Candidate reference platform Xref (ASX:XF1) has seen shares dip on the open, after the company released a quarterly update and announced a new acquisition.

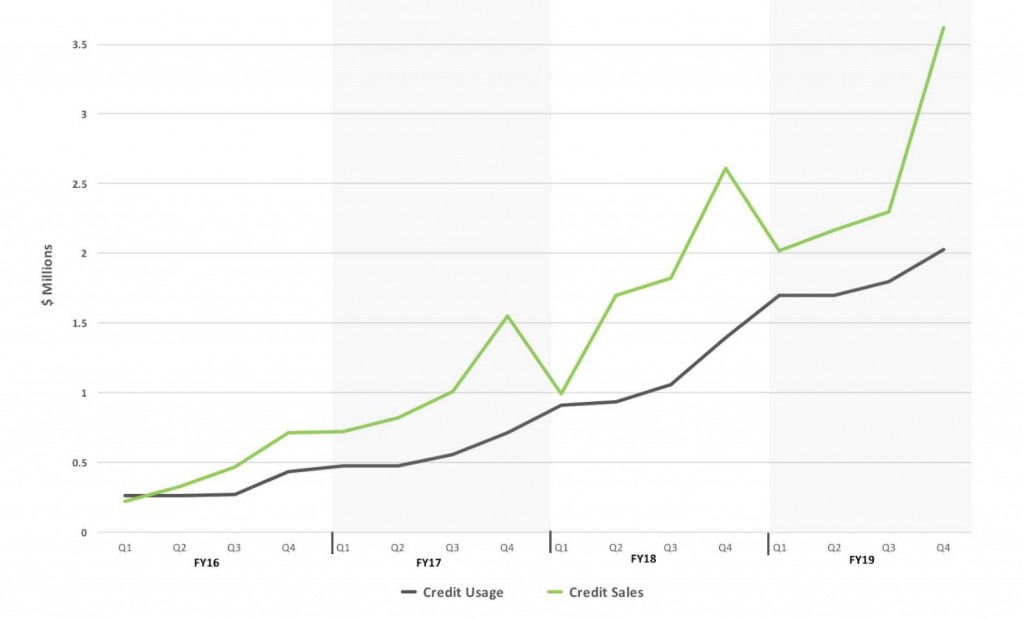

Sales for the the 4th quarter came in at $3.6 million, a 38% lift from the prior corresponding period. The proportion of international sales doubled to 20%. Xref’s business model involves selling ‘credits’ to clients upfront, which they then use as and when are needed. So it was also encouraging to see actual credit usage lift 40% to a record of $2 million for the quarter.

That puts Xref on an (unaudited) annual sales result of $10.1 million, a 42% lift on the previous full year. Sales have increased nearly 6-fold since the company listed in 2016.

Xref also announced the acquisition of Rapid ID Pty Ltd for $1.5 million. A relatively young Queensland company, Rapid ID’s software has already been integrated into the Xref platform and will allow customers to also verify the identity of candidates. Boasting clients such as Uber and Easypay, Rapid ID will also continue to be marketed separately and will look to develop into non-HR markets.

The purchase involves $600,000 in cash (at last quarterly results Xref had $12.2 million on hand), with the rest payable in shares. The share issue will increase the total count by roughly 1%.

Xref remains a cashflow negative operation, but the continued strong sales growth puts breakeven “clearly in sight”, according to the previous quarterly announcement (although no update was provided with today’s announcement). Based on reported sales for FY19, the company is presently trading on a price-to-sales ratio of 9.1 times.

Xref doesn’t yet have much of a following on Strawman, but the last member valuation gave shares a 72c intrinsic value. Click below to learn more, or visit the companies page to see the most popular recommendations from the community.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223