Open at depth @Scoonie means they haven't found the bottom of the gold yet, and open along strike means they haven't found the lateral extent of the gold yet - i.e. the edge of the deposit. However, technically, as long as they have at least one drill hole that had gold at the bottom of the core that was extracted, they can say "open at depth" because they can assume there's more gold below that hole. I often wonder if some of them limit the depth of their drilling to just above where they estimate the gold probably extends to at depth so they can say "open at depth" - which sounds like blue sky potential - rather than drill a bit further and then have to say: We found no gold below x metres in any of the drill holes.

I agree that Côte d’Ivoire (once known by some as the "Ivory Coast") is one of the safer places to mine gold in West Africa - Perseus (PRU) have two mines there and I have held Perseus for a few months up until this week - and I only sold them to move the money into a WA gold miner who I think has more shorter-term upside potential (Westgold - WGX).

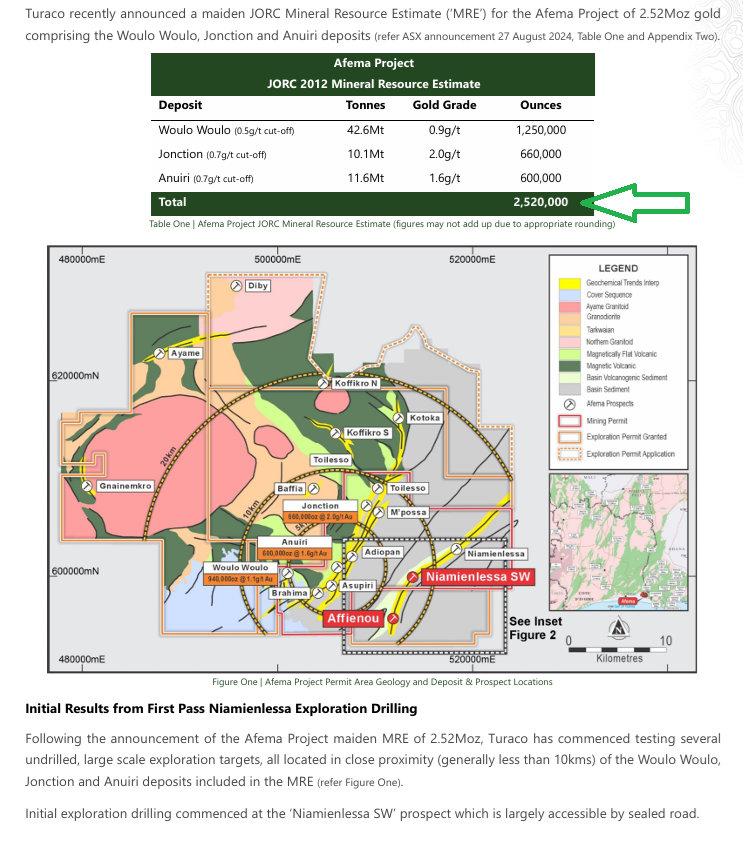

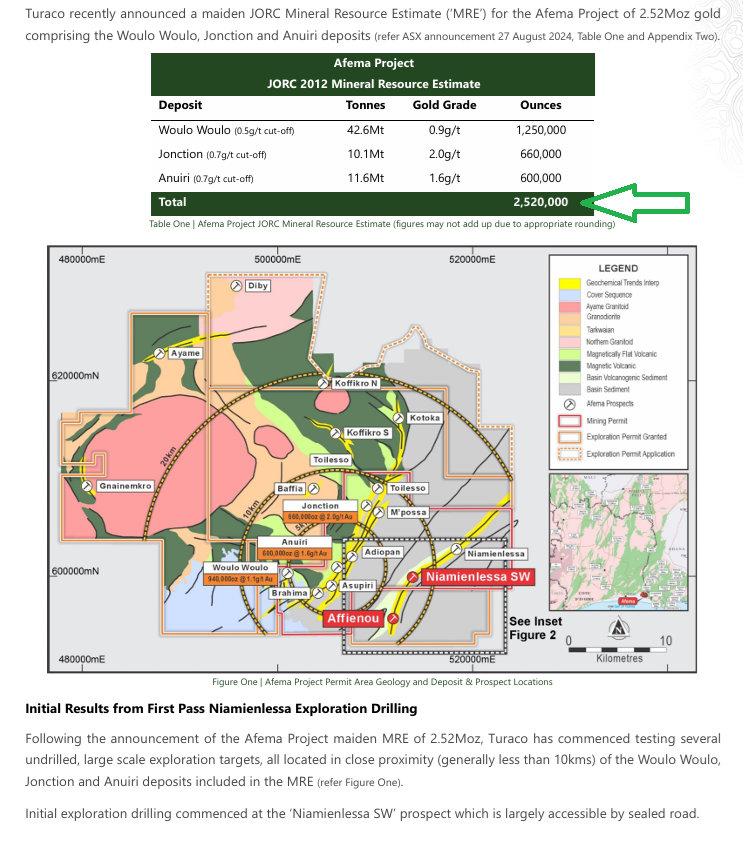

Turaco Gold (TCG) is not one I have been following, likely because they're an explorer and developer in West Africa (not yet a gold producer), however they've done well; they've already declared a JORC-compliant Mineral Resource Estimate (MRE) of over 2.5 million ounces of gold at their Afema Gold Project in Côte d’Ivoire, so they are likely on PRU's radar already - and PRU have form for acquisitions - and they can afford to - PRU have a $3.4 Billion market cap and three producing gold mines (their third one is in Ghana). TCG's m/cap is $240 million.

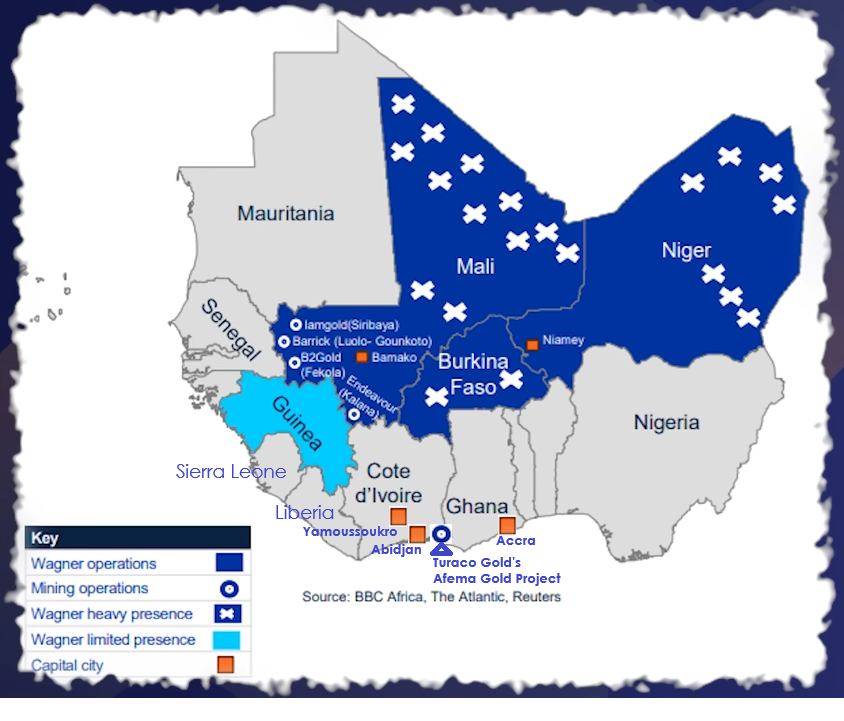

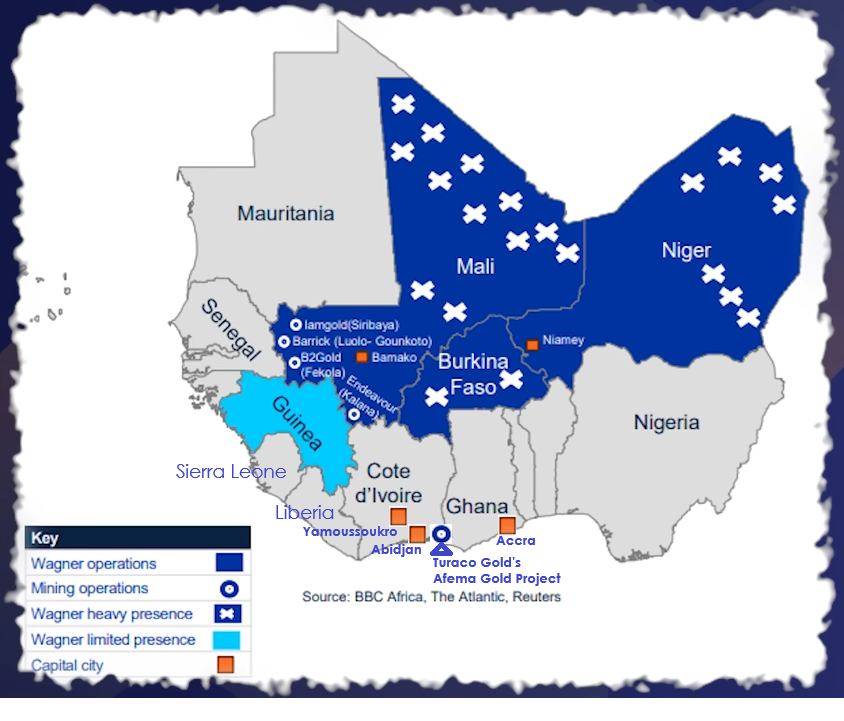

And you couldn't get much further away from Mali without leaving Côte d’Ivoire altogether.

Côte d’Ivoire has two capital cities; the de facto capital is the port city of Abidjan, just to the west of (to the left on the map from) TCG's Afema Project, while the administrative capital designate (since 1983) is Yamoussoukro in the centre of the country - sort of like Canberra, only relevant because that's where the government meets. And Abidjan is like Sydney, the de facto capital of Australia (and another port city on the coast).

That map above was used in a recent MoM (Money of Mine) podcast when they were discussing the issues that RSG (Resolute Mining) are facing and the risks of mining in Mali - highlighting the Wagner presence - now more Russian military presence since the demise of Wagner as an organisation - apparently the Russian military have taken over the Wagner operations. If Afema was any more south than they are they'd be in the Atlantic Ocean.

I've added the capitals of Côte d’Ivoire and Ghana plus the Afema project location to that map.

If I had more cash, Turaco is a company I might take a punt on. They are in a good location - for West Africa, and West African gold miners are always available at a discount because of where they mine - which can provide excellent shareholder returns in some cases - like PRU - or burn a lot of shareholder capital - like RSG over the years.

People can't even exit RSG now because they called for a trading halt yesterday and they're still in it. No word on their CEO and the other 3 RSG employees who were arrested at their hotel in Bamako (in Mali) on Friday and have been detained by Malian authorities since then.