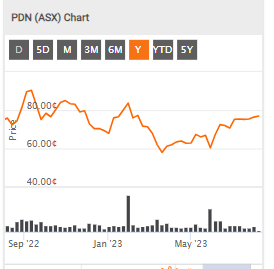

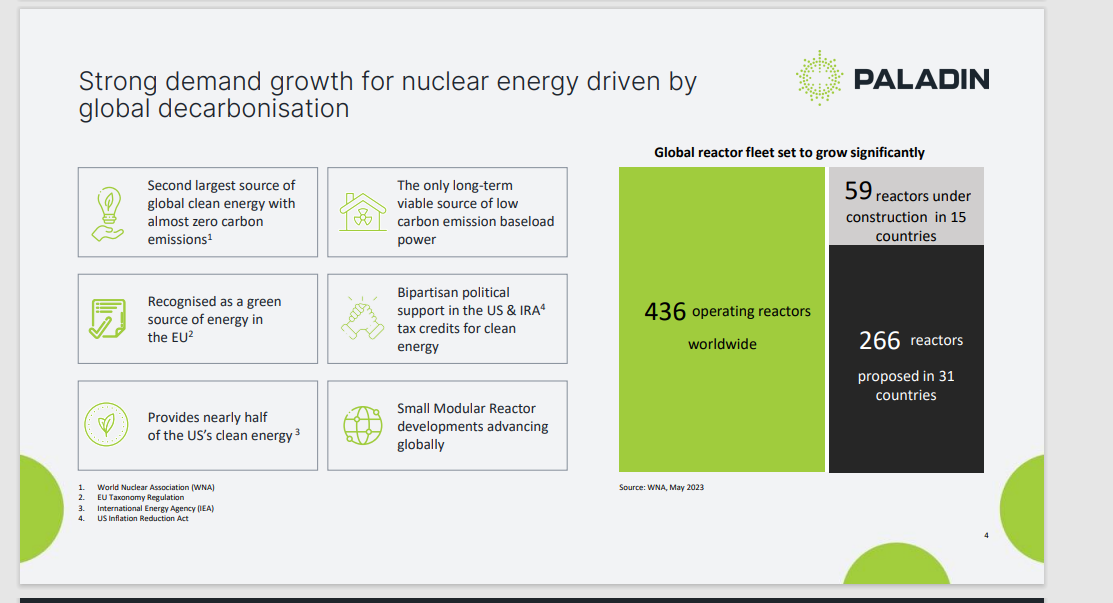

Strong demand growth for nuclear energy driven by global decarbonisation 4 Second largest source of global clean energy with almost zero carbon emissions

1 The only long-term viable source of low carbon emission baseload power Provides nearly half of the US’s clean energy 3 Small Modular Reactor developments advancing globally

1. World Nuclear Association (WNA)

2. EU Taxonomy Regulation

3. International Energy Agency (IEA)

4. US Inflation Reduction Act Recognised as a green source of energy in the EU2 Bipartisan political support in the US & IRA4 tax credits for clean energy Global reactor fleet set to grow significantly

PALADIN ENERGY LTD (ASX:PDN) - Ann: Diggers and Dealers Presentation 2023, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

No wood to burn / No wind will blow / the sun is dim / Quality Nuclear will maintain out standard / accustomed living.