Objective Corporation (ASX:OCL), a developer of enterprise content management and governance solutions, saw its shares surge over 25% to a fresh record high this week on the back of preliminary full year results.

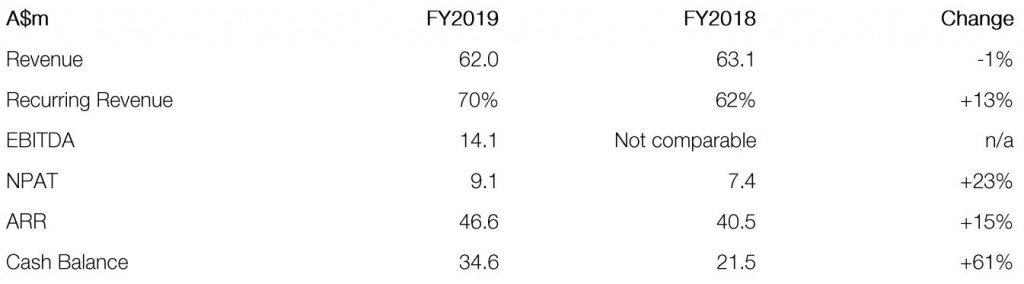

The veteran software provider revealed a 1% drop in revenue, which came in at $62 million. That didn’t phase the market, though, as FY2018’s top-line was boosted by a large one-off consulting project. Moreover, that work was replaced by higher margin software revenue which helped boost net profit by a solid 23%.

With the business continuing to transition to a subscription model, a 15% rise in annual recurring revenue was also of note, as was a further strengthening of the balance sheet with a 61% rise in the company’s cash reserves. Indeed, around 10% of the company’s total market capitalisation is in cash.

The company continues to reinvest its strong cash flows into product development and enhancement; a key factor in helping to sustain the group’s competitive edge. $12.7 million was invested here, or 20% of revenues, with all spending expensed on the income statement (as usual).

Although the company didn’t provide any forward guidance, CEO and founder Tony Walls said the company would continue to enhance its product offering and spoke to the potential this represented for increasing revenue per customer.

Following the share price surge this week, Objective Corp. is now trading on a price to earnings ratio (P/E) of approximately 36 and a trailing yield of 2.8%, or just over 4% when grossed up for franking credits. That’s far from egregious, especially given the company’s strong balance sheet, reliable earnings and the current low rate environment.

Nevertheless, according to the community consensus on Strawman, shares currently sit a tad over fair value. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223