AI enabler Appen (ASX:APX) has seen shares drop over 3% lower in early trade after the group’s half-year results failed to excite the market. Not that the numbers were weak — far from it!

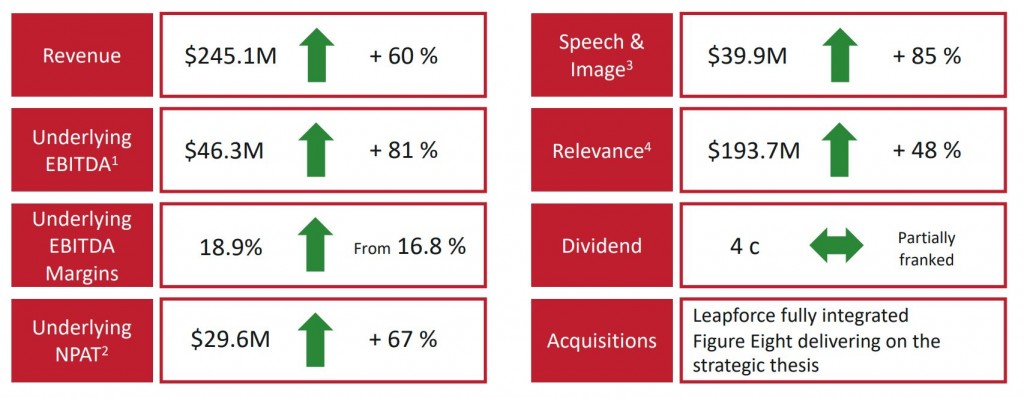

Revenue for the 6-months to June 30, 2019 was 60% higher than the previous corresponding period, coming in at $245.1 million. Underlying net profit — which excludes one-off costs associated with the Leapforce and Figure Eight acquisitions — rose 67% to $29.6 million.

An 85% jump in sales for the group’s speech & image segment (excluding the contribution from Figure Eight) helped drive the result, as did a solid improvement in Appen’s operating margins which grew from 16.8% to 18.9%. Importantly, a good part of the gain came from an increased spend from existing customers, which highlights the stickiness and value of the company’s service offering.

Management said that US based Figure Eight, which was acquired in April, is performing to plan with expected synergies and profitability pathway on track. Although the first half loss for this business came in less than expected, second quarter renewals were less than originally forecast and some larger deals had been delayed. As such the FY19 annual recurring revenue (ARR) target is now expected to come in between $30-$35 million, or around 26% below previous expectations.

This may be way we’ve seen an adverse reaction on the ASX this morning.

Nevertheless, Appen remains optimistic towards the future and sees big potential in China which has a fast growing AI industry. The company maintained full year guidance for between $85-90 million, but said it expected to report at the top end of this guidance. Given this is premised on a USD/AUD exchange rate of 74c, and the current rate is materially below this, we may in fact see a stronger result.

As for the balance sheet, Appen remains in rude good health, with the recent capital raise funding acquisitions and solid operating cash flows pushing the cash balance up to $70.8 million.

Annualising these first half numbers, Appen is on a PE of approximately 49 or a Price to sales ratio of 5.9. Given the rate of growth, that’s not actually too bad — especially in the context of current technology valuations.

Ranked #7 on Strawman, shares presently sit slightly below the community’s consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223