Utilities and airport software specialist Gentrack (ASX:GTK) has today told investors to expect a full year operating profit (EBITDA) of between $27 – $28 million, less than previous guidance which called for a result “marginally ahead of FY18 ($31 million)”.

Gentrack said the downgrade was due to delays in customer projects and contracts as well as bad debt risks in the UK (it’s largest geographic segment). However, the company was quick to point out the the delays experienced were primarily due to customer resourcing and that these projects were not at risk. The current political environment in the UK is also likely having an impact; something the company highlighted back in May.

To be fair, Gentrack has long stressed its dependence on contract timing, which is often out of its control. The business is also transitioning to a subscription billing (or SaaS) model, which is expected to dent near term sales growth but provide greater lifetime value and cash flow certainty.

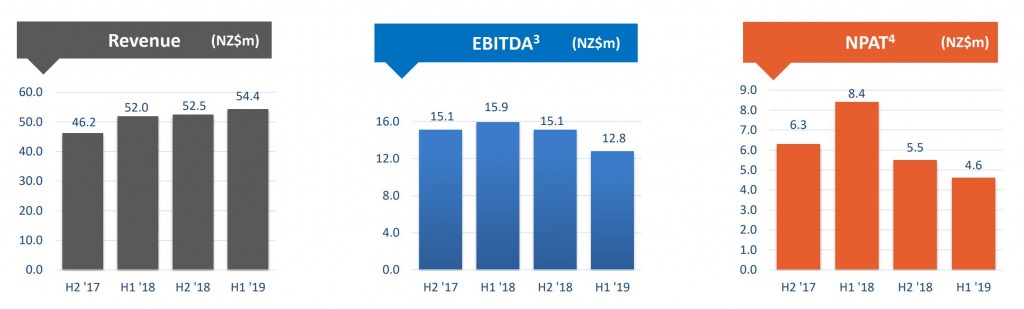

At the most recent half year, Gentrack revealed a 5% increase in revenue but a 19% drop in EBITDA; a consequence of increased employee and product investment. Nevertheless, the recurring revenue component was 26% higher and now represents at least 69% of the total.

Today’s guidance update also confirmed that the business enjoyed a “strong pipeline of opportunities”, which supported the group’s long-term growth objectives; previously defined as 15% organic EBITDA growth.

What to do?

Shares in Gentrack were, at the time of writing, down over 9% in reaction to the downgrade. That’s extended the falls from early July to around 20% and shares now sit around 28% below last year’s record high.

A (roughly) 12% decline in guidance should act to reduce investor valuations, but the degree to which they are lowered depends mainly on how much the longer-term prospects have changed. Taking management at their word, today’s news is largely a consequence of timing and speaks little to the company’s future prospects. Alternatively, the recent decline in sales and margins could suggest that Gentrack’s growth opportunities may be lower than previously thought.

Based on the midpoint of today’s guidance, Gentrack is trading on a EV/EBITDA ratio of around 17.7 times. If management is right in calling for 15% organic growth in the coming years, that’s not an unreasonable multiple — especially if the company can scale well.

However, if sales and earnings don’t pick-up, and soon, it will be increasingly difficult for investors to justify the current price.

Of course, expecting even and uninterrupted growth is probably not realistic, and jumping at every shadow is likely to be counterproductive for long-term investors. With tightly embedded and mission critical products, increasing recurring revenues, a large addressable market and positive operating cash flows, Gentrack is better placed than many of its peers.

Ranked #129 on Strawman, shares in Gentrack are considered above fair value. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223