Not sure if anyone else has looked at this... So I will fire away...

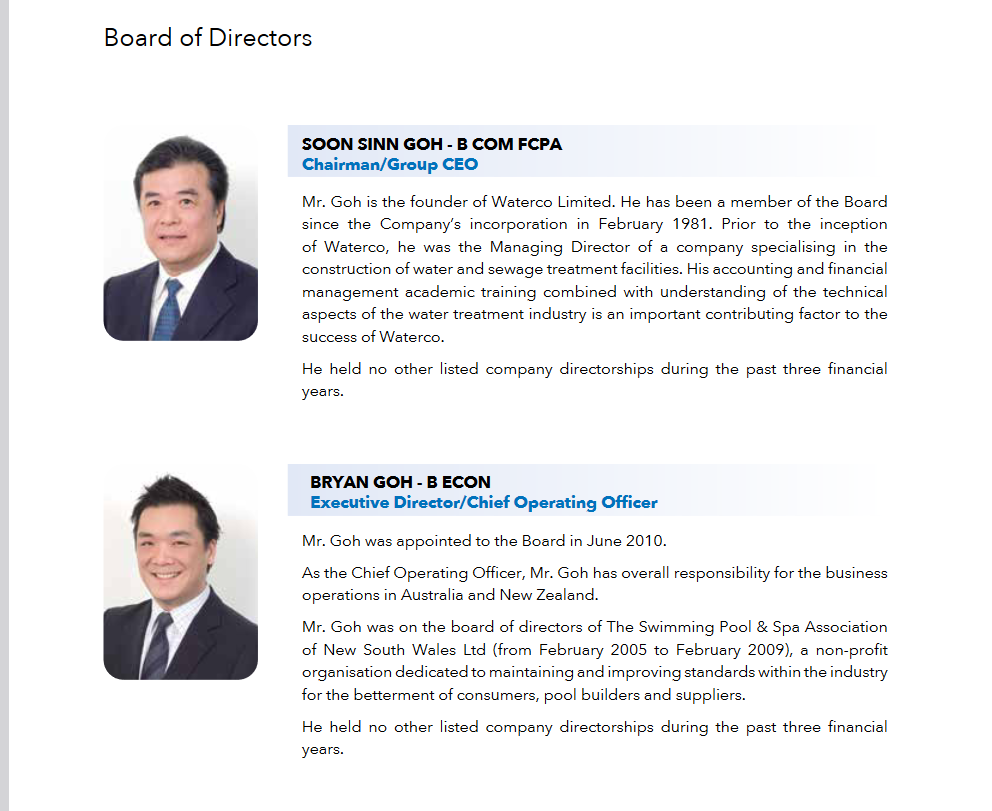

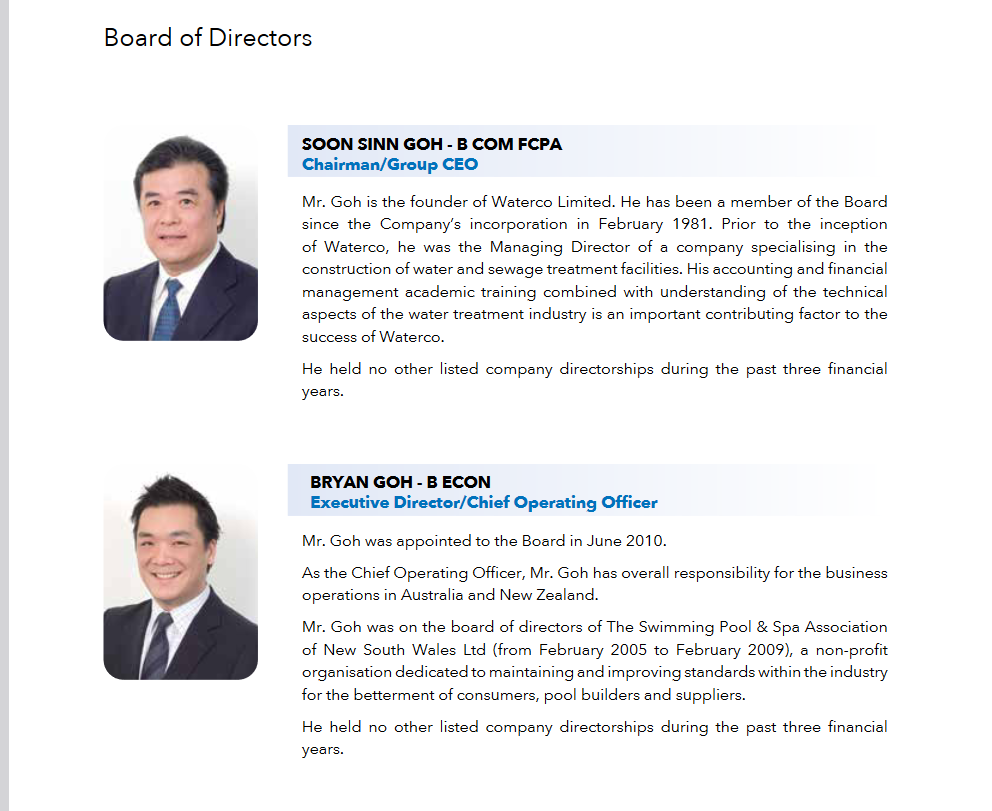

Really good to find one company that is performing well with just one person performing both as CEO and Chairman. My theory of governance risk and negative share return is possibly invalidated.

Linkedin shows up as Group CEO. Also not sure if the COO is the son or a relative just going by the surname - apologies to the Goh's if I'm wrong.

Pity I can't get to the website today.

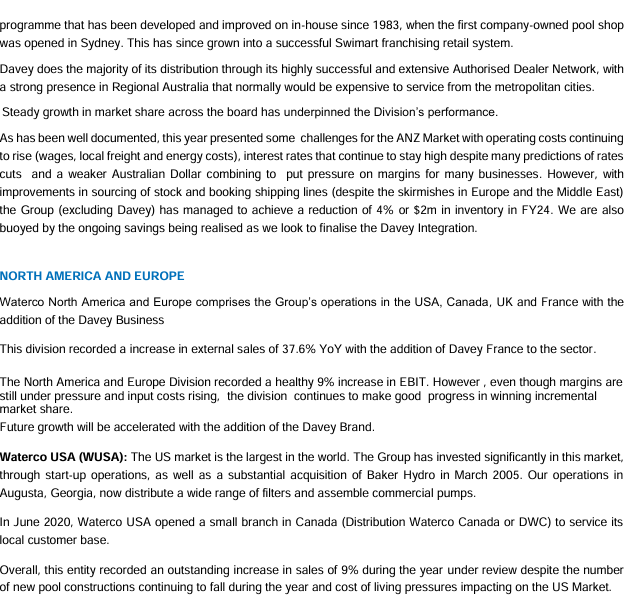

I was looking at the site earlier, not for the pool products (don't have room to install a pool because of big gum tree in a backyard), but the more fancier water hardware and consumables in the commercial and industrial space. Will post what I mean later.

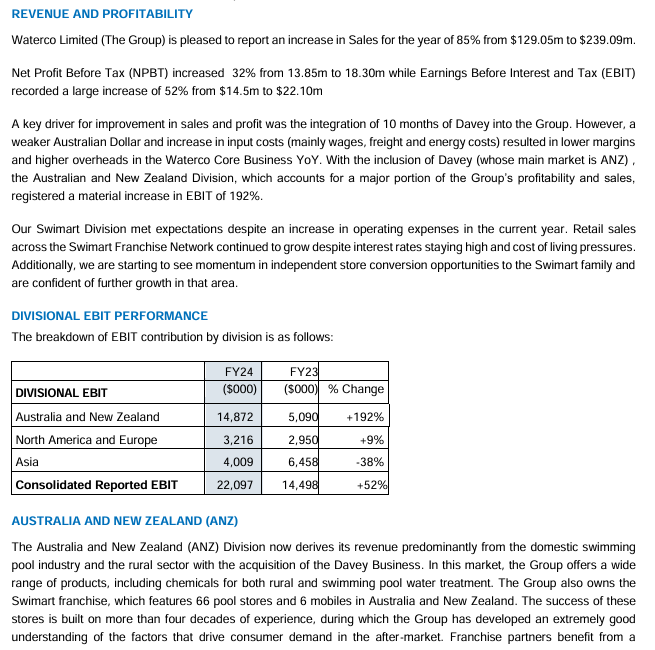

Waterco also acquired the Davey Pumps business for GUD recently which they are still in the process of integrating.

Also growing global footprint.

Trading around 178m with 10m NPAT on FY23. H1FY24 around 6.8m. So they could be on track to surpass last year.

The board is more solid than Compumedics (another one I pointed out that had one person serve as Chairman and CEO) with more members

But I'm still worried about having one person serve as both Chairman and CEO.as does present governance risk. That 503 error doesn't look nice either.