Thanks @SudMav , I reviewed them earlier and have the below letter ready to send tonight to the board. Feedback and suggestions from the SM community are sought and welcomed on the letter:

Dear Chair and Board,

I am writing to you as a shareholder who is unable to attend the AGM today but has questions having just received your AGM address regarding the takeover offer announced to the market on 19 November 2024. It is very hard to reconcile the boards endorsement of an offer price that is lower than the price the company traded three months ago and in light of the commentary and information the company has provided the market to date.

My questions are as follows:

1. In light of revenue growing over three times since IPO how does the board see the offer price as good value for all shareholders when it is just over double the IPO market cap?

2. The share price has only been below the current offer price for three months, having traded well above it for the past several years. Why at the lowest price the company has ever traded is the board considering offers to sell?

3. Is there an as yet unreported problem with the companies debt position that provides solvency concerns or loss of major contracts that significantly undermines current sales that justifies a low valuation in line with the offer price?

4. Do the board or senior management have any interest in or association with the company making the offer?

5. Are the changes in the board and senior management in any way related to the current offer or due to company performance and risk issues that would make the current offer attractive to shareholders?

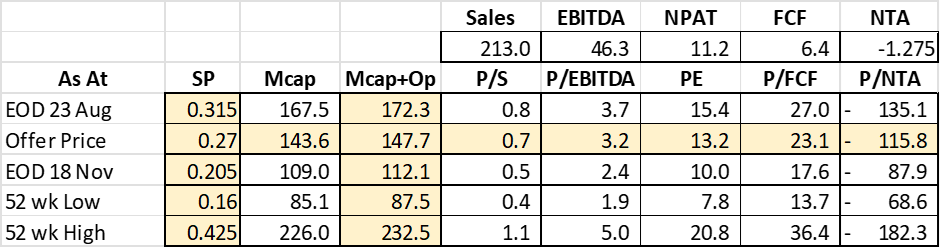

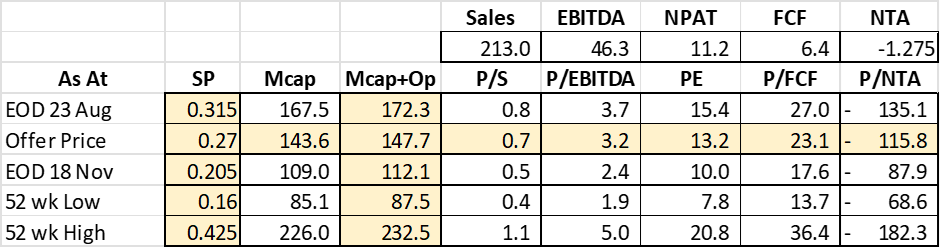

For Context I provide the below valuation metrics against a fully diluted market cap.

For a company with the growth prospects that have been communicated to the market the valuation at the current offer is low unless there are issues regarding NTA and debt. Running down of the debt and refinancing at cheaper rates will significantly reduce the PE ratio, noting the P/EBITDA is very low, so the operating business is very cheap, it’s only the financing of business that may be at issue.

I look forward to your response or market announcements that provide the clarity I seek and I am sure many shareholders require in reviewing the offer.

Kind regards,