An unpopular perspective is an almost unavoidable requirement if you’re hoping to find a multi-bagger. If everyone shared your insight, and saw the value you recognize, it’d already be reflected in the share price.

The consensus view may be cozy, but it’ll give you little opportunity for outsized returns.

What you want is a variant perception; an important but underappreciated insight into the capacity of a business to generate value. One that, if more widely recognized, would very likely result in a materially different market price (either better or worse).

Whereas the market might see a business with a falling margin and sluggish growth, you may observe one that expenses all its development and is building capacity and assets for a sensible and likely successful expansion.

Perhaps the market is disappointed by a quarterly earnings miss, but you see a company continuing to grow and improve scale.

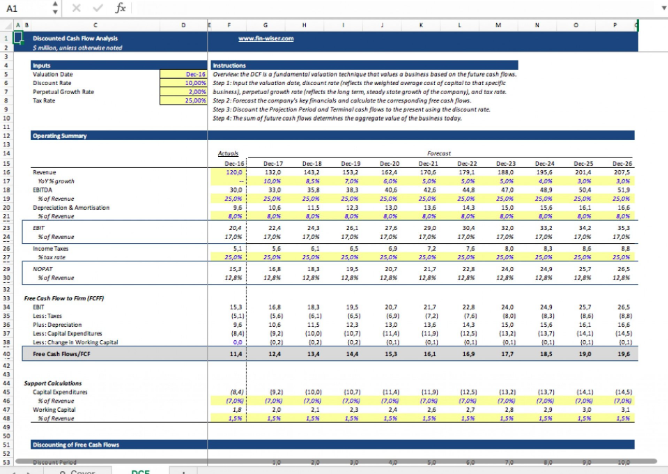

Those that only take a peripheral look at things, or focus too much on the immediate term, often fail to recognize what the true cash flow potential of the business actually is. And that’s great for those who would unburden them of their (heavily discounted) shares.

Finding and building conviction in a variant perception isn’t easy, but nor is it something beyond any one of us.

It requires a certain degree of curiosity in understanding the way the world works. Perhaps even some dissatisfaction with the currently accepted wisdom—or at least a recognition that a deeper level of understanding requires going beyond superficial explanations.

Most of all, it requires an ability to think critically and independently of others.

As Kant says, “Dare to know! Have the courage to use your own understanding.”

It’s important, too, to approach your investigations armed with as broad a knowledge base as you can. A deep but narrow expertise is impressive, but it won’t always allow you to see the full picture. It takes a well-rounded perspective to see connections and opportunities that a more limited view might miss.

So read widely. Engage with those that have different backgrounds and experiences. Be willing to explore things with an open mind and question conventional thinking.

You won’t always uncover a valuable insight; there will be a lot of dead ends. Often you’ll find that the consensus view is, in fact, likely the correct one.

But when you do identify important, non-obvious insights that the broader market has yet to recognize, and if you have the patience to let that reveal itself to other investors, you’ll not only enhance your prospects for a good profit, but you’ll also gain the satisfaction of knowing you saw what so many others missed.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211