Pinned straw:

You want me to read through a Beforepay write up? This is a joke, right? What's with the name, did they lose a bet?

I'll admit, Beforepay is not a company I thought I'd have any interest in owning. The first thing an investor is going to see is the name and think it's is a total rip off from Afterpay. Immediate meme stock alert. The second thing is the high level business model. It's a pay day lender. It's just not one as you know it.

Under their model they will lend you between $50 and $2,000 and you'll pay 5% for the privilege. If you're late there's no additional fee and interest doesn't compound. They'll keep trying to recover the funds but the worst that will happen is you can't make another loan. In fact, their business model has won a series of awards for its ethical nature. You could argue that being in financial services the competition doesn't bat real deep but still…

That doesn't sound right. How can that make money, especially when they're borrowing at 15% to loan to you?

So the first thing you do when you first apply is give them access to your bank account feed and they analyse transactions over the last 2 years to help make a credit decision. You also have to authorise a direct debit to permit repayment of your loan on your pay date(s). The maximum term is two months and the average is about 26 days. All of this combined means their net default rate is well under 2%, and in the most recent quarter was just 0.5%. That's incredibly low for an unsecured product and especially so when you consider they are lending to people who live paycheck to paycheck and can't access/pay for it on BNPL and/or credit card with a grace period.

But they're borrowing at 15% and charging only 5%, and that 5% has to pay for defaults and all their costs of doing business!

They're borrowing at 15% per annum but charging 5% on a 26 day loan. They turn over the book 14 times year, so they're actually getting a 70% return per annum. In fact, just 1/5th of the 5% (i.e. 1%) they charge is absorbed by external lending costs. Plus I don't think that 15% they are being charged will stay that way for long. That was negotiated when they were an unprofitable start-up with an unproven business model. They've now proven themselves and are consistently profitable.

When I say consistently profitable I'm talking about a company that started in 2019 and has grown purely organically from a standing start to generating revenue of $35 million in FY24. They've done that while keeping a tight rein on operating costs. Their marketing spend topped out in FY22 and then has declined year-on-year for the past two years. Despite this revenue more than doubled in the past two years. There's clearly something about the product that peeps like.

Surely this a product you'd use on a last resort basis only. How often does that happen? This doesn't sound very sticky.

I hear you but with respect it's been a long time since you were contemplating trading down from your Step One jocks and foregoing a daily coffee to pay the car repair. I must admit I arched a hairy brow when I read their CAC in the last quarter was $39. When you consider their average advance is $387, it means customers need to use the product twice to break even at a gross level. How long will that take? The answer is not long. They made 494k of advances in the quarter among 251k of users. That means users made an average two advances in the quarter. That tracks with Jamie's assertion that users access the product 7-8 times a year. Their customers come back.

Listen to you refer to the CEO on a first name basis, Mr "I hobnob with the big cheese". So if they're that good they must be expensive.

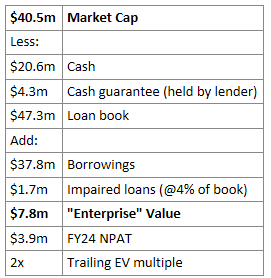

Well you be the judge but they're about 10x trailing NPAT. I can hardly believe I'm using an earnings multiple for a company that is only five years old but there it is. Here's another way of looking at it:

Hang on, you're adjusting EV for the loan book - that's not EV!

That's true but these aren't mortgages. The vast majority of that book will convert to cash in the next two months. Plus I'm adding back a healthy allowance for impairments. If you look really closely you'll see 4% of the loan book isn't exactly $1.7m either but my OCD needed the EV multiple to be a round number and that's how I got there. I'm asking for a little latitude!

A very little latitude, what's the catch?

Well, their primary market are millennials, who live paycheck to paycheck, who can't access alternatives e.g. BNPL or credit cards. It sounds like a bit of a niche market and there are signs they are topping out. Active users in Q1 FY25 was a record 251k, but that's only 7% higher than a year ago. Other loan metrics were similar. Impairment rates were considerably lower, but they can't go below zero.

There's also the whole "Your product is my feature" thing and CBA does have a somewhat similar, and in fact cheaper, offering called Advancepay. A few things though:

- CBA's minimum loan is $300. Beforepay's average loan is $387 and the median is lower. They cross over but not as much as you'd think and I don't think the big players have the appetite/systems to make smaller advances work.

- You need a CBA account. That's probably my least best defence tbh.

- If not paid by the nominated date the overdue amount starts to accrue 14.9% interest and other fees apply. In fact, that's the reason they're offering the product - they don't want you to pay it back.

So if I'm reading this right they have a somewhat tenuous position with a large proportion of a very niche market and you're relying on a dodgy definition of EV to make the maths work?

Tough crowd…

They've announced two growth initiatives to maintain the rage:

- A larger, longer dated personal loan product. They obtained a credit licence in Q1 to support this. Details are limited but it will need to be a different model to the current one. You'd think they'd want to stick with the fixed percentage model that's won them all the awards and a loyal customer base, but 5% is not going to compensate them for the additional risk and lower book turnover. More likely a sliding scale percentage based on duration and value, but known up front.

- Carrington Labs. So essentially this is them selling their IP, being their decisioning (risk) model and their lending platform to other players, with a focus on the U.S. They've consistently talked up these tools big time and the reality is they wrote up around 1,000 per loans per week per employee last quarter and recovered 99.5% of their value - they're doing something right with software! But can they sell it to 3rd parties? I dunno, but it seems like a low-risk way to try for international expansion. If they do manage it they want to use a usage based revenue model.

They continue to track user's bank feeds to constantly update their risk profiles and having a data set like for more than 250k of a particular cohort of people would seem to me to have some value, even on an aggregate basis. I asked Jamie…I mean the CEO…about this and he agrees but it comes down to time and priorities.

You bought it didn't you? I know you did. You're a sucker for a company that surprises you. What is it, guilt?

I bought a small amount IRL last week. I took a bigger swing on my SM portfolio. Look, Q1 is their seasonally best quarter from a defaults perspective and I took a bet the market would miss that. Today's pop on release of their 4C kind of vindicates that. I've got some time now to consider next steps. There are some potential catalysts with the growth initiatives in Q2 and I want to see how that plays out before deciding next steps.

Sucker…

UlladullaDave

Good write up @Noddy74

Have owned this since the start of the year IRL and held it on SM for a while (not sure why I sold it on here tbh). For me the thesis was that the heavy lifting of getting the business to breakeven had *probably* been done. The market is large enough that from breakeven adding customers is a function of spending money on marketing. Which is what seems to be playing out.

The main concern I have from here is that they have probably picked over the best customers at this point and the three points of triangulation (CAC, loan duration and credit risk) only get worse from here. To that end, I see the expansion into other credit products as attempting to juice that existing base.

Management are pretty cluey here and credit where it's due as you say they have managed to drive this business to $35m in revenue from a standing start in 5 years. I'm happy to hold because the current setup provides an interesting enough wait and see opportunity without having to worry about losses etc. The nature of the background checks, the DD payment on payday and the tiny feedback loop on how the loan book is holding up support that optionality.

Anything associated with the BNPL mania has been mostly overlooked by the market. Because most of it was trash lol.

Strawman

I'll second that, nice post @Noddy74

I agree B4P is a bit surprising, in that it's very much not the kind of business i'd typically have any interest in -- if only due to the ethical, cyclical, regulatory factors.

But, as you say, there's more going on here than first meets the eye, and it's great to see some free cash flow as of the latest quarter. I'll see if they are keen for another interview.

Noddy74

Thanks @Strawman - cashflow is a tough one when you're assessing lenders and it's one of several reasons I typically avoid. As you know the cashflow of lenders generally looks terrible and the better they're doing i.e. faster they're growing, the worse it looks. They'll usually have some sort of metrics that are designed to look through to the underlying story but they're far from being statutory numbers and inevitably rely on putting some sort of trust on management.

When it comes to Beforepay, I've seen quite a few presentations from Jamie (including those on Strawman) and in my experience he's a pretty straight shooter. He strikes a good balance between obvious enthusiasm for the company and keeping an appropriate level of caution. For instance, where seasonality is working in their favor they call it out. It's not everything but trust in management is an investment hurdle for me. That's been reinforced in the last few days given the degree to which a couple of CEOs in particular have dominated the feed...

edgescape

Seems everyone here missed the bit about AI as I've been learning about how fintech lenders work as it was part of my group assignment in the last 2 months.

Congrats to all that got into this early (and a few kept it to themselves really really really well and only disclosing now!!! And while I've been slogging away at my fintech assignment when this was here in plain sight all along :( )

This looks like genuine fintech lender using some sort of unconventional data sources and not just credit history to screen customers.

But my only question is what is their unconventional data source? Has anyone dug deeper on this?

Since they say they are ethical lenders, I assume their data source is looking at spending habits by scraping through bank transactions to see if the the customers are not frivolous spenders and also have sustainability in mind (ie: their algo probably assigns a low risk score if they are spending with low environmental footprint).

Only a guess though... Obviously they won't disclose the algo or the unconventional data which will be their secret sauce

Also from the last update it appears their net interest margin is 7%.

This is all I say for now - but yes for a boring lender in a risky sector this happens to be interesting.

Will keep an open mind that is all.

UlladullaDave

There's always reasonable money to be made in sub-prime lending, but it's not the bonanza of ripping off the poor it's made out to be. I'll leave others to discuss the ethics of it, but the reality is that a not insignificant number of people live pay cheque to pay cheque and unless the government wants to get into the business of short term lending like this then someone like B4P is going to be a lot more ethical than the alternative.

This business is doing well because it's built on the back of boring old sub-prime lending and is run by people with actual experience in the industry. I don't expect them to gain any real advantage from algorithms or being a fintech.

edgescape

Not saying it is a gimmick

But everyone needs to open their eyes a bit sometimes on the FinTech lending space and how it works and captures market against the incumbents. There's also lots of research on this area but the material takes lots of time to digest and understand and some of the software used in the research is hard to access. But I think I will let everyone else do their own research rather than put it here because just not worth it due to the skepticism

I thought you were way ahead of me on this being early as well but it seems there are lots of sceptics out there. That explains your silence about it for a whole year while I was slogging away on my research assignment not knowing we had this ASX FinTech lender.

UlladullaDave

I don't think it's a gimmick at all. But I don't think they have cracked the Enigma code on sub-prime lending. Like I said, it's a pretty plain vanilla lending operation with a bit of fintech wrapping.

I'm not sure what exactly you are trying to imply by my silence.

edgescape

Silence as in doubts about their business.

I'm all ears if there is a comparable or better FinTech lender or one that is a genuine FinTech lender not in fancy wrapping.

If I can't take the other side of the argument then there is a problem here.

Just funny I could have used this company for my research. Hope I don't get marked down for it.

UlladullaDave

My doubts about the business are the ones I posited in my first post:

The main concern I have from here is that they have probably picked over the best customers at this point and the three points of triangulation (CAC, loan duration and credit risk) only get worse from here. To that end, I see the expansion into other credit products as attempting to juice that existing base.

...

I'm all ears if there is a comparable or better FinTech lender or one that is a genuine FinTech lender not in fancy wrapping.

Why does it matter whether it's a fintech lender? I don't see why the distinction is at all important – lending is lending.

edgescape

Lending is lending

Yes that was my thought too till l spent months at University doing a research assignment on it. It was quite tough getting through the literature on sources used by fintechs, practical (using the software provided) and papers as well.

For the record I had issues doing the practical, for some reason I couldn't train the function to correctly predict defaults on the dataset. But I think there were issues with the dataset being too generic making the model ineffective or the Stata software install and thus shared those concerns.

I think over time the tech will develop and get better as more tech innovation becomes available

I probably shared too much here just to drive the point forward as this was an assessable task so will leave it at that...

But I think saying lending is all the same even if you are a FinTech could be implying all that academic research done in the area serves no purpose or value. So we need to be careful what we say in this respect as these are people with jobs trying to find ways of making finance more "available" and reducing risk at the same time

UlladullaDave

But I think saying lending is all the same even if you are a FinTech could be implying all that academic research done in the area serves no purpose or value. So we need to be careful what we say in this respect as these are people with jobs trying to find ways of making finance more "available" and reducing risk at the same time

With respect, I don't think anything either of us say on this platform is going to make a difference on the viability of any industry.

With that said, how often does the value of academic research land in shareholders' pockets? I'm not arguing that lending is somehow immune from technology change, but with rare exceptions, advances in tech are not competitive advantages they just end up as the price of admission. It's hard to envisage any other outcome in a business that is quite commoditised like lending.

edgescape

Yes there are probably others doing the same thing. But no one is going to opensource the code to anyone in as much as coming on Strawman to explain how it all works I so struggle to see how it's relevant.

Most of the research we examined is actually data from implemented platforms which are then used to generate their own models using what is available in statistics area such as regressions etc just to see if there is any insights in taking on risk or giving credit to someone with little credit history. In other words, the private sector is already ahead of the curve.

I stop here now as again don't want to share all my thoughts on the assessment. I had a few counter arguments also but not related to the whole lending is lending thing.