Technology stocks may be getting all the attention of late, but for those who may be put off by the nose-bleed valuations on offer, there remain opportunities in more traditional industries. One potential candidate is food industry veteran Freedom Foods (ASX:FNP) which was recently rated as a ‘Buy’ by Goldman Sachs.

Background

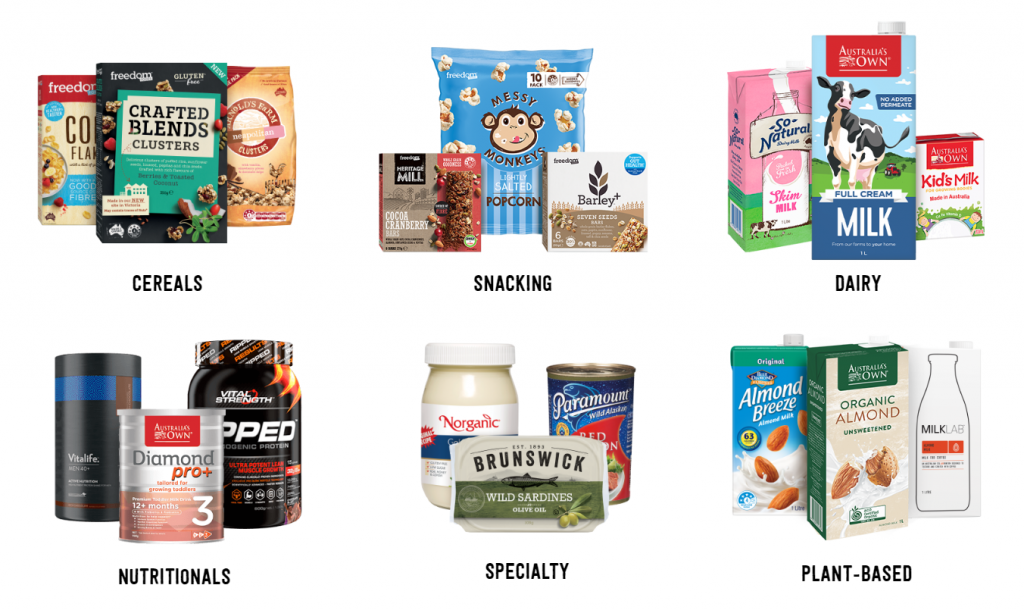

Freedom foods’ origins date back to 1986 when it introduced a range of plant based beverages (think soy and rice milk) to the market. Since then, the company has broadened into a much wider range of health food categories, including A2 milk, gluten and allergen free foods and even protein powders.

Backed by the billionaire Perich family, who own over half the company, Freedom Foods has seen sales grow by 300% in the past five years. Including dividends, Shareholders have more than doubled their money in that time.

In the most recent half, Freedom booked a 31% increase in sales, with net profit climbing more than 27% higher. Management told shareholders to expect at least a 40% rise in sales for the full year. Longer term, the business hopes to see further growth from its significant investment in new production capacity and product lines.

Just recently, Freedom completed a $130 million capital raising which it plans to further invest in growth initiatives.

Time to buy?

In a note to clients, Goldman Sachs said that Freedom Foods was well placed to benefit from rising demand from our Asian neighbours — including China — who, like us, are showing increased interests in healthier food. The broker also highlighted a strong supply chain and investment into processing facilities.

Goldman’s values Freedom Foods at $6.15 per share — a good 15% above the current price.

With shares on a trailing PE of around 58, and a dividend yield of less than 1%, Freedom is not cheap by traditional standards. Nevertheless, value is predicated on future earnings, and it seems the expectation here is strong. According to consensus estimates from Standard & Poors, analysts expect per share earnings to come in around 26c in FY2021, more than three times the forecast for 2019.

It’s not just brokers that are liking Freedom either. Ranked #53 on Strawman, shares currently sit well below the community’s estimate of fair value. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223