1.5 years ago, I detailed some of my main gripes with Credit Clear in the following forum post: https://strawman.com/forums/topic/6847

The TL;DR: Credit Clear tends to oversell the idea that they’re an AI and machine learning software company when, in reality, they’re more of a collections services company that uses software. While my opinion on that hasn’t changed much, I now find the business more interesting and have added it to both my personal and Strawman portfolios.

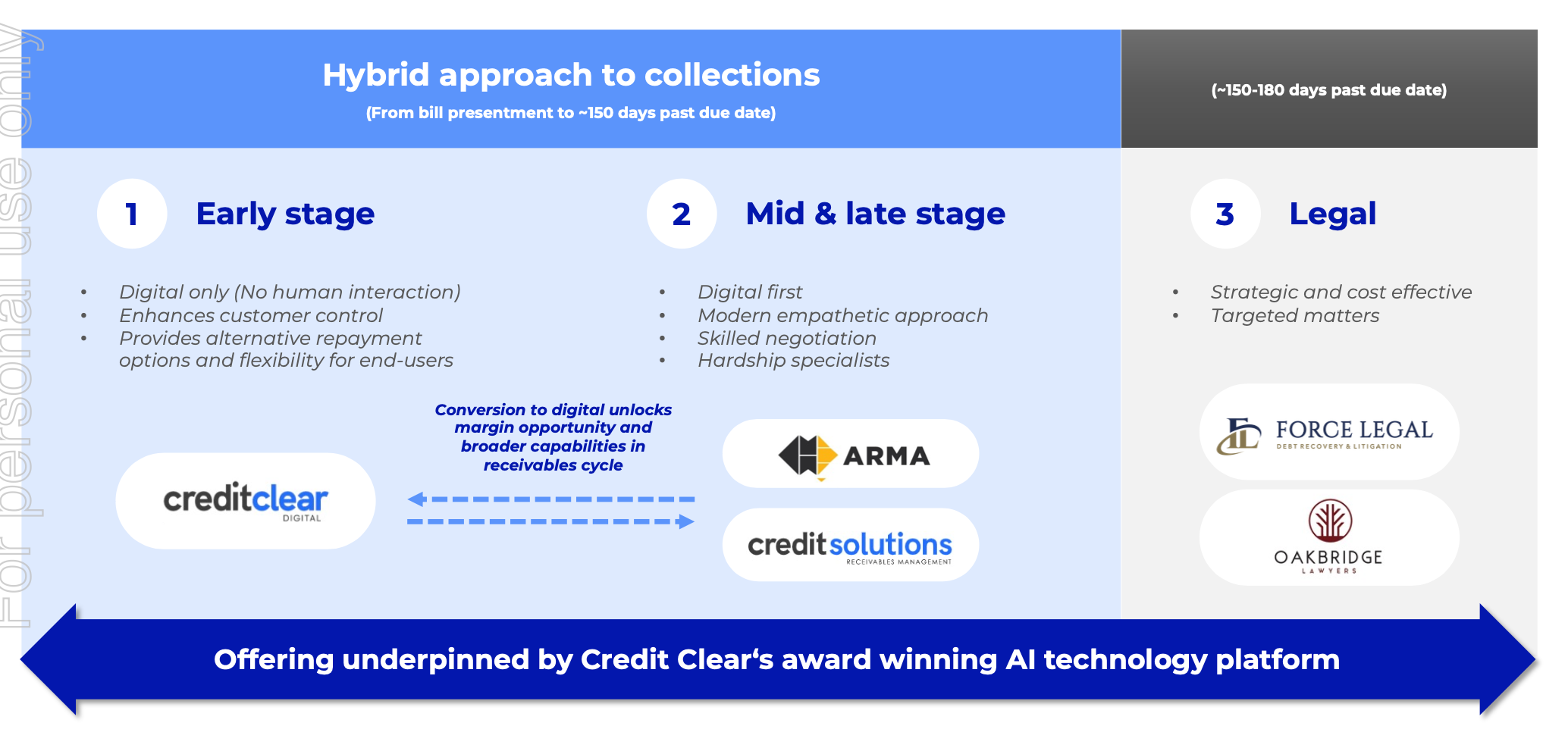

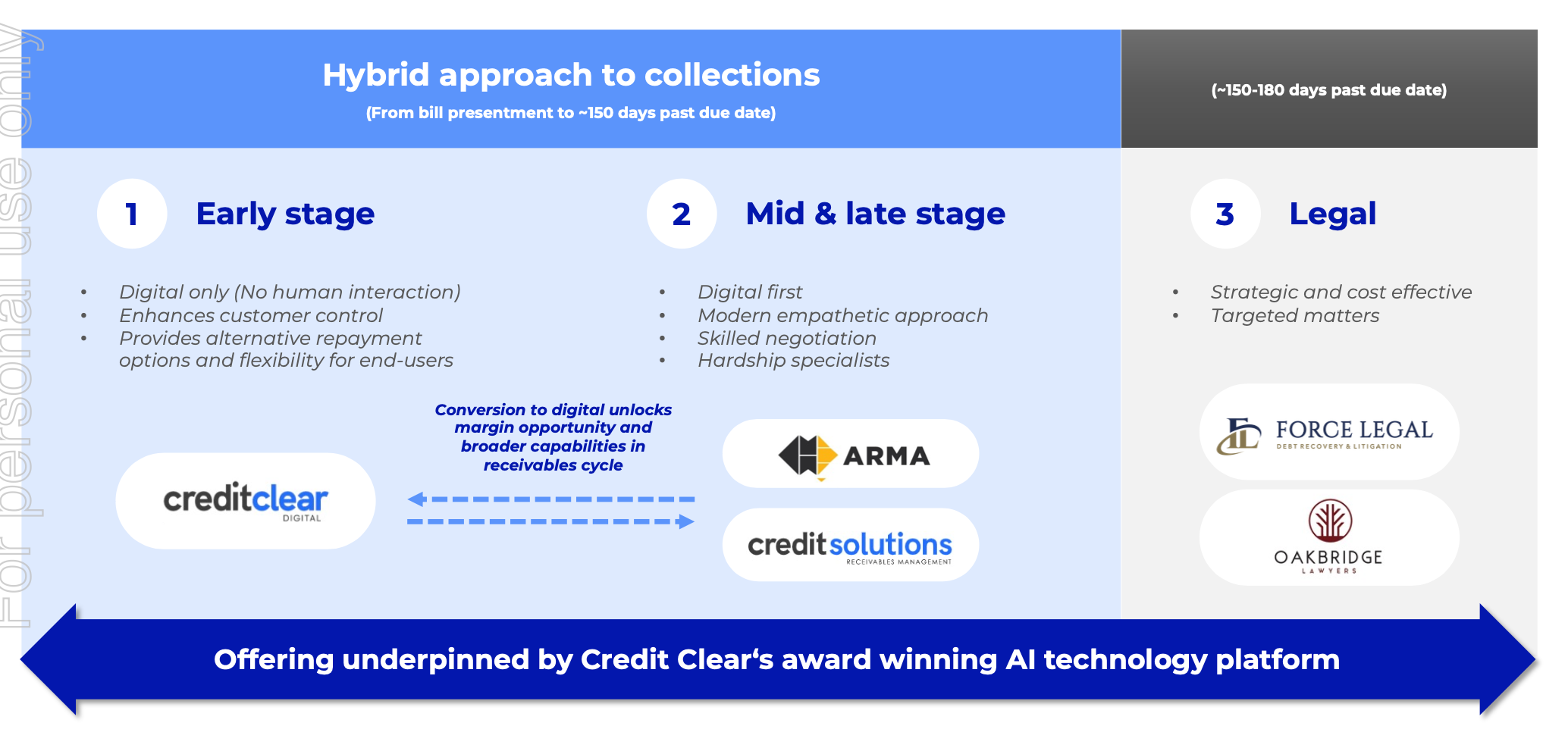

As a bit of background, Credit Clear is a collections services company. They help organizations recover overdue bills and loans, from the time a bill is issued up to around 180 days past due.

Many organisations require these types of services, as managing overdue payments internally can be a real headache. That’s why Credit Clear, along with many competitors, exists. Collection services companies collect overdue debts on the behalf of banks, credit unions, lenders, utilities, local, various levels of government, B2B companies, and essentially any business facing late payments.

Debts more 180 days overdue are generally considered highly impaired, and organisations may consider selling these to debt purchasing companies at cents on the dollar. The two largest debt purchasing companies in Australia - both listed on the ASX - are Credit Corp (CCP.AX) and Pioneer Credit (PNC.AX).

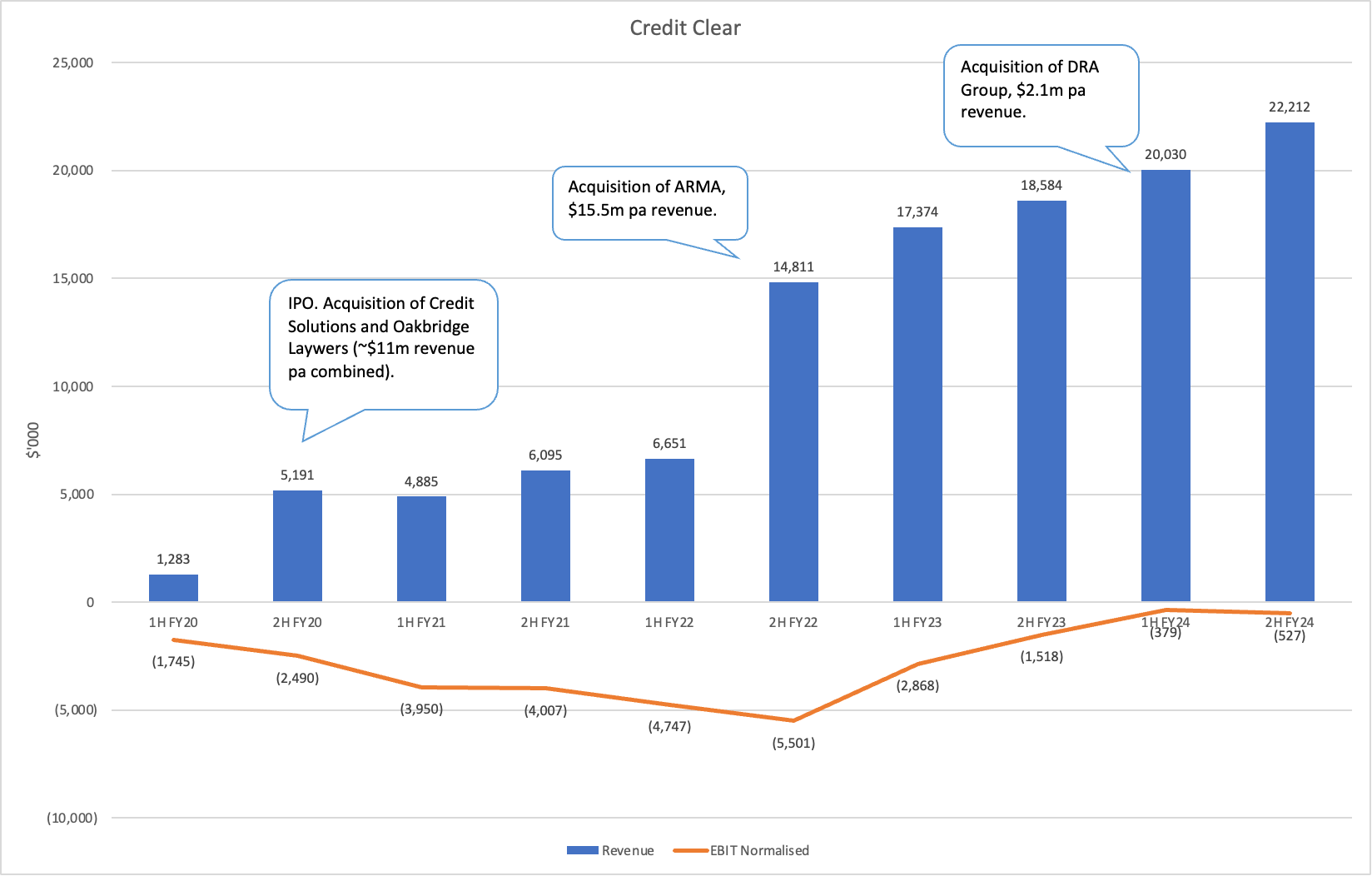

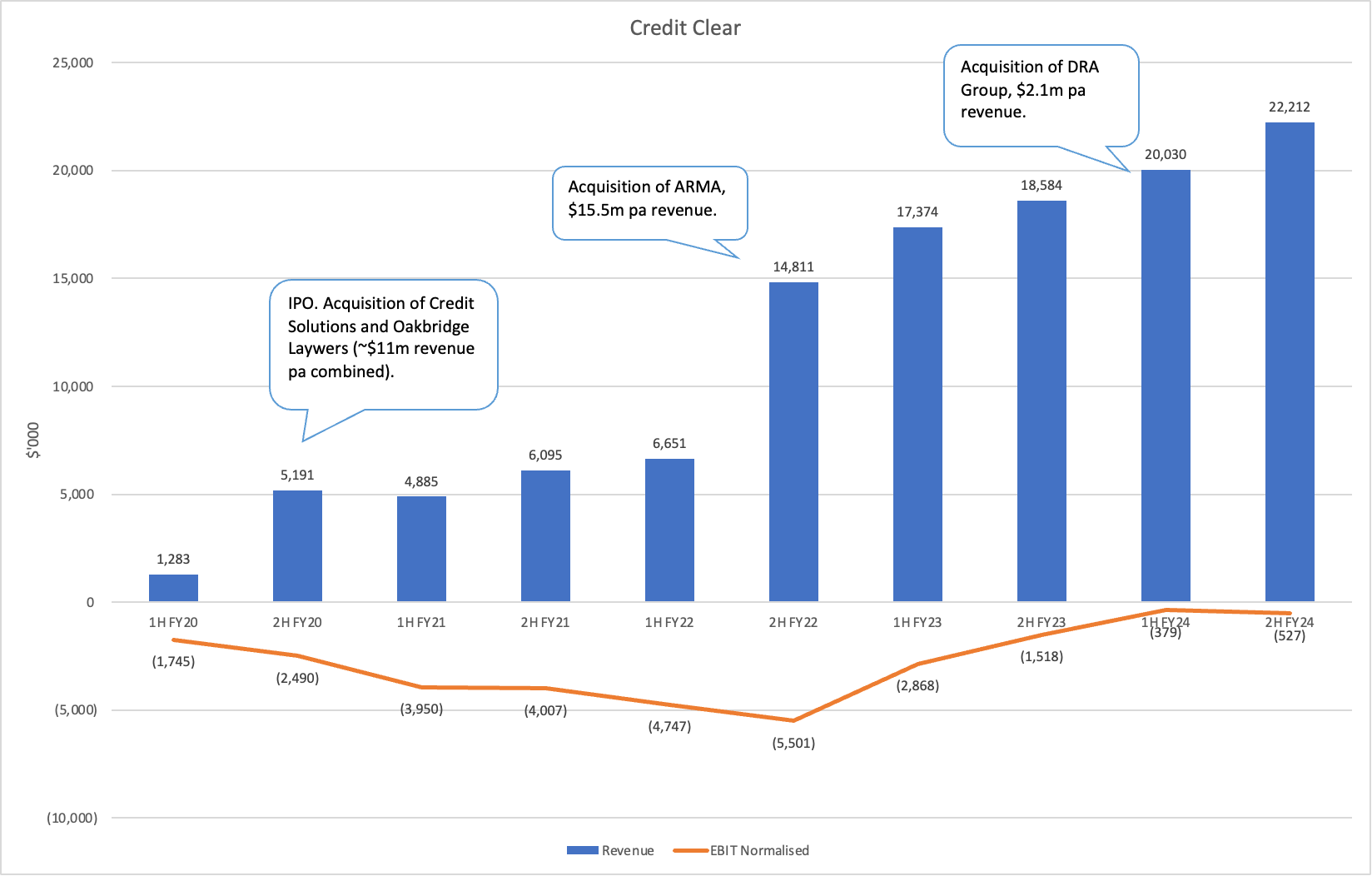

In the collections services space, Credit Clear is likely the second-largest player in Australia and New Zealand, after Credit Corp, with FY24 revenues of $42.2m compared to Credit Corp’s $75.5m.

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions

There are several things I like about the company:

- In FY24, Credit Clear inflected into free cashflow positive, and is close to profitability. EBIT, excluding the amortisation of customer contracts from previous acquisitions, was just -$900k.

- The revenue growth of +17.5% was largely organic growth. A small acquisition of an insurance collections company in Nov 2023 contributed, but even adjusting for this, revenue growth was still a healthy +14.5%. The company is guiding for revenue to grow +16% in FY25 mostly through the expansion of work with existing wins.

- Over the past 1.5 years, the company has become less promotional and more conservative. For example, FY24 guidance started on 30-Aug-2023 at $39-41m revenue and $1-2m underlying EBITDA (uEBITDA), and ended up at $42m revenue and $4.2m uEBITDA after multiple upgrades during the year.

- Gaining traction. In Q4 FY24, the company went live with collections for ANZ Bank. Following consistent performance, Credit Clear has been allocated increased share of ANZ’s debt portfolios. There will be more upside should they continue to outperform the other panelists. This case study will no doubt help strengthen its position in winning with other potential customers.

- There’s still considerable runway in Australia/NZ, in particular in segments where CCR has limited presence like federal government departments. International expansion, particularly in markets like the UK, is another possibility. Since Credit Clear collects debts on behalf of clients without taking on balance sheet risk (unlike debt purchasers), the risks of expanding abroad should be relatively low.

- The most exciting development for me is the area I was previously critical of - Credit Clear’s “AI company” narrative. While I believe they over-egged the AI sales pitch in the past, since the advent of ChatGPT, the sales pitch of having an AI assisted collections workflow no doubt has become a much more powerful one. In fact, its key subsidiary ARMA has increased its customer win rate increase from 30% to 70% in the space of a few years.

- There are signs of operating leverage. Gross margins are improving, with 40% of incremental revenue converting to Normalised EBIT in FY23, and 55% in FY24. The FY25 guidance projects a 37% conversion rate this year.

On the downside, Credit Clear isn’t an obvious bargain at current prices. An EV/S of around 2.5x isn’t cheap for a business services company with 53% gross margins, especially one that still requires collections staff to scale and is only just reaching profitability. However, if they can continue growing organically at a healthy pace and drive operating leverage, earnings could improve rapidly.

I believe that large language models (LLMs) and machine learning technologies are advancing rapidly and will significantly transform the operations of contact center businesses like Credit Clear over the next decade. These advancements will lead to increased efficiency, greater automation, and the displacement of tasks traditionally performed by humans. Credit Clear appears well-positioned to capitalise on these trends. As one of the larger collections services company in Australia and New Zealand, they have the scale to invest in in-house technology platforms and leverage technological advancements. Furthermore, having been initially established as a software-only company, improving efficiency through technology is a core part of the group’s DNA.

I’m interested to track the continued progress with ANZ. Credit Clear has been collecting debt for ANZ for the past 3-6 months and increased work from a small position on one portfolio to a bigger piece in 3 portfolio. Management claims they have a leading recovery rate compared to competitors on the same panel, exceeding them by over 50%, and they also lead in most other metrics. Increased work-share with ANZ will showcase how their technology focus and scale provide a quantitative advantage over competitors. This will serve as valuable collateral for the sales team, potentially leading to more wins and further market share gains.

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions