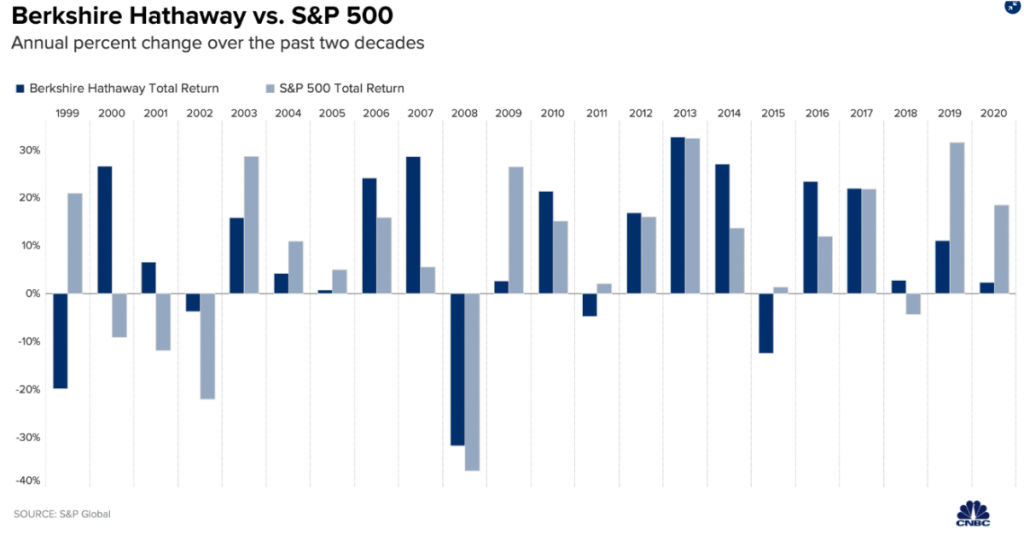

Between 2019 and 2020 Warren Buffett’s Berkshire Hathaway (NYSE:BRK) underperformed the S&P500 by 37%. It was one of the poorer periods of relative performance for the Oracle of Omaha, who was “burdened” with loads of cash and missed out on a lot of the boom in technology stocks.

As you can see, Buffett regularly lags the broader index. And sometimes for years at a time, as was the case between 2003 and 2005.

We all know the bigger picture, of course. Berkshire has done much, MUCH better than the market average over the decades, and it’s worth noting that this isn’t just due to early success. The company has a decent lead over the market for the last 3, 5 & 10 year periods too.

Indeed, since mid-2020, Berkshire’s stock has done twice as well as the market.

The point of this isn’t to gush over how awesome Uncle Warren is.

It’s just a useful reminder that if one of the world’s greatest investors is not immune to long stretches of underperformance (and even of going backwards in bull markets) it’s unrealistic to think that we can hope to avoid the same indignity.

What matters is having a sensible strategy, and being consistent in its application — even when it seems you’ve lost your mojo.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211