Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

CCR announced today their purchase of ARC Europe, debt collection agency for $10.9m through 6.8m cash, 1.8m cash, 2.3m in new shares along with deferred earnout opportunities.

The company is raising $20.75m (additional 92m shares) to fund this purchase and other growth initiatives, resulting in a circa 20% dilution.

The deal will be expected to be EPS Accretive, with EBITDA of $1.24m for next FY, although will need to get some further financials to confirm if this will push them to positive NPAT.

While there was no opportunity for us poor retail investors to purchase shares at 25c, the Chair Paul Dwyer is looking to materially increase his stake in the business from 2.3% to 8.2% under a second tranche of issues subject to shareholder approval

As a result of the deal and Chair's increased shareholding pushed the price up to 7% today to .29c. Will be interested to see if there is another small acquisition on the cards in the UK to go along with this purchase.

Disc: 2% holding IRL and SM

CCR released latest update and increased guidance and buyback

I sold on the pop and thought my move may have been premature. But then share price still finished down on Friday.

Not really sure what that means. Maybe there is the view that management has been here before with bullish guidance only to disappoint in the past. I note that management is not new and has been around for a while

[not held]

It's a good thing Thorney still sees something in CCR and reassuring to some shareholders

Old news but thought I'd post something about it as I feel anything that Alex Waislitz invests in seem to be in a downtrend.

And anything that Alex probably sells such as HUB24 continue to take out all time highs.

Obviously not advice or reliable information but it is a very disturbing correlation!

[held]

Half yearly is out and the share price was off by as much as -10% at one stage.

I don’t see much wrong with the result. My guess is that investors were expecting a guidance upgrade - something management had hinted at in earlier calls - but it didn’t materialise this year.

FY25 guidance was maintained at $48-50m in revenue and +$7m in underlying EBITDA. The company typically has a slightly stronger second half due to the seasonal challenge of debt collection leading up to Christmas. If 2H growth mirrors that of 1H, they should just edge past the upper end of the revenue range.

The Q&A session had a sense of frustration. Some investors questioned the credibility of the underlying EBITDA figure - one challenged the exclusion of share-based payments, while another pointed to the exclusion lease payments (which are part of D&A and therefore not included in EBITDA). Hopefully, management takes this feedback on board, as they have a tendency to skirt on the edge of BS metrics.

On the positive side, they introduced a new metric: NPATA, which adjusts NPAT by excluding the amortisation of customer contracts from prior acquisitions. This is a step in the right direction - I normalise my own EBIT figures for CCR in the same way.

Operating leverage was a bit disappointing this half. The jaws didn’t continue to widen but remained flat. Management attributed this to ~$800k in costs from consolidating five separate collections systems - an expense that will taper off in 2H FY25 and disappear by FY26.

Overall, they’re making steady progress, having turned free cash flow positive and moving closer to statutory profitability. The thesis remains straightforward and intact: a top-four Australian debt collection agency that outperforms competitors through superior technology and early adoption. This advantage should continue driving new customer wins, a larger share of collections from existing clients, and demonstrate increasing operating leverage over time.

There is a lot of history on CCR on Strawman, with some very useful posts by Mushroompanda and a Strawman interview with the CEO Andrew Smith on the 5/11/24.

Very briefly they floated October 2020 on the investor hook they were a tech platform business that would up-end the debt collections business. This did not quite work out and earnings and their share price continued to tank until late last year. Their eventual saviour was a traditional services debt collection business they bought for $46m in December 2021 called ARMA. With this purchase they also took on board a new CEO Andrew Smith, who very much appears to be the driving force of the current turnaround.

The recent figures for CCR are:

FY 24 revenue $42m up 20% for a underlying EBITA of $4.2m

FY25 guidance of $48- $50m revenue for an underlying EBITA of +$7m

In FY24 CCR had an operating cash flow of, less capitalised software development costs ($1.3m) of $2.5m.

This morning (22/11/24) at the AGM the CEO guided: “FY25 Guidance: YTD revenue run rate of ~$48.8m2 and margin expansion, with high confidence of a materially stronger 2H25 (~10%), places the Company on track to achieve or potentially exceed its FY25 guidance of $48m - $50m in revenue and +$7m in Underlying EBITDA”

All very positive and Andrew followed up with one of the most upbeat presentations by a CEO this quarter. He even had a presentation slide headed: “Existing Industry Domination” and ‘Future Industry Domination”.

All well and good, and a relevant question is, just what type of business is CCR? Is it:

a) A labour intensive, cyclical business in a very competitive debt collection services marketplace that has no enduring competitive advantage OR

b) A growing scalable business that can genuinely leverage off its existing tech and AI to be an enduring industry leader?

CCR management would of course want investors to believe (b). And there are good reasons to believe CCR management in this matter. This being:

- Improving gross margins from 53% last year to 56% YTD. At today’s AGM the CFO said this margin will keep improving for the following reasons:

- CCR are chasing and wining Teir 1 clients and the additional volume of business gives CCR economies of scale.

- These Teir 1 clients typically have high amounts of consumer debt that is low value. CCR argue their technology offering scales well into this versus the traditional Call Center recovery model.

The CEO made the point the gross margins have improved at a time of them undergoing the expense of onboarding new Teir 1 clients.

2) The business is growing revenue by +20% pa along with EBITA. Also the recent business wins take some time to appear in the accounts with only 30% of final revenue appearing in the first year and 80% in the second.

3) The competition is abating in the debt book market with Collection House and Panthera in administration. This result is the debt sellers (ie utilities, banks and the like) not being able to get the prices they previously did, and are now incentivised “sell” their debt on commission to the likes of CCR.

4) Their Net Promoter Score is in the 40s. Pretty impressive for a business that chases people for debt.

Currently the business m/cap is around $145m (with 50m performance and unlisted options floating around). If they hit the high end of their revenue target of $50m in FY 25, and an optimistic EBIT of $8m, then this will likely roughly translate to a FY25 PE of over 100. Or another way to look at it is around 3x revenue. So no gift at the current share price.

But there appears to be a lot of leverage. If they keep growing revenue at 20% plus for a few years out which the CEO verbally alluded to and margin keeps improving, the earnings multiple will come off pretty quickly.

I guess CCR is like just about anything else out there with a good balance sheet, cash flow positive, competent management and a strong prospect of growth - expensive.

This was an encouraging update

Credit Clear is showing strong business momentum, with October revenue hitting a record $4.29m, up 23% year-on-year. YTD revenue stands at $16.3m, a 20% increase, and gross margins have risen from 53% to 56%. They're on track to meet or exceed FY25 guidance of $48–50m revenue and $7m+ EBITDA.

The potential from eight new tier-1 clients is worth emphasising, with an additional $8-10m in future annual revenue. These include major players in energy and telecommunications, marking an important step into new sectors. This builds on their dominance in insurance, where they already serve five tier-1 clients.

As discussed with the CEO recently, each new tier-1 client acts as a strong reference, helping to accelerate further sales. Existing clients also seem to be broadening their relationship with CCR, adding more depth to their revenue streams.

With six consecutive quarters of positive operating cash flow and a strong cash buffer, Credit Clear appears in excellent financial health. And one of those rare businesses that can benefit from any economic malaise.

Disclosure: Held

1.5 years ago, I detailed some of my main gripes with Credit Clear in the following forum post: https://strawman.com/forums/topic/6847

The TL;DR: Credit Clear tends to oversell the idea that they’re an AI and machine learning software company when, in reality, they’re more of a collections services company that uses software. While my opinion on that hasn’t changed much, I now find the business more interesting and have added it to both my personal and Strawman portfolios.

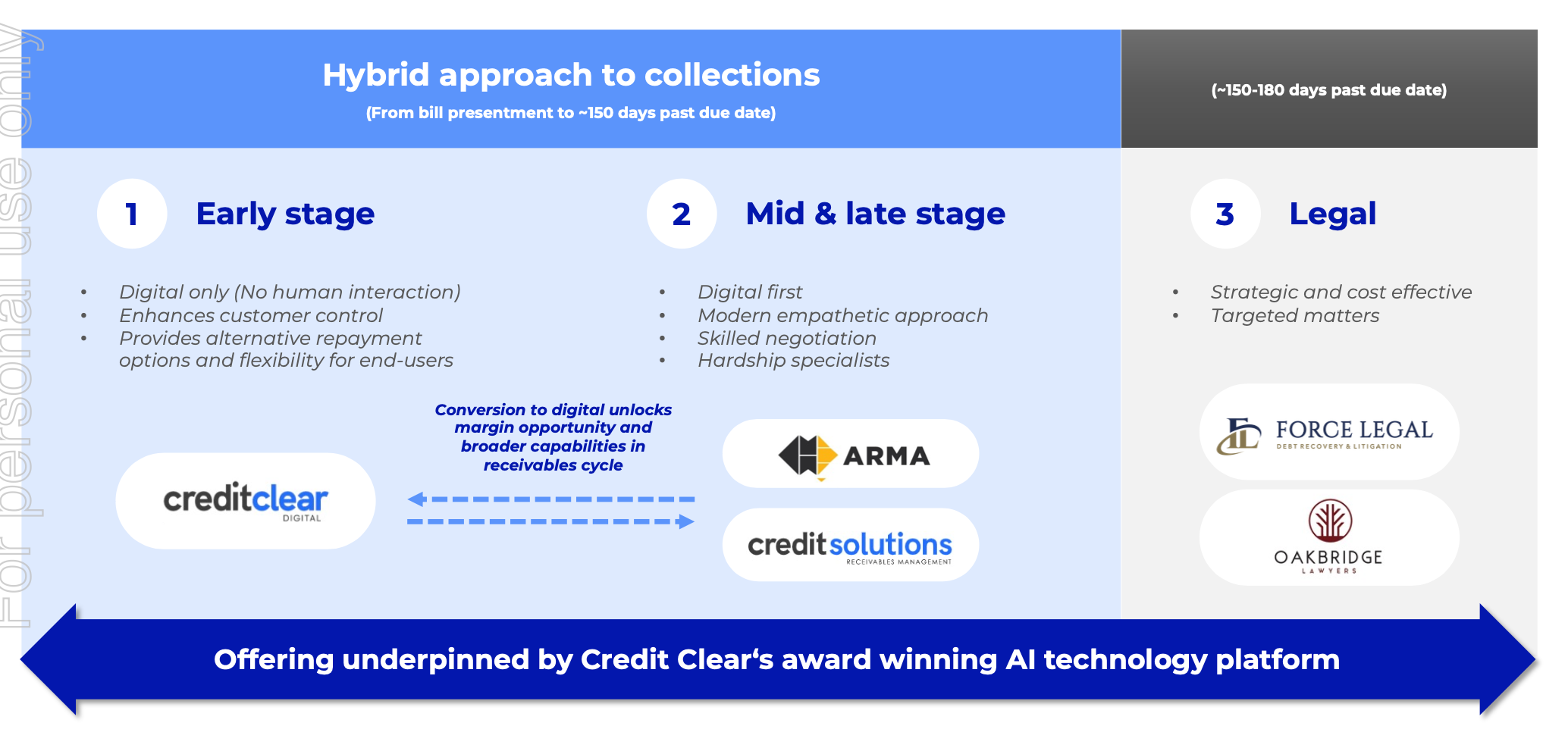

As a bit of background, Credit Clear is a collections services company. They help organizations recover overdue bills and loans, from the time a bill is issued up to around 180 days past due.

Many organisations require these types of services, as managing overdue payments internally can be a real headache. That’s why Credit Clear, along with many competitors, exists. Collection services companies collect overdue debts on the behalf of banks, credit unions, lenders, utilities, local, various levels of government, B2B companies, and essentially any business facing late payments.

Debts more 180 days overdue are generally considered highly impaired, and organisations may consider selling these to debt purchasing companies at cents on the dollar. The two largest debt purchasing companies in Australia - both listed on the ASX - are Credit Corp (CCP.AX) and Pioneer Credit (PNC.AX).

In the collections services space, Credit Clear is likely the second-largest player in Australia and New Zealand, after Credit Corp, with FY24 revenues of $42.2m compared to Credit Corp’s $75.5m.

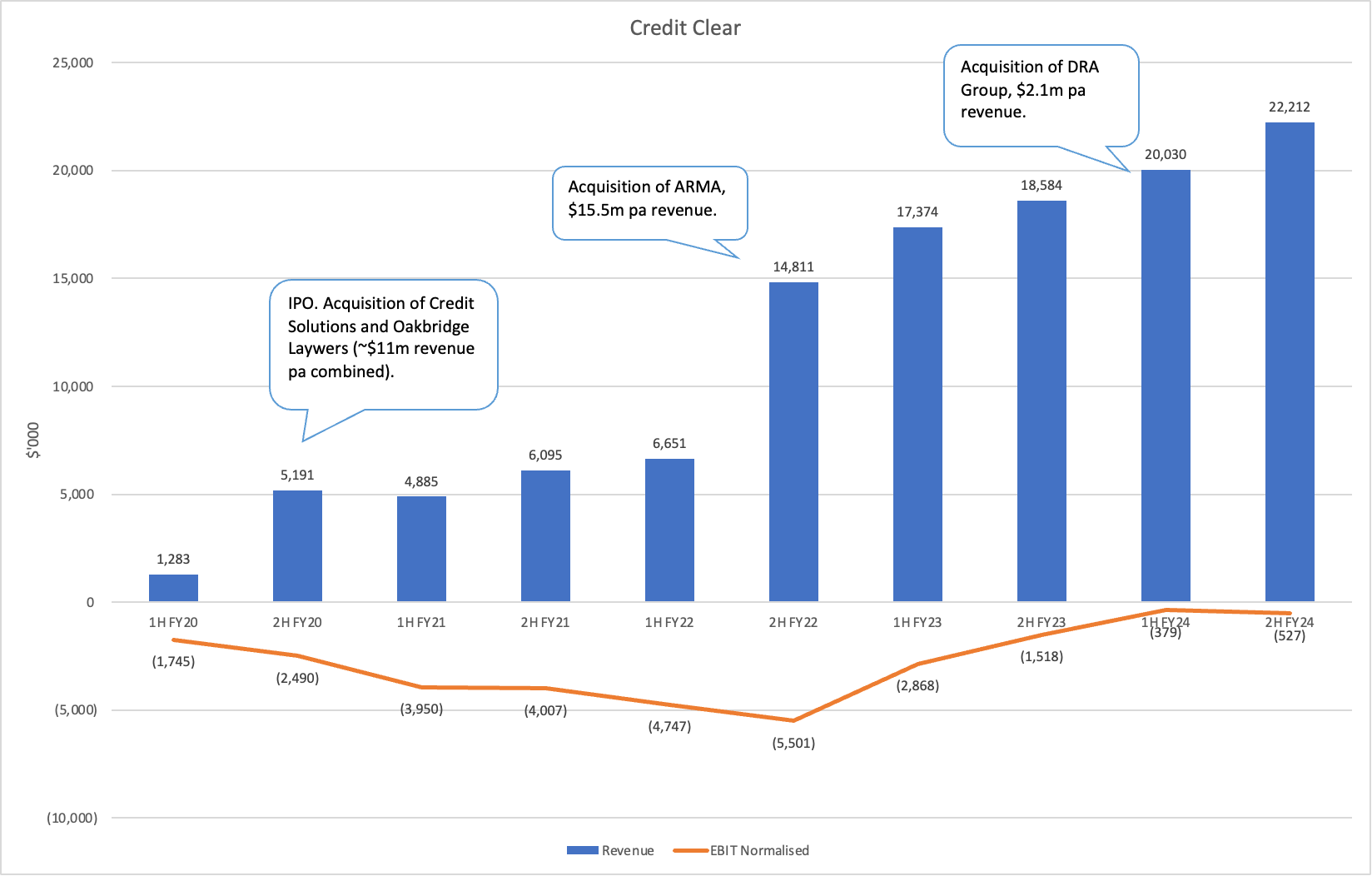

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions

EBIT Normalised is EBIT excluding amortisation of customer contracts from prior acquisitions

There are several things I like about the company:

- In FY24, Credit Clear inflected into free cashflow positive, and is close to profitability. EBIT, excluding the amortisation of customer contracts from previous acquisitions, was just -$900k.

- The revenue growth of +17.5% was largely organic growth. A small acquisition of an insurance collections company in Nov 2023 contributed, but even adjusting for this, revenue growth was still a healthy +14.5%. The company is guiding for revenue to grow +16% in FY25 mostly through the expansion of work with existing wins.

- Over the past 1.5 years, the company has become less promotional and more conservative. For example, FY24 guidance started on 30-Aug-2023 at $39-41m revenue and $1-2m underlying EBITDA (uEBITDA), and ended up at $42m revenue and $4.2m uEBITDA after multiple upgrades during the year.

- Gaining traction. In Q4 FY24, the company went live with collections for ANZ Bank. Following consistent performance, Credit Clear has been allocated increased share of ANZ’s debt portfolios. There will be more upside should they continue to outperform the other panelists. This case study will no doubt help strengthen its position in winning with other potential customers.

- There’s still considerable runway in Australia/NZ, in particular in segments where CCR has limited presence like federal government departments. International expansion, particularly in markets like the UK, is another possibility. Since Credit Clear collects debts on behalf of clients without taking on balance sheet risk (unlike debt purchasers), the risks of expanding abroad should be relatively low.

- The most exciting development for me is the area I was previously critical of - Credit Clear’s “AI company” narrative. While I believe they over-egged the AI sales pitch in the past, since the advent of ChatGPT, the sales pitch of having an AI assisted collections workflow no doubt has become a much more powerful one. In fact, its key subsidiary ARMA has increased its customer win rate increase from 30% to 70% in the space of a few years.

- There are signs of operating leverage. Gross margins are improving, with 40% of incremental revenue converting to Normalised EBIT in FY23, and 55% in FY24. The FY25 guidance projects a 37% conversion rate this year.

On the downside, Credit Clear isn’t an obvious bargain at current prices. An EV/S of around 2.5x isn’t cheap for a business services company with 53% gross margins, especially one that still requires collections staff to scale and is only just reaching profitability. However, if they can continue growing organically at a healthy pace and drive operating leverage, earnings could improve rapidly.

I believe that large language models (LLMs) and machine learning technologies are advancing rapidly and will significantly transform the operations of contact center businesses like Credit Clear over the next decade. These advancements will lead to increased efficiency, greater automation, and the displacement of tasks traditionally performed by humans. Credit Clear appears well-positioned to capitalise on these trends. As one of the larger collections services company in Australia and New Zealand, they have the scale to invest in in-house technology platforms and leverage technological advancements. Furthermore, having been initially established as a software-only company, improving efficiency through technology is a core part of the group’s DNA.

I’m interested to track the continued progress with ANZ. Credit Clear has been collecting debt for ANZ for the past 3-6 months and increased work from a small position on one portfolio to a bigger piece in 3 portfolio. Management claims they have a leading recovery rate compared to competitors on the same panel, exceeding them by over 50%, and they also lead in most other metrics. Increased work-share with ANZ will showcase how their technology focus and scale provide a quantitative advantage over competitors. This will serve as valuable collateral for the sales team, potentially leading to more wins and further market share gains.

Shares are consolidating just beneath the 52w high. If it breaks out decisively, that will be very bullish.

A similar business, Indebted, is valued at 3x.

https://www.afr.com/technology/digital-debt-collector-worth-350m-after-big-money-raise-20240919-p5kbya

Valuation on H1 Results (14/3/23)

FY23 H1 Result Summary

· Sales up 166% vs PCP, which is muddied by the ARMA acquisition but HoH sales are up 17%

· Op Cash flow positive +$599k, FCF much improved at -$648k

· They point to “Normalised EBITDA” which is +$968k, the exclusion of $2.5m ARMA earn out makes sense but Share Based Expenses of $1,989 is a stretch, EBITDA is still heavily negative at -$4.4m as is NPAT at -$7.2m

· Digital collections are up 35% and Transactions processed are up 37% in the half.

· Tailwinds for growth flagged: Fewer competitors (M&A activity – hmmm, fewer but bigger competitor in my view), Cost of living (agree this is a big help) and Less debt being sold (well this may change as we head into a recession).

· Current annualised revenue of $34.8, expected to reach $40.1m on current signings.

Note: Escrow release of 45m shares occurred on 7Feb23 from ARMA purchase consideration.

Valuation

I have valued using a two methods, DCF at 11% and discounted PE of 15 from FY28 forecasted EPS figures to get the values. Assumptions for each noted, but all have the same FY23 assumption of 37.8m sales (below 40.1m company guidance), -6.9m EBITDA, -10.4m NPAT.

Bull Case ($0.96-$1.46): Sales grow strongly, reaching A$136m by FY28 and cost discipline to improve EBITDA% to 54.2% (positive FY24) and NPAT% to 36.3% (positive FY24) by FY28. This is the opportunity if they can maintain high growth though rapid customer and revenue per customer growth and do so in a capital light low cost (high margin) digital service offering.

Base Case ($0.31-$0.44): Heading into an economic down turn which should provide CCR a tail wind and on the back of strong growth I have the same sales assumptions for my base case as my Bull. But the history of cost growth leads me to adopt the bear case for costs. So by 2028 EBITDA% of 18.7% (positive from FY25) and NPAT% of 10.6% (positive from FY26) as profit is achieved through sales growth rather than margin expansion.

Bear Case ($0.15-$0.21): Sales grow much more slowly, reaching A$75m by FY28 and cost continue to grow at just below sales growth rates. So by 2028 EBITDA% of 17.6% (positive from FY25) and NPAT% of 7.4% (positive from FY26) similar to base case but on a much lower top line.

The acquisition of ARMA makes it hard to get a view on sales and cost growth going forward. I hope the FY23 results provide some clarity because the valuation depends heavily on it. With good sales growth and improved operating leverage it’s a great business, cash flow results for H1 showed a good sign, but they are yet to prove an ability to keep a lid on cost growth and grow rapidly at the same time.

I was thinking of selling on valuation grounds ($0.38 base mid-point), but seem to have missed that boat. Also, I feel that the next 12 months offers CCR an inflection point in terms of profitable growth. They may not take it (for many reasons), but having bought at much higher prices, I will stick with my loss aversion and hold…

Disc: I own in RL & SM

Summary from announcement below. The foot in the door with IAG is good to see, growth in sales flagged is also welcome, but as CCR scale, the numbers quoted will need be much larger for a share price bump. This level of growth is base line at best in my view and has spurred me to updating my valuation for the H1 results which I will publish later.

Announcement highlights:

• In March, Credit Clear has signed a two-year agreement with IAG

• Credit Clear will deploy its purpose-built digital workflow for IAG, enabling third-party payments to be made online

• In January and February, 52 new clients were signed for a total of $2.4m in Potential Reveune1

• The appointment of PSC Insurance founder Paul Dwyer as Credit Clear’s Chairman has enhanced the Company’s reach into Australian and international insurance markets

• The Company expects revenue from insurance clients to grow 141% this year, from a total of $2.2m achieved in FY22 to approximately $5.3m in FY23

Disc: I own in RL & SM

Wasn't impressed with the top line shrinking here, maybe its q4 and a bit of down time on collection for Xmas, but they must either be having trouble on boarding these new clients (and they've said they need to speed this up) or something else is eroding in the background. As was pointed out here on the strawman meeting (I think) they didn't pick up any organic growth in q1 either. These last couple of reasons are less tangible and may be unfair, but I was concerned that it took to the 31st for the quarterly (they did last Jan so maybe no big deal, and everyone needs a bit of allowance in Jan!), and was concerned that they haven't advertised an investor briefing, seems out of character. I said I'd give them 2 quarters and am normally slow to sell, but have broken my own rule and sold out after only 1! I'm happy to watch it upto the next quarterly.

I'm ascribing a 50c value to CCR, based on assumptions outlined below, with in my mind enough upside asymmetry to make it a buy. I purchased on market at 40c a few weeks ago.

There are a number of aspects of the business I like, including:

- Reasonably high insider ownership, founders still onboard (of both Credit Clear and ARMA).

- Its simple. Digitising debt collection seems simple and they're taking a good first mover position. No super high capital investments, no irrational billionaire disruptors/competitors, not sexy.

- Have invested ~A$30m in AI. Their use of AI sounds pretty simple and has been proven to work. To me that probably makes it a good application rather than looking for a "hail mary" application.

- They have grown by acquisition, but Q1 FY23 showed strong leading indicators of growth in new clients, increased digital payments. I'll look to see the end user number and revenue follow in next quarters. If revenue doesn't grow over next 2 quarters I need to reassess.

- Growing into a large market and potential for international expansion given the relative simplicity of the tech and global nature of the industry

- Unfortunately, there's likely to be growing demand for their services as the music stops around the world on cheap credit.

- Cashflow positive, cash in the bank (although growing earn-out obligation to ARMA founders)

Things that concern me and I am watching:

- Relatively slow revenue growth (compared to my expectations) in Q1-23. I expect better for next few quarters as discussed above.

- Risk around personal security and hacking and lack of trust in digital communications. Doesn't mean there's necessarily great trust in "old school" methods, but it might slow some of their onboarding or force some redesign of their communications and algorithm.

- The whole ARMA acquisition (almost a merger) is relatively new. On the outside looks like a logical and harmonious merger, especially with Smith taking over as CEO. But always something to watch to ensure the happy family stays happy. The incentives are a bit awkward with Smith now running the business and his earn-out still growing for the next few months.

- It's not dirt cheap so there's downside risk. Current market cap ~150m, yet unprofitable and in a non-sexy industry. Potential for the market to dump it if growth is slow to materialize.

Valuation:

I've run a few DCFs at NPV10 and am comfortable with the risk reward at 40c currently.

50c valuation is based on the following:

High revenue growth occurs thanks to successful execution of the digitization model at a time when the macro is in their favour with world facing rising cost of debt. ~A$100m revenue by 2026 and A$200m revenue by 2032. Continues to grow at 5% after that. Important to note 40% of my value is picked up after 2032. I'd argue this is no different to saying you expect a PE of 20 in 5 years time - implying you think you can sell it to someone else who will see long life profits at that point in time.

Gross margins transition from 50% (non-digital) upto 70% by 2027. Management have stated digital collection has 85% gross margins, I'm not going all the way there.

The fixed cost base increases gradually to about A$70m in 2032.

By signing four contracts with new and existing insurance clients in Sep22, CCR has further widened its insurance sector offering. A new contract with Zurich Australian Insurance Limited (Zurich) and two contracts with new motor insurance specialists including Aioi Nissay Dowa Insurance Company Australia (ADICA) further expanded its relationship with one of Australia's largest insurance groups. Revenue from insurance clients is expected to grow 150% this year, from a total of $2.2m achieved in FY22 to $5.5m in FY23.

On 15 Sep 22, CCR provided a business update for the month of Aug22. With new clients onboarded in the past few months, growing debt referrals from the existing clients contributed significant growth in the month of August, with revenue reaching a new record of $3.28m.

The group's legal recovery businesses also produced strong growth in revenue for the month. The revenue run rate is now $39.4m2, and the company has achieved four consecutive months of operational profitability.

Awarded “Best use of AI” at the 7th Annual Australian Fintech Awards. The company was also been named an “Insurtech Start-up of the Year” finalist at 2022 Australian and New Zealand Institute of Insurance and Finance (ANZIIF) industry awards for its automation of third-party motor claims with potential Insurance clients building strongly in the pipeline.

Late last year Credit Clear acquired ARMA for $46M, funded by a $25.5M insto placement and $4M share plan at 40c.

ARMA offers a debt recovery solution, outsourced accounts receivables and litigation services. Last year ARMA reported $6.4M in EBITDA from $15.5M revenue.

It’s all about the synergies, isn’t it always, with Credit Clear intending to pursue its billing platform in ARMA’s approximately 400 customers.

ARMA co-founder Andrew Smith will take the role of CEO of the joint organisation with former CEO, who has only been in the seat around 6 months, is moving to a new role to focus on international markets.

Shares are down around 20% in the last 6 months. Not held, but will be watching to see if the synergies eventuate.

Credit Clear has taken out the award for “Best use of AI” at the sixth annual 2021 Australian FinTECH Awards over contenders Moula and MyMoney.

In winning the Best use of AI award, Credit Clear demonstrated integrating AI into its accounts receivable technology had resulted in a 150% plus increase in collections.

The company uses AI to "select the optimal content and channel of engagement which can lead to significantly better outcomes, while a wrong decision can result in increased costs or worse, permanently lost opportunities".

Using its next best action (NBA) model, the Credit Clear developed its AI technology to optimise recoveries while minimising collection costs.

Credit Clear says its NBA model treats every account in a “distinctly unique way” and has a recurrent neural network to assist with building and identifying patterns in a customer’s engagement history.

In other words, they have optimised when to hound people over outstanding debts.

Credit Clear has delivered solid results with a 70% revenue increase to $11 million. The increase has come organically from digital revenues, new client wins and high retention rates across their customer accounts across various industries including transport, financial services, insurance, government, and utilities.

This puts them on their way to meeting the aspiration of being leading technology company in receivable management, delivered using proprietary digital billing and communications platform. Both artificial intelligence (AI) and machine learning (ML) are used to increase engagement and improve debt management.

The process uses email and SMS to target customers. While this sounds like standard debt recovery tools, the use of technology has been proven to increase recovery. In the 4 years since launch the company has increased recovery rates by over 300% for customers including Bendigo Bank, Suncorp, ME Bank.

This is a highly competitive (and regulated) market that can be a tough way to make money, especially against large, established competitors - did someone say Collection House?

Incoming CEO David Hentschke has a growth hat, seeking to expand the use of technology as well as investigating opportunities outside Australia. This is a watch to see if he can execute as he does not come from this industry.

The company has also recently added Hugh Robertson, director of equity capital markets at Bell Potter to the board. Robertson currently sits on the board of Envirosuite and Maggie Beer, and brings decades of experience in financial services.