Been a while since SLS gave something to talk about, today releasing assays from the drilling done at the Bluetooth prospect.

Pros: thick hits with grade from surface over a strike of ~800m

Cons: only in the oxide with no indication of a source in the fresh (yet)

Whilst the con means scale will be moderate, higher grade low strip ounces in oxide have value and in this gold price environment, a lot of value as it opens up the potential to do a HV mining & toll deal that other juniors have been able to do to generate cash and fund ongoing exploration.

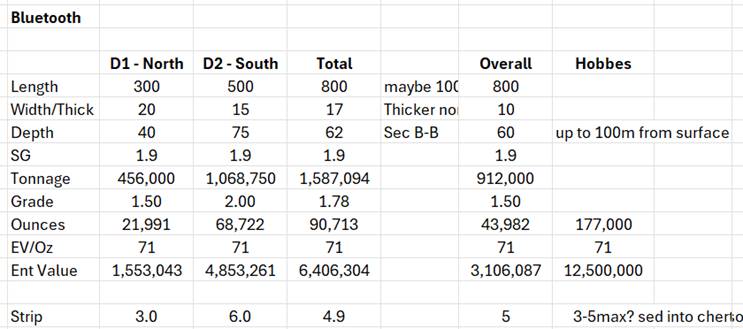

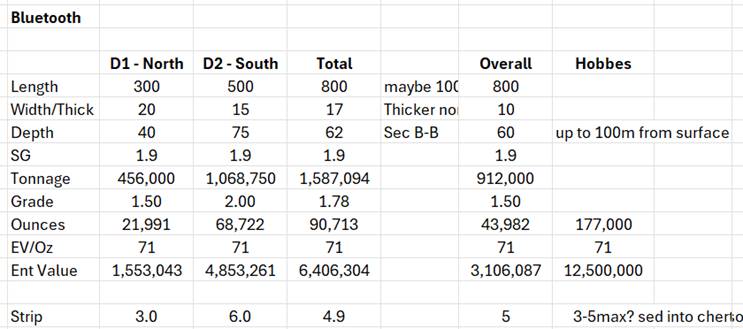

Below are some basic sums and given the level of density in drilling, particularly to the south, I will say there is a half decent chance that these may be overstated.

As illustrated above, there is a case that there could be up to 100koz loosely defined but I would hazard it’s a firmer ~20-40koz given the better definition at the northern end.

As some may recall, SLS sold off the 177koz at Hobbes for $12.5m in April 2024 to the neighbouring NST (Carusoe Dam) which at the same valuation ($71/oz) implies ~$1.6-3.0m here. I would say that the price for ounces to go into Carusoe Dam may have gone up since.

But as noted above, the surge in the gold price has opened up toll mining options which SLS could consider now as a way to monetise these ounces for a better RoI. The company has not indicated this as a pathway in any formal sense but will be considered more deeply depending on the results of follow up work. It would also be considered alongside success across this part of their tenement package (i.e. Statesmans Well, Edjudina).

Given the results, SLS stated they will be returning ASAP to test extensions and infill to support an inaugural MRE. With $13.6m in cash at the end of the last quarter, SLS remains cashed up to do this follow up program and maintain exploration across the tenement package.

With success starting to be recognised, good management and with a fully funded ongoing drilling programs across several prospects, SLS still remains an attractive exploration play.