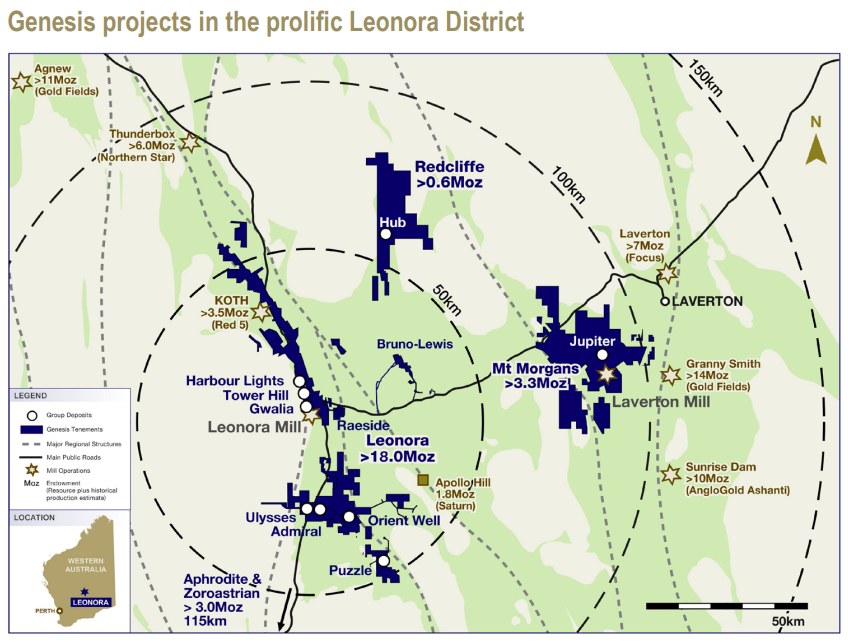

14-Dec-2023: From today's GMD Announcement that they are buying two gold projects off Kin Mining (KIN): GMD-to-acquire-the-Bruno-Lewis-and-Raeside-gold-projects.PDF (also: Kin-Receives-$535m-from-Sale-of-Gold-Deposits-to-Genesis.PDF - note that is $53.5m, not $535m):

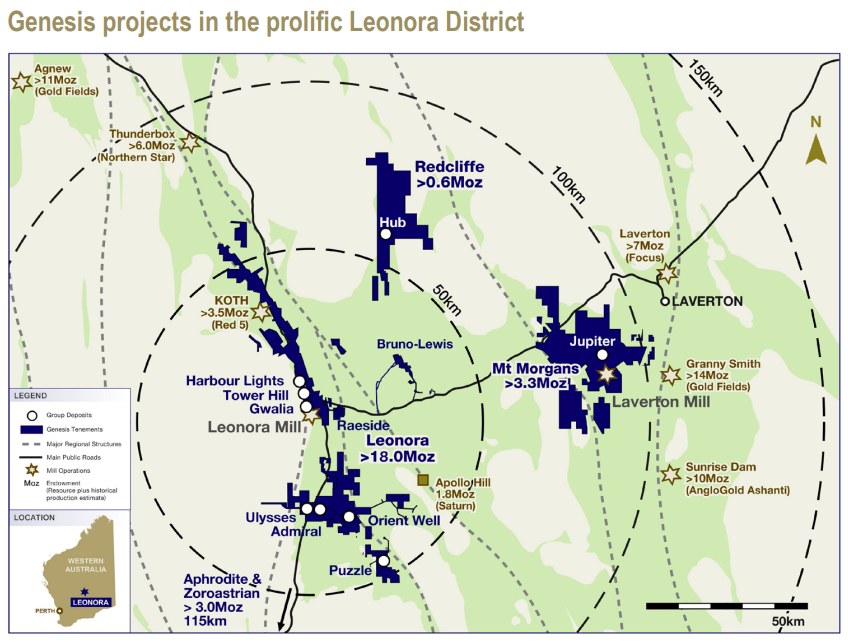

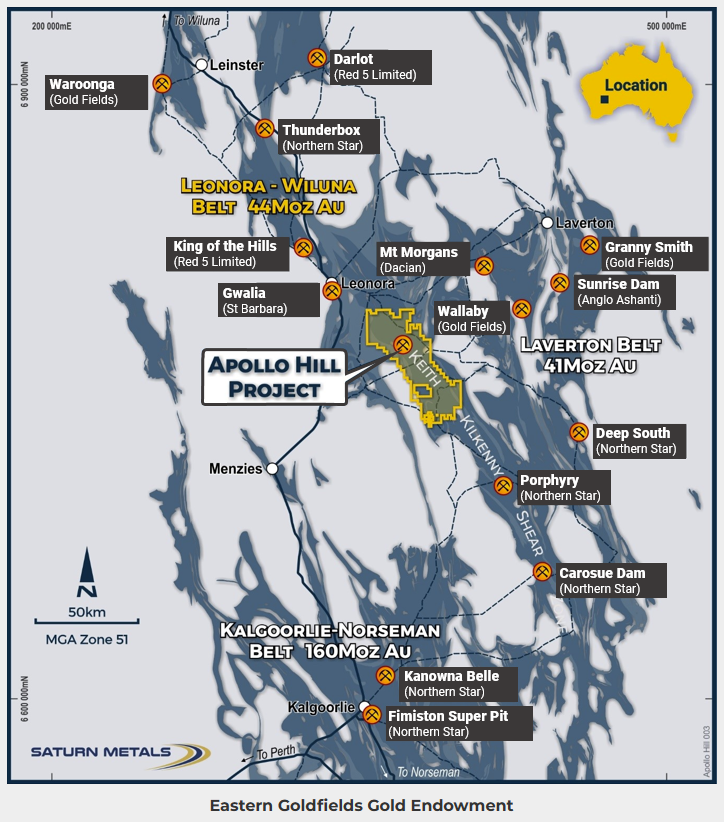

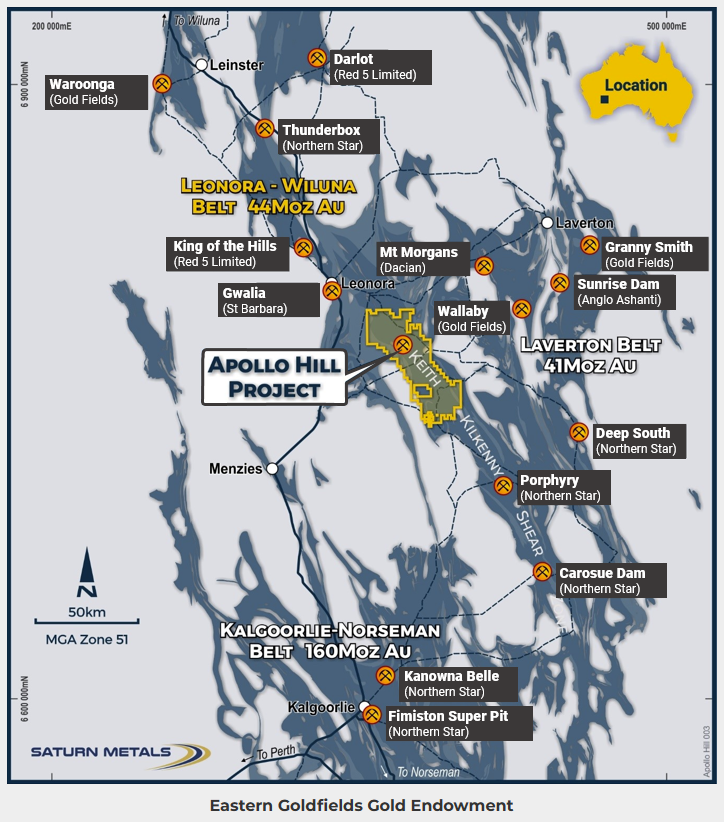

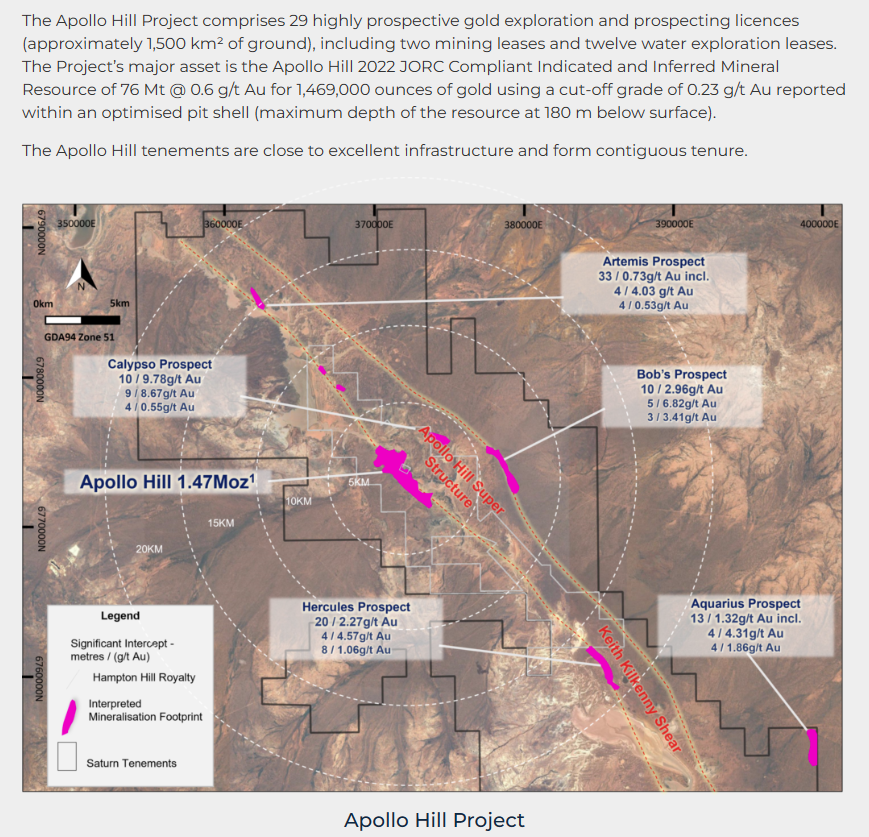

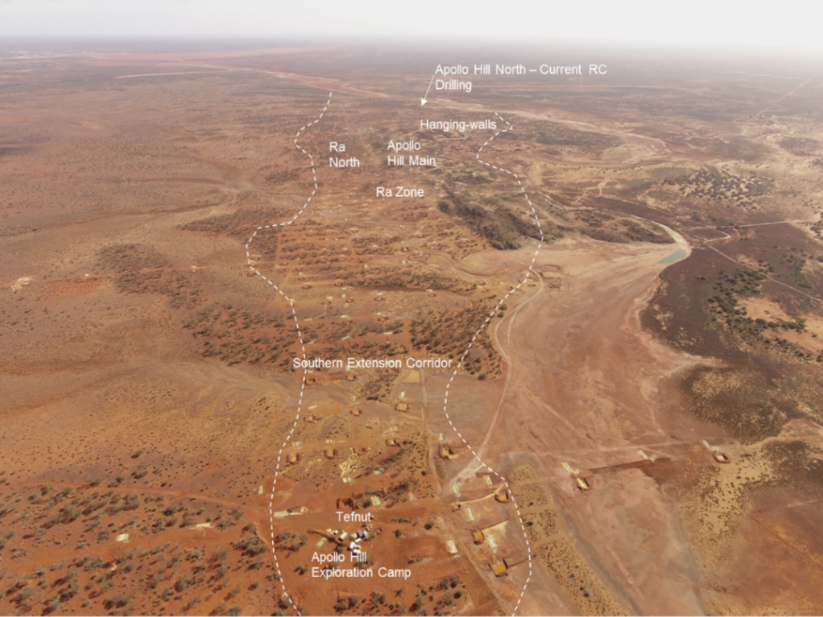

Saturn Metals (STN) own Apollo Hill, shown there in GMD's map as being around 40km south east of GMD's Leonora Mill.

I have no idea if Raleigh Finlayson at Genesis will try to buy Apollo Hill from Saturn Metals, or try to acquire the whole company (STN) which is currently valued by the market at less than $40m, but I think it remains a real possibility considering Apollo Hill's location in relation to Leonora, and Genesis' stated “Open for business” strategy - "Building a premium gold business with sustainable, high quality, +300koz pa production 100% from the Leonora District in Western Australia" (from today's GMD announcement - see also Open-for-Business---Corporate-Presentation.PDF [April 2022] ).

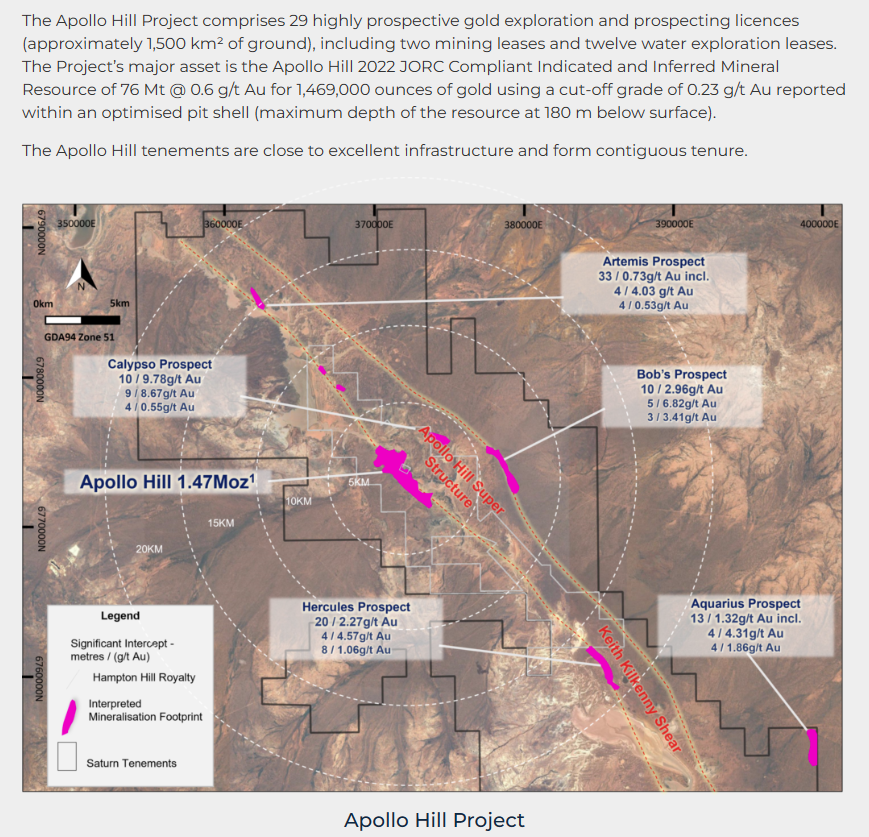

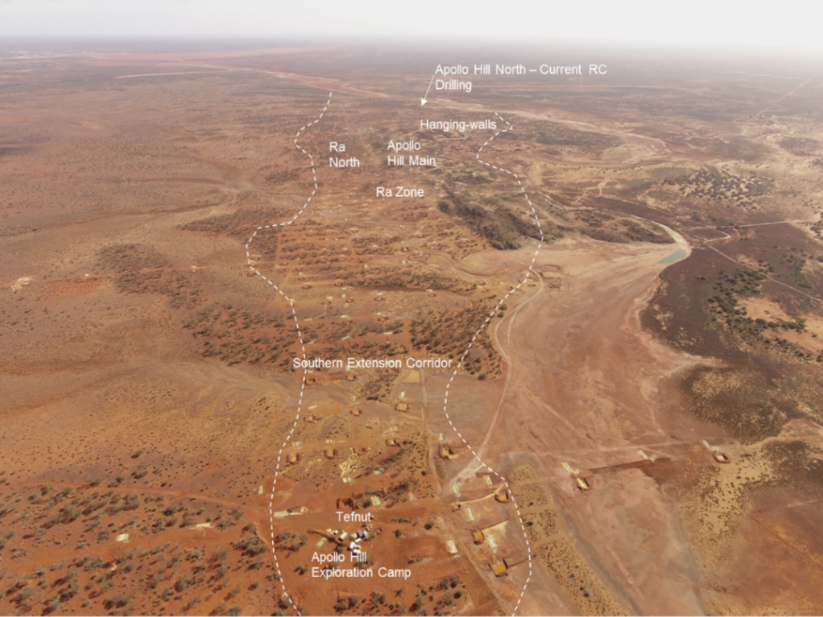

The following screenshots are from Saturn Metals website today (https://saturnmetals.com.au/projects/apollo-hill/) and clearly need to be updated as they still show Gwalia as owned by St Barbara and Mt Morgans owned by Dacian - and both are now owned by Genesis Minerals.

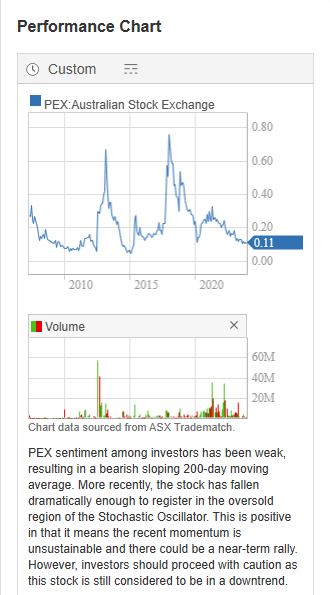

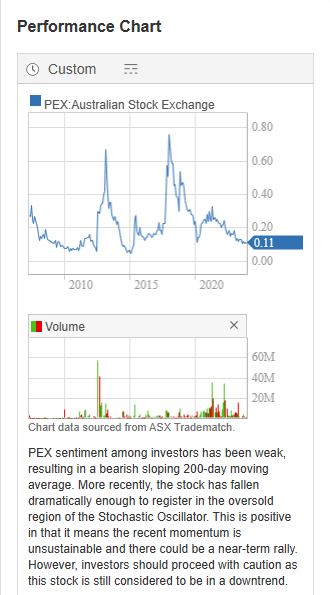

So this one could be both a nearology play and an M&A target at some point, but they remain high risk, and they could certainly go broke if they don't find significantly more gold and transition to a producer, or else get acquired by another company (like Genesis). In the meantime, as all small explorers do, they will continue to raise fresh capital to fund their cash burn (i.e. expenditure on further exploration drilling and overheads). Some of these companies can go for decades without ever producing a single ounce of gold from production. Peel Mining (PEX) sold Apollo Hill to Saturn Metals (STN) in mid 2017, opting to instead keep looking for something even better.

PEX has been trading since 2007, and it's been a rollercoaster ride for their shareholders. OK for traders who got their timing right I suppose, but not a good buy and hold company, typical actually for precious metals and base metals explorers. Most of them go broke, but not before mining their shareholders' wallets for all they're worth. Some of them do OK, but it's a small minority. I tend to stay away from that speculative end of the market these days - i.e. I have NO current explorers in any of my portfolios; All of my miners (including my gold miners) are producers and most are also developing additional projects as well or expanding existing ones to become larger producers in the future. But I have dabbled in the past, and STN is now on one of my watchlists.

High risk, but Apollo Hill is certainly located close enough to Leonora to make them a prospective M&A target at some point.

That's the bull case. The bear case is they don't make money, they are burning through cash, they could go broke, there are no guarantees anyone will make a bid for either Saturn Metals or their Apollo Hill gold project, and they are going to keep raising cash until they either (a) find something really good and transition to being producers (which takes years), (b) get taken over (acquired), or (c) go broke. So they're a punt, not an investment, and the odds aren't good with explorers and early stage developers, but this one has got my attention today; not enough to buy any shares, but enough to go on a watchlist.