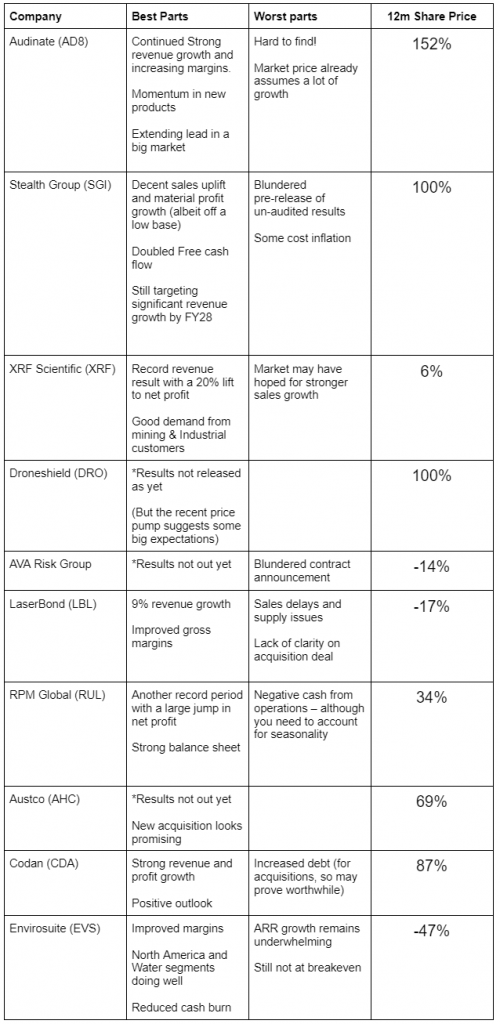

The market always offers up something of a mixed bag each results season but, on balance, at least among the most popular stocks on Strawman, what we’ve seen so far has been rather encouraging.

Not so much in terms of the immediate market reaction — though we’ve certainly seen some big moves — but in terms of what these numbers say about the broader strength and opportunity of the underlying businesses.

Here’s some highlights from the top-10 ranked stocks on Strawman, in regard to recent result announcements.

They are, of course, subjective and there’s a lot of important context missing, but it does help explain why some of these companies are so popular on Strawman.

The recent price appreciation for many of these stocks is certainly impressive — about 47% on average across the top 10 over the last year — but it’s worth putting that in context. Many of these same stocks had been beaten down during 2022, or stuck in a go-nowhere range.

But the market can’t ignore real progress forever, and the investors that were able to look through the pessimism of the time have had their convictions and patience well rewarded.

As ever, it’s only now we’re seeing some good price rises that the majority of punters are showing any interest. Not to suggest it’s ever ‘too late’; their are always opportunities to be found. But you do often see the biggest gains in the early parts of a recovery as pessimism gives way to hope.

Let’s hope we see some more recognition of the quiet achievers on the ASX.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211