Shares in iSignthis (ASX:ISX) have quadrupled in value so far in 2019, as the company continues to win new customers and grow sales. After there years of trending sideways, it’s certainly a welcome turn of event for patient long-term shareholders.

For the rest of us, though, the question is whether this ship has already sailed.

What does the company do?

iSignthis is a ‘neobank’ — a bank that is 100% digital without any physical branches. iSignthis also claims to be the only neobank that offers payments, eMoney deposit taking and identity verification across multiple jurisdictions. Customers include “cross-border, regulated and high-value businesses”, or more plainly, other financial organisations that require the company’s wholesale digital banking services.

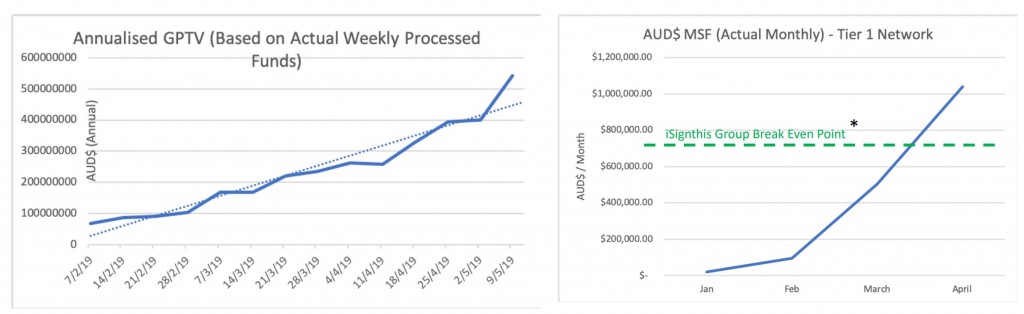

In the first quarter of the current financial year, iSignthis reported a 56% rise in revenues, with actual cash receipts up by a similar amount. Shortly after releasing these results, the company also said it had reached break-even on a weekly cash run-rate basis.

Are shares good value?

iSignthis has told the market it expects its full year operating profit (EBITDA) of approximately $10.7 million. At present, shares are trading on a multiple of over 62 times that amount.

Although that’s well above the market average, the growth rate seems to justify it. The potential market size is huge, so even if the company can only capture a small proportion of the total pie, it’ll likely be a lot larger and more profitable in the years ahead.

Of course, if growth were to stall shares would likely see a very sharp re-rating…

Ranked #40 on Strawman, iSignthis is considered modestly overvalued according to the community consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223