Medical imaging software provider Volpara (ASX:VHT) has delivered another set of strong results today, reporting financial results for the six months ending 30 September, 2019.

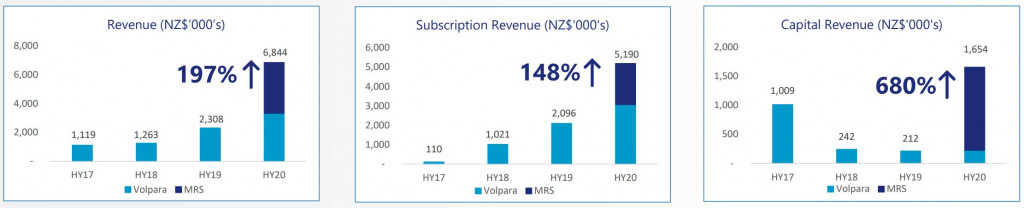

Total revenue surged 197% to NZ$6.8 million, with subscription revenue up 148% to NZ$5.2 million. At the end of the period, Volpara’s level of annual recurring revenue was NZ$15.7 million, up from just NZ$4.8 million at the same time last year.

Of course, a big part of this growth is attributable to the recent acquisition of MRS, which accounted for roughly half of the reported revenue:

The NZ$23 million acquisition of MRS in June added more costs, and Volpara also increased its investment in capacity and capability. Combined, this saw a 92% lift in operating expenses and an increased after tax loss which widened from NZ$5.1 million to NZ$8 million in the first half.

The move did however substantially strengthen the group’s US market share, which jumped from 5.6% to 25.8%. The move is also expected to help Volpara tap into other sectors, such as lung cancer screening. Importantly, the company is hoping to expand market share to over 27% by the end of the financial year.

The blow-out in costs is, however, well supported following a capital raising earlier in the year. After funding the purchase of MRS, Volpara still has NZ$40.2 million of cash and equivalents on hand — enough to sustain operations for at least another 5 years at the current burn-rate.

The market opportunity for Volpara is certainly vast, and the company looks to have great traction. The company is also seeing increasing revenue per user, negligible customer churn and improved gross margins — all the things you like to see for a SaaS business.

But the market has taken notice, and there’s a good deal of optimism priced into Volpara’s shares. Relative to the expected revenue for the full year, shares are trading on roughly 25 times sales. Indeed, at present, shares remain a little above the community consensus on Strawman.

Nevertheless, the company has long been a community favourite, and Volpara currently ranks #12 on Strawman. Click below to discover more, and be sure to add your own perspective.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

Strawman Pty Ltd does not endorse an investment in any securities mentioned or guarantee the performance of, or returns on any investment. This information is general in nature only and has not taken your personal circumstances into account. We recommend consulting a licensed professional before making any investment decisions. For more information please see our Terms of use.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211