Bull Case:

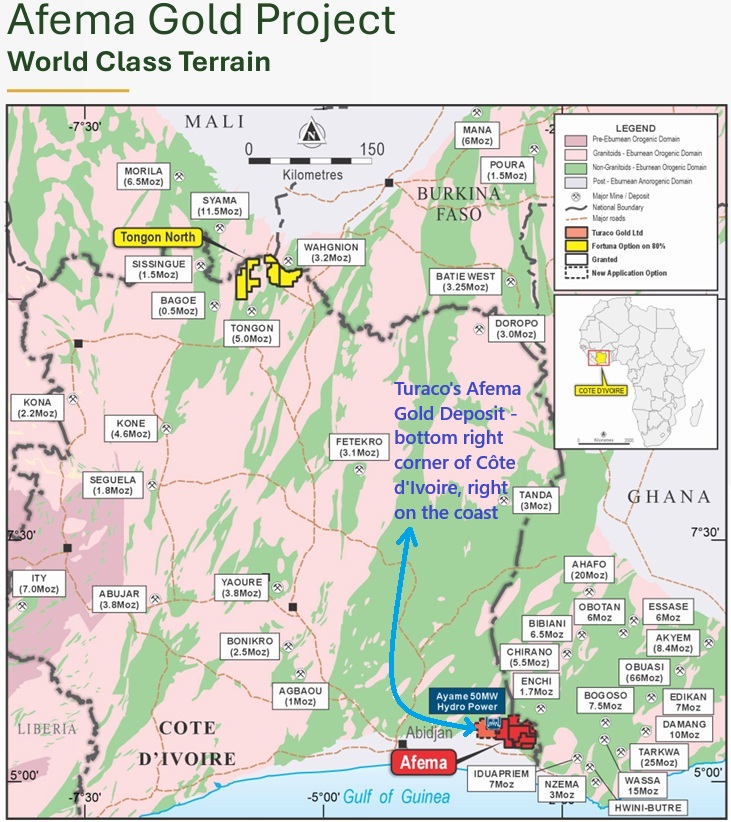

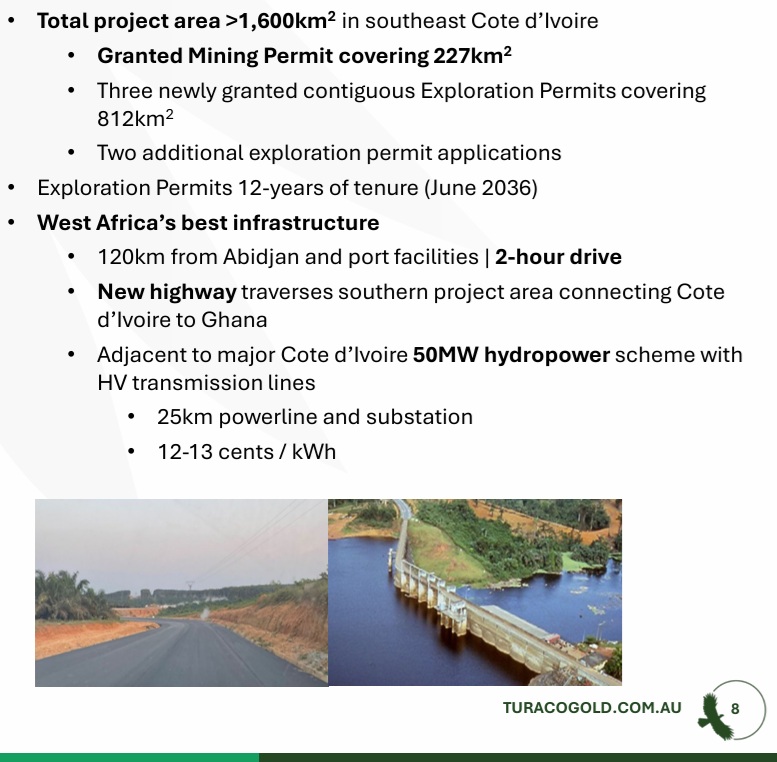

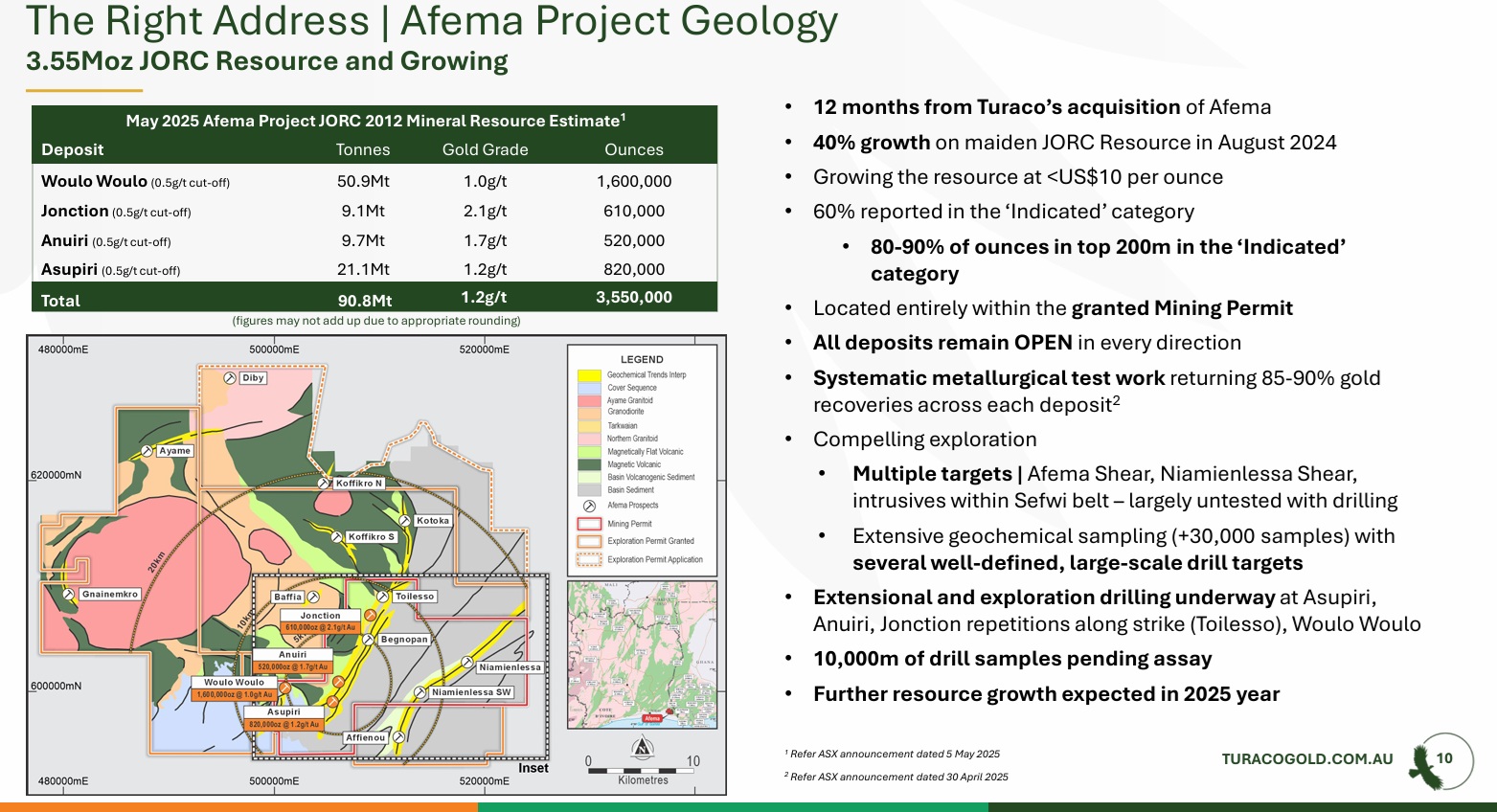

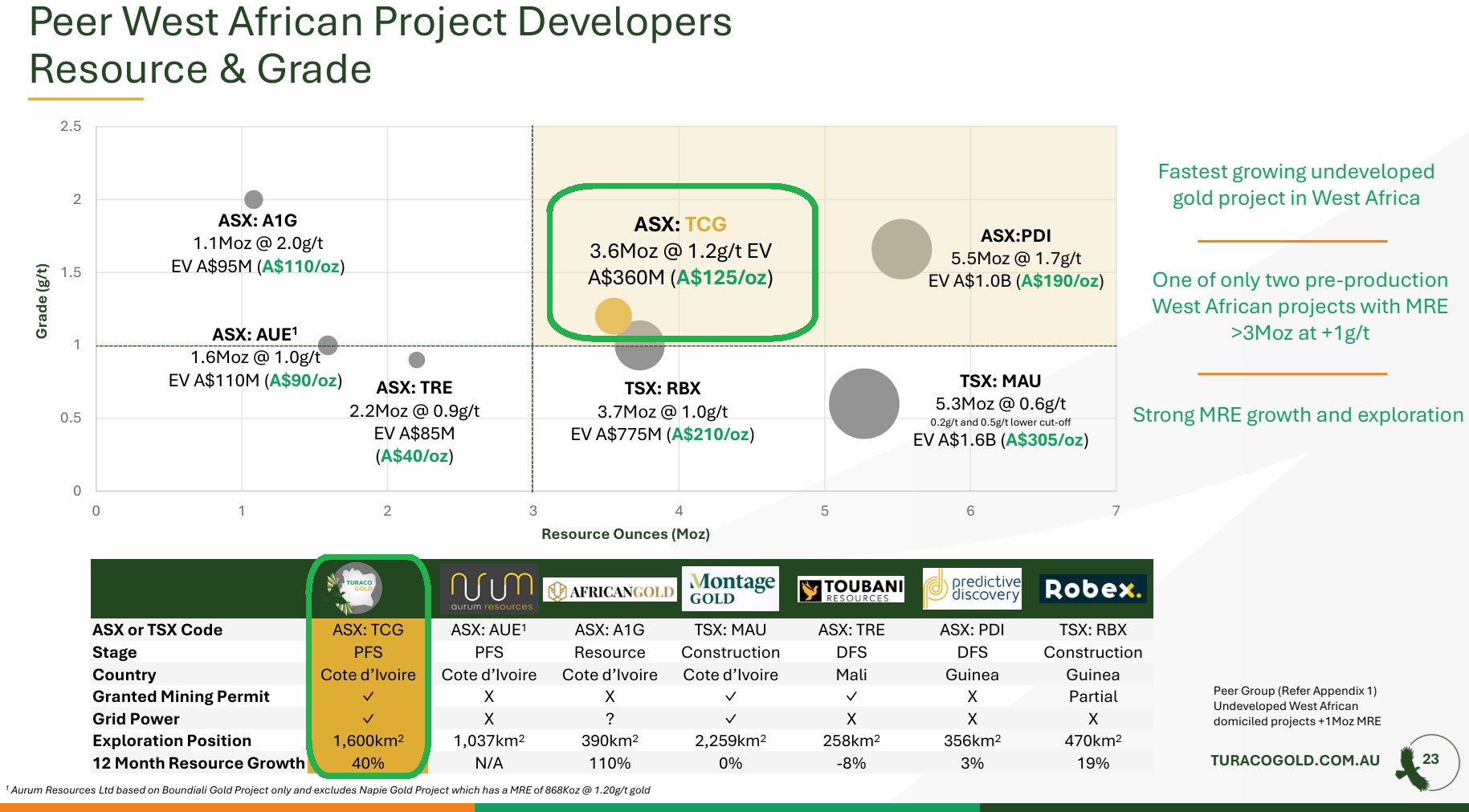

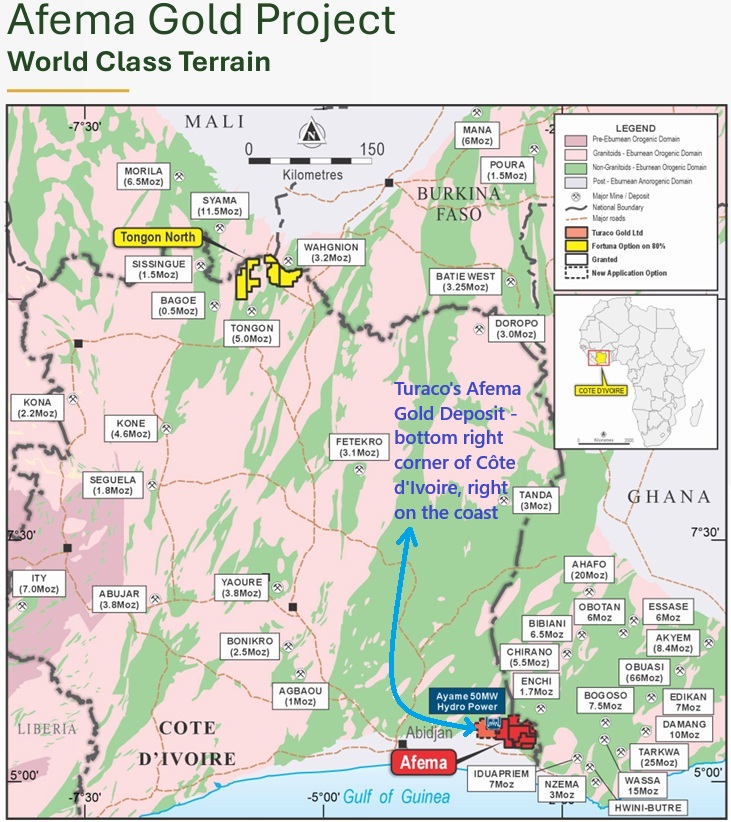

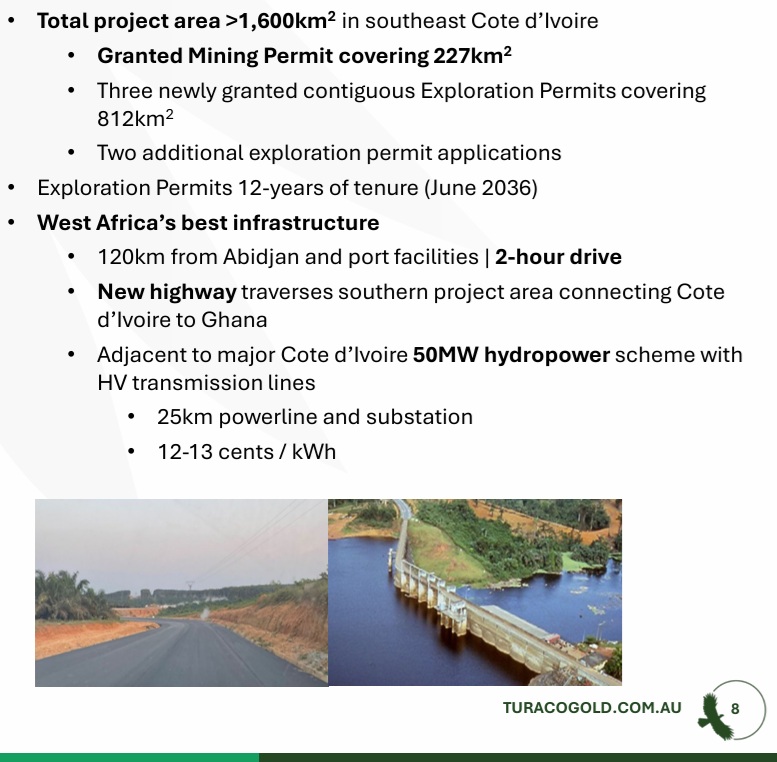

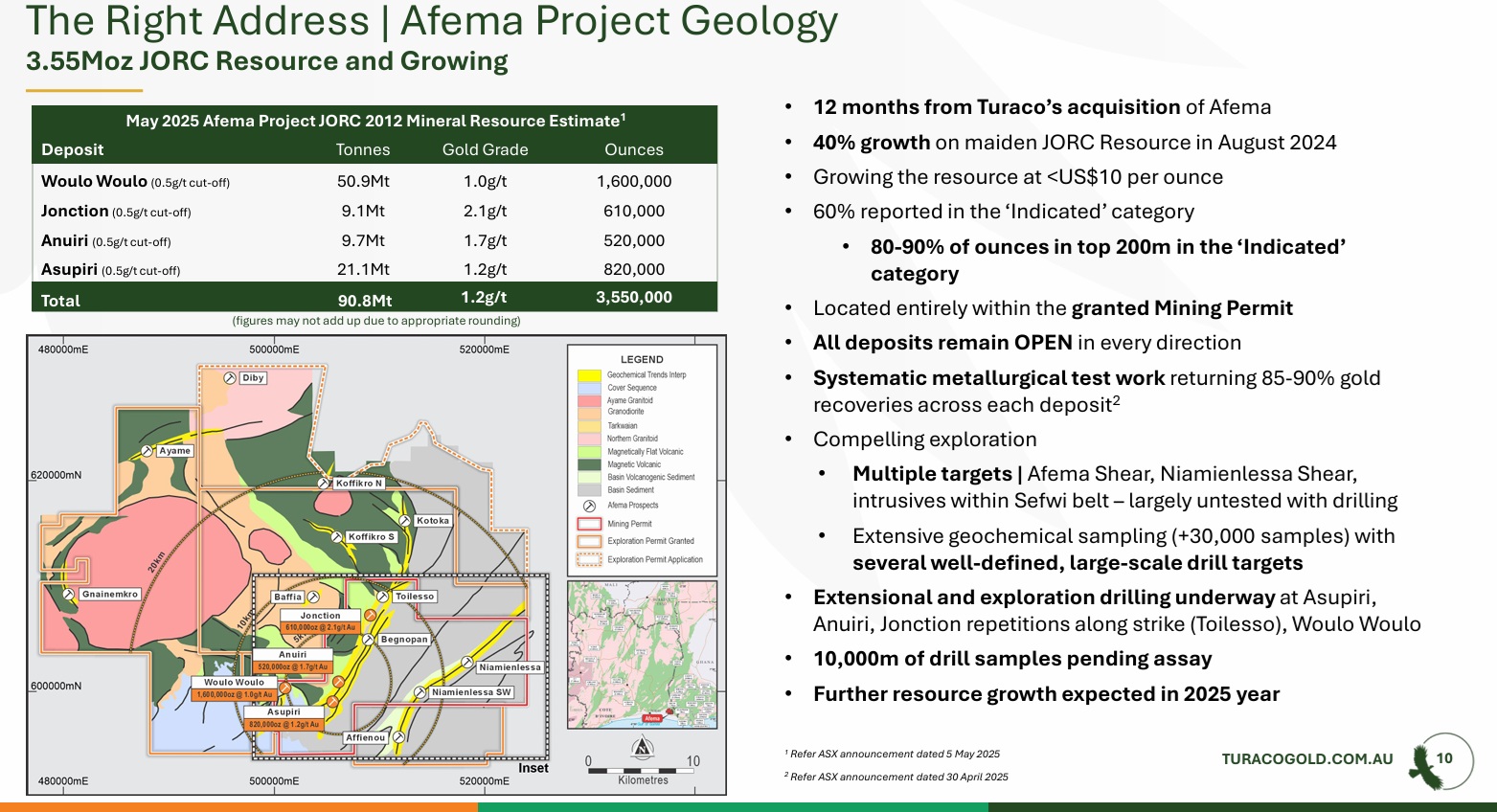

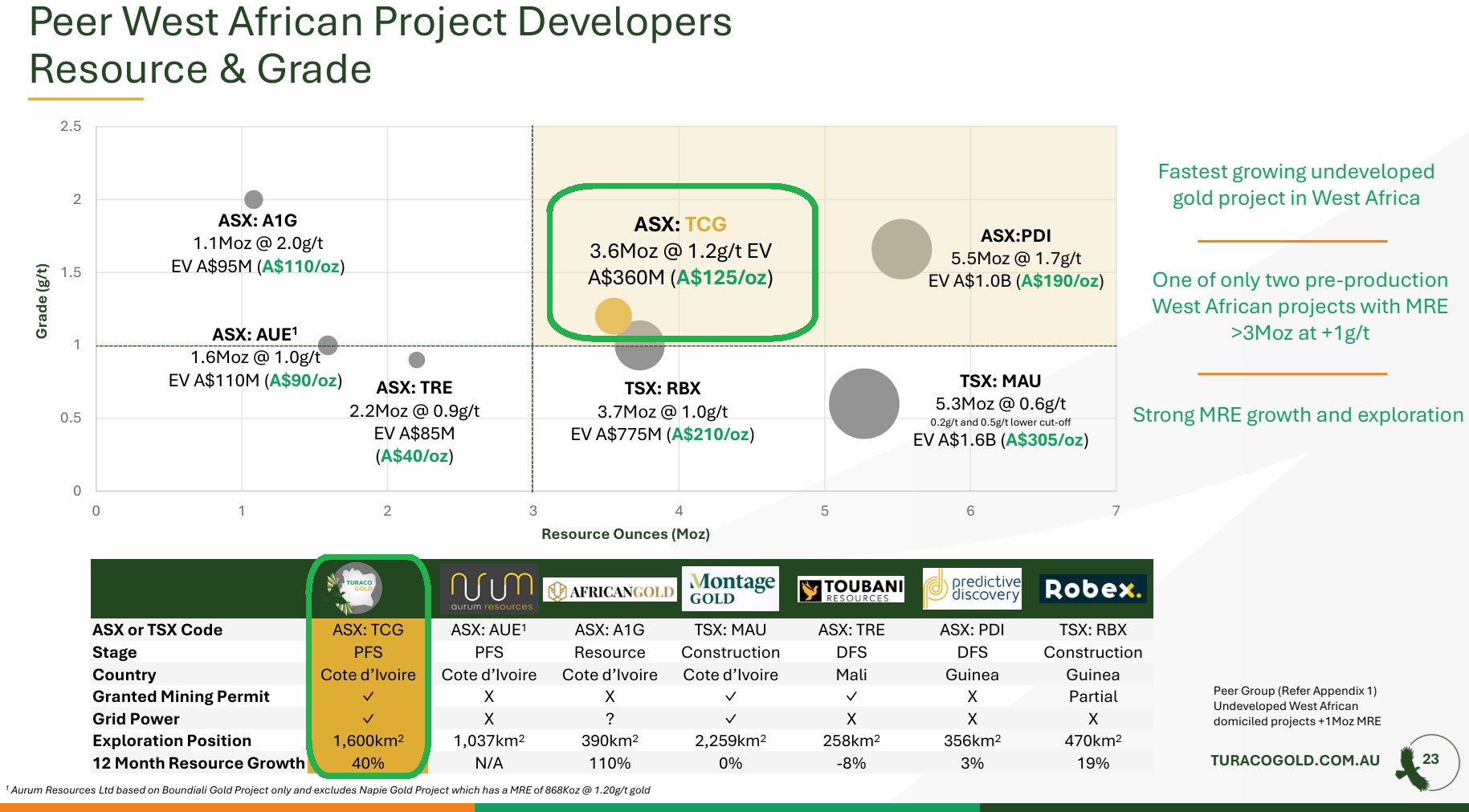

As you can see below (and above), the grades are quite average, but very simple chemistry, the gold is simple - and cheap - to extract, they're situated right next to a 50MW hydropower station, so cheap power, they're about as far away from the trouble spots in West Africa as you can get without moving into the ocean, their permitting is well advanced, they have plenty of land and plenty of exploration upside, good sealed roads all the way through to the country's capital and through into Ghana, great relationships with the government there in Côte d'Ivoire and the local community, and they're not expensive compared to their peers on a dollars per ounce of gold basis.

Afema WILL become a mine, most likely in 2027, and I would expect they'll have found significantly more gold between now and then as well, which will keep driving up their valuation.

West African gold project developers (peer) comparison:

These (above) are all slides from this recent presentation: TCG's 04-Aug-2025 D&D Presentation.PDF

If any of the above slides are too small to read, and you want to read the details, click on that link above and you can look at the source material and blow it up as large as you like.

I should also thank @Scoonie - who first got me interested in this company last year.

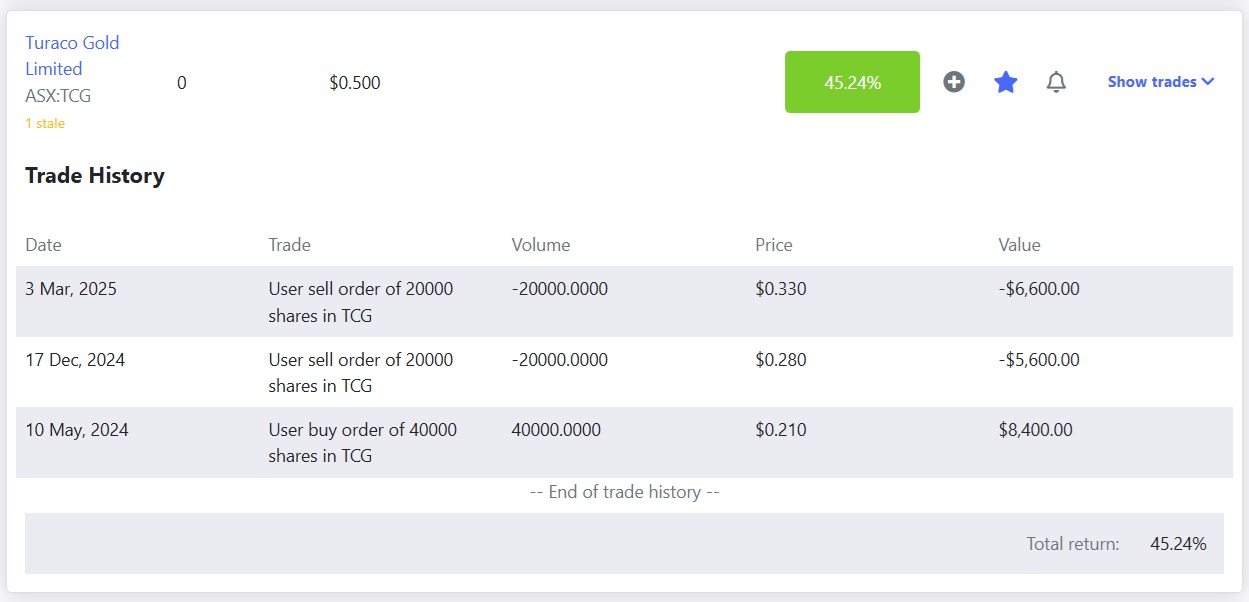

That's Scoonie's 45% return on TCG in less than 10 months. It would be better, but those shares were unfortunately sold on 3rd March this year @ 33 cps - TCG closed today at 50 cps.

I'm a bit late to the story, buying in only last week both here on SM and in my real-money 5-company speculative goldies portfolio (I hold much larger positions in much larger gold producers in other portfolios). It would have been nice to have got into TCG last year...

That's their 3 year chart with weekly data points. There are a few metals explorers and project developers, especially in gold, that exhibit that sort of SP growth, but their potential isn't always obvious in their earlier stages.

I have to say, looking back, that Turaco's potential was actually pretty obvious last year, I was however suffering under the strong bias that West African gold miners were best left alone, and project developers and explorers in West Africa even more so, and apart from some short stints in PRU and WAF (who both produce gold from multiple mines there already) - until I got cold feet - I did manage to mostly give West African gold a wide berth - apart from holding Lycopodium (LYL) throughout (and still do) - who build many of the gold mills over there - but anyway, better late than never with TCG.

Higher risk, as they do not produce gold yet, and won't be producing any before late 2027 or 2028, but still plenty of potential for share price appreciation if they keep finding more gold and keep progressing Afema towards becoming a gold mine in Côte d'Ivoire.

Conversely, if the gold price falls, and/or TCG do NOT find significantly more gold, then there's also downside here, so this sort of company certainly won't suit everybody.

Discl: Holding.