Med-tech superstar Promedicus (ASX:PME) has been one of the real market standouts in recent years. But with shares up more than 200% in the past year alone, and the company now trading at more than 50 times sales (!), it’s not easy to justify at current prices.

But for those looking for similar exposure, there may just be an alternative…

A baby Promedicus

Like Promedicus, Mach7 Technologies (ASX:M7T) develops enterprise imagine software for medical organisations. As the frequency and size of medical imaging continues to grow, and as medical institutions transition away from out-dated legacy systems, it’s providing a significant opportunity for those that are able to deliver efficiency gains, cost savings and improved workflows.

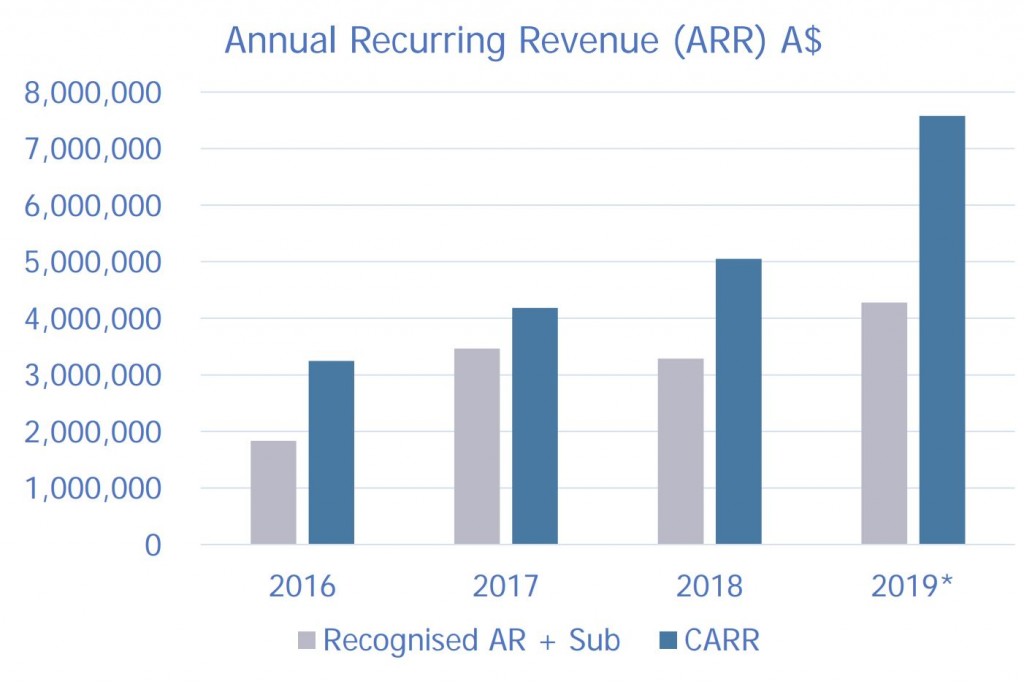

Like Promedicus, Mach7 is growing strongly. Annual recurring revenue has more than doubled in the past few years, and is on track to see a 30% growth in the current financial year.

Unlike, Promedicus, Mach7 technologies is still unprofitable — although that seems likely to change. In the most recent reported quarter, cash receipts saw a 227% gain, giving the business $650,000 of free cash flow for the period. Management reckon they’re on track to be cash-flow positive on a 12-month basis by February next year.

Higher risk, higher reward?

Another stark difference between the two players is that Mark7 is ostensibly cheaper, at least based on current sales multiples.

While Promedicus sits at 52 times forward sales, Mach7 Technologies is on roughly 10 times. Put another way, Promedicus generates 6 times as much recurring revenue as Mach7, but is valued 32 times more expensive.

And that’s not unreasonable. Promedicus is in rude financial health; gushing profits, paying a dividend and with loads of cash in the bank. It also has more prominent clients to point to as reference sites and (arguably) provides a better service proposition.

Mach7 still has a lot of work to do before it hits profitability, but if it can sustain sales its momentum and effectively manage costs, it’ll likely attract a better market premium in the years ahead.

Visit the Mach7 Technologies Strawman company report to see the consensus valuation and member research.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223