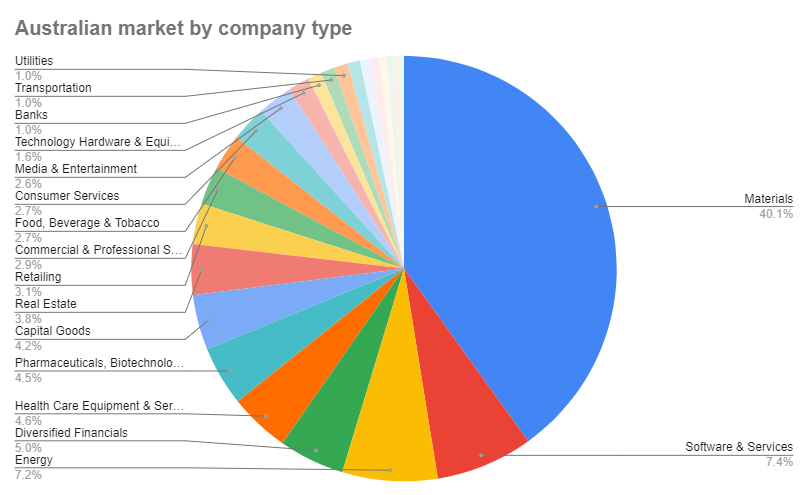

Consisting of over 2100 individual companies, the Australian share market has a few interesting features.

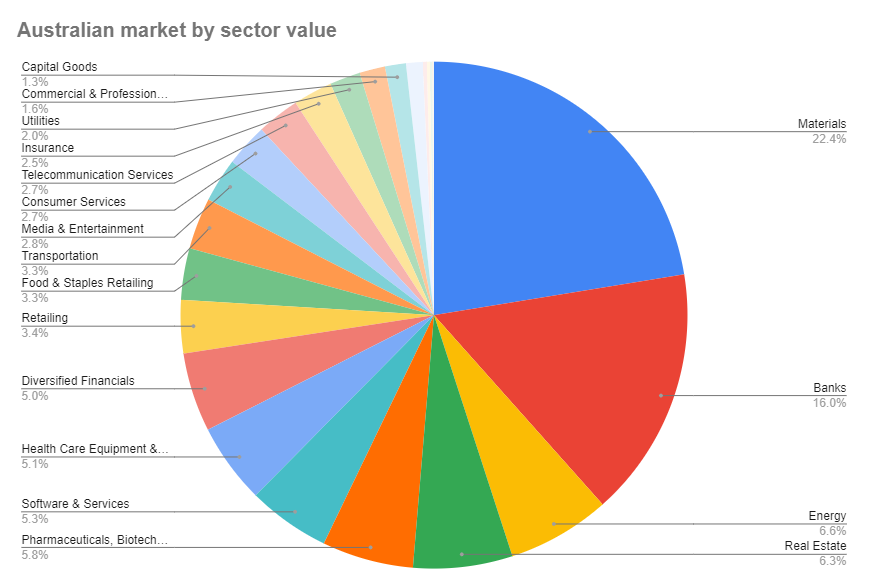

One of the first things a curious investor might notice is the significance of the major banks. There are only 21 businesses on the ASX classified (loosely) as banks, but the ‘Big 4’ — CBA, NAB, ANZ and Westpac — are the clear standouts. Combined, they account for 94% of the total market value of the listed banking space.

In total, we’re talking over $400 billion of market value — or roughly 15% of the total value of the entire share market — represented by just four companies.

Then we have our mining giants. BHP Billiton, Rio Tinto and Fortescue Metals together represent $280 billion of current market value, or more than 10% of the total value of the entire sharemarket.

Of course, when people talk of ‘the market’, they’re usually referring to the All Ordinaries index, which represents the top 500 or so listed companies. Of this, the major banks and miners alone account for almost one third of the total value.

The Australian market is very top heavy; 7 individual companies represent about a quarter of the entire market value of the ASX. The top 20 stocks account for about half the total dollar value.

Another thing that stands out about the ASX is that 45% of all listed companies belong to either the materials or energy sectors. That’s almost 1,000 individual companies.

Throw a dart at the ASX, and the odds are good you’ll hit a stock that extracts stuff from the ground.

Things move around a bit when you instead carve things up according to the associated market value of these companies. Not surprising, really, when you remember the massive size of the banks, and the fact that many of materials and energy stocks are relatively tiny.

Given the core business of our largest companies, it really is true to say that the Australian economy is largely about ‘houses & holes’.

Perhaps the more interesting question, however, is what sectors show the best performance.

Peter Thornhill, a financial consultant, has long argued that it’s the ‘industrials’ that create most of the value for shareholders. (Here, he’s referring to any company that isn’t involved in raw material extraction.)

The contrast is pretty stark. Resource companies, on average, aren’t typically kind to investors.

It makes intuitive sense: an iPhone is far more valuable than the sum of its raw component materials. Real value creation occurs when you put stuff together in interesting ways.

That being said, the irony is that, whenever you ask what has been the best performing company over the last 3, 5 or 10 years — the answer is almost always a resources related stock.

Indeed, over the past five years, nine out of the top ten performing stocks have been resource companies.

At the top of the pops is Liontown Resources (ASX:LTR).

Back in 2017, you could have picked up shares at 0.7c each. Had you invested $10,000 back then, you’d today have over $2.4 million. That’s an average annual compound return of 197% per annum!

Of course, five years ago Liontown was a highly speculative explorer with little more than some hopes and dreams. Things turned out well — very well — for shareholders, but it’s worth remembering that it is the exception to the rule.

So what’s the take home message here?

Well, it’s just interesting to understand the character of the market. But, perhaps, there are a few insights we can extract.

First, you can afford to be fussy. You really don’t need more than, say, 20 stocks to be well diversified, so you should be saying a hard ‘no’ to 99% of the companies you come across.

Why settle for mediocrity?

Next, if you want incredible returns, you need to take incredible risks. Triple digit compound annual returns are your reward for getting it right. Bone crushing losses await if you get it wrong — and the odds are against you. There’s nothing wrong with that, just understand the game you’re playing.

Also, what ‘the market’ does will probably have little relevance for a selective stock picker that ventures away from the big banks and miners. Indeed, the more you want to outperform the market, the less your portfolio should look like the benchmark indices. Of course, that can be for better or worse, but if you’re going to ‘hug the index’ you’re never going to cover yourself in glory.

(That being said, the average tends to be pretty decent, so that’s not a terrible thing. Again, it just pays to understand what you should expect.)

Finally, somewhere out there, amongst those thousands of listed companies, there exists today a good number of stocks that offer truly life changing potential. And these will almost certainly be largely unnoticed and underappreciated small cap companies.

Finding them wont be easy. Holding on for the duration will be even harder.

But, man, you’ve got to love the thrill of the hunt!

© 2022 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211