Pinned straw:

Very different companies, but the mechanics of the downgrade are similar to Audinate. Another high growth, erstwhile market darling surprising the market and expecting the upcoming fiscal to be "transitional", with an uncertain rebound period beyond that.

Had insider selling and CFO resignations in the lead up in both cases too!

IMO, PWH requires looking past the headline numbers.

Five years out from now, the growth (if it happens) is all going to be in Aerospace and Defence.

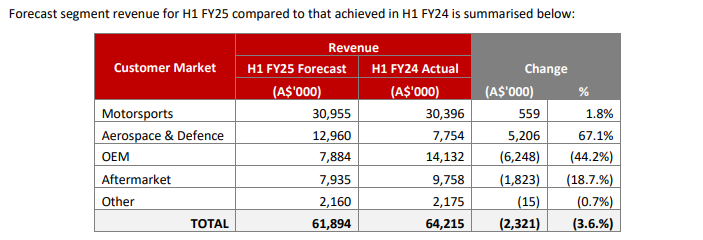

Unsurprising that OEM and aftermarket are negative with current broader market sentiment meaning people aren't spending as much on cars and bling. Motorsports being flat is also unsurprising.

A&D, if if keeps going, will catch up to Motorsports within three years, assuming the latter is flat. I suspect we will see a modest uptick in 2026 with new F1 regulations coming into play. The teams are not investing in new tech just yet with the old rules in play for aone more year.

So PWH today, is a defence manufacturing play, with all of the risks that come with that.

I took a bite a few weeks ago with a flat price at $9, but I am buying more after today's drop.

This is how I feel about this one this morning: https://www.youtube.com/watch?v=tUA8eij_cEs

Me being Coach Boone and PWH being Petey...