The last few decades have seen a sharp and prominent rise of software companies whose business models revolve around largely upfront development and marketing costs followed by ongoing recurring revenues. They have been dubbed as software as a service (SaaS) companies and there is no doubt that this has been a buzzword in recent times, justifiable or not.

Often the method of valuation for these companies is mysterious, especially given a large proportion of them are loss making on an operational basis. So as private investors, is it safe to use a “standard” annual recurring revenue (ARR) multiple based on relative valuation of comparable companies, and do the general rules of valuation support the higher multiples being used for these companies?

Depending on your source or selection of data, companies which are classified under this relatively broad umbrella are being ascribed with handsome valuation multiples. Where a reasonable revenue multiple for a traditional business might be 2 to 6x current annual revenues, ARR is often placed on a multiple in the range of 5 to 15x. So, from a valuation perspective, what really is the difference between these types of revenues?

Ultimately, a standard valuation based on future cashflows, usually called a discounted cashflow analysis (DCF), assumes that current revenues and earnings will continue in the future at a certain estimated growth rate. That is, in some respect, current revenues are expected to recur into the future. So why are recurring revenues of SaaS companies treated differently?

The most obvious discrepancy is that recurring revenues are defined to be the revenues of existing customers, which are independent of new deals being signed in the future. Structurally, recurring revenues of SaaS companies stick around dependent on annual churn and characteristically are of high gross margin as software is scalable on a marginal basis. That is, after the product has been developed and marketing and sales has been spent to acquire a customer, the cost to continue to service them is typically small.

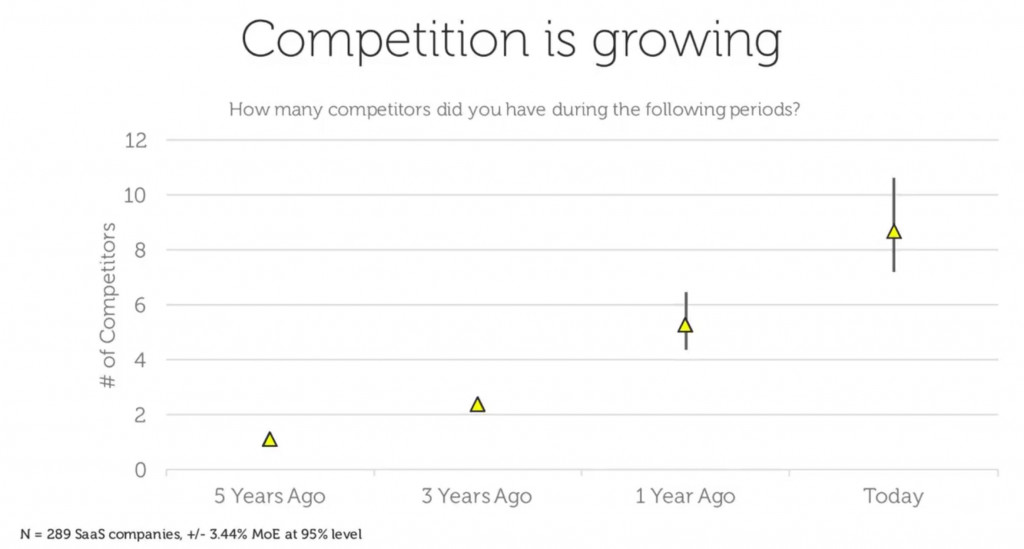

However, it is important to note other important structural differences to traditional revenues. The scalability and predictability of the SaaS model means that in recent years, competition has continued to increase and so companies who want to maintain low churn, high customer satisfaction and continue with strong new customer acquisition must continue to invest heavily in research and development. So, does the higher revenue multiple come from the fact that the revenues are of higher profit margin?

Ultimately, yes. The fact that median and average revenue multiples is higher than that of the overall market is justified by the fact that overall, the margin of those revenues is higher. Those that are familiar with business valuation will be aware that one of the main drivers of revenue multiples is profit margin, and thus in this case, it makes sense that SaaS businesses should be valued on a higher multiple. There is also the clear benefit that the revenues are much more likely to be received in the future than with traditional revenues.

Investors that are especially conscious of intrinsic value (and you should be) understand that there is no magic with SaaS valuation. Modelled correctly, recurring revenue can be valued using a DCF model which uses churn to predict future cashflows based on current ARR base. It is very important to include years of negative cashflow for young companies as it is with any standard DCF as ultimately this is the trade-off for all SaaS companies – high upfront cost of acquisition in the hope of multiples higher customer lifetime value.

Visit Strawman.com to see how our members are valuing some of the most popular ASX SaaS companies

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211