Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

PWR just announced a follow-on contract in the "Aerospace and Defence" sector, relating to a US government project.

The market clearly likes it, up 8% today. Seems a reasonable response given that PWR had $130m AU total FY25 revenue, of which their mature automotive sector contributed $70m vs A&D $26 million (but rapidly growing).

This announcement is evidence that their strategy of leveraging their expertise in motorsport to expand into Aerospace and Defense is working.

AI summary follows:

Key Financial & Operational Details

- Contract Value: The order is valued at US$9.1 million (approximately A$13.5 million).

- Revenue Recognition: Deliveries under this contract are expected to occur predominantly in FY 2027.

- Strategic Growth: This is a follow-on order from an initial US$5.5 million contract announced in January 2025. It signals the project's progression toward full-rate production.

- Long-term Outlook: The underlying US government project is scheduled to span multiple years, providing a potential pipeline of future demand subject to US fiscal funding and PWR’s performance.

Management Commentary

Acting CEO Matthew Bryson noted that this second phase demonstrates PWR’s ability to execute reliably on complex projects and adapt to evolving program requirements, further cementing their reputation in the Aerospace and Defence markets.

A not too often talked about risk with PWH but something that’s troubled me given their reliance and total dominance in motorsports. What’s to stop another company doing to them what they did to the former incumbent BEHR?

The good news is they have an 8am call tomorrow to present their case. The bad news is prima facie this is their case.

I think a FY26 10% increase in revenue and 20% increase in costs are heroic assumptions, which I've fully adopted because otherwise...

SP to get smashed tomorrow.

Get well soon Kees.

PWR Founder and Managing Director Takes Medical Leave

PWR’s Managing Director and Founder, Kees Weel, is taking temporary leave from his full-time role to seek treatment for an

acute medical condition. PWR’s Executive Leadership Team will assume Kees Weel’s day-to-day responsibilities, with Chief

Technical and Commercial Officer, Matthew Bryson, appointed by the Board to the role of Acting CEO.

Kees Weel said, “While I will remain active in PWR’s overall direction, I have advised the Board that concentrating on my

recovery is my priority. Matthew Bryson and the Executive Leadership Team have my full support, and I have complete faith that they will be able to deliver on PWR’s objectives and the move to PWR’s new headquarters, which has successfully commenced.”

PWR’s Chairman, Roland Dane said, “The Board supports Kees in his decision to focus on his health and wishes him all the best for his recovery. We look forward to welcoming him back when he is ready.”

About Matthew Bryson

Matthew joined PWR in 2000 as a design and manufacturing engineer contributing to PWR’s formative years across product and production engineering responsibilities. This role progressed to the position of Engineering Manager at PWR, as a position held

for 15 years, working closely with PWR’s customers to grow the business, and overseeing the continued development of PWR’s product and advanced manufacturing capabilities. In July 2020, Matthew commenced the position of Chief Operating Officer at

PWR, before taking on his current role of Chief Technical and Commercial Officer in August 2021 to support the future growth of PWR.

Remuneration details for Matthew Bryson are summarised below:

Length of Contract Open ended

Notice Period 6 months

Total Fixed Remuneration $420,300

Additional Remuneration for Acting CEO role $220,000

Short Term Incentive Plan Participation Up to 50% of Total Fixed Remuneration

Long Term Incentive Plan Participation Up to 50% of Total Fixed Remuneration

Matthew Bryson Sharyn Williams

Acting CEO Chief Financial Officer

+61 7 5547 1600 +61 7 5547 1600

PWR Holdings (PWH) released results after market close last night. From their presentation:

On paper an ugly result but was well flagged in their trading update from Nov 24. Decrease in revenue mostly due to delays and cancellations is its automotive OEM segment but this was offset by a large increase in A&D revenue.

FY25 is an investment year for PWH as they look to upgrade their Australian factory as well as increase capacity in Europe and North America. This coupled with the loss of revenue in some segments of the business means that this result along with the FY25 result will look ugly.

Outlook was given with the company expecting FY25 revenue to be around 5-10% less than FY24. Although on the call Kees did mention that this was mainly due to some "timing issues" with regards to them moving to the new factory along with them being a bit more conservative with guidance in the hope of "under promising and over delivering".

At the current share price it definitely looks expensive looking backwards and you'd hope that this current investment period will bear fruit in the medium-long term future. I'm willing to give management the benefit of doubt that they will pay off in the future so will likely top up on expected share price weakness.

Disc: Held IRL and on Strawman.

BAE systems has made the first STRIX VTOL test flight PWR Holdings involvement in this project is for the cooling system.

Reference of PWR Holdings initial involvement can also be found on the BAE systems website - https://www.baesystems.com/en-aus/blog/how-pwr-went-from-f1-to-drone-technologies

I think this project with BAE systems has been the only thing supporting the share price lately although the price appears to pump in the morning before getting dumped late in the day. Interesting this bit of news was not announced recently to the market.

Hard to say where the market demand for this drone will be in the future.

Being a test flight it is still early days so we shouldn't expect what is on the latest AGM presentation below

What happens to a growth company with a high PE when it announces it won't be growing the coming 12 month period, then subsequently announce to market that it's revenue will reverse?

Well the share price will fall, substantially. We are down ~23% at time of writing, and down close to 50% in the space of about 3 months. Why?

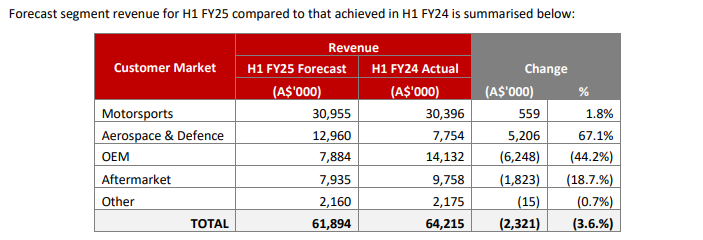

Well, PWR Holdings (PWH), has provided this update to the market this morning.

Key points to the above table are as follows:

- Lower revenue in two markets:

- OEM – three niche OEM EV programs are not proceeding in FY25 despite PWR receiving purchase orders in FY24 for the FY25 work program. Whilst several new programs are in various stages of discussion, the volatility of the EV market is creating unpredictability; and

- Aftermarket – revenue globally has been impacted by broader economic pressures.

- Semi-Fixed Production Costs – production costs are higher than pcp as they cannot be immediately reduced to match lower than expected volumes and, accordingly, are expected to disproportionately impact forecast earnings for H1 FY25.

This has come as a bit of a sucker punch after their full year release back on the 15th of August that FY25 will be a "transitional year" for them as they look to position themselves for "future growth" which will impact margins. What the market didn't expect is that revenue will go backwards, so this is a bit of a surprise and hence likely to take some time to digest.

I'm still mulling this one over, as PWH is a long term compounder for me, however this will cause for some reflection. Concerned about management not guiding for this a couple of months ago, and also the added pressure this will place on management which, if they depart or lighten holdings may be a deal/thesis breaker for me.

At this stage I am keen to see how this transitional year progresses but FY26 will definitely want to see them shift back to some growth and see some runs put on the board after the "transition" settles. Always risky to take a bet on how long this takes.

HELD here and IRL.

Seems like a logical Trump trade

Seems like institutions don't agree

BlackRock still has 900K left to sell. Van Eck has completely gone

[held]

F1 commission had a meeting overnight and approved Driver Cooling Kits to be used in extreme heat. The exact technical details haven't been released yet but may be something for PWH to come up with?

It seems that it will only be used in races of extreme heat which at the moment would only be perhaps the middle eastern races and maybe Singapore?

Disc: Held IRL and on Strawman.

A rare special from Bell Potter

Been quite hard to find any broker report

I did top up here but not in real life since I think maybe price is not right yet and appears a few index funds aren't done selling since it is now below the magical $1bn

[held]

Would be truly gobsmacked if someone or a group was selling purely because they knew the CFO was about to retire and there was nervousness about transition process. Selling on the basis of inside information?

If so, then this is pretty unfair that someone has taken pure advantage of this information that the rest of the market was unaware of.

Seems to have done a recovery but will have to see...

I guess next time if I see this happen to something I hold, I know where to look...

Probably fully priced

[held]

Update 22/08/2024

Updating with FY24 results added:

FY24 result came in a bit below expectations given that H1 was very strong.

Management have flagged that the next year will likely be an investment year as they build out their capability to facilitate further growth.

I'm going to give them the benefit of the doubt that a CAGR of 15% is still achievable in the long run. Discounting it back 10% pa with a terminal PE of 30x gives a valuation of $7.75.

I think I see some value if the price got to below $8 given the potential upside of their Aerospace and Defence segment (100% yoy growth) but this is still only 15% of total revenue.

Disc: Held IRL and on Strawman.

Update 22/02/2024

Updating my charts with 1H FY24 results added:

Revising some assumptions with NPAT growth of 25% for FY24 before returning to 15% growth for the next 4 years.

Discounting back 10% pa with a terminal PE of 30x gives a valuation of $8.14.

Disc: Held IRL and on Strawman.

Update 19/08/2023

Basing my valuation on a return to growth of 15% pa for the next 5 years and a terminal PE of 30x. This gives me a valuation of $6.80 in order to achieve a return of 10% pa.

Disc: Held IRL and on Strawman.

Update 18/03/2023

H1 FY23 results were quite disappointing for a company that was trading on a high PE although I do think the underlying business will benefit from the near term increase in investment to scale out their business.

I still regard this as one of the highest quality companies on the ASX and am willing to maintain my valuation of $6.51. I think if the share price decreased below $7 this starts to look interesting again. Capital allocation from management has always been first class and there are plenty of projects in the pipeline to continue on their growth trajectory.

The skew to 2H has always been strong so I wouldn't be surprised if they had a killer 2H FY23.

Definitely one to watch if there is further share price weakness.

Disc: Held IRL and on Strawman. Did sell some shares above $11 but will likely look to top up again if the SP fell below $7.

Update 18/08/2022

FY22 NPAT came in at around $20.4m representing a 24% increase YOY.

I am usually hesitant to assume that NPAT will continue to grow by such a large amount every year and so if I maintain my assumption of 15% CAGR for the next 5 years, and a terminal PE of 30x. This gives an updated valuation of $6.51.

Disc: Held IRL and on Strawman.

Update 08/06/2022

Just adjusting my valuation slightly as I think there will be further compression of PE ratios.

Same assumptions as above but assuming a terminal 30x PE would give a valuation of $5.77.

A terminal 25x PE would give a valuation of $4.81.

Disc: Held IRL and on Strawman

Original Valuation

PWR is an interesting company focusing on building cooling systems mostly in automobiles but are pivoting into other opportunities such as aerospace and defence.

- FY21 NPAT = $16.797m

- EPS = $0.1677

If they can grow NPAT at 15% per annum for the next 5 years (ambitious but some analysts have forecasts of greater than this) this gives:

- FY26 NPAT = $33.78m

- FY26 EPS (assuming around 120m shares on issue) = $0.28

- FY26 target price (assuming 35x PE) = $9.85

Discounting this back 10% per annum gives us an FY22 price of $6.73.

A PE of 40x would have FY22 price of $7.65.

Currently do hold some shares purchased around current prices but wouldn't likely add unless the price started with a $7.xx.

Reported Results after hrs with revenues and profits coming in softer versus consensus forecasts.

PWH: have spent some cash on the business expansion this generally dints the Revenue, Profit trend.

PWH is this a Buy?

The investments in headcount, factory space, equipment and systems are necessary to prepare PWR to deliver on our medium- and long-term growth objective, specifically growth in aerospace and defence, and is consistent with our approach to “invest now and collect later”

Opened down this morning

After hours announcement of FY24 results.

Prepare for some cheap shares since it was after hours.

[held]

PWR Holdings (ASX:PWH) updated valuation of $ 8.50 based on their 1H FY24 results and Investor presentation released on 21/02/204.

All comparisons below are with the prior corresponding period 1H FY23

Basic Earnings of 9.74 c.p.s up from 7.77 c.p.s ; an increase of 25.4 %

Revenue increase of 22.2 % $64.2 m from $52.6 m

EBITDA increase of 27.2 % $18.4.m from $14.5 m

NPAT increase of 25.5 % $9.8 m from $7.8 m

Interim Dividend per share increase of 33% 4.80 cents from 3.60 cents

Aerospace and Defence revenue grew by 124% as the number and size of programs continues to increase.

Motorsport revenue grew by 19% due to increased demand for emerging technologies

Maintained its strong balance sheet with $15.6 million in cash as at 31 December 2023

Continue to hold here on SM and in real life.

PWR holdings reported their H1 FY24 results after hours last night. From their presentation:

A much better half compared to this time last year. Their increase in investments over the past year are starting to show through now. Seasonally 1H is always the weaker half with lower revenue and lower margins. Although net margins have improved back above 15% for the half. Overall net margins are usually around 20%.

Customer mix is improving with less than 50% of revenue coming from the motorsports segment showing their increasing footprint into aerospace and defence.

Overall I thought this was a very solid result given the increased investment of the past year and look forward to seeing the growth come through in future periods.

Disc: Held IRL and on Strawman.

Assumed 4 Growth Scenarios ranging from 25% down to 10% over next 5 years . Share Count 100.8m and Net margins of 20% which they have been historically. Blended together and discounted at 10% come up with Valuation $9.28.

Do not hold.

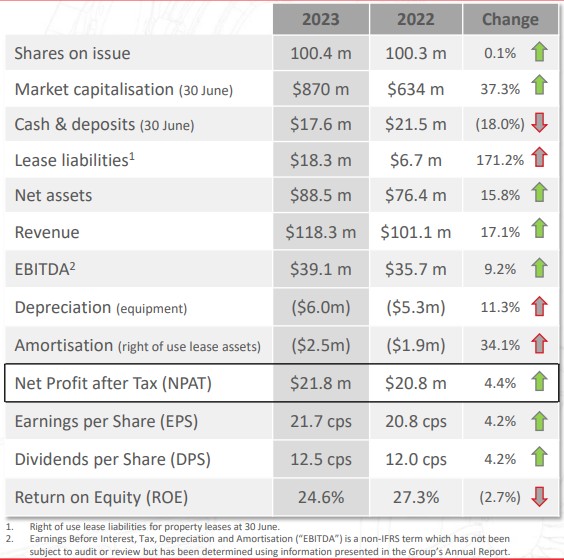

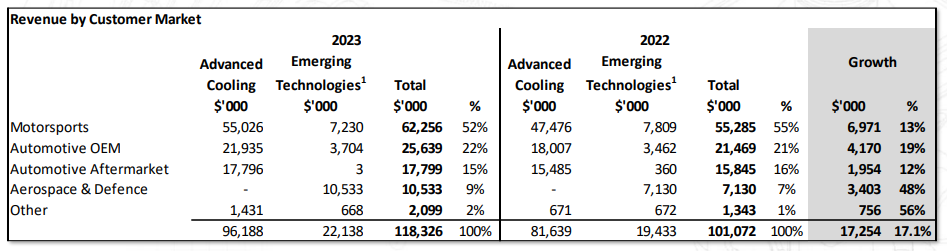

PWH released their FY23 results a few days ago, from their presentation:

I thought the result was pretty solid after a fairly disappointing 1H FY23. This year has been a year of investment in the business with the acquisition of several businesses to increase their footprint into Europe. The increase in net assets and lease liabilities reflects this.

Whilst 1H FY23 saw net margins fall below 15% as a result of this increase in spending and also the increased cost of raw materials. 2H FY23 saw a return to increased profitability with net margins improving to back above 20% again.

Management themselves have mentioned that with the increased investment, they will be able to support further growth with current capacity at their new site in Rugby (UK) only being 50% utilised at present.

Once again there was strong growth in emerging technologies with Aerospace and Defence now making up 9% of total revenue. This table below shows their Revenue by Customer Market.

Still lots of projects in the pipeline and interestingly as an F1 fan, I saw that they had secured the contracts for multiple teams for FY26. This is interesting as this is around the time that several major teams will be entering/re-entering the F1 scene. I believe given the growth of F1 in North America, there will likely be more than 10 teams on the grid, thus providing more teams for PWH to work with.

Will update my valuation shortly. Whilst the business seems to be back on track, shares are still quite expensive, and growth would need to continue into the future to support the current price.

Disc: Held IRL and on Strawman.

PWR Preliminary Final Report and 2023 Annual Report

Your new Chairman, Roland Dane, who has unanimous support of the Board, has substantial Board, leadership, operational and financial experience and has been a Board member since March 2017. Roland will take over as Chairman at the conclusion of the 2023 Annual General Meeting

Return (inc div) 1yr: 4.38% 3yr: 27.35% pa 5yr: 27.90% pa

PWH: returns are like the leaky radiator at the moment. Engine light is amber!!! not red yet...

PWR Holdings (PWH) released their 1H FY23 results after market yesterday. From their presentation:

Probably not the best result considering before the results release they were trading on a PE of around 60x. Management stated that increase labour costs and raw material costs impacted the bottom line. They also spent money to expand into Europe in the last half.

I think in the long term PWH should benefit from the current investment period. Their business is relatively capital intensive, needing to purchase assets in order to scale up their business, and so it remains to be seen whether this level of investment will pay off in years to come.

Shares are still too expensive (even after today's pullback) for mine. I did sell around half of my shares at above $11 around a month ago as I thought the valuation was looking stretched then. At under $7 I think I will likely top up my holdings but they remain a solid hold at the moment. Still lots of projects in the pipeline.

Disc: Held IRL and on Strawman.

@Vandelay agree PWH looks expensive at the moment, especially compared to other opportunities in the market right now.

Also agree that looking at expected future returns from here is the lens through which to assess opportunities competing for your capital.

Sticking with the 5 year time horizon and the methodology you outline, I ran some numbers and got the following.

Observations:

$SP = $11.97 @ 13-Jan-22 * SOI = 100.6m (fully diluted) = Mkt Cap of AU$1,203.8m.

Assumptions:

NPAT Margin in 5 years = 20% (95% of last 5 year average, which has been stable between 20-23%).

PE Exit Multiple in 5 years = 28.5% (90% of last 5 year average @ 30-Jun). Trailing PE is currently double this at 57.8x.

10% Required Rate of Return (RRR).

This requires a 5 year Revenue CAGR of 27%.

That is, with the above NPAT Margin and Exit PE Multiple in 5 years, you would need a 27% Revenue CAGR to earn a 10% Compound Return from current prices.

Questions:

So can they do 27% CAGR? I think they definitely can but not sure of the probability. Probably not the best base case.

What if 5yr Revenue CAGR is 18% as @Vandelay expects? All else being equal, that would halve your expected Compound Return (RRR) to 5% from current prices.

Are my assumptions too conservative? I think they're a little on the conservative side, but not so much as to offer a large margin of safety.

Other considerations:

They could also be a takeover target, but Kees has a blocking stake > 20%, although his son is now out of the business, so he may sell if the terms are right? Not enough certainty to put a premium on for this in my view.

At the AGM, mgmt said motorsports revenue growth to be moderate, but that the smaller Auto OEM & Aero/Defence segments to be stronger.

Capex in FY23 projected to be back to FY21 levels (double FY22), so they are looking to keep growing through innovation which they look to be adequately funded to do. With their prospects and track record of execution, this is a business I would like to own (more of) for the long term.

However, given the expected moderate Revenue growth from motorsports being the biggest segment and smaller segments set to grow strongly from here, the high $SP could be under threat if top line growth underwhelms.

Disc: Held

PWR Holdings (PWH) released their FY22 Results ahead of their conference call tomorrow morning. From their release:

A bumper H2FY22 saw a record result for the company as they ticked over $100m in revenue for the first time. NPAT was also a record. Cash flow was a little lower due to increase in spending due to supply chain constraints although management have said that this will ease as supply chains revert back to normal.

I have updated my chart from the previous straw to reflect the full year results.

If you ignore FY20 which was covid impacted, NPAT has compounded at 15% for the last 5 years and shows the quality of this company to execute their goals.

I will update my valuation accordingly.

Full presentation here

Disc: Held IRL and on Strawman.

PWR Holdings (ASX:PWH) released their results for H1 FY22 after hours yesterday. From their release:

Overall a decent result given current covid headwinds driven mostly by a return in motorsports to a more normalised race program. I have graphed out their revenue growth and NPAT growth for the last few years below.

H2 is seasonally the stronger half so it will be interesting to see if they can maintain the growth. I still see a very long run way for this company as their cooling systems can be used in a multitude of applications and we are only just starting to see this playing out (emerging technologies grew by 36% but is only 14% of overall revenue).

I will maintain my valuation (see my valuation straw) as I still think currently shares are a bit overvalued but am a happy holder at current levels.

Disc: Held IRL and on Strawman

PWR Holdings (ASX:PWH)

PWR produces advanced cooling systems to the motorsports, aerospace/defence sector. Also derives part of its revenue from OEM and automotive aftermarket segments. Basically - super niche, high tech/IP company run by founder/MD Kees Wheel.

Financials

- 77% gross margin, >25% operating margin and 21% net margin

- $19.8m in cash, no debt

- Consistent share count since listing

- ROA >15%, ROIC > 20% and ROE > 20% over last 5 years

Insider Holdings

- Kees Wheel Founder/MD 20.3m shares (20% of company)

- Matthew Bryson CTO 3.3m shares

Summary

- Valuation seems a little stretched at the moment - Sitting on TTM PE of 52x, and P/FCF of 94x

- However - if we take a closer look at the business, wow. Ticks many boxes for me:

- Founder led with huge amount of skin in the game. So far management have been very transparent and fair to shareholders

- 20%+ net margins, rock solid balance sheet

- Optionality - Some mentions in the AGM to branch into the aerospace/space segment.

- Their clients are largely those with deep pockets, willing to pay a premium to get the best product for their cars etc. Largely unaffected by Covid.

- Been a happy shareholder for the last 18 months, will be very happy if the market gives me a discount to pick up more shares in the future.

Long standing holder of PWR with impressive results from a disciplined organisation whom have good prospects in niche automotive / air space. Growth in US strong and launching online as we speak .

Culture a clear strength reflective in financial results

Shares on issue has remained steady at 100m

Debt has always remained minimal 1.7mill. Cash $19.857mill

Rev 2016 = 46.6mill - 79.2 2021

EBIT 2016 = 13mil - 21mil 2021

Operating Margin 2016 = 30% grown to 36% in 2021

Div 2016 4c - 9c 2021

EPS 2016 9c - 2021 15c

PWR had a large "Staff Wanted" sign up at the front of their Ormeau office as I drove by. I thought I'd do a search of Seek as this is a company on my watchlist. The following jobs came up:

TIG Welder

CNC Machinist

Graduate Accountant

CNC Programmer

School Leaver Program

Manufacturing Production Assistant

Chef

The company states the need for new staff is due to "Exponential growth at PWR has opened up an exciting career opportunity for..."

The company offers "Fully catered meals from our onsite diner, morning tea & lunch provided". This was highlighted in a podcast featuring Emma Fisher of Airlie Funds where she mentioned the company having a strong culture and management wanting employees to have access to healthy, nutritious food. It also explains why they're hiring a chef.

Management see a bright future for the company stating they offer a "Long Term career path within a growing global business" and "we are searching for candidates who are looking for a long stable career"

"Fully Funded Apprenticeships" are available as well; however, I'm unsure if this is the norm in Australia?

With over 300 staff, this number of new jobs listing may not be significant but it was interesting to take a look at their hiring process, the benefits they offer and their outlook for the company.

H1 FY21 performance places us in a strong position for full year FY21 • Revenue $37.2m up 25% on pcp. Growth across all primary categories with 51% of revenue growth coming from emerging technologies and OEM categories

- Cash on hand at 31 Dec 2020 of $16.8m (2019 : $7.9m) with over $22m of finance facilities available and unutilised.

- Sales movement by currency to pcp - GBP sales up 5%, USD sales up 92% mainly from increased OEM sales and AUD sales up 16%.

- C&R revenue increase of 82% from organic growth in emerging technology and OEM sales.

- EBITDA margin of 32.8% improved from pcp (25.6%) as a result of higher volumes, efficiencies of scale and JobKeeper receipts. Rescheduling of Formula 1 and other race categories from the first half of the 2021 calendar year to the second half.

- NPAT of $6.6m up 90% on pcp

Increased dividend

• Fully franked interim dividend of 2.80 cents per share – an increase of 47% on pcp.

Cash flows

- 317% increase in operating cashflow compared to pcp. Due to improved cash conversion ratio, lower working capital and prepaid contractual commitments (some due to timing).

- Working capital invested decreased by 12% with revenue growth of 25%.

- EBITDA to cash conversion ratio of 122% for the period (pcp : 68%).

- Loans drawn down at 30 June 2020 (due to COVID 19 uncertainty) fully repaid during current period.

- Cash on hand at 31 Dec 2020 of $16.8m (2019 : $7.9m) with over $22m of finance facilities available and unutilised.

Presentation

https://www.asx.com.au/asxpdf/20210219/pdf/44stkpvhqf4mml.pdf