We love our small caps here at Strawman. And not without good reason.

The trouble is, at least according to conventional wisdom, that things are far riskier in that space. Perhaps that’s true, to some extent, if by risk you mean volatility. And it’s not an unfair characterisation if you assume, as many do, that “small cap” must mean pre-revenue, cash-burning penny stocks.

But is it really that much better at the big end of town? I’d argue that there are plenty of capital killers among even the largest stocks on the ASX.

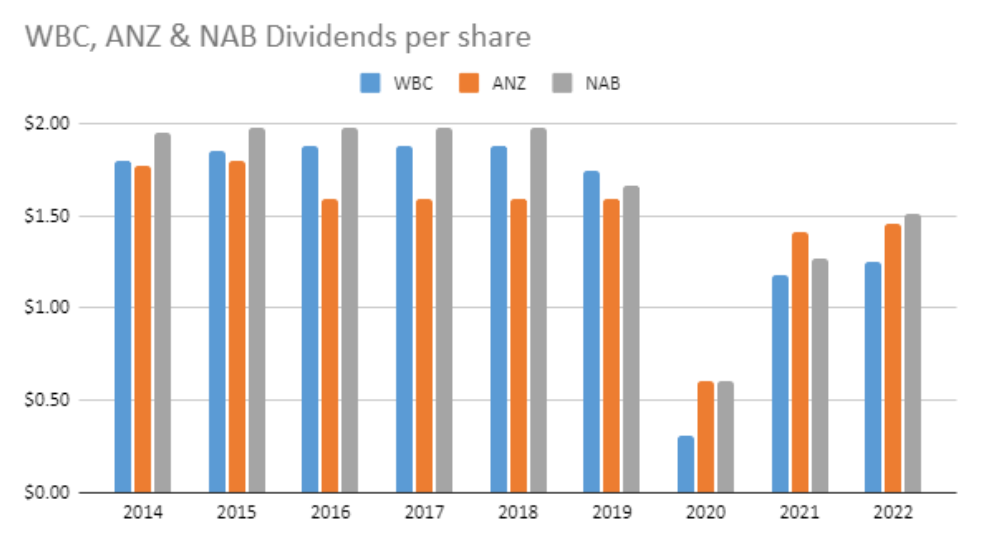

Take, for example, three of our largest banks, which seem to be regarded as sacrosanct by many investment advisors. ANZ, Westpac and National Australia Bank have not exactly been great investments over the past ten years.

OK, you need to include dividends, but these behemoths have hardly shot the lights out on that front.

I do love to put the boot into the banks, but you’ll find no shortage of mediocrity elsewhere in the ASX top 20.

Telstra certainly deserves a mention. Even with all those dividends reinvested you’d only just have kept your head above water since 2013.

(For whatever reason, people are still happy to buy Telstra today at a yield of 4.5%. Ok, let’s call that 6.4% to account for franking credits, but that’s not much of a premium when you can, right now, buy a risk-free 12-month term deposit that’s offering 5.25%. Maybe you could justify it if you expected a bit of growth, but none of the analysts following it seem to expect anything there for the foreseeable future.)

Of course, if disappointing is what you want, you can’t go past the train wreck that is AMP which has obliterated close to two thirds of shareholder capital over the last ten years — again, that’s even if you factor in dividends.

I could go on. Other ‘blue chips’ like QBE, Brambles, Origin Energy & Woodside have all delivered nothing other than disappointment over the last decade.

(Even CSL, which is arguably one of the best businesses to ever grace the ASX, has had a tough run recently.)

Sure, there have been some standouts at the top end of town since 2013, but when you combine the 20 largest stocks you get an average that is, well, pretty average.

Here’s the ASX 20, with dividends reinvested.

It isn’t a disaster, but a compound annual return of 6.9% is hardly awe inspiring. And it’s less than the wider average to boot.

At any rate, all of this isn’t to suggest you should avoid big companies. Rather, that we shouldn’t let our investment decisions by guided by broad generalisations — especially ones that rest on rather flawed assumptions.

The idea that all large caps are all boring and provide sub-par returns is just as wrong as the notion that all small caps are risky and speculative.

John Huber, who manages Saber Capital, said it well in a recent investor update:

“Saber’s watchlist has all kinds of businesses, and while there are commonalities I’m looking for (durable free cash flow, a business I can understand, rational capital allocation, good returns on capital), size is not one of them. There are highly predictable, durable companies that are small, just as there are risky, unpredictable companies that are large. All we want is value, which means paying less than something is worth with a large margin of safety.”

Interestingly, he also said:

“There are some large stocks that still offer great value in my view, but the quantity of bargains in small/mid cap stocks is the most I’ve seen in many years.”

I tend to agree.

It’s just that right now, small caps look terrible because that’s been the experience in recent times. Whereas the large cap stocks seem safer because they’ve held up relatively well over the past year or so.

As Seth Klarman once noted:

“The tendency of investors to follow the market’s momentum and bet on whatever has worked recently is accompanied by antipathy to whatever hasn’t. Underperforming market sectors and asset classes are generally experiencing fund outflows, exacerbating the downward trend. Historically, out-of-favour investments have typically performed best in the periods immediately following their underperformance, while those that have done well almost always follow their success by lagging badly.”

Food for thought.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211