497 AUD

- This is a total Net Asset Value (NAV) of $10,219,497 AUD or 8.5c/share (given 120,740,000 SOI)

- With this impending uplift, new NAV (or NTA) will rise to 8.9c-9.3c/share

Thus, the current share price at 4.7c trades at a circa 50% discount to NTA.

Possibly a mini Bailador in the making.

A sizeable trade went through in the post-market auction today for 1.78M units ($84K) at 4.7c on the CXA (formerly Chi-X). I'm purely speculating here, but this could have been Capital H (which is now out of a blackout window) buying the remaining holdings of an ex-Director of the company (pre-Kruger et. al.'s era). If so, this might mark the bottom for the share price. We'll find out in a week or so if this is the case via a new substantial shareholder notice.

I've been very wrong on the timing of this one so far (based on the SP) — the market certainly has a way of humbling those who dare to believe they can consistently beat it.

Yet, I'm still holding all of my PVL shares and I've averaged down considerably. I'm comfortable with the NTA backing at around 8.1c/share (AUD) [9c NZD/share] and the growth prospects from future valuation rounds for its portfolio companies. As far as I'm aware, there have been no thesis-breaking elements for any of PVL's recent portfolio investments.

In my eyes, the drop in the share price reflects the macroeconomic environment, the current lack of interest in the VC asset class and the exit of some investors with a timeframe much shorter than I.

I'm running with a similar thesis to most, which is that I am comfortable with the management team and also firmly back the judgement of the cornerstone investor (Capital H), whose average entry price is also well above the current share price (smart guys -- but that doesn't guarantee they'll get this right -- although it improves the odds).

Of the portfolio companies, I'm most interested in Skykraft, Quantum Brilliance and CourseLoop. I don't know as much as I would like, but I've recently spoken with some Air Traffic Controllers about Skykraft.

My gut feeling is that the idea is supported in the upper echelons of Air Services Australia, but I'm not (yet) convinced of the extent of real-world applicability/need, which will ultimately drive how much this is worth (pricing power).

I met the SkyKraft Co-Founder/CEO briefly at a pitch event a month ago and he struck me as someone with a high IQ. Let's see how it plays out, there's a long way to go for the share price at 5.2c back up to >20c for James Kruger to be in the green on his incentive package, but one or two 10x's on a portfolio holding will massively help.

PVL has done a good job so far in reducing operating cash requirements, but more can be done on this front. I think the gap between the current share price and NTA should close if that is achieved in conjunction with some stability in the broader market.

As far as I am aware, Capital H, James Kruger, and co. remain locked in, focused and aligned.

Massive disconnect now between the share price (5c) and NTA (cash and investments) of 8.1c.

Someone has been exiting indiscriminately today, and as such, I've revisited the public news flow from each of the ~8 core VC portfolio holdings of PVL — I can't seem to find any negative, thesis-breaking news on any of these portfolio companies.

This makes me wonder, does someone simply need their money back quickly in cash?

I think so, which is why I bought more today at 5.0c.

I agree with previous comments (@Dominator) — PVL has done a good job so far in reducing operating cash requirements, but more can be done on this front. I think the gap between the current share price and NTA should close if that is achieved.

In addition, if we see some positive news from the portfolio companies (re-valuations) PVL might return to trading at a small premium to NTA.

As far as I am aware, Capital H, James Kruger, and co. remain locked in, focused and aligned.

Does anyone have other perspectives on why this has fallen so far below NTA?

With 2m units on offer at 9c, there is a rare chance to build a meaningful position in PVL ($180k). It would be interesting if Capital H (or the management team/board) used this as a chance to materially increase their stake at levels slightly under their average entry price.

Investment in Quantum Brilliance

As initially hypothesised several weeks ago on Strawman, PVL has now taken a stake in Quantum Brilliance.

Powerhouse Ventures Limited (PVL) is pleased to advise shareholders that it has invested AUD500,000 for an ownership stake in Quantum Brilliance Pty Ltd. (“Quantum Brilliance”). Quantum Brilliance is an Australian-German quantum computing hardware company, developing quantum accelerators supported by a full stack of software and application tools. Using synthetic diamond, their quantum processor is designed to operate at room temperature and is miniaturisable leading to capabilities in co-processing of computational tasks with classical computer units. This is in contrast with most quantum computing developments with delicate hardware that needs super stable and super cold environments, and which will have reduced accessibility, like the mainframe computers of the 1970s. With a roadmap to develop a quantum accelerator card with a form factor of a graphics card, Quantum Brilliance’s vision is to integrate quantum computation into real world applications such as satellites, robots, and autonomous vehicles. Quantum Brilliance was spun out of ANU in 2019 and is strongly supported by institutional VC. They have already achieved significant milestones along the technology roadmap, including the delivering of quantum system to a world leading supercomputing centre. The initial product fits into a standard server rack, and over the next few years the company will achieve gradual miniaturisation. Quantum Brilliance has also established its European HQ in Germany which is working with leading German institutions and companies on quantum computing and fabrication projects. With no serious competition in room-temperature, edge-based quantum processors, Quantum Brilliance have significant IP moat, providing the decisive technology that would enable innovators to solve many global problems.

The valuation details are private, given that Quantum Brilliance is not a publicly listed company — and valuation details are often a sensitive topic with startups. However, the seed round for Quantum was US$9.7 million ($13.4 million) in Aug 2021 and the estimated valuation at the time was $34-50m. Assuming Powerhouse (ASX PVL) was able to achieve the same terms (and why not because Kruger is on the board of the company!), their stake in the company is now circa 1% to 1.5%. Regardless, what matters most is the percentage valuation growth of the companies that PVL invests in (across seed, to series A, B, C, IPO etc.), not how heavy their ownership stake is (be that 1% or 10%). From the last 5 investments made, I can see the potential for any of them to 10x across a few years compared to where they are today. They are all operating in massive markets, with strong IP moats and strong management. Obviously, there's no guarantee that any of them will work out, but the quality of VC investments made since the new team has taken over (Kruger & Co. in late 2021) has been a massive step-up in my opinion. It's hard to get access to these types of private companies as an individual investor otherwise. And unlike investing in these companies as an angel investor, investing via the PVL ASX vehicle provides liquidity (albeit it's a little limited) to either top up when the valuation is compelling (i.e. a discount to NTA), hold or sell. BTI is also a quality vehicle (with excellent management), but I prefer PVL because it is more diversified and its journey (PVL 2.0) is only just getting started ($10m MC). I like the fact that operational cash burn is near zero. The management team will be rewarded only if the share price gets above 20c before the 31st of Dec 2023. I personally think they will achieve that and it will be a win win for everyone given the target presents over 100% share price upside within ~1.5 years.

Would be great to get James Kruger on as a Strawman guest.

This is a really good connection to have in my opinion. Kruger refers to them as "smart guys" and I'd have to agree. Andrew Horsley, one of the Co-Founders of Quantum Brilliance, went to the same school as I — he was 1st in physics in his year and received a UAI of 99/100 (his brother Patrick scored a perfect UAI of 100/100, 2 years later). The last funding round of Quantum Brilliance was in Aug 2021 raising $9.7m in seed funding, primarily from Main Sequence Ventures. When the next funding round comes around for Quantum, you'd have to think that PVL will get a look in. I'm enjoying watching this story unfold — Kruger & Co has what it takes in my opinion.

No formal timelines have been released to the market yet. Yet, I believe we can look forward to the following over the coming year:

- Q1-CY22: Re-branding and release of 'PVL2.0' revamped website

- Q2-CY22: Update on potential (listed) funds management strategies & updates on PVL's plans to unlock network effects with a community-powered VC model (I know the team at Afterwork Ventures well - it is an interesting analogue as to where this could go)

- Q2-CY22: Commencement of 'advocacy' of PVL and the new board strategy from Capital H, via mentions on Livewire etc.

- Q3-CY22: PVL portfolio company Firmus Grid to double its data centre footprint to 40MW in Launceston, with LST02 – another 20MW data hall – targeted for completion in the middle of 2022

- Q4-CY22: IPO of CourseLoop PtyLtd, a provider of a course management software (CMS) platform to universities across Australia, the UK and the US of which PVL executed a convertible note for $A435k to CourseLoop Pty Ltd in Q4-CY21

- Q1/2/3/4-CY22: Management of existing portfolio and further VC investments particularly in Cleantech (EV/Battery & waste/environment tech) and Engineering and Information & Communications Technologies, across Australian based geographies

I'm expecting prudent capital management and significant further value to be unlocked with an expansion in PVL's status quo. This is a stellar team and a business model with massive potential.

Thanks, @Noddy74,

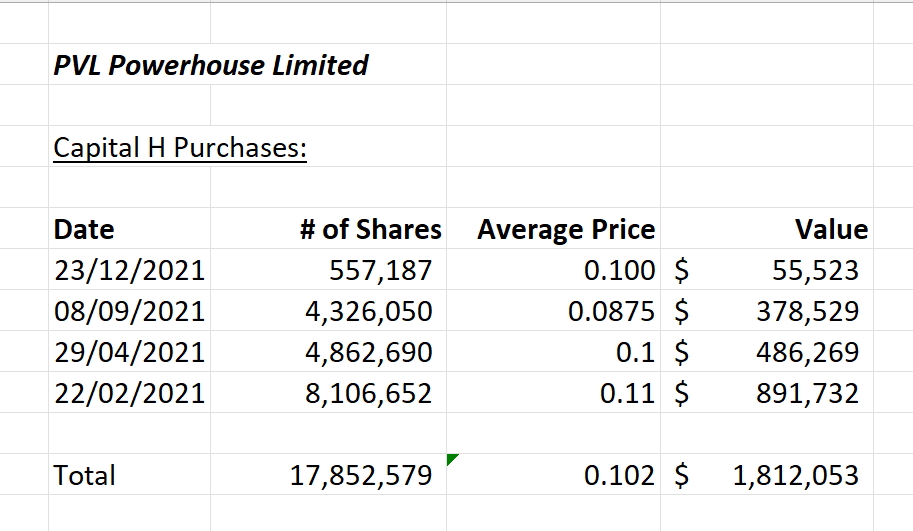

So far, my position in PVL has an average entry price (aep) of 11 cents and the position comprises circa 4% of my total (personal) portfolio. The Capital H active fund also has a similar average entry price (of 10.2c), thus I believe this is the ground floor, if you will, for the share price of PVL 2.0

Initially, I was concerned that I wouldn't be able to accumulate a sizeable position. But, I managed to transact a decent amount. What I noted was that there was an offscreen seller who refilled the offers at 11c last week after I took small bites at them. Although this seller appears to be exhausted now, I would gradually test the waters with bids, rather than feel the need to start line-wiping to build a position.

The share price has churned at 8-13c across the past 6 months and the register is tightening up, but there may still be a decent opportunity to accumulate a reasonable amount around 11-14c levels, before supply is exhausted and the share price pushes on to 20c+. It will be interesting to see what Raven, Amherst and Ramsay (who were supporting the other board contenders: McGrath, Armstrong and Andrew Ramsay) do with their position — I believe that they are supportive of the change to Harley's new board team — their qualm was with the old board not Harley.

So, it is a fairly high-convicted idea (particularly with the firepower of Capital H accumulating), although I am leaving capacity and time to see how the situation evolves. I'd be willing to accumulate further if/when the new management team demonstrate success with the new strategic direction for the company. Even if that means averaging up.

I'm very confident on the upside to 20c for a c. $20m market cap (purely with attention, newsflow and a bit of noise in Q1-CY22), but success beyond this point will be largely dictated by the quality of investments made by the new team.

The ASX has a scattered history of unsuccessful attempts at holding a basket of unlisted private companies running inside a listed vehicle, such as with 8EC (now LAN) and YNB (now AVC). Normally, all of the best VC investments go to the best private VC funds (Blackbird etc), and listed ASX entities are just a back-door outback method of giving it a run. The best private start-ups don't need the ASX for funding. I did some work for Main Sequence Ventures a couple of years ago and they are the sort of outfit that PVL will have to compete against for deals.

But if PVL can get access to a few winners via their networks then it is game on...

It is such a competitive space: the best startups have lots of opportunities for funding in the Aussie VC landscape these days (unlike a decade ago). To attract the best start-ups you also need to offer them more than just funding — strategic support etc is all-important. This is exactly what Kruger did to get access to an investment in SkyCraft.

Another point to consider is that the current portfolio valuation of PVL is a lagging indicator (valued at cost initially and then at the most recent funding round). I think there is scope for the portfolio value to increase sizeably. This is because PVL has been quite conservative; for example, they wrote off EdPotential to $0, but then Kruger managed to divest it for a $330K NZD deal.

Ultimately, I don't think PVL will be valued on their cashflows. PVL will be valued based on the equity value of their portfolio. Any profits achieved on these investments will be recycled back into additional investments. Moreover, in time, I think the ASX will soon value PVL based on Harley Grosser's history of actively reshaping entities into something more valuable.

Courseloop is a perfect example of the new strategy. They are set to IPO this year, which will return cashflow to PVL, and allow more late-stage deals to be struck, accelerating the flywheel. There will be significant newsflow in 2022 for PVL and Capital H haven't started promoting it yet...

T.E.P.

Post a valuation or endorse another member's valuation.