I'm not negative on uranium @Aaronfzr (and @SebastianG ) - I'm more neutral - as I don't have a good feel for the future demand because logically the price should go up but there is a lot of strong sentiment around uranium - both positive and negative - and it's also become a political football here in Australia with our Liberal opposition leader being for nuclear power here in Oz, and Labor deciding to take the opposite view.

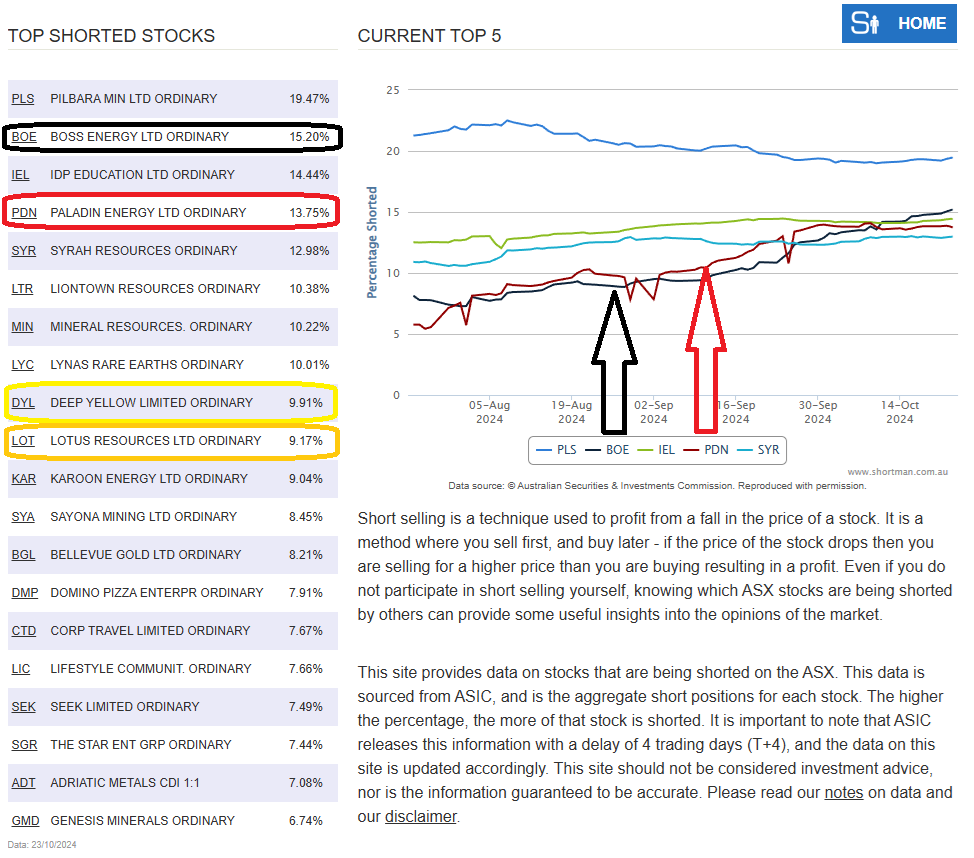

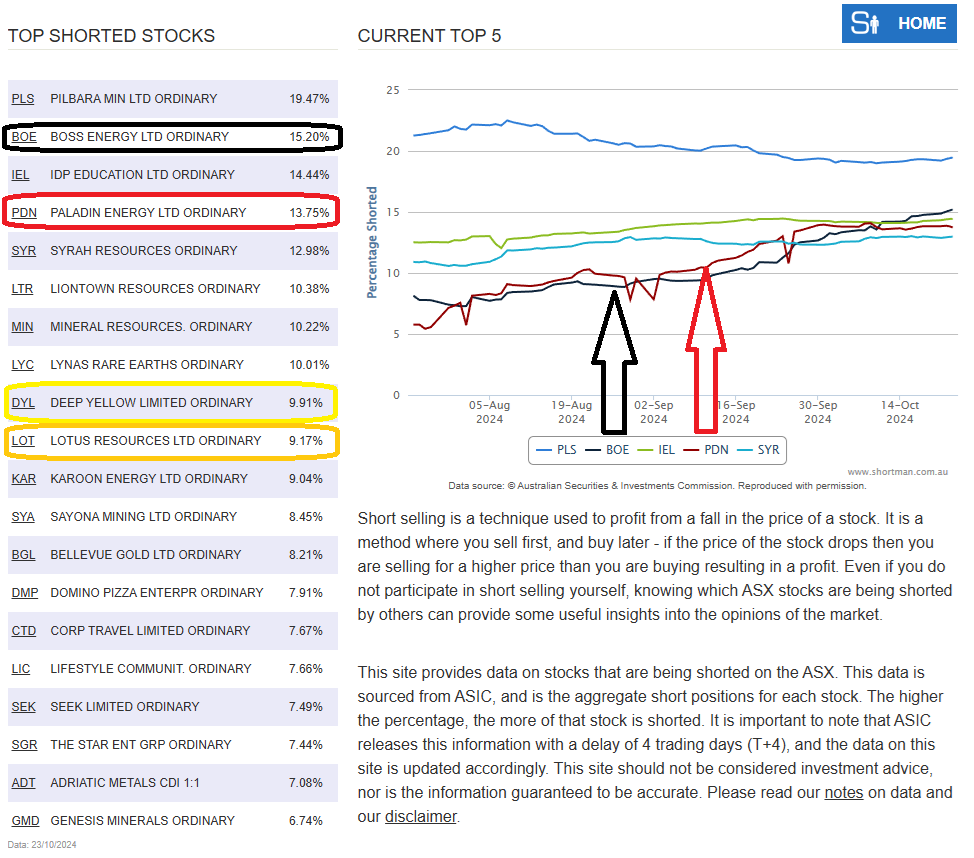

I do note that uranium companies are often heavily shorted, and there are 4 uranium companies within the top 10 most shorted stocks on the ASX according to Shortman.com.au when I checked just now (7pm on Tues 29-Oct-2024):

And the shorts have been rising not falling as shown on the graph there.

Those details were current as at 23-Oct-2024, i.e. 6 days ago, being 4 trading days ago.

Lotus (LOT) is one that doesn't get a lot of press:

Source: Investor Presentation - Kayelekera Restart and Equity Raise.PDF

Since then (22-Oct-2024):

24/10/2024 (9:41 am AEDT): Upsized A$130 million Placement to Fund Kayelekera Restart

24/10/2024 (9:41 am AEDT): Retraction of Letlhakane Scoping Study Production Targets

I'm not holding any uranium companies directly at this point, but I have traded them in the past.

If I was going to hold uranium companies directly, I would probably do that through BOE and PDN as you have @Aaronfzr - not through DYL or LOT, but I haven't done any proper research on any of them. A portion of the market has a negative view clearly. That said, there has been money made on bombed out uranium stocks in the past 18 months.

But when PDN can drop from a year high of $17.98 in May down to $8.37 in September - so in 4 months - it's certainly a wild ride for those who are onboard.