When a company tells the market it’s expecting to post a record full year result you mightn’t expect to see shares drop lower, but that’s exactly what’s happened with Integrated Research (ASX:IRI). The developer of market-leading performance management software Prognosis has seen shares tumble over 20% lower in the past two days, dropping back from its recent 14-month high.

So, what’s going on?

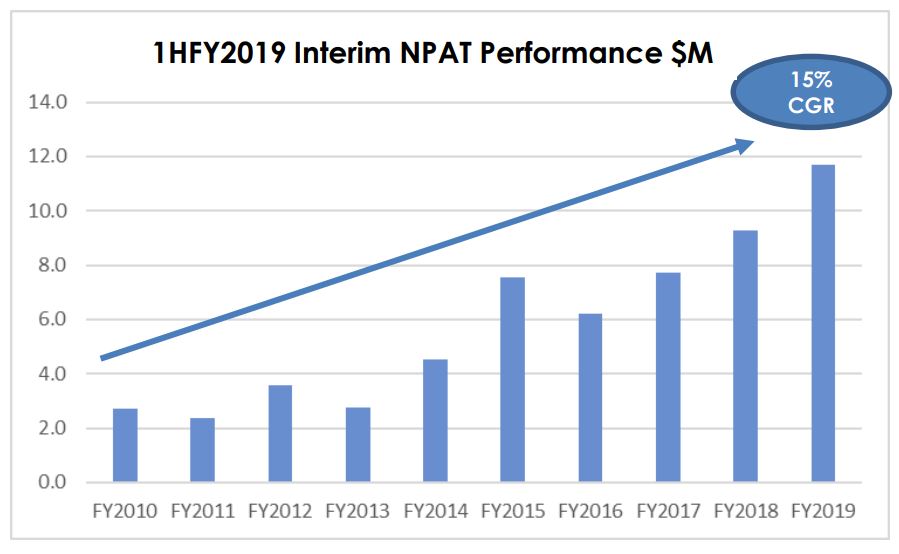

On Monday, Integrated Research told investors it was on track to post a record sales result of between $100-$101.5 million, which represents growth of 10-12% on the previous year. Likewise, net profit was expected to come in between $21.2-$22 million, or 10-15% higher than FY2018.

The company hadn’t previously offered any specific guidance (it usually doesn’t), but according to CommSec the preliminary results were a tad below the consensus expectations of analysts. Per share earnings were expected to come in at 13 cents per share, as opposed to the 12.6 cents as represented by the midpoint of guidance.

That’s hardly a big miss, but the full year numbers also appear to suggest that net margins have contracted slightly too — dropping from around 23.3% in the first half, to around 21.4% in the second.

With a majority of earnings billed in US dollars, it also seems likely the business got a bit of a free kick with a weaker Aussie dollar. In constant currency, it seems likely that growth was weaker than the headline numbers suggest. Investors will have to wait until August 22 when the full year audited results are released to get a clearer picture.

At any rate, these are still very solid numbers. Unlike so many tech stocks these days, Integrated Research is highly profitable with outstanding net margins, healthy cash flows and a super strong balance sheet. The business is not only self-funding (and has been for years), but it’s the leader in a large and fast growing global market. Customers are sticky, revenues are reliable and there remains a long runway for growth.

Of course, to paraphrase Buffett, price and value are two separate things. Although Integrated Research is set to post another record year with double digit growth, the market seems to have been after an even stronger full-year result.

After two days of big falls, shares are now on a price to earnings multiple (P/E) of ~22 times. In a low interest rate world, that hardly seems expensive given the pace of growth, the health of the business and the longer-term opportunity.

Investors should remember, too, that Integrated Research tends to suffer from rather exaggerated moves as the market over-reacts to news. Historically, these have proven to be great buying opportunities for longer-term focused investors…

Ranked #13 on Strawman, shares in Integrated Research remain below the community’s estimate of fair value. Click below to discover more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223