A third straight week of gains has helped lift the market — as measured by the S&P All Ordinaries index — to a tickle below its all time record high. We’re now less than 2% away from passing the high water market that the index set in November 2007.

It’s rather sobering that it’s taken 12 long years to recover from the GFC meltdown. No wonder most people consider the share market risky — who wants to invest in something that could, at any time, wipe out half your wealth and then take over a decade to recover!?

Of course, such a view assumes you put all your money into the market at the very peak, and never contribute a cent more. One of the few free-kicks you get with investing is the ability to drip-feed your capital into the market over time; a process called dollar cost averaging.

More importantly, though, by focusing only on the so-called price index we ignore a major driver of shareholder returns: dividends.

The 3 or 4% yield you may expect each year from your average dividend stock doesn’t seem like much, but over time that makes all the difference. Indeed, in the long run, dividends tend to account for close to half the total market return.

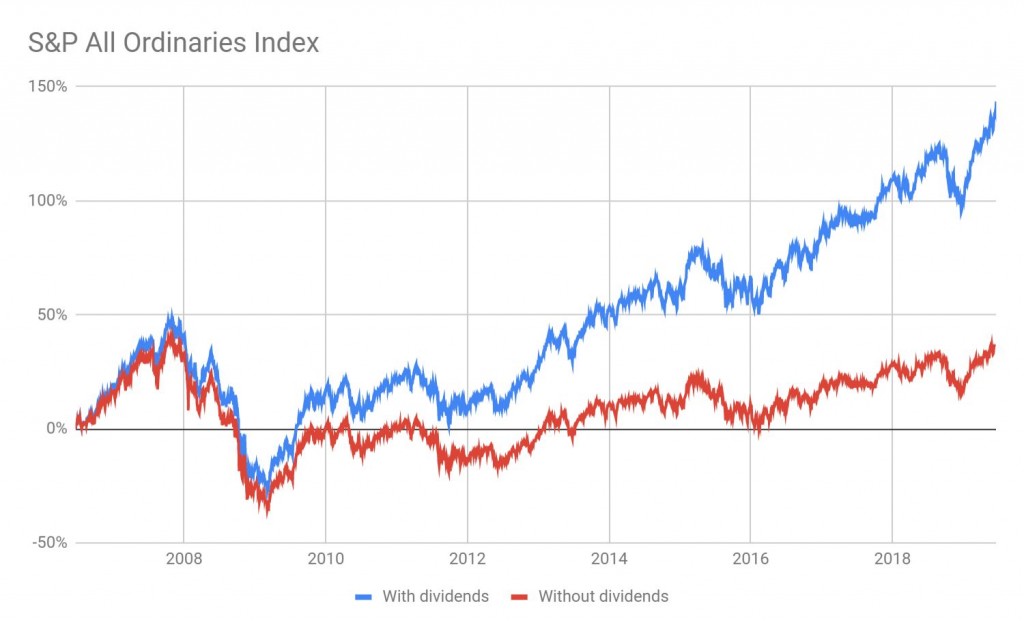

Look what happens when you reinvest dividends back into the market, which is what the S&P All Ordinaries Accumulation index does:

When we factor in dividends, as we rightly should, we can that the market was at fresh record highs back in 2014. And since then, we’ve seen the market climb a further 50% or so.

That’s the power of compounding.

Sooner or later, we’ll see the more popular price index break new highs, and there’ll be plenty of coverage by the financial press. Only now you know they’re missing half the story and are around 5 years too late…

Invest regularly, invest for the long-term and remember the number one rule of compounding: don’t interrupt it!

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223