Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Return (inc div) 1yr: -14.46% 3yr: -33.37% pa 5yr: -17.51% pa

Stock Idea...

Haven't been following this one but after 1H FY25 result, the Market seems to have changed its expectations.

Does anyone follow this one? in a similar space as AI Media and also one of the holdings of BTI.

I've been a bit distracted this week, so have missed a few quarterlies -- but great to see all the key details posted here for the ones I missed. Nice work team!

I did notice Straker out with its second quarter results today, so thought I'd post some key highlights here.

Q2 revenue was 19% higher at $14.2m, taking the first half result to $33m -- up 42%. (all figures in NZD)

You'll notice a slowdown from Q1 to Q2, which Straker said was due to "general uncertainty caused by global macroeconomic pressures and geopolitical tensions". Honestly, not sure how that would massively impact their customers, but I could be wrong. The UN is a client I guess.

Adjusted EBITDA (which excludes acquisition and restructuring costs) came in negative at -$1m, but was a positive $0.5m for the half.

The company was $500k poorer on a cash basis for the first half of FY23, but the second quarter was a positive $1.8m. They have $12.5m of cash on hand, so remain very well funded.

Of course, we have to account for the IDST acquisition, and unhelpfully they didnt provide like-for-like comparisons. Still, IDST did about NZ$6.6m in the 12m prior to acquisition, which was at the end of FY22, so it seems they have still achieved some decent organic growth for the half.

The company reiterated their guidance from May of 20% revenue growth and 54% gross margins. That implies H2 revenue of $34 -- basically flat on the first half.

Accounting for FX, shares are presently on 1.2x forward sales.

Our discussion with CEO and Founder Grant Straker is here

Full ASX announcement here

Disc. Not held

Another strong result from Straker -- not that you'd know it by looking at the market's reaction (down 6% at time of writing, not far off their 52-week low).

- Q1 Revenue up 66%, or 8% up from the preceding quarter

- EBITDA positive for the 3rd consecutive quarter

- reiterated FY23 FY guidance of 20% revenue growth, with increasing gross margins

- ISO certification audit completed successfully

- No debt and balance sheet of NZ$11m

- Strong sales pipeline

On FY23 guidance, Straker is trading on 0.64x sales..so it seems very cheap at face value.

On the downside:

- Operating cash flow negative due to increased working capital and timing of customer receipts. They expect to be opCF positive again next quarter

- Total cash outflow was $4.3m due to earn out payments for recent acquisitions (in part because these acquisitions had performed well)

I don't own but have kept an eye on the company since we met with the founder and CEO earlier in the year (see Meetings page). I also like that it's one of the companies the Bailador have backed (and still own a part of).

It's probably not worth reading too much into the market's reaction. There was a sum total of 21 trades on the ASX today, for a total value of $50k.

ASX announcement here

After watching Grant Straker's presentation of his company on Strawman, I was sufficiently intrigued to do a deep dive on the company. This is the result of my research.

Where Does The Revenue Come From?

“Straker is a world leading AI-enabled languages service provider that powers global growth for business”

Essentially they are providing translation services to companies that operate in global markets and therefore that need to provide information in multiple languages, e.g. financial reports, web sites, marketing promotions. They also provide translation of the spoken word for conferences and dubbing of movies.

The principal product is RAY - a software platform that supports AI driven adaptive translation, where machine translations are reviewed and finalised by humans. In 2021 there were 20,000 crowdsourced translators, up from 13,000 in 2019. Part of the smarts of the RAY platform is to match each translation job with the best translator, to review and edit the software-generated translations. The platform has connectors into clients systems, allowing for a streamlined translation workflow. RAY is used not only internally by Straker to manage its translation jobs, but can also be used in self-service mode by customers to place orders, track progress, choose translators and approve the finished result.

Traditionally revenue is derived from individual projects, e.g. this was the delivery model for a project with SEAT to translate 10 e-learning courses into 6 languages in under a month.

The recently acquired Lingotek also has a translation management system, which its customers subscribe to in an SaaS model. This brings in $5m revenue, so it is becoming a meaningful contributor to the total expected revenue in FY22 of $50m. The aim is to grow this to 20% of revenue.

There is a good distribution of revenues across customers, with the top 20 customers representing 47% of revenues. 1 customer (presumably IBM) accounts for 7% of revenues

What About The Management?

Grant Straker CEO co-founded the business in 1999 with wife Merryn Straker, who is COO.

David Ingrams, CFO - less than 2 years with Straker, 6 years prior experience as CFO of technology companies (Gentrack and Ultra Commerce).

Phil Norman non-exec Chairman for past 8 years was founding chairman of Xero for 5 years.

David Sowerby has been Chief Revenue Officer since 2008.

Indy Nagpal has been CTO since 2005.

What Is The Moat?

‘Industry leading AI technology’ - increases the productivity of human translators.

Scale benefits - as more translations are done on Ray platform there are more data points for machine learning, to further improve translation productivity.

Global presence - makes them more attractive to enterprise clients.

Blue chip customer base, e.g. Nike, IBM, and (through Idest acquisition) European Commission, UN.

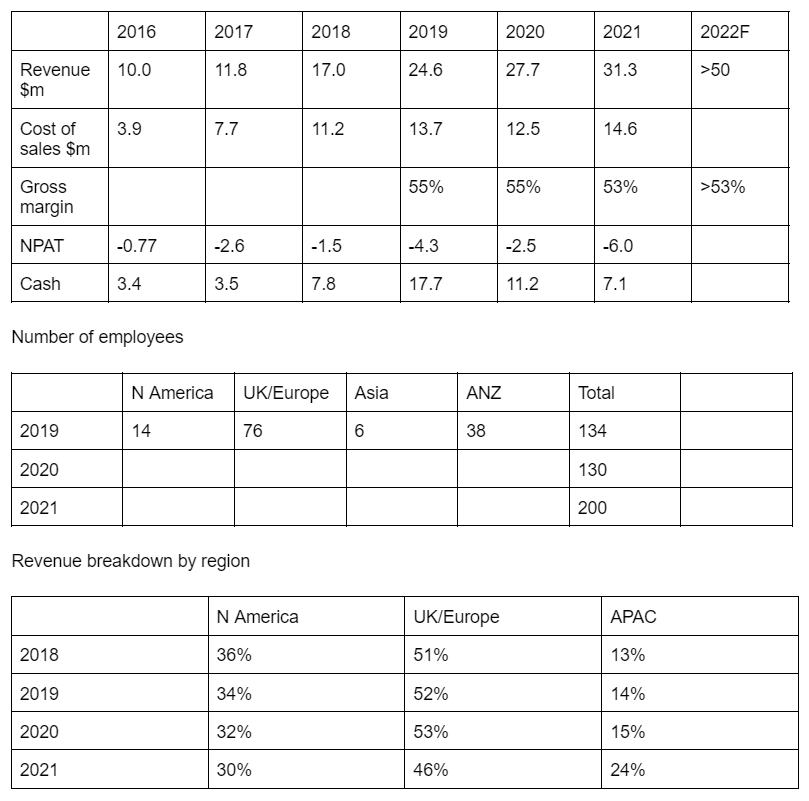

Financials

2021 growth in APAC is due to the NZTC acquisition.

Note the company reports in NZ$, and the year end is March 31st.

At HY FY22 they were guiding for $50m annual revenue for FY22 but now guiding for revenue run rate of $60m - $70m pa.

No debt.

HY $18m cash, Q3 $17m cash in bank.

Company claims that greater operating leverage will be seen as company grows to $100m revenue, e.g. this is a doubling of revenue but headcount only expected to grow 20% (240 > 290)

>90% of revenue is repeating

$25m capital raising in June 2021, mostly institutional, $1m retail (BTS took up $4m as underwriter).

At 1H FY22 the company reported negative operating cash flow of $3.3m and a net loss of $5.6m.

Average price of an acquisition is 0.8 x revenue, which sounds remarkable.

Where Will Growth Come From?

Expansion of use cases in existing customer base, e.g. IBM contract has already expanded from 50 to 90 languages.

IBM JV will lead to new enterprise customers, e.g. first project has been won with IBM Consulting, worth $500K in CY22.

Winning other enterprise customers, following the IBM model.

Increasing the SaaS product offerings, with the aim being to merge the Lingotek platform into the RAY platform.

Industry is highly fragmented, more than 20,000 participants competing for more than US $55bn TAM, with the top 100 companies claiming 18% of the market. The market is growing at 7% CAGR, forecast size in 2022 isUS $ 66bn..

Aims to acquire companies in markets where it already has a presence. In FY20 there was an acquisition pipeline of 20 companies representing a $200m revenue opportunity.

Straker positions itself as a technology leader, and will continue to acquire smaller companies to bring them onto the RAY platform, gaining access to their customers, and increasing the productivity of their translation services. The value proposition to customers is simple: ‘Faster, easier and smarter translations’.

Risks

- Indigestion from M&A deals - just completed 9th acquisition.

- Competition / lack of scale. In this analysis of the top 100 language service providers by revenue, Straker comes in at number 67. It is a minnow compared with companies like Lionbridge (number 5 by revenue, at $500m), who are often mentioned in discussions about Appen. Appen itself comes in at number 7, but clearly is not playing in quite the same market as Straker and many others in this analysis. Contrary to Straker’s claims to have market leading AI-driven technology, the use of machine learning models to automate translation seems to be the norm in the industry, at least among the bigger players. Straker do not appear to have any competitive advantage.

- Technological disruption - potentially the continuous improvement of machine learning translation services such as Google Translate will eventually remove humans from the translation loop, a bit like the risk we may be seeing with Appen and the possible decline in the need for human labelling of data as machine learning models get ever better. However this risk seems to be low probability given the complexities of domain specific language translation, such as in health sciences and the legal profession.

Milestones

- October 2016 Acquisition of Eurotext, Ireland, maybe 10-20 employees, $2.5m revenue, acquisition cost not disclosed.

- Feb 2017 Acquisition of Elanex, based in San Francisco, 35 employees, US$4.5m revenue, acquisition cost not disclosed.

- July 2018 Acquisition of EULE Lokalisierung, a small German translation company,23 employees, $3.2m revenue, acquisition cost not disclosed.

- June 2018 Acquisition of Management Systems Solutions SL Unipersonal, a small Spanish translation company, $3.2m revenue.

- October 2018 IPO, raising $20m ‘to fund organic growth and further acquisitions’.

- Feb 2019 Acquisition of COM Translations, Spanish translation company wit office also in LA, specialising in subtitles and voiceovers for movies, 20 employees, $1.5m revenue, for $750K.

- June 2019 Acquisition of On-Global, Spanish, 14 employees, $3m revenue, for $2.25m plus $0.8m earn out, sales manager Amaya Montoya transitioned to Straker.

- Feb 2020 Acquisition of New Zealand Translation Centre (NZTC), 25 employees, $4.3m revenue, for $0.9m plus $0.8m earn out. Gives Straker ability to provide interpreter services as well as translation, plus a portfolio of enterprise and government customers, mostly in NZ (e.g. Orica, Fonterra, ResMed, NZ Government).

- November 2020 Enterprise deal with IBM. This seems to be a two-sided deal where Straker uses IBM Cloud to provide translation services and IBM uses Straker to translate and subtitle its internal marketing materials. Initial deal is for 2 years and covers 55 languages.

- Jan 2021 Acquisition of Lingotek, based in Utah, bringing SaaS capabilities and enterprise clients Nike and Panasonic, for US$6.47. 51 employees, US $7.9 revenue. As well as its customer base, the attraction of Lingotek was its suite of 17 connectors into leading content management systems (e.g. Wordpress, Adobe, Drupal), which Straker will start to plug into its RAY platform.

- June 2021 Capital raising of A$20m to fund growth, pay down debt from Lingotech acquisition, and pay the costs of the CR. Upsized to a$25m due to strong demand.

- January 2022 Acquisition of IDEST, Belgian translation company with 18 employess $6.6m revenue for $2.9m cash/shares, plus a further $4m in earn out. Key customers include the European Commission, European Parliament, UN and UNESCO.

Conclusion

Straker has taken 22 years to get to $30-odd million in revenues, and is still not profitable. It is a minnow compared to the bigger players in the market. Whilst the joint venture with IBM, and the impressive roster of blue chip clients, demonstrates that Staker clearly has a compelling value proposition, I don’t see what makes the company stand out from the competition. The CEO, CRO and CTO have extremely long tenure - I can’t really see what is going to propel the growth of the company without some fresh blood and new strategy. Simply nibbling away at acquiring small translation agencies around the world does not sound like a recipe for success. (Having said that, Wisetech adopted a similar strategy with considerable success - but it is now the leader in its market, and Straker is a long, long way from that.)

.

Just watched the presentation, and whilst there was nothing new it was valuable to hear it from the horse's mouth: Straker is pretty cheap right now.

It is certainly not a true SaaS company and will probably never be one in its entirety, but I suspect will end up one day predominantly charging in a similar fashion to SaaS companies (ie a mix of volume based and subscription based). This was mentioned during the interview and could easily provide a significant increase in margins.

Also, the company is in good hands - the closing comments were to my mind highly reassuring - the same group of Managers/execs have steered the ship from listing 5 years ago, to a 50m+ revenue company, and are all shareholders. They know the company and the industry inside out and have a clear vision of where they are going and how to effectively get there.

I hold IRL and strawman. And am just off to top up a little more!

I’ve copied the headline points of their latest update below. Straker never seem to have attracted much attention in the SaaS space (possibly because they are part of the way in transitioning to a SaaS model) and trade on a lowly multiple despite increasing evidence that they are executing well. It ticks many boxes for a lower risk SaaS company suited to these times!

You can get exposure through BTI as well as buying directly

Q3 FY 2022 FINANCIAL HIGHLIGHTS1

• Revenue of $15m, up 99% vs pcp (up 101% in constant currency) and 26% vs

Q2;

• Annualised run-rate2 of $60m;

• Approximately 50% of run-rate increase driven by organic sales growth;

• Positive adjusted EBITDA;

• Operating cash is positive with an inflow of $34k driven by increasing sales and

good cash collections, moderated by expansion of global sales & marketing

capability and operational support to the IBM contract;

• Strong balance sheet with no debt and cash of $17.5m

It looks like Straker has gone into a trading halt pending announcement of an acquisition. It's been a choppy year but they do seem to do more right than wrong. In retrospect it seems an excellent buying opportunity at $1.32 last week. What would I know though - I sold last year at less than a dollar and a month later they were $1.50.

[Not held]

I finally bit the bullet and took a starter position in STG (only in my personal portfolio as I have no straw man $$$). I have had it on my Watch List for a while. With a target of >50m in revenue for 2022 a significant increase on the 31.3m achieved in 2021 I felt now was the time to strike.

The company had a huge 2021 with the purchase of the US company Lingotek that adds a subscription revenue stream, the strategic relation with IBM, new customers in Nike, Zoom and Siemans meant 2021 was a watershed moment for this NZ company.

As they continue to look for bolt on acquisitions, invest in their platform development with a focus on growth it's hard to see this continue to stay under the radar with only a 118m MC (note low share count ~70m and top 20 holding 80% makes it fairly illiquid).

Should they execute and hit their medium term target of 100m in revenue then its share price could be multiples of where it is today.

PS. BTI has a 12% ownership position in STG and as a holder of Bailador I feel I could do worse than following one of their picks. Note AEF is also a significant holder.

NOTE. Director Grant Strakker sold a significant number of shares in the middle of the year which might have contributed to the retreat in the share price. It was a decent sale.