Software company LiveTiles (ASX:LVT), a developer of “intelligent workplace solutions”, has seen shares climb further away from a recent 14-month lows as the market welcomed the group’s latest quarterly report.

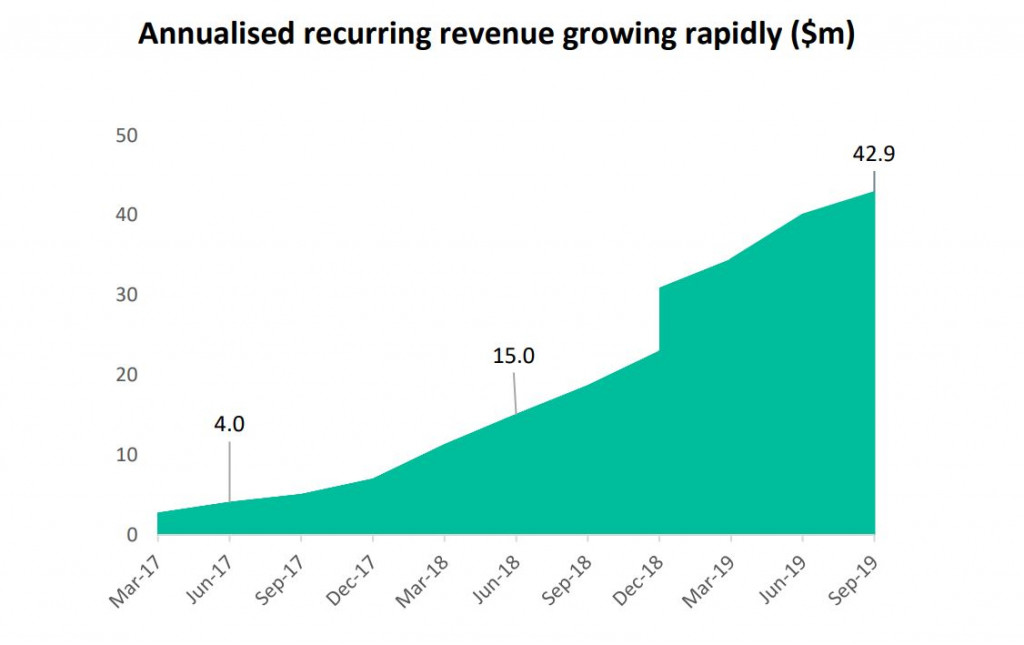

As previously announced, the company’s annual recurring revenue (ARR) climbed to $42.9 million in the September quarter, a modest 7% improvement from the preceeding quarter, but a full 131% over the year and an 8.6x lift from two years ago. Given LiveTiles has seen a near 70% lift in customer numbers, this shows that the average spend per customer is also growing well.

Importantly, customer cash receipts grew 252% from the previous corresponding quarter, coming in at $8.5 million. This is the 4th consecutive quarter of record customer cash received. Still, the business remains cash flow negative overall, with operating cash outflows of $5.3 million for the quarter (including a $3.8 million tax incentive). Nevertheless, this is an improvement on the $6.2 million cash burn from the June quarter.

Underlying operating expenses came in above previous guidance, at $16.4 million for the quarter, as the company made additional investments to support growth.

With LiveTiles sitting on around $56.9 million in cash, it has enough reserves to fund operations for a good while yet. Hopefully, enough to see the business transition to a cash flow positive position.

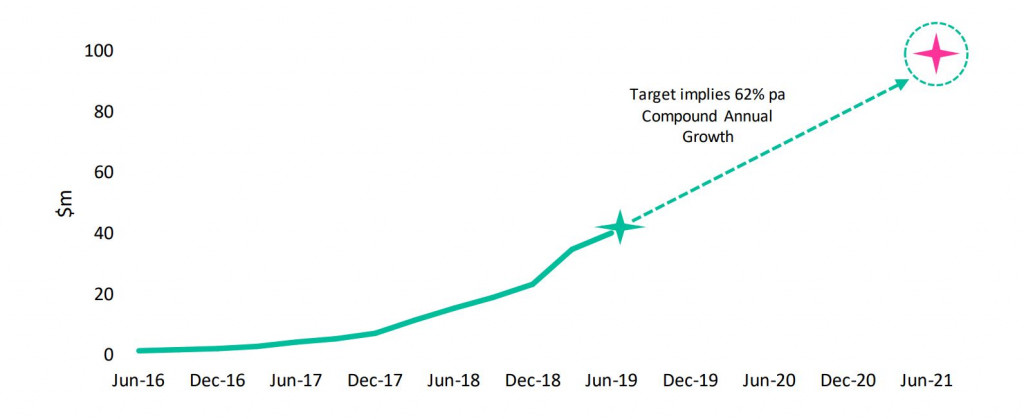

LiveTiles said that it expected “another strong year of customer and revenue growth in FY20” and has previously outlined an aspirational target of $100 million in ARR by FY2021.

With shares trading on an ARR multiple of 5.8x, or ~13x last year’s sales, the market is certainly factoring in a good deal of growth. But if LiveTiles can get close to its ARR target, the current market valuation would not seem unreasonable.

Ranked #8 on Strawman, shares remain below the community’s consensus valuation. Click below to discover more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223