This week, Magellan reported results for FY22 headlined by a 23% decline in ‘revenue and other income’ from $715m last year to now $553m; NPAT $383m or ‘adjusted’ NPAT of $399.7m (down 3% from $412.4m FY21). EPS quoted at $2.09; with $1.79 per share total paid in dividends, franked at a little over 75%. Current share price of $14.43 therefore implies trailing P/E of ~6.9x, yielding 12.4% or around 16% if grossed up.

Core funds management revenue reached $609m for the full year on PBT margin of 79.1%, or 78.7% if performance fees are excluded. This in comparison to HY22 result shows 1H22 core funds management revenue was $364m and NPAT $252m, implying 2H22 funds management revenue of $245m (down 32.7% half-on-half) and 2H22 NPAT $131m.

Average FUM 1H22 was $112.7b, compared to FY $94.3b and implying an average of $75.9b 2H22 FUM. FUM closed the year at $61.3b (46% decline on prior year close), with base management fee held virtually stable at 62bps. These year end numbers imply $380m in funds management revenue for next year if and only if outflows are abated. Even then, this would be the worst result since FY17 on a revenue basis ($329.2m) and I note that in the time since funds management expenses had increased to the tune of ~50%. This means layoffs at Magellan may be necessary to maintain historic 70%+ PBT margins, though as has been pointed out time and again by the AFR, this may be exceedingly difficult to pull off given employees owe the business money for participation in an employee SPP at significantly higher prices than current, where employees were essentially offered unsecured loans by their employer against their participation (to the tune of reportedly $37m, though the accounts show $33.5m in receivables of this nature at present).

Source here for those that can access: Modern slavery at Magellan (afr.com)

The group owns $374m in investments in Magellan funds, plus around $4.7m in ‘seed investments.’ Also owned investments include a now 36% stake in Barrenjoey (carried at $133m) as well as 16% stake in Finclear (carried at $29m). $50m in working capital loans has been made available to Barrenjoey by Magellan, though this was entirely undrawn at year end and management notes has not been drawn since. 11.6% stake in Guzman y Gomez was sold throughout the second half for $140m representing 36.3% return on this investment in little under 18 months. $6m in possible performance incentives may be forthcoming in relation to this transaction also. Cash sits at $419.9m at end FY22.

By my calculation this equates to $2.27 per share cash as well as $2.92 in investments. These investments are delivering cash, with $17.6m in dividends received by the group from Magellan funds and a further reported share of $7.97m in share of net profit from associates (Barrenjoey/Finclear), as well as $416k share in net profit for the partial year relating to ownership of GyG. Management have made clear there will be no further investments pursued by this business unit as they maintain their focus on performance of the core funds management business.

Stripping out the one-off windfall from sale of GyG, FCF came in at +$430m for the full year, of which $331.3m was offered as dividends implying payout ratio of 77% (or alternatively 86.5% of NPAT). A buyback program for up to 10m shares, or around 5.4% of those currently on issue was announced throughout the second half, under which Magellan had already repurchased by year end ~627k units. 5-year, $35.00 strike price options were also issued to employees in March of 2022 which could cause further dilution to ordinary shareholders, though in return for cash upon execution and given the whopping premium to my current range of valuation it’s hard to bake this in as much of a negative at all.

End July FUM came in at $60.2b in total - comprising $22.6b retail, $37.6b institutional; or alternatively comprised of $33b global equities, $18.9b infrastructure and $8.3b Aus equities. Institutional funds continue their decline since the reported period to end June, to the tune of $2.1b net outflows, offset partially by positive investment performance. For the first time, I note a marked decline in funds held in infrastructure portfolios that I sincerely hope is not the start of a continued downwards trend in what has been to this point by far the most resilient portfolio of funds over last 12 months.

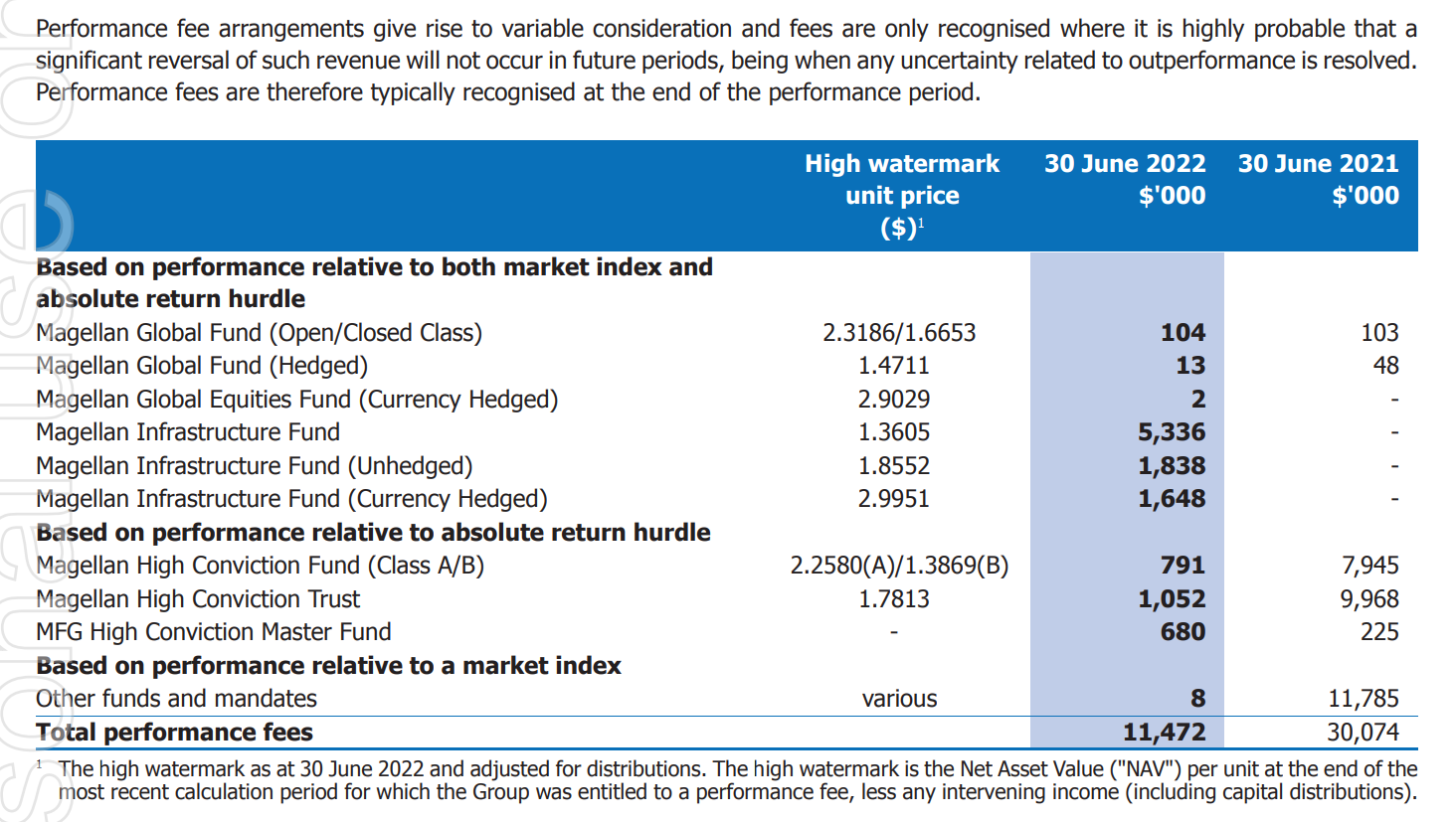

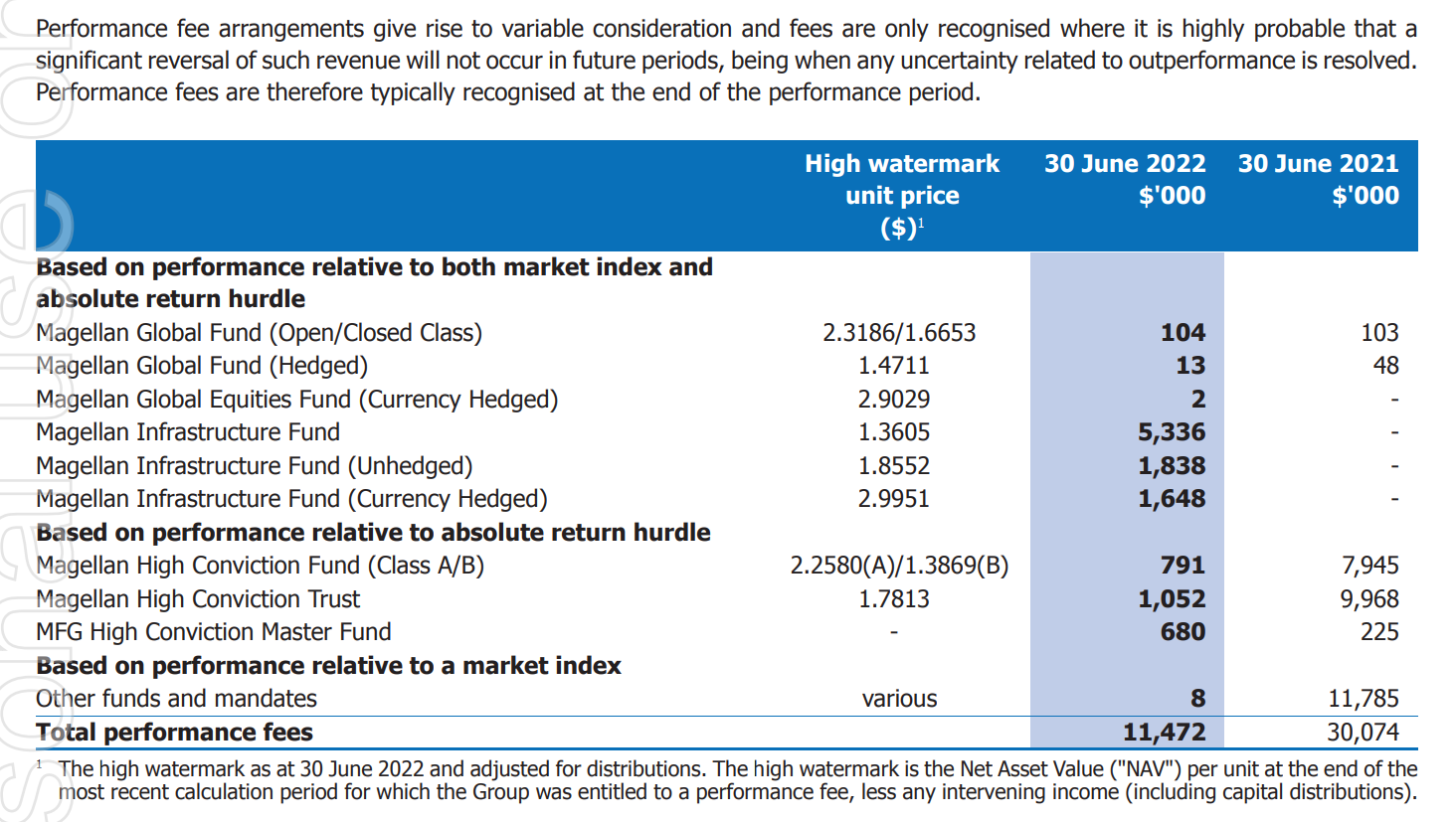

In total, it certainly is clear that allocators have followed SJP away from Magellan’s management. The proportion of FUM from retail customers has reweighted from ~25.7% at November 2021 to now ~37.5% (at end July 2022) which, in the short-medium term at least, might bode well for Magellan’s take rate. Proportion of funds under management subject to performance fees has increased from 34% to 40%, though with recent underperformance of these funds (high watermarks quoted as below), performance fees are likely off the table for at least the next couple of years.

185.089m shares on issue implies market cap of $2.67b at current share price of $14.43

A super crude valuation below:

Assuming average FUM for FY23 of $50b and take rate consistent at 62bps

Management revs = $310m

Performance fees = nil

Services and advisory fees = $5.6m

Assuming 70% PBT margins and 30% tax rate implies core funds management business NPAT of $154.64m, P/E of 10x = $1.546b

Add back $541m in investments and $420m cash = $2.507b or $13.54 per share