There is no one ‘right’ way to invest.

Even if there were, somehow, a way to prove the superiority of a particular approach, it’s not worth much if you lack the wherewithal to execute it. And it’s not necessarily a question of ability; temperament, time, experience, resources, personal interest, and many other things besides, are also important.

The best investing approach is, therefore, not just one that is rational, but one that is also aligned to your specific circumstance.

It’s the same with your fitness & health; a highly rigorous diet and exercise regimen isn’t worth jack if you’re unable to stick with it. Trying to get in a few steps each day and cutting back a little on the booze & sugar is far less effective in theory, but it’s probably much better in practice for the simple fact that you actually have a chance of sticking with it.

Similarly, when you adjust for risk and effort, it’s difficult to beat a passive investing approach. Yeah, it’s not exciting, and it won’t generate outsized returns, but it requires very little work and you’re virtually guaranteed quite reasonable long-term gains. Nevertheless, I personally (Andrew here) just can’t get behind it in any major way.

I find the study of business and the thrill of the hunt way too alluring to take an overly passive approach (plus, to be honest, there’s a degree of hubris that makes me think — rightly or wrongly — I can do better as a stock picker).

To know which approach is best for you, you must first know thyself. And in a truly honest way.

How easily do you stomach volatility? Does reading financial statements bore you silly? Can you commit the time necessary to stay up to date with all the various company filings? Is growth or income more important to you? Do you want the (relative) safety of investing in more mature businesses, or do you prefer to swing for the fences?

The list of potential questions is long and the only correct answers are those that are honest. Oftentimes, you can’t really know the answer without having had some direct experience first. For example, everyone says they can handle volatility, but until you experience a substantial drawdown you don’t really know.

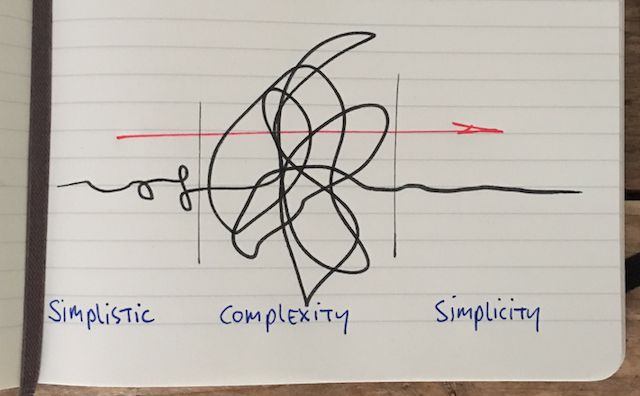

It also takes time for each of us to understand what best works for our unique situation. We usually have to flirt with a variety of styles before we land on the one that is best suited. And even then things can change as our circumstances and preferences evolve.

The good news is that in finding your path you can take baby steps. Perhaps start with a heavy allocation to ETFs, and experiment with various investing styles with a relatively small amount of your capital. As you find your way, you can then extend the amount of capital you devote to your preferred approach.

It is often helpful to write down your style, as you currently see it. The process of articulating your desired strategy will not only help you think through things more clearly, but it should also help you avoid straying too far from where you want to be.

And keep in mind that there are many different ways to skin a cat; Buffett, Drukenmiller and Ichan all delivered spectacular long-term returns, but each employed a style that was radically different from the others. No one approach was ‘better’ than the others, only better suited to the person executing it.

Lastly, remember that investing, as with life, is a journey, not a destination.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211