Shares in 3D data technology company Pointera (ASX:3DP) have run hard in the past few weeks, climbing over 50% since hitting a 12-month low in late October.

This gain is not supported by any announced news from the company, but sentiment has clearly improved. The question, as always, is if this change is justified, and whether or not value remains for investors.

Laser scanning and other geospatial mapping technologies, which have dramatically fallen in price and are seeing a rapid uptake by various industries, are underpinning an explosion of 3D data sets. These files are huge and can be very cumbersome to manipulate, which is where Pointerra comes in.

Based on patented technology, Pointera’s product stores and processes this data in the cloud which enables users to access and use it without requiring a lot of processing power and bandwidth. The company also provides analytics for this data and a market place to allow customers to share (and monetise) data sets.

In a lot of ways, Pointerra is similar to aerial imaging company Nearmap (ASX:NEA), which also enables clients to remotely visualise, measure and monitor real world locations. That business has enjoyed extremely strong growth in sales and successfully expanded into offshore markets as potential customers realise the benefits of the technology.

In fact, Dr Rob Newman, the CEO of Nearmap, helped float the company and only recently stepped down as Chairman due to the increasing time commitments of his Chief Executive role. Dr Newman still has a significant interest in Pointerra, though, holding around 13 million shares and 5 million options as of the last notice.

Investors should be mindful that Pointera is as yet unprofitable and burning through cash — around $0.5 million in the latest quarter. Moreover, the business has less than $1 million in available cash, so it’s reasonable to expect another capital raising in the near future.

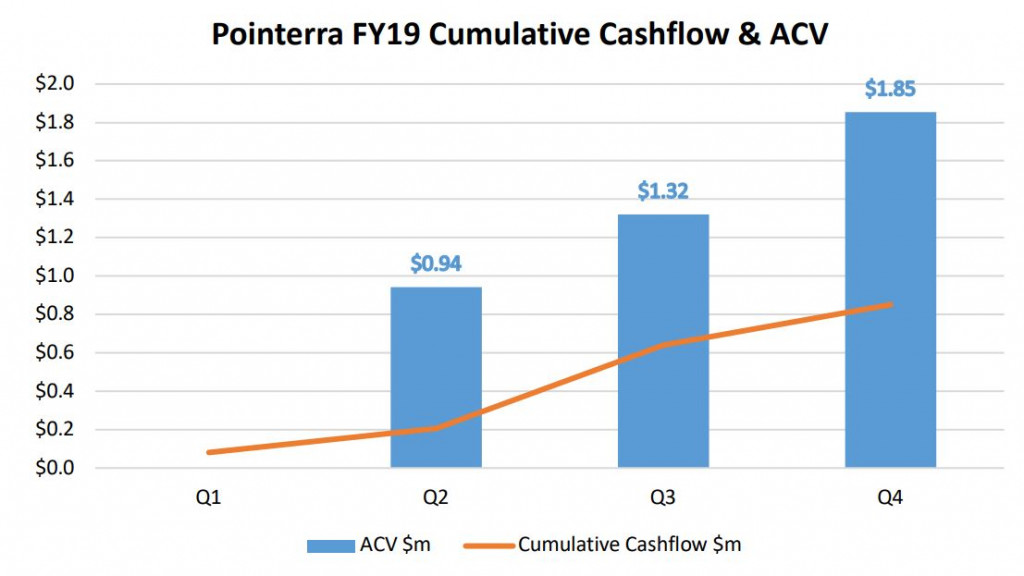

That being said, the company is generating sales, and these are growing exceptionally well. As of the end of June 2019, the annualised contract value (ACV) was $1.85 million, which was over 40% higher than the preceding quarter.

The company has around 521 million shares on issue, and 16 million options. So on a fully diluted basis, at the current market price of 5.7c, the market capitalisation is ~$30 million. That’s about 17x the ACV, which is fairly high in comparison to other tech companies.

That being said, with sales growing off a low base, an addressable market worth billions per year, and little direct competition, it’s possible we could see sales grow at high double digit rates for many years. If that proves to be the case, the current market price could still be seen as cheap.

Of course, early stage companies — even those with fast growing sales — can often underwhelm if they fail to manage costs and make poor investments with their limited capital. It’s worth remembering, too, that microcap companies like this tend to exhibit a lot of volatility; shareholders can expect a bumpy ride no matter the outcome.

Pointerra has gained a solid following on Strawman in recent months and now sits at #12 in the rankings. Click below to read what others are saying, and to view the consensus forecast.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223