At bottom the ability to buy securities – particularly common stocks – successfully is the ability to look ahead accurately. Looking backward, however carefully, will not suffice, and may do more harm than good.” — Benjamin Graham

The financial statements can tell you a great deal about a company, and any serious investor ignores them at their own peril. Revenue, margins, debt, cash flows — you name it — all tell a story that can help the savvy capital allocator identify quality and value.

Nevertheless, in and of themselves, reported numbers are somewhat limited in what they might reveal. Especially for early stage companies.

If an analysis of the financials were all you needed to reliably outperform the market, then people far smarter and better resourced would have long ago figured out the ideal combination of factors needed to do so. And because markets are dynamic beasts, the very act of exploiting these factors would have eventually arbitraged away any advantage.

(To be fair, there is some evidence to suggest that so-called “factor investing” can offer a small edge, but it generally requires managing extremely large portfolios, which tends to be impractical for private investors. And even then, any ‘alpha’ is generally small when costs are included.)

Investing is, obviously, all about trying to work out what will happen in the future. And past performance, as they like to say in the financial services industry, is not indicative of future performance.

Indeed, some of the biggest corporate blow-ups in history reported great financials right up until the very end.

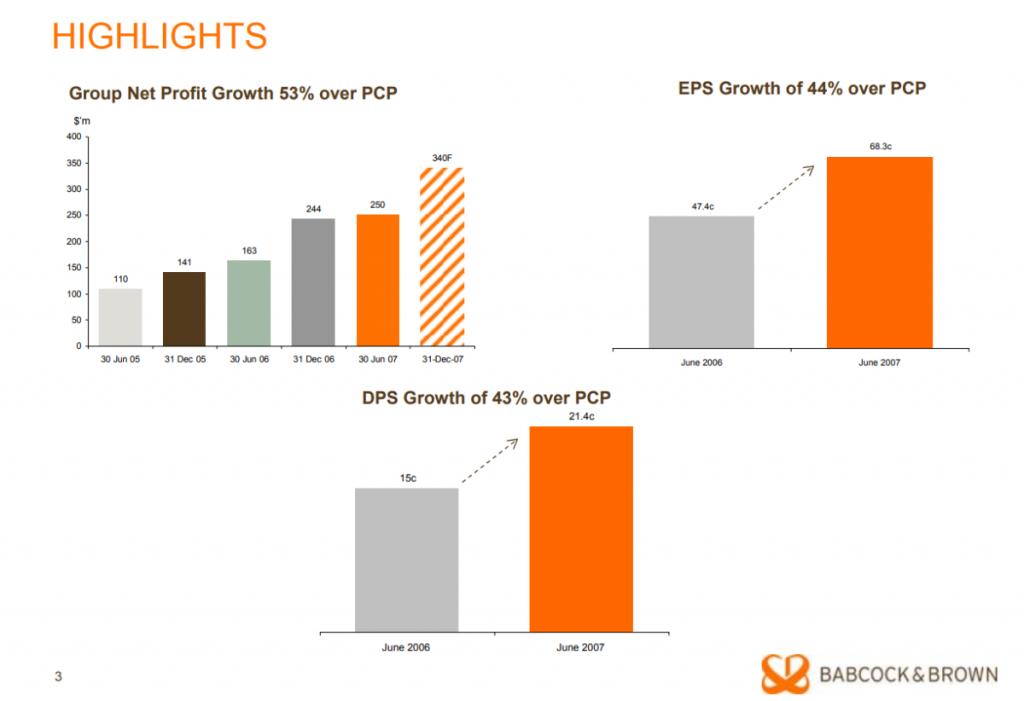

In 2007 Aussie investment bank Babcock & Brown was reporting growing profits & dividends. It also had a 30 history of delivering strong returns for investors, and things were only accelerating.

The business was even highlighting the strength of its balance sheet and conservative gearing levels:

ABC Learning, Forge Group, HIH Insurance, and a host of others, were similar in that regard — everything looked great, until all of a sudden it wasn’t.

It often seems obvious in hindsight, but very few saw what was to come. Even among the smartest guys in the room.

The truth is that many, if not most, of the important insights you need to avoid a loser (or spot a winner) won’t be found in the accounts.

Business model, industry dynamics, corporate culture, competitive advantages, funding requirements, insider alignment and incentive structures, among other things, matter a hell of a lot but these qualitative factors are not easily measured.

They often require a lot of upfront investment too; things like machinery, inventory, R&D, brand building all require companies to depress cash flows today, in the hope of generating a return tomorrow. And while cutting back on many of these can juice short term results, it’s not something you should wish for as a long-term investor.

As asset manager Paul Black recently observed:

“If you read Phil Fisher’s book Common Stocks & Uncommon Profits, I think he has a 25 point checklist on how to analyse a company & interestingly of the 25, probably 15 are qualitative elements. Which is just the reverse of what most people on Wall Street do.”

All of this is not to say ignore the financials; no qualitative element is important if it can’t (eventually) push them in the right direction. But you can’t move forward if you keep your gaze stuck in the rear view mirror.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211