Disinfection specialist Nanosonics (ASX:NAN) has continued its momentum from the first half, delivering a record full year result and calling for more of the same in the current year.

Total revenue climbed a full 39% higher to $84.3 million, recovering from FY18’s dip as the installed base of the company’s sole product grew across all regions. Average top-line growth over the past three years (which normalises the impact of deferred sales from the release of the Trophon 2 unit) works out to approximately 25% per annum.

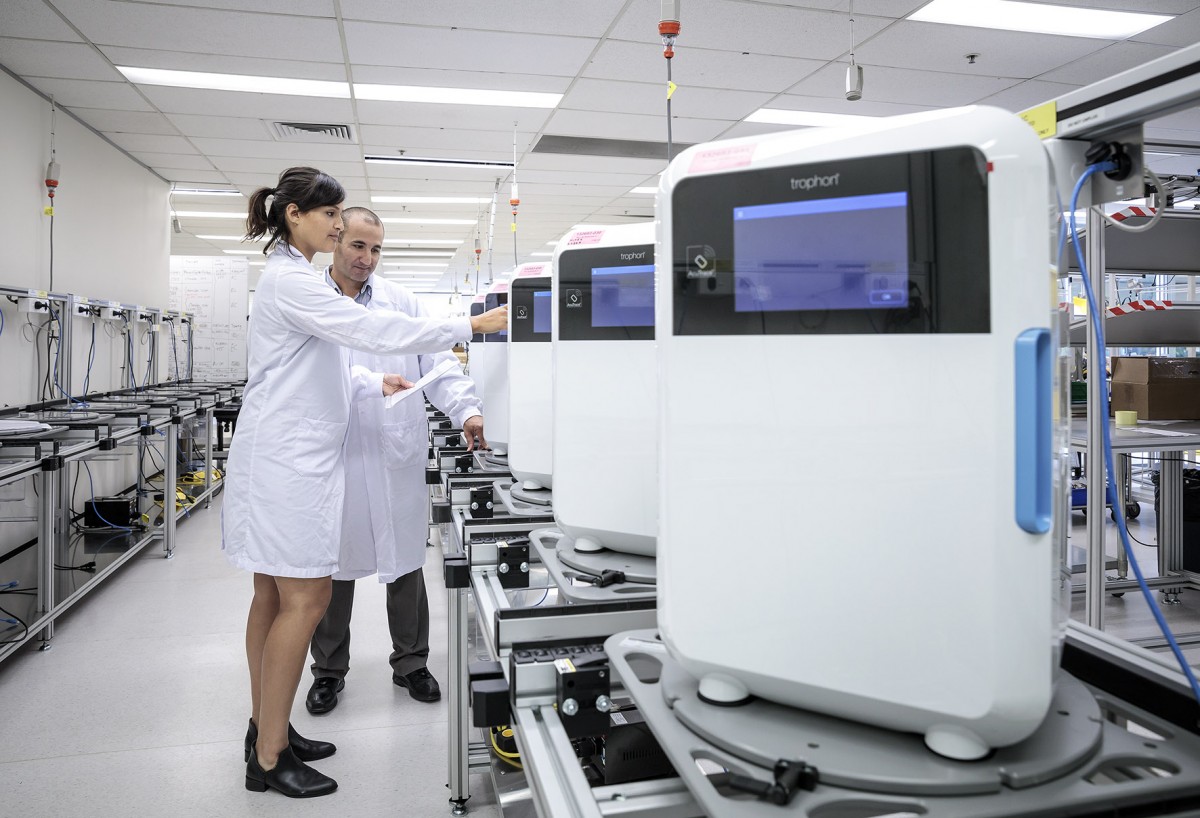

The number of trophon units in operation increased by 18% globally, with North America again the biggest contributor with the addition of almost 3,000 new units — in line with guidance provided at the first half.

The growth in units in Europe/Middle East and Asia Pacific segments was noteworthy too, though in both percentage and absolute terms it was less than the previous year’s. With a 75% penetration in Australia and New Zealand (which accounts for most of the Asia Pacific installed base) that isn’t perhaps surprising, but it is worth noting that a 6% increase in units saw a 29% increase in capital revenue, suggesting a price increase. Indeed, the same can be said of all regions (although currency movements are also a factor, more on that below).

Source: Nanosonics FY2019 Results presentation

Importantly, consumables and services revenue — which is both higher margin and recurring in nature, and now accounts for over 60% of total revenue — saw a hefty 47% improvement from the previous corresponding period.

Operating expenses grew by around 15% to just shy of $50 million, as telegraphed at the half year, due to a 27% lift in headcount and an increasing R&D spend. Nanosonics told investors that costs would increase significantly in the current year, saying it forecast $67 million in operating expenses (a 36% increase) for FY2020 as the business readied itself for its “strategic growth agenda”. That includes new products, sales & marketing and business development.

At the bottom line, excluding tax, Nanosonics registered $16.8 million in profit, or almost 20% of total revenue. That’s a 200% increase on FY18’s result. With prior year’s losses helping to reduce the tax burden, net profit came in at $13.6 million, or 4.53 cents per share.

It is however important to note the (significant) exchange rate benefit in these results. Revenue growth reduces from 39% to 29% on a constant currency basis. Investors would do well to remember that although very real, this benefit can’t be relied on in future periods, and that exchange rates tend to move in both directions. Moreover, it has nothing to do with the operational effectiveness of the underlying business.

Looking ahead, Nanosonics told the market to expect continued growth, with FY20 adoption in the major North American market to be similar to that just reported. Meanwhile, new European regions and improved fundamentals would drive growth in that region.

Importantly, the new GE Healthcare distribution agreement would see an improved consumables margin, the benefits of which would be most noticeable in the second half. On top of this, and pending regulatory approval, new product releases were also expected in the later half of the current year.

With over 30% of the current installed base due for renewal in the next two years, the replacement cycle should also help bolster capital sales.

Nanosonics estimates it has just 17% of the total addressable global market, so there’s clearly a long runway for growth. And as a profitable business with over $72 million in cash on hand, it has plenty of dry powder to prosecutive its strategy.

With shares up over 23% to a fresh record high (at time of writing), the market is clearly enamoured with today’s results. They are unquestionably strong, and the future appears bright. The question, as always, is whether shares represent value at these levels.

Although traditional value metrics are often misleading for fast growing companies with substantial global potential, it’s worth noting that Nanosonics now trades at P/E of 134. The price to sales sits at ~21.3.

As such, strong and persistent growth is already heavily accounted for by the market. To outperform from here, Nanosonics will need to exceed already lofty expectations. With currency and tax benefits likely to diminish in the years ahead, and with the business expected to carry a much higher cost base, we really do need to see something special.

For example, even if we assume 30% top line growth over the next five years, and apply a net margin of 30% (both of which represent a significant improvement on historical numbers), we’d need to see shares attract a PE of at least 30 at the end of the period to generate a 10% average annual compound return.

That’s far from impossible, but the point is Nanosonics will have to execute extremely well, and/or the market will need to maintain a buoyant multiple for investors to achieve what amounts only to the market’s long-run average return.

And, needless to say, should growth not materialise as expected, the downside could be severe.

Ranked #14 on Strawman, shares presently sit above the consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223