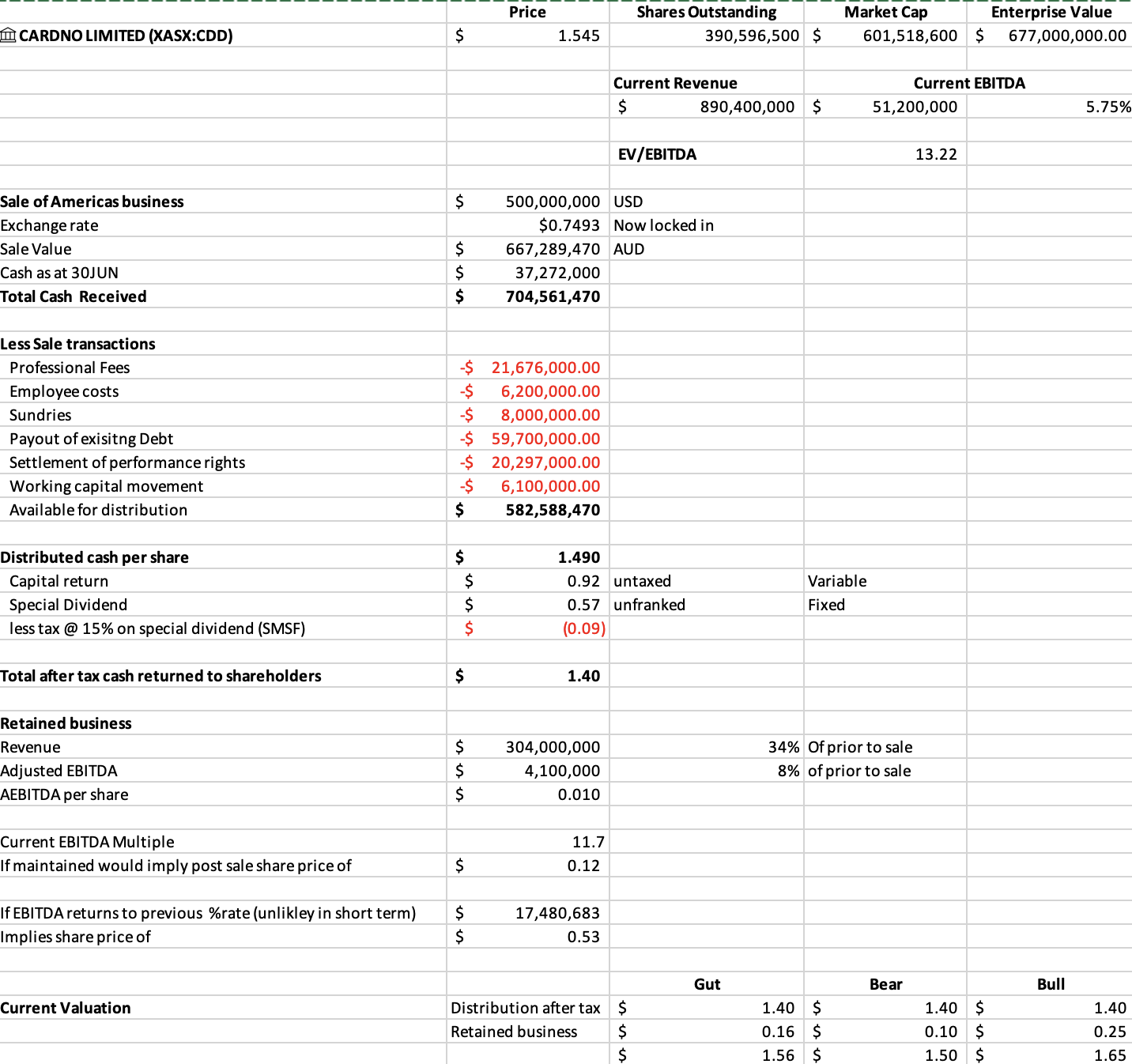

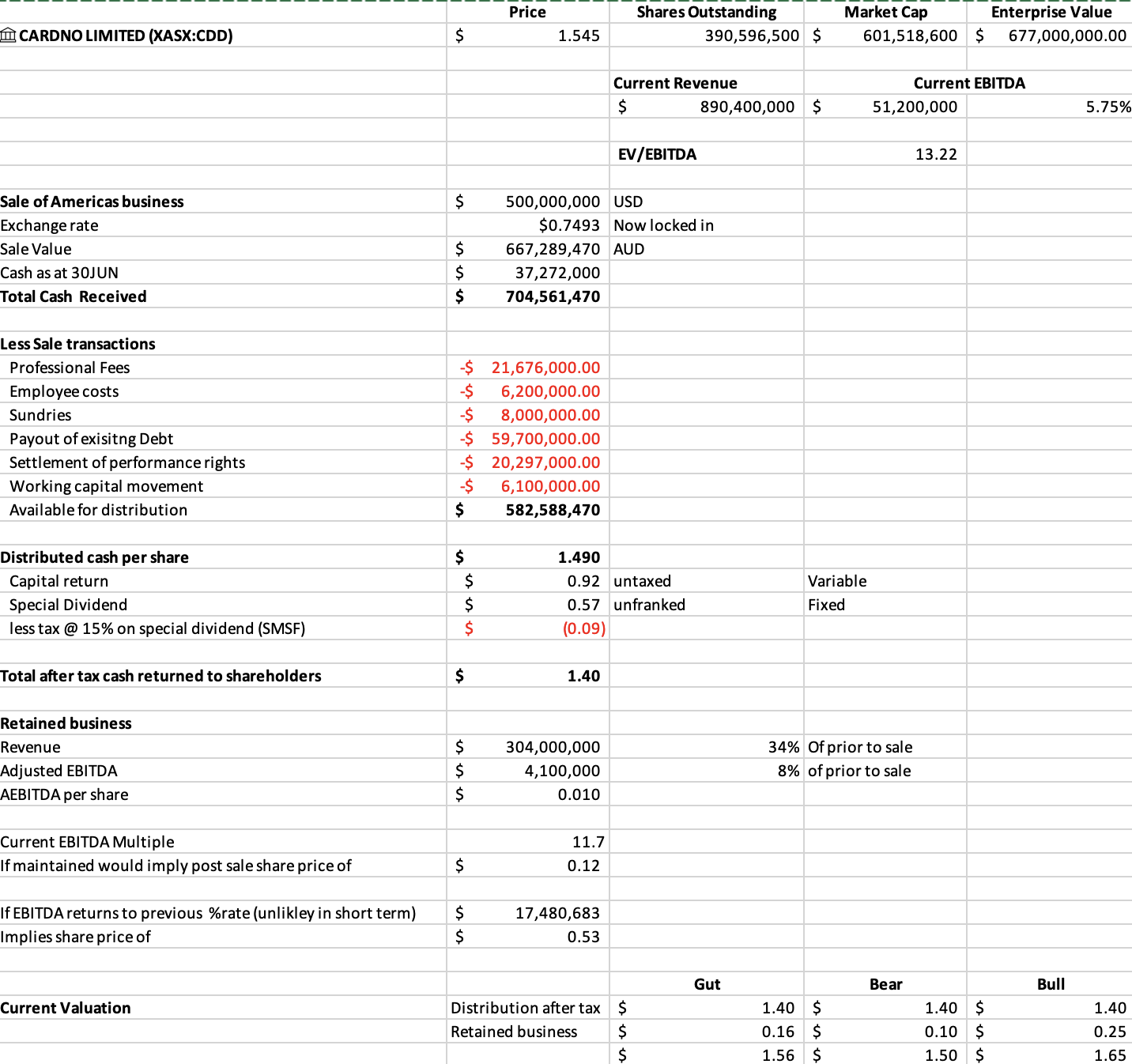

Since my last Straw, the company has released more info and has actually removed some of the risk for the transaction. Below is the latest analysis.

Not sure if anyone else is using this info but I just want to be clear it wont be for everyone. I use these kinds of special situations to get a quick return on my SMSF cash portion rather than having it sit fat dumb and happy in a bank account. The tax in an SMSF is low and I am comfortable with the risk / return but while it can sound attractive to end up with "shares in a company for little to no cost" you need to fully analyse your situation. You can get left with a small return all caught up in a very low liquidity company that is hard to finally realise.

If you want to use my spreadsheet to adjust it for your own situation I am happy to share it with you or talk through the situation - I have to admit I am not yet super comfortable with people investing off my analysis (which is why I am still finding my feet on posting straws in strawman, putting my ideas into the portfolio etc) but this one is a different kind of situation to a normal "Strawman" type of opportunity and figured it may help some people see some different techniques.

Analysis

So what has changed:

- The company has taken out the risk of the USD / AUD exchange rate and locked in an exchange rate of 0.7493. This removes some of the downside and upside risks

- The company has determined the split of Capital Return Vs Special Dividend (0.57c Special Dividend which is fixed and a capital return for the rest). This makes it easier to determine the potential tax impact and final return.

- More details on the costs and plans for the use of the cash.

- The only variable now other than the price you buy at is the value of the remaining business. All we know is we will have no debt, a reasonable cash account, and a business earning around

As such my final analysis is below (this assumes an SMSF holding so please factor in your own situation).

In short - there is a $1.40 after tax return in 2 months and then you will be left with the holding in the remaining company.

- If you could buy at $1.40 you will get a full return of your costs in 2 months and be left with a holding in the remaining business at no cash cost. Your return is whatever you can sell the shares for post sale.

- anything above that and you need to make a return on the remaining company to break even and make a profit. eg if you buy at $1.52 you need to get a sale of 12c per share to break even after the capital return and special dividend and your profit is anything above that.

I have made some purchases at $1.50 - $1.52 which I am comfortable at and will be jumping in at anything under $1.50. Above 1.52 I will wait until after the sale goes through and try and pick up some shares in early January when there will be holders looking to cash in and go. I am pretty comfortable with the remaining business being a reasonable investment, but liquidity could be very low. You end up with a company which last year earned revenue of around $300M and EBITDA of around $4.1M. The company will be resizing to suit and may merge with another or continue. There are large Private Equity / Hedge Fund holdings and they are looking to maximise return in short term so I believe a further sale and windup or Merge is most likely. I also think this could be a real opportunity to pick up some shares cheap in the new year when they head for the exits.