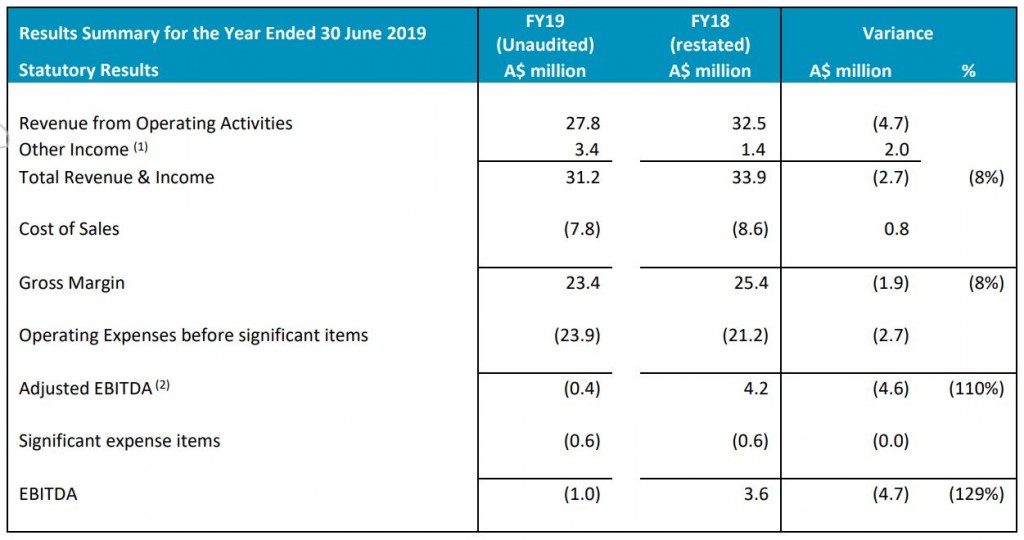

Developer of club management software MSL Solutions (ASX:MPW) has released its unaudited results for the 2019 financial year, and they’re not great.

Sales from operations were almost 15% lower at $27.8 million as a number of orders slipped into the current period. Allowing for these, and assuming all orders would have been contracted, the result would have been $7.7 million higher.

Combined with a (previously flagged) ramp up in marketing and R&D expenses, MSL tipped back into a loss making position with operating profit EBITDA of -$1 million, versus $3.6 million in the previous year. If we exclude the gain from the sale of the Zuuse business, the operating loss would have been -$3.8 million.

MSL saw a $4.5 million cash deficit from operations, which reduced the company;s cash balance to $2.1 million, down from $6.6 million at the end of FY2018.

The business is in the process of transitioning to more of a subscription model, and this will impact near term sales as higher upfront (but lower lifetime value) capital sales are replaced by ongoing subscriptions. Nevertheless, the key metric of Annualised Recurring Revenue (ARR) grew by just 6.5% to $17.9 million.

MSL is also in the process of conducting a strategic review, of which the results will be released to the market “shortly”. History would suggest that this tends to signal a degree of dysfunction within the business, and very often results in some tough medicine. Even if successful, these things tend to take a while before any results become apparent.

With shares down 35% over the past 12 months, investors could make an argument for value. At the most recent price shares in MSL Solutions are trading on just 1.2 times sales or 1.8 times ARR. Should the business manage to deliver an acceleration of top-line growth, and avoid a capital raise, the current price will no doubt seem cheap in the years ahead.

If MSL continues to burn through cash, and if the added investment in research and sales doesn’t bear fruit, this may just prove to be a value trap…

MSL Solutions has fallen significantly in the Strawman rankings, although shares sit below the community’s estimate of fair value. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223