Kiwi accounting disruptor Xero (ASX:XRO) is undoubtedly one of the more remarkable ASX success stories. Had you invested in the company when it first listed on the Aussie bourse back in late 2012, your shares would today be worth more than 13 times as much.

Heck, even if you’d bought at the start of this year you’d have gained around 43%!

Of course, as they say, that was then and this is now. Unless you have a time machine, the real question is whether it’s now too late to buy in?

Solid foundations

Plenty of shares manage spectacular gains for a time, but unless that’s backed up by a substantial improvement in the underlying business fundamentals they never last. Fortunately, to date, Xero has managed to underpin its rise with genuine business success.

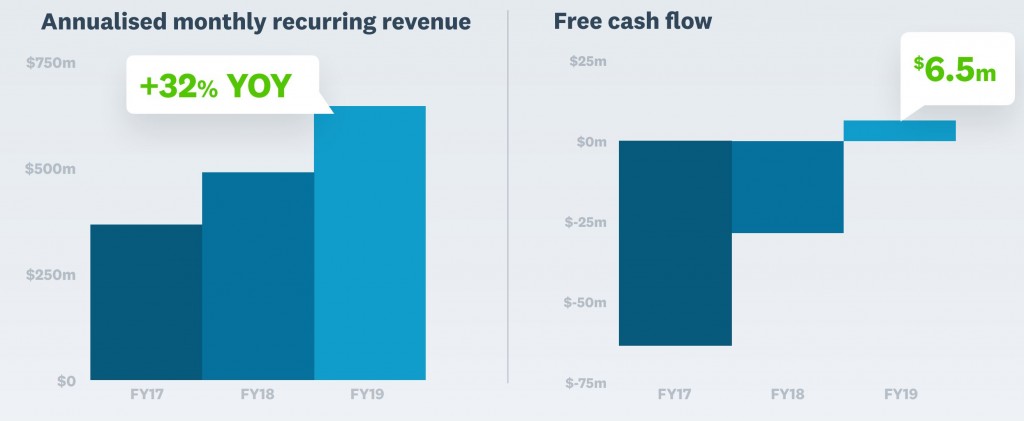

When the company joined the ASX almost seven years ago, it had only 112,000 paying customers and $19 million in annual revenue. It was also bleeding cash and posting an annual net loss of around $8 million. Fast forward to the most recent full year results, and Xero has more than 16 times as many subscribers and is bringing in over half a billion in annual revenue. What’s more, the pace of growth is still explosive, with the top line improving 36% year on year.

Better still, Xero generated positive free cash flow and a positive operating profit (EBITDA). The average revenue per customer continues to track higher, as does the gross margin which now sits at an impressive 83.6%.

Importantly, having more or less already ‘won’ in the domestic market, Xero continues to see real traction offshore. In particular the significant US and UK markets, both of which saw subscriber growth of 48% last year.

The business has no net debt and over $120 million of cash on hand.

Is Xero good value?

Shares in Xero look rather expensive in the context of traditional valuations: at present, the market is pricing the business at almost 16 times sales.

Then again, shares in Xero have almost always seemed expensive. Back when the business first came to the ASX, Xero stock was trading at approximately 20 times sales!

History now reveals the ASX entry price as a bargain, but that’s because the business has sustained >30% annual sales growth for well over a decade, gained a toe-hold in vast offshore markets and transitioned to a cash flow positive operation. The question is whether or not Xero can maintain such a solid pace of growth from a much larger base.

The world is still transitioning its book keeping and accounting tools to the cloud, and so the opportunity for Xero certainly remains vast. Of course, it’s up against some very well-heeled and savvy global competitors and winning on the international stage wont be easy. Most of the cash generated will likely be reinvested for growth, and the prospect for dividends remains distant.

The ‘bet’, so to speak, is whether or not Xero will end up as one of the dominant global players once the industry re-structure has run its course. If it does, shareholders will no doubt still do well from here — but will need the patience and fortitude to see this vision realised.

As has been the case over the past 12 years, investors should expect a volatile ride.

Ranked #16 on Strawman, shares still remain below the community’s estimate of fair value. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223