While most tech stocks have been busy carving out fresh record highs in 2019, kiwi payments platform PushPay (ASX:PPH) has failed to elicit the same enthusiasm from investors. Although shares have climbed around 20% higher so far this year, they remain below their 2018 high and are hovering at levels first reached in late 2017.

So, what’s going on?

The business

Founded in 2011, PushPay provides payments services to the faith-sector. Gone are the days of passing around the collection plate; today’s churches seek to improve donation, tithing and accounting using technology — and PushPay has fast grown to be the industry leader.

Processing north of US$4.2 billion of payments last financial year, Pushpay has over 7,600 customers including 55 of the 100 largest churches in the USA. And these are really BIG churches — the largest has an average of 51,000 attendees!

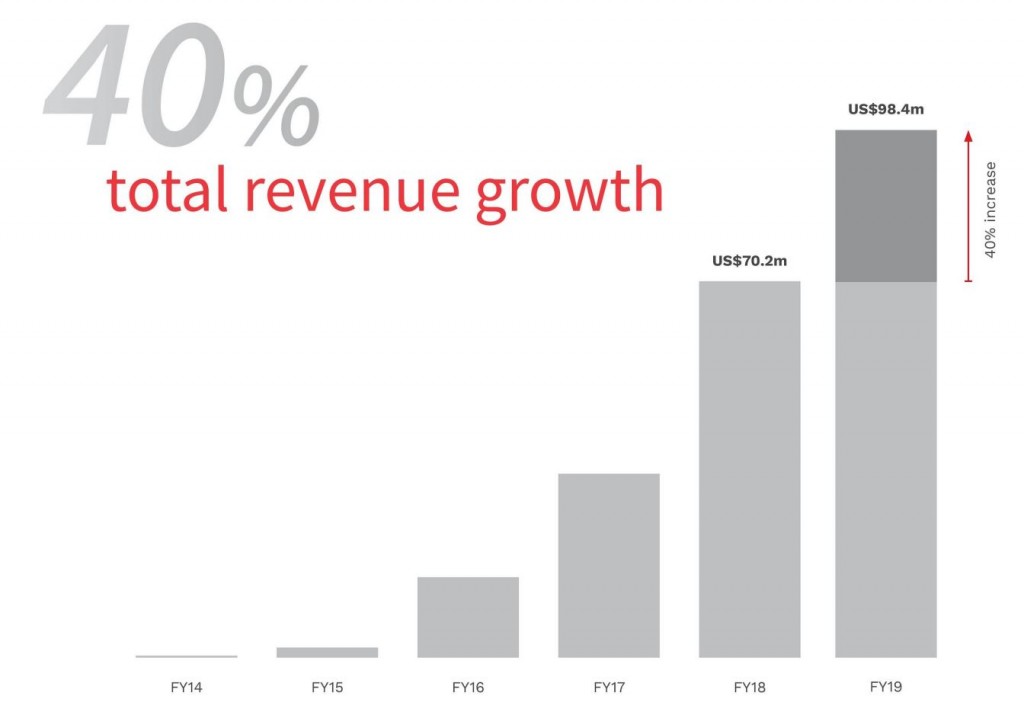

Sales have been growing incredibly strongly over the past few years. Indeed, take any financial metric you care to name and you can be confident it’s been moving in the right direction.

Not only are customer numbers growing, but each customer is increasingly processing more and more volume. In fact, the average revenue per customer (ARPC) was up 33% in the last year alone. Gross margins are likewise improving and the company is now cash flow positive and profitable.

With over US$13 million of cash in the bank, good cost discipline, sticky customers and a long run way for growth, PushPay seems very well placed to continue its expansion.

Price is what you pay, value is what you get…

Given the current market for technology stocks, and the significant pace of growth from the company, you’d expect shares to be trading on a rather ‘full’ multiple. But while a price to sales of approximately 7 is far from ‘cheap’ in the context of more mature businesses, it’s hardly excessive given the pace of expansion and future outlook.

(For context, Afterpay (ASX:APT) is on P/S of 60. Xero‘s (ASX:XRO) multiple is ~16, while NearMap (ASX:NEA) sits at ~20.)

Following a 40% surge in revenue last year, PushPay expects the top line to grow a further ~29% in FY2020. Longer term, it has aspirations to capture 50% of the large & medium church market, which would represent around US$1 billion in annual revenue.

Accounting for the operating leverage that is typical of software companies, if PushPay is able to get anywhere near this target within the next 10 to 15 years, then the current price seems very undemanding.

To reiterate, this is a fast-growing, profitable business with no debt and a significant addressable market in which it is already the global leader.

No wonder it’s ranked #3 on Strawman.

Click below to see valuation estimates and research from our community of investors.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223