Accounting may not be the most enthralling of topics, but some basic literacy here is vital if you fancy yourself a stock picker. As Buffett put it:

“You have to understand accounting and you have to understand the nuances of accounting. It’s the language of business and it’s an imperfect language, but unless you are willing to put in the effort to learn accounting – how to read and interpret financial statements – you really shouldn’t select stocks yourself.”

It’s a BIG subject matter, and it’s easy to get lost in the weeds. So it is important to start with a sense of the overall architecture; what are the main financial statements and how do they all fit together?

Indeed, we first need to ask what, exactly, are we hoping to discover by examining a company’s accounts?

We’d suggest that the goal is simply to determine whether or not the business is in good shape (that is, is capable of meeting its financial obligations) AND has the capacity to grow the net assets and/or free cash flows over time, and to a degree that is superior to the ‘risk-free’ rate of return.

If either of these things are not true, it is probably not a business you’d want to own. (Yes, there is a distinction between a good business and a good investment, it’s just that a bad business is almost always a bad investment, given enough time)

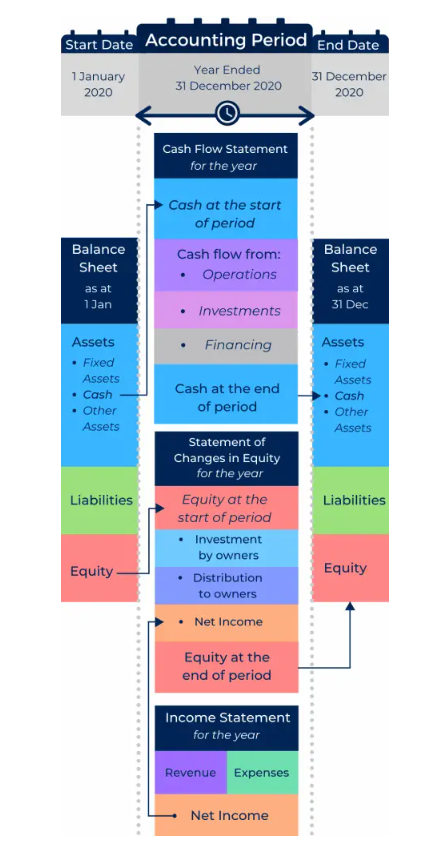

This is why the Statement of Financial Position (aka the balance sheet) is so important, and central to any financial analysis. Indeed, the other statements really only exist to bridge one balance sheet to the next.

Unlike the others, the statement of financial position gives a picture of the business at a specific point in time (such as the end of the financial year). The balance sheet lists all the assets (what it owns), liabilities (what it owes) and equity (the difference between the two, or net assets). Importantly, it does so in adherence to the all important accounting equation which is the foundation of double-entry accounting:

Assets = Liabilities + Equity

Next we have the Statement of Financial Performance, or the income statement. This tells you how profitable a business is and will give you insight into how efficiently a company’s assets are being employed.

The Statement of Changes in Equity shows how a company’s net assets have changed over the period, in relation to things like share capital, dividends and reserves. Ideally, unless the company is embarking on an attractive and well-conceived expansion, you want to see little to no fresh share capital being issued, with any distributions being covered by the company’s net income.

Last, but by no means least, is the Statement of Cash Flows. This is perhaps the most ‘honest’ statement in the sense that it’s just a record of what cash moved in and out of a business over a given period — there’s little room for creative accounting. And it does so across three distinct areas: operations, financing and investing.

You can have all the statutory profit in the world, but unless the business is capable of generating cold, hard cash, it doesn’t really account for much. Needless to say, it’s always nice to see lots of cash being generated through business operations, but it’s also important this doesn’t come as a result of maintaining and/or enhancing the capital base of the business. This is why ‘free cash flow’ is so important — the amount of cash generated AFTER accounting for ongoing investment.

Anyway, the cool thing about the full set of financial statements is how they all fit together:

None of the financial statements exist in isolation. Each will tell you something specific, but it’s the holistic view that will provide the most valuable insight.

At the end of the day, a company should be viewed as an economic machine. The best ones deliver ever growing cash flows, supported by an expanding and increasingly efficient capital base. Or, at least, show the potential to be able to do so. And their success, or otherwise, will be revealed in the pages of financial statements.

It’s worth keeping in mind, however, that all financial statements are backwards looking. They tell you what has happened, not what will happen. And when you’re dealing with growth companies the cash flow and income statements can look pretty awful — even when the company’s prospects continue to improve. That’s when a more subjective analysis is important — what, exactly, are the “assets” the company has invested in and how effectively will they underpin future cash flows?

We’ve only scratched the surface so far, but hopefully it’s helped connect a few dots. And with a sensible overview you should be better equipped to pursue the many nuances and subtleties that the dark art of accounting has to offer.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211