Do you like highly illiquid assets that involve significant trade frictions and costs? Do you like dealing with an army of mostly useless, self-serving middlemen? Do you like assets that require extreme leverage and offer pitiful yields?

Welcome to Australian property.

I’m currently in the process of trying to secure a house, and I need to get a few things off my chest. (Sorry.)

First off, this isn’t about getting on the “property ladder”. Man, I hate that hackneyed trope.

No, I’m not looking to buy–flip–repeat my way to generational wealth, or whatever. Call me old fashioned, but I just want somewhere for me and the family to live with some degree of peace and security. If the house more or less preserves its value in real terms over the coming decades, that’s good enough for me.

I would, if possible, like to do that without taking on an ungodly loan. A lifetime of debt servitude, where the slightest hiccup risks financial ruin, is not what I’m after.

Sydney was, and remains, totally undoable for us. That ship has sailed!

But I did some numbers and felt we could put something together that would allow us to get a place that was more affordable, in an area we liked.

The first challenge was in securing finance. Gone are the days where you might visit with your local bank manager — it’s the mortgage brokers that guard the all-important credit taps. And you’ll need to navigate all manner of arcane online portals that repeatedly crash, have laughable security measures and only accept a narrow range of file formats.

I naively thought your income history/capacity, size of deposit, and the collateral provided by the property itself would be all any reasonable lender would want to know. And maybe that’s broadly true, at least notionally, but for us the process has been unyielding and bizarre. Maybe it’s better for a long-serving salaried employee, but we had to jump through all kinds of ridiculous hoops.

I mean, I get it. Being self-employed and having paid myself in lump sums, usually poorly timed around the end of financial years, my income looked somewhat shady. And most of my money was in illiquid small caps. Who’d lend money to a degenerate stock market speculator? (Just quietly, holding some bitcoin does NOT do you any favours here…)

Anyway, even though a decade of reliable rent payments are not taken into consideration (I mean, why not?), the broker found a lender that was happy to extend what we needed. Pre-approval was granted shortly after the broker submitted our application.

I guess they reckon the broker is more or less on the money. There’s no way they could review several years of financial records so quickly. Or maybe they didn’t care? It definitely gave me some ‘Big Short’ vibes at the time.

Whatever. All that mattered was that our finance was sorted.

Enter the next boss; the dreaded real estate agent. This particular gate keeper was, as always, a wily foe. Full of guile and cunning. For the sake of brevity I’ll spare the details. The bottom line is, by some miracle, we endured the usual barrage of half-truths, misdirection and obfuscation to finally make a successful bid on a house we found.

Contract signed and ready to go! Or so we thought…

The mortgage broker told us that, sadly, the bank was no longer sure it wanted to lend us the money. As it turns out, pre-approvals are not worth sh%t.

Not that our personal circumstances changed, mind you, but apparently “market conditions had evolved” and they needed to take a closer look at things.

With a 5 day cooling-off period and a not-insignificant holding deposit paid, we had to get moving.

A quick aside. Part of the bank’s process was to send out a valuer. Now, I don’t want to get into the theory of free market economics, which might suggest the value is whatever we paid for it, but it turns out the subjective opinion of one random dude is more important. There is of course a modest fee for their expert services.*sigh*

Ok, so the guy does his thing and comes back with a valuation that is — you guessed it — exactly the same as our offer price!

Anyway, that’s all beside the point. The bigger issue was that the bank now couldn’t get past the lump-sum/poorly-timed nature of my salary payments; even though that was made clear at the time of pre-approval. A bit of basic financial literacy and common sense may have helped but, for some insane reason, we’re dealing with an uncaring, rigid, box-ticking nightmare.

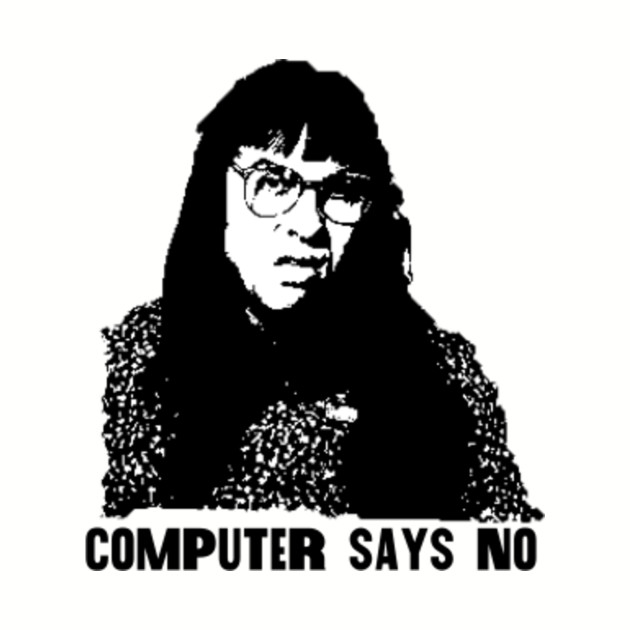

“Computer says no.”

Loan application, REJECTED.

I guess that’s their pejorative but, for the love of mercy, don’t give us pre-approval in the first place!?

(Also, maddeningly, why send out a valuer if you weren’t otherwise going to approve the loan? Did you think there was a chance the house was worth significantly more than what we bid?)

The mortgage broker reckons they will have better luck with another lender. One that, for some reason, places an emphasis on different financial aspects. So hopefully we’ll get some luck there, but it sure is a soul-destroying process.

What frustrates us most is not that they shouldn’t try and build up a clear picture of our financials and lending capacity, of course they should. Rather, that they can only evaluate you against extremely rigid and narrow conditions.

And, believe it or not, I’m told this new lender would also like to do their own valuation. It’s surreal.

I mean, consider the middlemen to a typical property:

- A mortgage broker

- Auctioneer

- A banks

- Two solicitors/conveyancers

- Pest inspector

- Building inspector

- Valuer(s)

- Real estate agent

There’s also something, apparently, called ‘Title Insurance’ which covers you for things like competing title claims and non-compliant renovations. If you thought that’s the kind of due diligence the solicitor/conveyancer should be responsible for, well, I wholeheartedly agree! But I guess there’s always more room for another snout in the trough, eh?

It’s a funny old world. We have a banking system that’s happy to provide ever more credit to some knucklehead with six negatively geared properties, but not someone with a track record of full employment, zero debt, and a large deposit.

Look, I’m sure it’ll work out. The wheels, as they say, are in motion. I just wanted to shake my fist at the sky for a bit. But man has it been interesting to see the property finance machine up close.

It’s also given me a new found appreciation for share market transactions. It’s a beautiful thing to have market depth, instantly transaction matching, 2-day settlement and a tiny transaction fees.

(p.s. Given I’m looking to finally “get on the property ladder”, now may be a great time to somehow go short the property market. Just wait until we get this damned thing over the line and you could be the Michael Burry of Australia!)

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211