Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

UPDATE ON INDICATIVE PROPOSALS FROM ADAMANTEM, ROUSE

QANTM Intellectual Property Limited (QANTM) announces that it has agreed to grant exclusive due diligence access to Adamantem Capital (Adamantem) in relation to its non-binding indicative proposal for the acquisition of all the shares in QANTM for $1.817 per share by way of scheme of arrangement (Adamantem Indicative Proposal).

QANTM and Rouse International Holdings Limited (Rouse) have agreed to terminate their exclusivity arrangements after Rouse withdrew its non-binding indicative proposal (Rouse Indicative Proposal), which was announced to the ASX on 27 February 2024. No break fees are payable in relation to the termination.

The Adamantem Indicative Proposal, which was announced to the ASX on 12 March 2024, offers shareholders the opportunity to elect to receive either all cash or 50% of their consideration in the form of scrip in the Adamantem acquisition entity. The scrip election will be subject to a minimum take-up, and will be scaled back if the take-up exceeds a maximum amount. These minimum and maximum thresholds have yet to be agreed.

Following careful consideration, the QANTM Board has agreed to Adamantem’s request to undertake a period of exclusive due diligence, with a view to putting forward a binding offer capable of being considered by shareholders. QANTM and Adamantem have entered into a process deed that outlines the basis of the due diligence and exclusivity arrangements, a copy of which is attached to this announcement.

The QANTM Board considers that the Adamantem Indicative Proposal provides an attractive premium for QANTM shareholders, with the cash offer price of $1.817 per share representing:

• A 58.0% premium to close price on 26 February 2024 (being the last trading day before the announcement of the Rouse Indicative Proposal) of $1.15;

• A 66.0% premium to 30-day VWAP on 26 February 2024 of $1.09; and

• An 86.1% premium to 180-day VWAP on 26 February 2024 of $0.98.

Subject to QANTM and Adamantem agreeing an implementation deed on terms acceptable to QANTM including any condition requiring a minimum level of take-up of the scrip election, and rights and obligations that holders of scrip will have, it is the QANTM Board’s intention to unanimously recommend that shareholders vote in favour of the transaction proposed in the Adamantem Indicative Proposal if the consideration is at least $1.817 cash per share, in the absence of a superior proposal and subject to an independent expert concluding that the transaction is in the best interests of QANTM shareholders.

The Adamantem Indicative Proposal remains subject to a number of conditions, including satisfactory completion of due diligence, and the negotiation and execution of transaction documentation, as well as customary conditions.

There is no certainty that the Adamantem Indicative Proposal will result in transaction capable of being considered by shareholders.

QANTM shareholders do not need to take any action in relation to the Adamantem Indicative Proposal. The QANTM Board will continue to keep shareholders and the market informed of developments.

Held IRL (1.2%)

QANTM RECEIVES FURTHER INDICATIVE PROPOSAL

QANTM Intellectual Property Limited (QANTM) confirms, in response to recent media speculation, that it has received a non-binding indicative offer from Adamantem Capital (Adamantem) in relation to a potential acquisition of all the shares in QANTM for $1.817 per share by way of a scheme of arrangement (Adamantem Indicative Proposal). The Adamantem Indicative Proposal is all cash with a scrip election of up to 50%.

Adamantem is an Australian-based private equity investor. The Adamantem Indicative Proposal is subject to a number of conditions, including completion of satisfactory due diligence, and negotiation and execution of transaction documentation, as well as other customary conditions.

As previously announced on 27 February 2024, QANTM is currently engaged in discussions with

Rouse International Holdings Limited (Rouse Indicative Proposal). Those discussions are on an exclusive basis.

The Adamantem Indicative Proposal represents a higher price than the Rouse Indicative Proposal, but has not yet been comprehensively assessed by the QANTM Board. Under the exclusive due diligence arrangements, which are ongoing, Rouse has certain rights which will be discussed between Rouse and QANTM.

No agreement has been reached between QANTM and any party in relation to the value, structure or terms of a transaction. There is no certainty a control transaction capable of being considered by shareholders will eventuate.

The QANTM Board recommends that shareholders take no action in regard to either proposal.

QANTM confirms that it is in compliance with the ASX Listing Rules, in particular, Listing Rule 3.1, and will keep shareholders fully informed in accordance with its continuous disclosure obligations.

QANTM has appointed MA Moelis Australia as financial adviser and Gilbert + Tobin as legal adviser.

Held IRL (1%)

in late news yesterday, AFR’s Street Talk uncovered a second bid underway for QANTM International (QIP) by Adamantem. It will be interesting to see what plays out today with company announcements and the share price action in response to media speculation. Street Talk story below:

Adamantem takes second swing at Qantm IP, offer pegged at 58pc premium - AFR, 11 March, 8.00pm

Here comes another test in appropriate company disclosure for Qantm Intellectual Property’s board.

Investor sources told this column on Monday that Sydney buyout firm Adamantem Capital had submitted a non-binding indicative offer for in-play Qantm IP, and had retained Gresham for advice.

It is understood the offer price was pitched at $1.817 a share. That reflects a juicy 58 per cent premium to the undisturbed share price – aka before this column, on February 26, outed that the board was sitting on a privitisation proposal.

Adamantem’s bid has landed at a time when UK-based intellectual property firm Rouse International Holdings remains in due diligence with its mystery proposal. As reported, both Adamantem and rival Quadrant Private Equity had expressed interest around the same time as Rouse lobbed its offer.

It will be interesting to see how Qantm responds to our latest report in Tuesday’s ASX filings. Readers of this column will recall the target board has been surprisingly tight-lipped on Rouse’s proposal and why it deserved a look at the books, especially at a time when PE players have been swarming around the business. Forget bid price, Qantm shareholders were left in the dark – and remain so – on the most basic details, including if Rouse was offering cash or scrip.

Starved of details by their board, Qantm shareholders have been sifting through public documents to learn more about Rouse, which is partly owned by London mid-market private equity firm MML Capital.

Rouse International Holdings Limited, the group’s parent entity, had just $US14 million cash at April 30, 2023. It posted a $US5.3 million loss from $US72.2 million revenue for the financial year ending April 30. With numbers like that, it wouldn’t be a stretch to think Rouse may struggle to fund a bid for Qantm without its PE backer stepping in.

Between Rouse and Adamantem, Qantm is shaping up to be something of a private equity shootout. Of note, sector gorilla IPH Limited, which is capitalised at $1.54 billion on the ASX, is known to be watching the situation closely. IPH has historically retained Macquarie Capital for corporate activity. MA Moelis is tending to the target.

Qantm has three units across patents, trademarks and litigation. It owns Davies Collison Cave, one of Asia-Pacific’s largest patent and trademark attorney firms. Two of Australia’s top-three agents for trademark applications, Sortify.tm and DCC, are also in its stables.

It debuted on the ASX with a $295 million market capitalisation in 2016 and had shrunk to just $161 million as of February 26. The Adamantem offer is worth about $260 million. Angry shareholders voted down the remuneration report at the recent AGM.

The takeover interest comes after Qantm handed down its first set of pleasing numbers last month since listing. It tallied up $56.8 million revenue for the December half, while underlying EBITDA shot up 25.7 per cent to $17.3 million. Net debt fell to $21.7 million.”

-ENDS-

Held IRL (1%)

QANTM RESPONSE TO MEDIA SPECULATION

QANTM Intellectual Property Limited (QANTM) confirms, in response to recent media speculation, that it has received a non-binding indicative proposal from Rouse International Holdings Limited (Rouse) in relation to a potential acquisition of all the shares in QANTM (Proposal).

Rouse is a UK-based international intellectual property firm operating in 12 jurisdictions, with a significant emphasis on the Asia Pacific region. It is highly complementary in both geographic and service lines to QANTM. It does not have a physical presence in Australia.

The Proposal is subject to a number of conditions, including completion of satisfactory due diligence, and negotiation and execution of transaction documentation.

Following careful consideration, including the potential strategic benefits of a combination of two complementary businesses, the QANTM Board has agreed to Rouse’s request to conduct due diligence with a view to putting forward a binding offer capable of being considered by shareholders.

Given the early stage nature of discussions there is no certainty a transaction capable of being considered by shareholders will eventuate.

The QANTM Board recommends that shareholders take no action at this time.

QANTM confirms that it is in compliance with the ASX Listing Rules, in particular, Listing Rule 3.1, and will keep shareholders fully informed in accordance with its continuous disclosure obligations.

QANTM has appointed MA Moelis Australia as financial adviser and Gilbert + Tobin as legal adviser.

It looks like there might be some substance behind the AFR ‘Street Talk’ story. QIP has requested a temporary pause in trading pending a further announcement.

Early this morning the AFR (Street Talk) revealed that QANTM has received a privatisation proposal, in a deal expected to be announced Today (27/02/2024). I only just rediscovered this little gem a few months ago, and now there’s a possibility it will be swallowed up by private equity. Here’s the story:

QANTM Intellectual Property Snares bid; MA Moelis on scene - Sarah Thompson, Kanika Sood and Sarah Rapaport.

Sources said the Investec-advised acquirer is an offshore trade player, and had all but agreed terms with the Sonia Petering-chaired board.

Of note, Quadrant Private Equity deal makers and their cross-town rivals at Adamantem Capital submitted proposals to acquire QANTM, but were bested by the afore-mentioned suitor.

Sources said QANTM boss Craig Downer had been taking advice from MA Financial

QANTM may not be a household name, but it commands respectable market share on its patch. It owns Davies Collison Cave, one of Asia-Pacific’s largest patent and trademark attorney firms. Two of Australia’s top-three agents for trademark applications, Sortify.tm and DCC, are also in its stables.

The M&A interest comes at a time when QANTM, capitalised at $161 million on the ASX, has just reported its strongest set of numbers since it listed in 2017.

While its shares have risen 23 per cent in the past 12 months, the business is still a long way off the $295 million market capitalisation with which it debuted on the bourse. PE firms love to hitch a ride on turnaround, which is likely what Quadrant and Adamantem found compelling.

It tallied up $56.8 million revenue for the December half. Of note, underlying EBITDA shot up 25.7 per cent to $17.3 million, while net debt fell by 33.4 per cent to $21.7 million.

The business has three units, across patents, trademarks and litigation. Operations span more than 380 employees working five markets: Australia, New Zealand, Singapore, Malaysia and Hong Kong.

The biggest earner is litigation services, which spoke for two-thirds of total service charges at December 31.

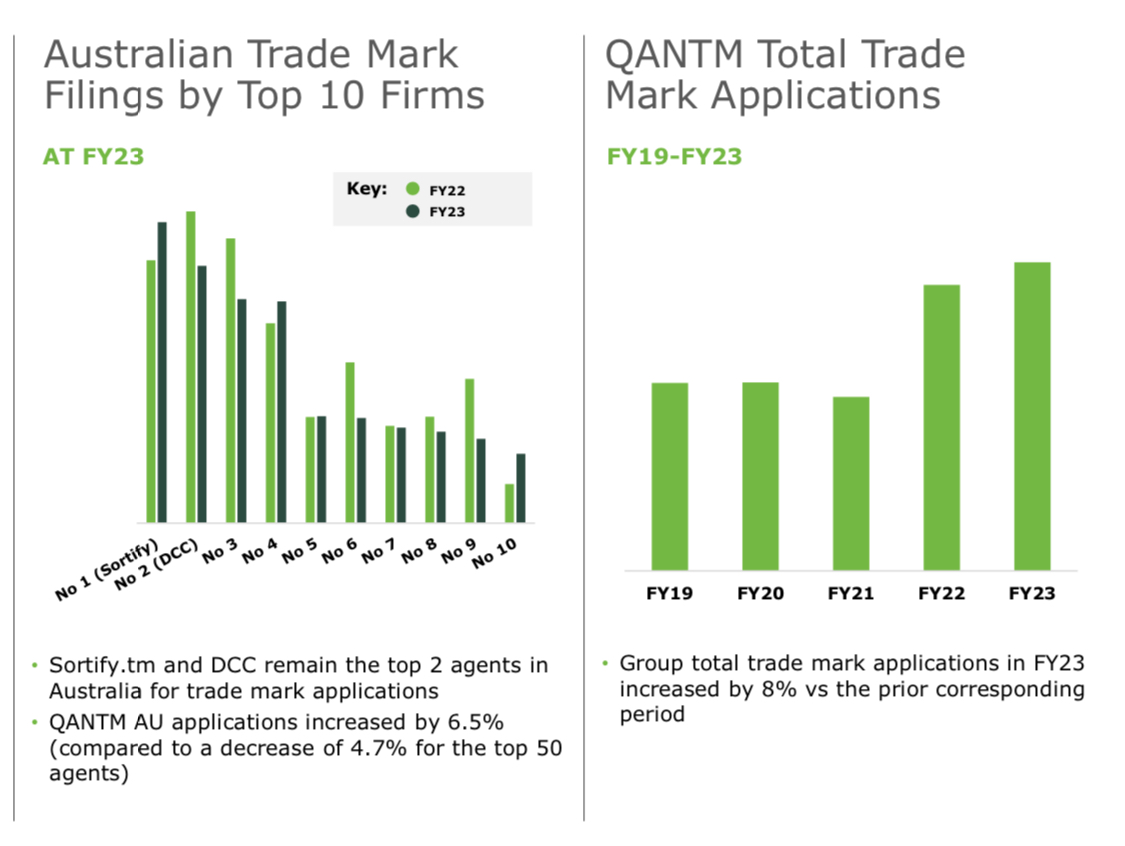

QANTM’s trademark business reported a 12.8 per cent uptick in applications in the six months, which helped management offset a 12.7 per cent fall in Aussie patent applications during the period.

The C-suite is in the fourth year of a five-year program to modernise its technology systems.

It has migrated core production systems to Microsoft Azure, upgraded its IP management platforms used by attorneys, and automated tasks.

Next on the list is implementing a finance platform while, in the background, an “AI Working Group” is crafting QANTM’s strategy for the emerging technology.

-ENDS-

Held IRL (1%)

QANTM Intellectual (QIP) released an outstanding result after the close of trade yesterday (19/02//2024). Earnings are well ahead of analyst expectations (albeit low coverage) and the market has reacted positively today (up 10%).

Here are the Key Financials:

Source: 1H24 Results Presentation

- Service Charges of $56.8m (1H23: $52.0m)

- Patent Service Charges up 6.6% to $37.8m (H123: $35.4m)

- Trade Marks Service Charges up 7.0% to $11.1m (H123: $10.4m)

- Legal Service Charges up 27.3% to $7.9m (H123: $6.2m)

- Total Revenue (Service Charges and Associate Charges) increased 8.1% to $74.2m (1H23:$68.6m).

- Total Net Revenue of $58.8m (1H23 $54.1m), increased by 8.7%, and is after recoverable expenses from Associate Charges of $16.6m (1H22 $15.7m).

- Underlying operating expenses of $41.5m (1H23: $40.3m). Operating expenses include an extra $0.5m in technology expenses due to cloud hosting implemented in January 2023.

- Underlying EBITDA was $17.3m (1H23: $13.8m).

- Statutory net profit after tax of $7.4m (1H23: $3.4m) an increase of 117.2%.

- Underlying net profit after tax of $9.6m (1H23: $6.7m) an increase of 43.4%. The appendix provides a reconciliation from statutory to underlying NPAT.

- Net debt at 31 December 2023 was $21.2m (1H23: $31.8m). The ratio of net debt to underlying EBITDA was 0.61 at 31 December 2023 (30 June 2023: 0.85). At 31 December 2023, the Group held cash and cash equivalents of $6.2m (1H23: $1.7m).

- Cash Flow before acquisitions, financing activities and tax was significantly higher at $14.0m (1H23: $3.5m) due to: better financial discipline having been put in place; a $1.1m reduction in property fit out costs; and $1.0m in EST payments being issued in shares and not settled in cash.

Source: 1H24 Results Announcement

Outlook

Craig Dower, QANTM’s Chief Executive Officer and Managing Director said “We expect our strong first-half momentum to continue, and recently advised the market of an upgrade in our earnings outlook for the FY24 full year compared to the analyst estimate. Trading performance in January has been strong and we maintain that positive outlook. We also continue to maintain a positive outlook for the industry as a whole, and expect to see continued growth across our three businesses: DCC, FPA and Sortify.tm. This is now the fourth consecutive period of margin improvement, after a period of substantial investments in our strategic initiatives, and we expect to see underlying margins continue to be in the low 30’s.”

Valuation

Recently QIP upgraded FY24 earnings guidance from 8.1cps to approx 10 cps (see Earnings Guidance Upgrade straw). Given earnings for 1H24 came in at 5.29 cps, I think this very achievable. On current equity of 52 cps that’s a ROE of 19.2%.

I believe QIP has strong tailwinds going forward following recent investment in technology to improve its platform (including incorporation of AI), and from expansion of the Sortify.tm business globally.

Using McNiven’s Formula, ROE of 20% (accounting for stronger future growth), Equity 52cps, 30% of earnings reinvested into growth, fully franked franked dividends (11% including franking credits), and a required return of 12%, I get a valuation of $1.30. At $1.30 QIP would be trading on a PE ratio of 13 x FY24 earnings guidance. This is slightly higher than the average annual PE over the last 6 years (12%) but I think this is reasonable given the quality of the business is improving.

Held: IRL (1%)

On the 23rd January 2024 QANTM Intellectual Property Limited (QIP) updated FY24 earnings guidance compared to the analyst estimate.

The update was provided on that basis that market conditions, industry conditions, the US$ to AU$ exchange rate and the regulatory environment do not materially change.

For the full financial year 2024, QANTM expects Earnings Per Share (reported) to be between 20% and 25% higher than the analyst estimate of 8.1 cents per share.

For the full financial year 2024, QANTM expects underlying EBITDA (post AASB 16) to be between 8% and 10% higher than the analyst estimate of $31 million.

The increase in expected earnings is mainly driven by:

1. improved financial disciplines, focused on more effective cost management and the reduction of debtor days;

2. the implementation of strategic initiatives starting to deliver increased benefits;

3. stronger than expected performance by Davies Collison Cave and FPA Patent Attorneys, in particular by Davies Collison Cave Law in the provision of intellectual property litigation services over an extended period; and

4. stronger than expected foreign exchange tailwinds.

Caution should be exercised in relation to any prior corresponding period comparison given it was a softer period during which QANTM made major investments across technology, people, processes and clients.

The key assumption that patent and trademark filing activities globally remain consistent with current trends continues to apply.

QANTM’s earnings announcement will be released on 22 February 2024 with full details to be provided at that time.

My Comments

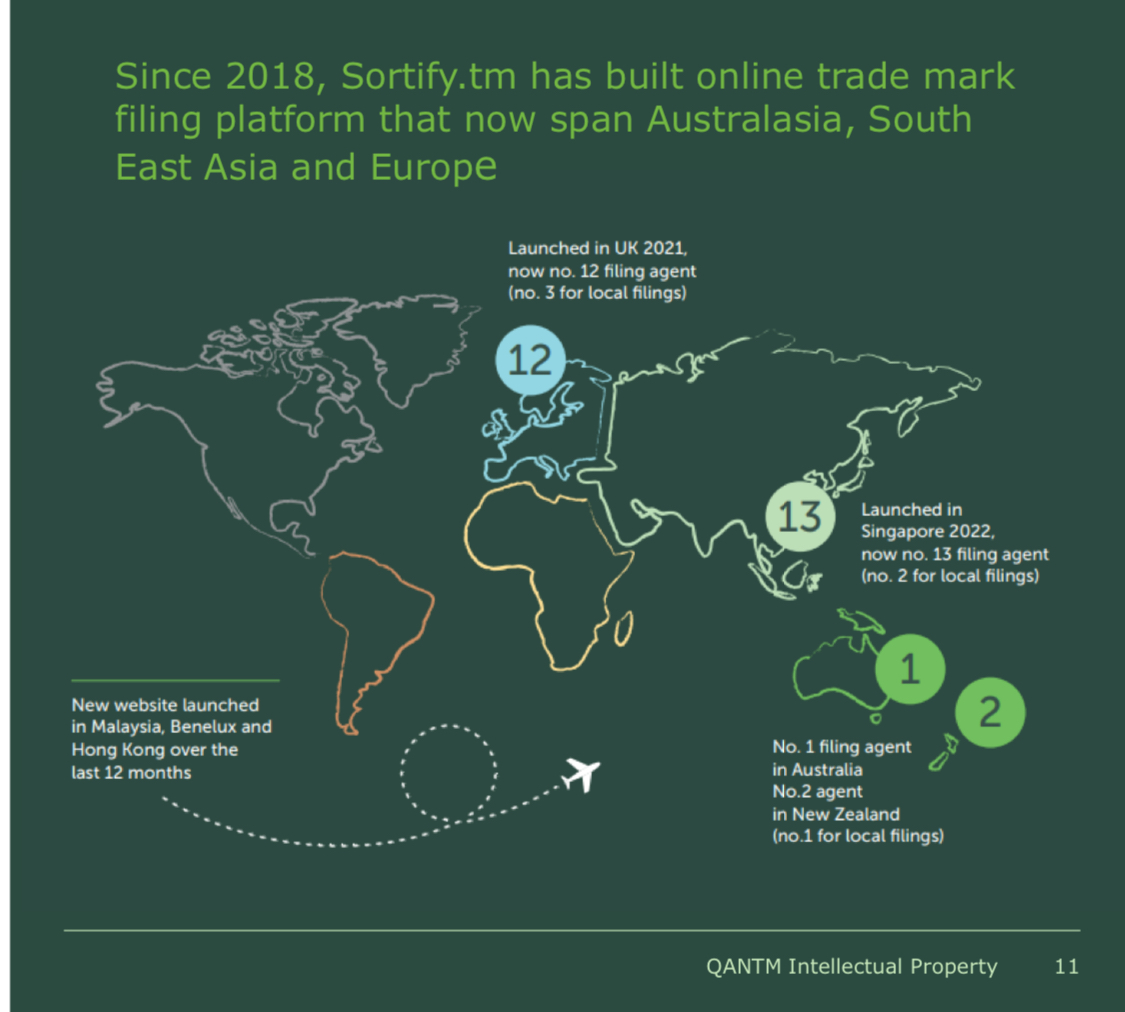

I added QANTM to our IRL portfolio a few months ago based on its growing SaaS business (Sortify.tm) which I believe has the potential to be a global disrupter in trade mark protection. Sortify.tm’s mission is “making trade mark protection available to anyone”. Currently QANTM is only a small holding in our portfolio (1%) due to it’s low liquidity making it difficult to acquire (and perhaps difficult to sell, if needed!).

“Sortify.tm Attorney is the world’s only AI-based Software-as-a-Service (SaaS) suite of trademark classification and productivity tools, built by trademark attorneys for attorneys.

The intelligence of Sortify.tm’s software allows trademark lawyers and their teams to carry out everyday tasks smarter and faster across all stages of the trademark process - pre-filing, filing, examination and registration.” (From the Sortify.tm website: https://www.sortify.tm/)

QANTM acquired Sortify.tm in September 2021 for $11 million, with an upfront payment of $8 million and deferred payment of $3 million in two annual instalments (https://www.lawyersweekly.com.au/newlaw/32362-qantm-acquires-sortify-tm-for-11m)

Sortify was founded in New Zealand as a traditional trademark practice and evolved into a legal tech company providing technology solutions to brand owners, IP practitioners, and public and private sector entities.

During FY23 Sortify.tm achieved record volumes in its main markets as the No 1 filer of trade marks in Australia, No 2 in NZ, and it is approaching the top 10 in the UK which is a very large market.

Source: Investor Briefing, 31 October 2023 (https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02733184-3A629660)

Sortify platforms have been established in Singapore, Malaysia and Hong Kong with promising early traction. Asian countries filed 67.6% of global patent applications in 2021 (largest patent market globally).

QANTM intends leveraging the Sortify.tm automation expertise into its DCC and FPA platforms.

QANTM is also looking for opportunities to further expand into Asia (eg. Thailand, Indonesia and India).

The analyst providing guidance for QANTM on Simply Wall Street (I believe it’s Bell Potter) is forecasting 25% annual earnings growth over the next few years.

I think this business is interesting and is worth some further investigation. As I research further into QANTM and Sortify.tm I hope to add further straws.

Held (1%)

About QANTM Intellectual Property

QANTM Intellectual Property Limited (QANTM, ASX: QIP) is the owner of a group of leading intellectual property (IP) services businesses operating in Australia, New Zealand, Singapore, Malaysia and Hong Kong under key brands Davies Collison Cave, DCC Advanz Malaysia, Davies Collison Cave Law, FPA Patent Attorneys, and Sortify.tm Ltd (including Sortify’s brands – DIY Trademarks, Trademarks Online and Trademark Planet). With more than 150 highly qualified professionals, the businesses within the QANTM Group have a strong track record in providing a comprehensive suite of services across the IP value chain to a broad range of Australian and international clients, ranging from start-up technology businesses to Fortune 500 multinationals, public research institutions and universities.

Post a valuation or endorse another member's valuation.