The last year has been a wild one for stock market investors. Since the March 2020 lows, the ASX200 (ASX:XJO) is up an eye watering 56%, the NASDAQ (ASX: NDQ) has gained 71% and the S&P500 (ASX:IVV) has marched 54% higher. With astronomical gains from these indices, individual investors may have seen similar results. However, if you’re not matching these market gains, there could be three main reasons why you’re not seeing more green in your portfolio.

Friction

Friction can really eat away into your profits. Consistently buying and selling in and out of stocks is an almost impossible way to generate long term wealth. The thing about trying to buy and sell at the right time is you have to actually be precisely correct – you have to not only pick the correct time to sell, but also pick the correct time to buy. This need for surgical precision and incessant trading is the enemy of the long-term investor. Warren Buffett once claimed his investing success was due to “lethargy bordering on sloth.”

Not only is friction stopping the compounding of your stocks, it usually starts to rack up significant brokerage fees – the termites gnawing away at the foundations of your portfolio. $19.95 here, $9.95 there and all of a sudden your 22% gain has slowly evaporated and lined the pockets of your broker! Minimise friction by choosing great companies, sitting back and worrying less about the ebb and flow of market movements.

Tax inefficiencies

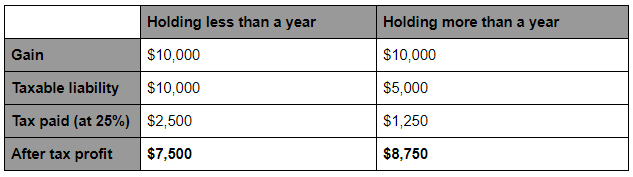

Another reason you may be underperforming the market is that you are unable to capitalise on minimising your tax liability. Capital gains discount means that in Australia you can pay half the tax on any potential gains if you hold the stock for over a year. Let’s compare two profits of $10,000 with the only difference being holding over a year or under a year.

Impatiently buying and selling of stocks is not only riskier and more difficult than buying and holding for the long term, but it means that you can miss out on discounting your gains by 50%.

Short-term mindset

Both of the previously mentioned pitfalls dovetail into one overarching hindrance to making compounding gains: a short-term mindset.

Having a long-term mindset doesn’t just mean you don’t have to worry about day-to-day price movements, it allows you to zoom out and take a macro approach to your investments. See how your thesis plays out over the course of months, but better yet, years.

Your thesis on renewable energy could prove fruitful, but if your time horizon is only a matter of days or weeks, how can you hope to be so correct so soon? Time will help to massage out bumps in the market, macro-economic funks and give a much truer indicator as to whether your investment is a compelling and lucrative one. Give it some time to run its course and you won’t only benefit from compound gains, but also have a much more accurate portrayal of how the company is developing.

Founder and CEO Tim O’Reilly once said “Being too early is indistinguishable from being wrong.” Give your investments time to grow, your thesis time to play out and yourself time to enjoy other things in life than day-to-day stock market movements.

If your stock picking isn’t quite up to scratch with the market, it’s worthwhile to consider these things before throwing in the towel and buying an index fund. Be patient, maximise your tax efficiency and focus on the long term – the opposite can be dangerous to your wealth!

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2021 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211